Industry: Food and Beverages

Published Date: November-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 188

Report ID: PMRREP34906

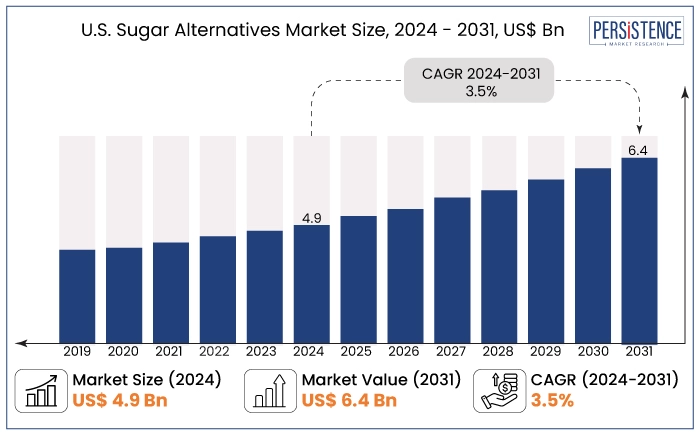

The U.S. sugar alternatives market is estimated to be valued at US$ 6.4 Bn by 2031 from US$ 4.9 Bn recorded in 2024. The market is set to record a CAGR of 3.5% in the forthcoming years from 2024 to 2031. Increasing prevalence of cardiovascular diseases (CVD) in the U.S. is anticipated to augment sugar alternatives demand in the next ten years.

According to the Centers for Disease Control and Prevention (CDC), approximately 702,880 individuals died from heart diseases in 2022 in the U.S. Cardiovascular disease is considered the leading cause of death in the country among men and women. Also, in 2024, the age-adjusted death rate from CVD rose to 233.3 per 100,000, a 4% rise over the year before. To reduce the aforementioned numbers, government bodies are conducting awareness campaigns to support reduced sugar intake. It is anticipated to bolster growth in the market.

Key Market Highlights

|

Market Attributes |

Key Insights |

|

U.S. Sugar Alternatives Market Size (2024E) |

US$ 4.9 Bn |

|

Projected Market Value (2031F) |

US$ 6.4 Bn |

|

U.S. Sugar Alternatives Market Growth Rate (CAGR 2024 to 2031) |

3.5% |

|

Historical Market Growth Rate (CAGR 2019 to 2024) |

3.1% |

|

Category |

CAGR through 2031 |

|

Product Type- Stevia |

8.3% |

Individuals are now moving away from traditional sweets, which are linked to diseases like diabetes and obesity, as they become increasingly health conscious. Companies are hence striving to make sugar substitutes from the leaves of the stevia rebaudiana plant.

It is a natural sweetener that offers a calorie-free substitute, appealing to people who want to reduce their calorie intake without sacrificing sweetness. Growing demand for clean-label products and minimally processed ingredients is also in line with the perception that stevia is a healthier option than artificial sweeteners.

The clean-eating movement has prompted consumers to seek products with recognizable, natural components, making stevia an ideal fit for this trend. Often marketed as a plant-based sweetener, stevia appeals to the growing number of consumers who follow vegan and plant-focused diets.

Advances in extraction and formulation technologies have also enhanced the taste profile of stevia, significantly reducing the bitter aftertaste that has historically deterred some users. This improvement in sensory quality, paired with aggressive marketing efforts from key industry players, is fostering a higher acceptance and usage of stevia in a wide range of food and beverages.

|

Category |

CAGR through 2031 |

|

Application- Beverages |

3.4% |

By application, the beverage segment is anticipated to lead through 2031 and positively affect the U.S. sugar alternatives market growth. Sweeteners like stevia, monk fruit, and allulose are becoming popular choices for beverage formulations. These offer the desired sweetness without the associated calories or negative health impacts. This shift is not only limited to soft drinks but also extends to a wide range of products, including flavored waters, teas, juices, and even alcoholic beverages.

Leading brands are reformulating their existing products to incorporate sugar alternatives. New entrants are emerging with innovative offerings that prioritize natural ingredients and clean-label attributes. For instance,

The clean-eating movement also encourages consumers to seek products with recognizable, plant-based ingredients, further fueling demand for sugar alternatives in beverage applications. As technology continues to improve, the sensory profiles of these sweeteners are becoming more appealing, reducing bitterness and enhancing flavor experiences. Consequently, the beverage segment is poised for a significant shift, with sugar alternatives playing a key role in reshaping consumer choices and industry standards.

The U.S. sugar alternatives market is experiencing steady growth as health-conscious consumers seek organic substitutes to traditional sugar. Rising awareness of the negative health impacts of high sugar consumption, such as obesity and diabetes, is pushing demand for products that offer the sweetness of sugar without its adverse effects. This shift is driven by millennials and Gen Z, who prioritize clean-label, natural, and minimally processed ingredients.

High- and low-intensity sweeteners represent two distinct categories in the natural sweetener industry. High-intensity sweeteners, such as aspartame and sucralose, are significantly sweeter than sugar. These are used in small quantities to achieve desired sweetness levels with minimal calories. However, they often face criticism for potential aftertastes that can deter consumers.

Low-intensity sweeteners, like erythritol and agave nectar, offer a taste and mouthfeel more similar to sugar. This makes them appealing to consumers seeking a more authentic sweet taste. These alternatives cater to health-conscious consumers looking to reduce caloric intake while still enjoying sweet flavors.

The U.S. all-natural sweetener industry witnessed a CAGR of 3.1% during the period between 2019 and 2023. It was attributed to increasing awareness among modern consumers regarding the consequences of lifestyle diseases, such as obesity and diabetes. This positive outlook was underpinned by several key trends, including a growing inclination toward natural sweeteners like stevia and monk fruit.

Consumers increasingly prioritized clean-label ingredients with transparent sourcing. The rising prevalence of diabetes also created a high demand for sugar alternatives that helped manage blood sugar levels without sacrificing flavor. Additionally, regulatory pressures aimed at reducing sugar consumption encouraged manufacturers to reformulate their products and innovate new offerings.

Growing Prevalence of Diabetes to Fuel Sugar Replacement Demand

Growing prevalence of diabetes, particularly type 2 diabetes, is significantly driving demand for sugar alternatives in the U.S. As the number of individuals living with diabetes increases, so does the need for alternatives that allow for sweet indulgences without the health risks associated with traditional sugar.

Today’s consumers are increasingly aware of the health risks associated with high sugar consumption due to health campaigns promoting healthy eating habits. Several sugar substitutes, such as saccharin and aspartame, are safe for diabetics, offering sweetness with minimal calories. These alternatives are often considered ‘free foods’ due to their low calorie and carbohydrate content.

Consumers, however, should be cautious about other ingredients in these products that may affect blood sugar levels. As diabetes prevalence continues to rise, demand for sugar substitutes will likely surge, allowing consumers to enjoy sweetness while prioritizing their health.

Demand for Clean-label Substitutes to Rise from Millennials and Gen Z

Young consumers, particularly millennials and Generation Z, are increasingly driving the U.S. sugar alternatives market due to their rising preference for healthy food options. With easy access to information through digital platforms, these consumers are well-informed about the adverse health effects of excessive sugar intake, including obesity, diabetes, and other chronic diseases.

Rising awareness, coupled with a growing interest in wellness and nutrition, is prompting them to seek out alternatives that align with their health goals.

Unlike previous generations, millennials are more inclined to read labels, research ingredients, and prioritize clean-label products that feature minimal processing and transparent sourcing. Hence, they are turning to sugar substitutes such as stevia, monk fruit, and erythritol. These provide sweetness without the calories and health risks associated with traditional sugars.

Social media also plays a significant role in shaping their dietary choices, as influencers and health advocates promote the benefits of low-calorie and natural sweeteners. This demographic is more likely to experiment with innovative food and beverage options that incorporate sugar alternatives, further fueling demand.

Young consumers are not only reshaping their own diets but also influencing food manufacturers to reformulate their products to meet these preferences. This shift toward healthy alternatives is set to propel growth in the U.S. as brands focus on attracting this discerning consumer base with innovative and appealing offerings.

Brands Face the Challenge of Providing Exact Sugar-like Taste

Consumers often associate sweetness with specific sensory experiences that sugar uniquely provides. It includes not just sweetness but also texture, flavor enhancement, and satisfaction. Various sugar substitutes, such as artificial sweeteners, struggle to deliver this multifaceted sensory profile, which can lead to consumer dissatisfaction. For instance,

The inability to fully mimic sugar’s organoleptic qualities limits the application of sugar substitutes in certain food and beverage categories. It is particularly evident in products where texture and mouthfeel are critical, such as baked goods, sauces, and dressings.

Several consumers remain skeptical of the long-term health implications of consuming artificial sweeteners, which can further hinder adoption of low carb sugar substitutes.

Manufacturers hence face the challenge of developing innovative formulations that not only provide sweetness but also closely replicate the taste and texture of sugar to meet consumer expectations. Until significant innovations are made in flavor technology and formulation techniques, this restraint will likely continue to impact the growth and acceptance of sugar alternatives in the U.S.

Collaborative Efforts Enable Brands to Co-develop Unique Granular Sugar Alternatives

The U.S. sugar alternatives market presents a significant opportunity for companies to engage in collaborative efforts to innovate and co-develop products using sugar substitutes. A prime example of this trend is Ajinomoto’s partnership with Shiru in August 2024. Through its subsidiary, Ajinomoto Health and Nutrition North America (AHN), the company sought to leverage Shiru's AI-driven protein discovery capabilities alongside its fermentation expertise.

It helped the company to create sweet proteins for beverages and specialty products. This collaboration focused on developing natural sweeteners that mimic the taste of sugar while being derived from fruits and berries found near the equator. It aligned with the rising consumer preference for natural and minimally processed ingredients.

Similar partnerships allow companies to combine their strengths, enhance product offerings, and address the growing demand for healthy alternatives to traditional sugars. By working together, they can accelerate the development of innovative sweetening solutions that not only meet taste expectations but also align with the need for transparency and sustainability.

Key market participants are investing significantly in research and development to innovate and enhance their product offerings. They are also focusing on improving taste profiles and reducing any undesirable aftertastes associated with traditional sweeteners.

Collaborations and partnerships are becoming increasingly common as companies leverage each other's strengths in formulation, technology, and distribution. Additionally, the rise of e-commerce is enabling new entrants to reach consumers more effectively, while established brands are enhancing their digital presence. The competitive landscape is evolving rapidly, driven by consumer shifts toward natural, clean-label products.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Zones Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

|

By Product Type

By Intensity

By Application

By Distribution Channel

By Zone

To know more about delivery timeline for this report Contact Sales

The market is set to reach US$ 6.4 Bn in 2031.

Sucralose and saccharin are considered the most common alternatives.

Allulose, stevia, and monk fruit are used instead of sugar.

Date sugar, jaggery, coconut sugar, and raw honey are a few best replacements.

Cargill, Inc., Tate & Lyle, and Roquette are the leading manufacturers.