Comprehensive Snapshot for U.S. Yogurt Market Including Zone and Segment Analysis in Brief.

Industry: Food and Beverages

Published Date: April-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 160

Report ID: PMRREP35227

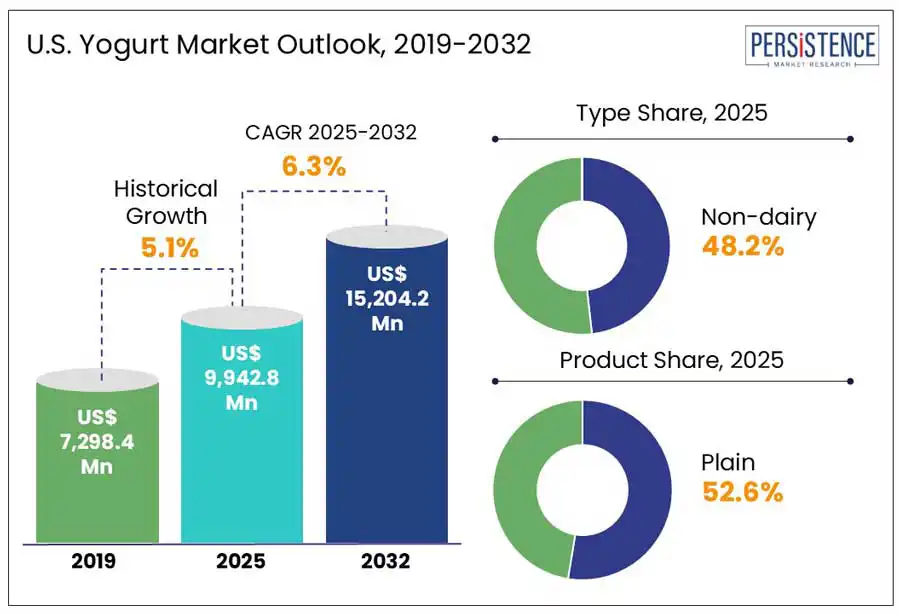

The U.S. yogurt market size is projected to rise from US$ 9,942.8 Mn in 2025 to US$ 15,204.2 Mn by 2032. It is anticipated to witness a CAGR of 6.3% during the forecast period from 2025 to 2032.

Yogurt has gained immense popularity in the U.S. due to its various nutritional benefits such as the ability to prevent osteoporosis, type two diabetes, and colon cancer. It also helps in boosting healthy digestion and enhancing the immune system. Individuals looking to lose weight are hence increasing their yogurt consumption on a regular basis due to rising awareness of its benefits. Several companies in the country have come up with innovative flavors to attract a large consumer base.

Key Industry Highlights

|

Market Attribute |

Key Insights |

|

U.S. Yogurt Market Size (2025E) |

US$ 9,942.8 Mn |

|

Market Value Forecast (2032F) |

US$ 15,204.2 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

6.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.1% |

The shift of modern consumers toward smaller, convenient, and frequent eating occasions from conventional meals is anticipated to spur the U.S. yogurt market growth. Ready-to-eat yet nutritious snacks are gaining impetus among Gen Z and millennial consumers as these fit into their busy lifestyles. Mondel?z International, for example, found in its State of Snacking survey that nearly 71% of consumers in the U.S. said they preferred snacking more than two times a day. Over 60% of consumers, revealed that they usually replace at least one meal with snacks.

Yogurt, specifically drinkable formats, pouches, and single-serve cups has become the ideal choice as it offers a balance of probiotics, calcium, and protein conveniently. Several brands capitalize on this trend with product development and innovation. Yoplait Go-GURT, for instance, which was originally launched for children, was recently reformulated and rebranded with adult appeal and clean labels. The brand aims to offer consumers a suitable on-the-go probiotic snack that does not require a spoon.

Even though demand for yogurt has surged significantly in the U.S., the market is estimated to witness slight signs of stagnation due to increasing label scrutiny. Several consumers are becoming increasingly conscious about added thickeners, artificial flavors, and sugars in flavored yogurt.

The U.S. Department of Agriculture, for instance, found in a 2023 report that around 43% of consumers refrain from purchasing yogurt backed by sugar concerns. This is especially evident in fruit-flavored varieties and children’s products. Various renowned brands still provide 12 to 18 grams of sugar each serving, despite their natural claims. It is further expected to deter health-conscious consumers.

Well-known brands in the U.S. are speculated to accelerate innovation in the field of plant-based yogurt. The segment is still at the nascent stage due to various persistent issues with cost, protein content, texture, and taste. The Plant Based Foods Association mentioned that in 2023, retail sales of plant-based yogurt surged to US$ 452 Mn in the U.S, highlighting an average 2.5% year-over-year surge.

A new survey further found that nearly 38% of consumers in the country who consumed plant-based yogurt did not repurchase. They stated lack of protein, bland or sour flavors, and off-putting textures as the main deterrents. These numbers point to a huge gap between consumer expectations and product availability. Hence, brands can strengthen their position in this field by launching new formulations catering to consumer requirements.

The emergence of culinary and savory yogurt is estimated to create lucrative growth avenues for yogurt brands in the U.S. Historically, yogurt has been associated with sweet flavors such as blueberry, strawberry, or vanilla. A key change, however, is underway as today’s consumers demand savory yogurt. Their preference is mainly influenced by social media influencers supporting international cuisines and a shift toward healthy alternatives such as sauces and dips.

FAGE USA, for instance, is a notable example of this trend. The company launched its new range of savory items, including FAGE Total with Mediterranean Flavors. These are infused with Mediterranean spices and herbs. With this launch, the company successfully extended yogurt’s use beyond dessert and breakfast. It marketed the products as versatile ingredients for dips, sandwiches, and salads. Launch of similar products by other companies is expected to create new opportunities, extending the application areas of yogurt.

In terms of type, the market is divided into dairy-based and non-dairy. Among these, the non-dairy segment will likely generate around 48.2% share in 2025, says Persistence Market Research. It is attributed to high prevalence of lactose intolerance in the U.S., which is spurring demand for lactose-free products.

A few studies revealed that nearly 30 Mn individuals in the country suffer from lactose intolerance. Yogurt made from alternatives such as soy, oats, coconuts, and almonds are showing high demand as it provides a cruelty-free and lactose-free option for those with ethical concerns or dietary restrictions.

Dairy-based yogurt, on the other hand, is estimated to exhibit steady growth through 2032 due to the launch of new formats and flavors in this segment. These cater to a wide range of preferences and tastes. Right from original fruit-flavored varieties to new dessert-inspired yogurts such as lime pie or cheesecake flavors, brands are constantly innovating their portfolios to gain a large consumer base. Dairy-based yogurt drinks have also become popular as these provide convenience to busy consumers.

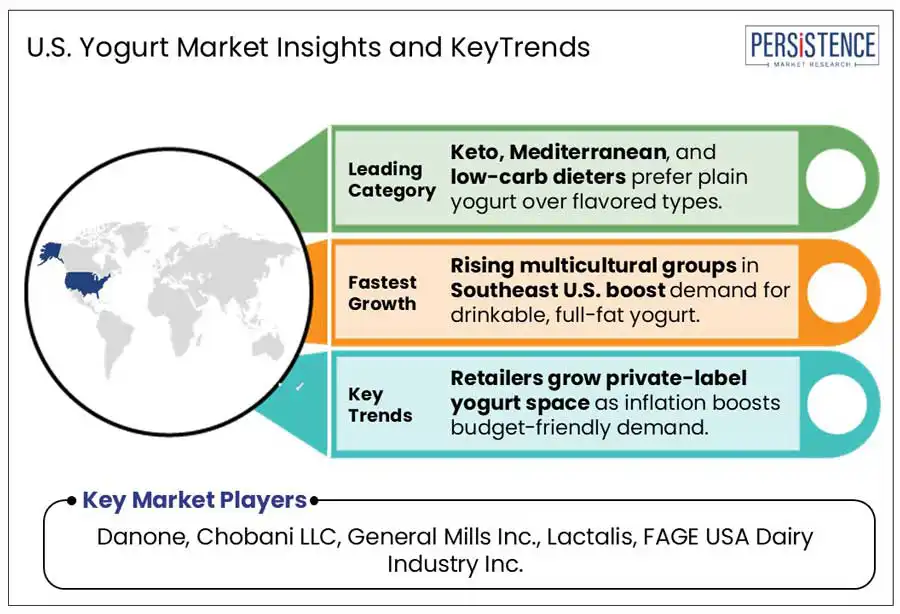

Based on product, the market is bifurcated into plain and flavored. Out of these, the plain segment is presumed to account for nearly 52.6% of the U.S. yogurt market share in 2025. This type of yogurt has high protein content and hence it is showing increasing demand among individuals following ketogenic or low-carb diets. Several brands in the country are now providing plain Greek yogurt with zero added sugar and artificial preservatives to meet the high demand for clean-label items.

Plain yogurt also has probiotic benefits that often attract consumers focusing on improving their gut health. As this type of yogurt is minimally processed, it includes live probiotic cultures supporting digestive health. As per a recent study, around 30% of consumers in the U.S. emphasize food items with probiotics. This trend is anticipated to be highlighted with the rising demand for plain yogurt, which is naturally rich in these beneficial bacteria.

Flavored yogurt is predicted to showcase an average CAGR in the foreseeable future. It is attributed to rising consumer preference for low-sugar products. Even though this type of yogurt is often promoted as a tasty snack, its popularity has declined with surging health consciousness. As per the Centers for Disease Control and Prevention (CDC), more than 60% of adults are actively striving to lower their sugar intake in the U.S. This is further expected to contribute to the relatively lower growth trajectory of flavored yogurt compared to its plain counterpart.

In West U.S., cities such as Seattle, San Francisco, and Los Angeles are showcasing a skyrocketing demand for dairy-free, organic, low-sugar, and high-protein yogurt offerings. As per a recent survey, sales of yogurt surged by 7.1% year-over-year in the West, outpacing other zones due to increasing inclination toward functional and specialty products.

The zone is further considered a significant hub for innovation when it comes to plant-based yogurt. For example, California, houses brands such as Forager Project and Kite Hill that mainly focus on producing coconut, cashew, and almond-based yogurts. They are striving to enhance their brand visibility by launching new products across retailers such as Sprouts and Whole Foods.

Southeast U.S. is anticipated to account for a share of 37.7% in 2025. Key companies such as Danone exhibit high demand for multipack yogurts and fruit-on-the-bottom cups over plant-based varieties. Price sensitivity is a significant factor expected to influence growth in this zone. South Carolina, Alabama, Georgia, and Mississippi house a relatively higher proportion of middle-income and low-income households. Hence, affordability is the priority for consumers in these states over premium health claims. Renowned retail chains such as Publix are predicted to offer their store-brand yogurts at low costs to attract consumers’ attention.

The Midwest has recently witnessed a steady shift of consumers from traditional yogurt toward probiotic-rich and high-protein options. The increasing popularity of family-sized tubs and multipacks catering to cost-conscious consumers and large households is presumed to create new opportunities in this zone. Retailers such as Hy-Vee, Kroger, and Meijer play an important role in the distribution of yogurt. These often provide weekly promotions or discounts on bulk purchases to influence buying behavior.

In states such as Wisconsin, Michigan, and Ohio, functional yogurt with added probiotics has become popular among the geriatric population. These consumers are adding yogurt to their daily diet to support immunity and boost digestion. It is further propelling the product sales, including Nancy’s Probiotic Yogurt and Activia.

The U.S. yogurt market is consolidated with the presence of only a few key players. They are focusing on launching new products across the country to extend their product portfolios and generate high shares. A few other companies are aiming to embrace strategies such as mergers and acquisitions as well as collaborations to either gain access to already established brands or co-develop innovative formulations catering to varying consumer demands.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Type

By Product

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

The U.S. yogurt market is projected to be valued at US$ 9,942.8 Mn in 2025.

Increasing awareness of yogurt’s potential health benefits and launch of new flavors are the key market drivers.

The market is poised to witness a CAGR of 6.3% from 2025 to 2032.

Innovations in plant-based yogurt and launch of single-serve yogurt formats are the key market opportunities.

Danone, Chobani LLC, General Mills Inc., and Lactalis are a few key players.