Industry: Food and Beverages

Published Date: March-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 182

Report ID: PMRREP35171

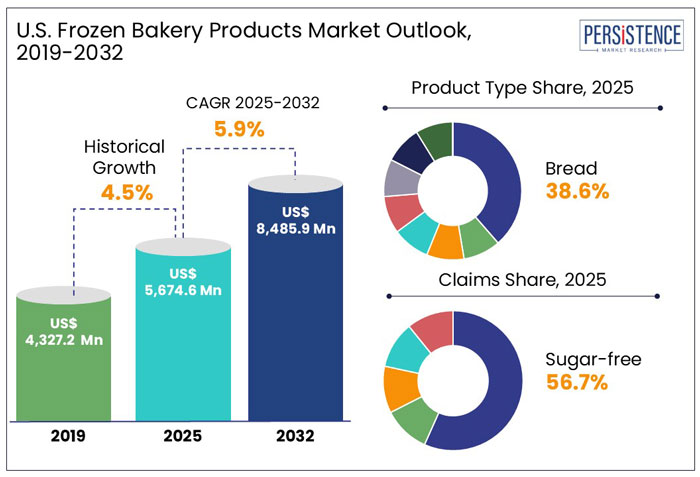

The U.S. frozen bakery products market is estimated to rise from US$ 5,674.6 Mn in 2025 to US$ 8,485.9 Mn by 2032. The market is projected to record a CAGR of 5.9% during the forecast period from 2025 to 2032.

Frozen bakery products have become a staple in kitchens across the U.S. as these provide a convenient solution for flavorful baked goods. Modern consumers, especially those looking for quick and hassle-free meal alternatives to fit their hectic lifestyles, find great resonance in this convenience factor.

Research conducted by the American Frozen Food Institute (AFFI) in January 2022, for instance, found that frozen foods have gained impetus in households across the U.S., with nearly 30% of consumers broadening their freezer capacity since the pandemic began in 2020. A variety of frozen bakery products that require little preparation have been introduced in the U.S. in response to consumer desire for convenience. It includes frozen breakfast items like pancakes, frozen bites, and waffles to cater to consumers looking for quick meal preparation.

Key Highlights of the U.S. Frozen Bakery Products Market

|

Market Attributes |

Key Insights |

|

Market Size (2025E) |

US$ 5,674.6 Mn |

|

Market Value Forecast (2032F) |

US$ 8,485.9 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

5.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.5% |

Historical Period Saw High Demand for Pizza Crusts and Breads as QSRs Looked for Product Consistency

As per Persistence Market Research, the U.S. frozen bakery products market witnessed a CAGR of 4.5% in the historical period from 2019 to 2024. This growth was fueled by the expansion of quick-service restaurants (QSRs) and retail bakeries who often require frozen items for quick meal preparation. High consumer spending in the aforementioned eateries created significant demand for frozen items like pizza crusts and bread.

As per a recent study, in 2023 alone, consumers in the U.S. spent about US$ 41.3 Bn in the quick service pizza restaurant industry. Constant evolutions in pizza offerings contributed to this high spending in the country. Restaurateurs and chefs started launching fusion pizzas by blending unique cultural flavors with conventional recipes, thereby appealing to a broad consumer base.

Value-based promotions and novel marketing campaigns further bolstered sales. For example, Domino's Pizza introduced its promotional campaign called ‘Emergency Pizza.’ It provided loyalty program members with a free pizza in just 30 days of purchase. This campaign, which ran from October 2023 to February 2024, increased sales and brought in 2 Mn new loyalty members, showing how successful targeted promotions are increasing consumer spending.

Increasing fast food consumption raised demand for frozen bakery products in the historical period, with QSRs relying on these to maintain efficiency and consistency. Pizza crusts and breads witnessed high demand, propelled by unique promotional strategies and the emergence of new flavors across pizza outlets.

Bulk Purchasing Trends and Cost Savings to Push the Market in Forecast Period

The U.S. frozen bakery products market is projected to rise at a 5.9% CAGR through 2032. Cost-effectiveness and bulk purchasing trends in the U.S. are anticipated to augment demand for frozen bakery products in the future. Retailers, foodservice providers, and consumers alike are likely to gradually recognize the pros of purchasing frozen products in large quantities, resulting in high sales across both institutional and retail sectors.

Significant warehouse retailers in the U.S., such as Sam’s Club and Costco, for instance, recently launched bulk frozen cookie dough product lines. Such offerings are set to make it convenient for consumers to buy large quantities at discounts.

A 120-count box of pre-formed chocolate chunk cookie dough costs about US$ 23 to US$ 26, which is around 20 cents per cookie at Costco. Compared to purchasing freshly baked cookies from a grocery store or bakery, this shows a notable saving.

Catering companies and cafeterias are also anticipated to benefit from bulk purchases. These require large quantities of baked products on a daily basis. However, they often lack the time or resources to prepare such products from scratch every day. Hence, frozen bakery products are considered an affordable solution, ensuring consistent quality and lowering labor costs.

Rising Veganism and Changing Dietary Preferences to Propel Dairy-free Frozen Bakery Products Demand

The U.S. is projected to see a high demand for dairy-free and plant-based frozen bakery products in the foreseeable future. This is attributed to growing veganism, flexitarian lifestyles, celiac disease prevalence, and lactose intolerance among consumers. These consumers are actively seeking frozen breads, pastries, and desserts made with plant-based ingredients like almond milk, coconut oil, and oat-based alternatives.

Key brands are set to respond to this demand by broadening their portfolios to include dairy-free frozen croissants, cookie dough, muffins, and cakes. For example, Kayco’s Beyond Division launched 12-ounce packs of Absolutely! Gluten Free Frozen Cookie Dough in January 2025. A few retailers are also planning to dedicate more shelf space to plant-based options, further boosting accessibility.

Availability of these products in supermarkets, specialty stores, and online platforms highlights their rising popularity. As the plant-based movement continues to gain momentum, manufacturers investing in innovative formulations and clean-label ingredients will likely capture a larger share of the market.

Demand for Premium and Preservative-free Baked Goods May Hinder Sales of Frozen Products

The U.S. frozen bakery products market may face competition from artisanal bakeries, which appeal to those consumers seeking high-quality, preservative-free baked goods. While frozen bakery products offer convenience, a few consumers still prefer freshly baked alternatives due to their perceived superior taste, texture, and authenticity.

Artisanal bakeries are also capitalizing on the trend of premium, handcrafted products, catering to niche demands such as organic and locally sourced ingredients. They are further bagging funds to extend their presence across various retail outlets and enhance innovation. For instance,

Some supermarkets and specialty stores are also set to join hands with artisanal bakeries to provide them with in-house space, thereby intensifying competition.

Emergence of Innovative Refrigeration Solutions to Help Reduce Spoilage and Extend Shelf Life of Frozen Baked Goods

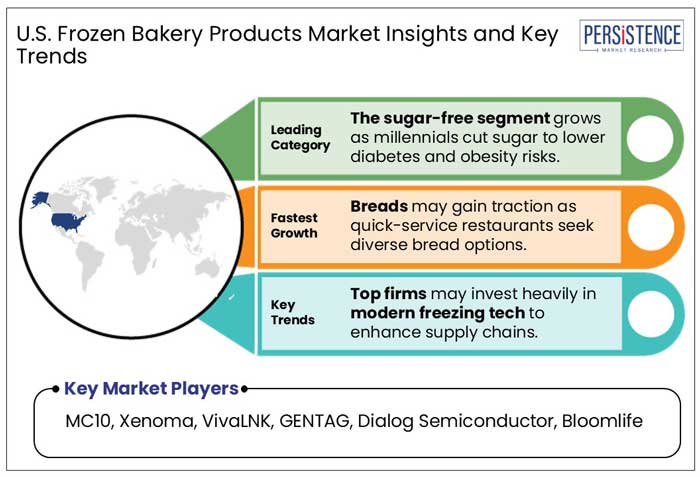

The U.S. frozen bakery products market mainly relies on novel cold storage and transportation solutions to maintain product quality, extend shelf life, and reduce spoilage. Manufacturers and distributors are investing in state-of-the-art refrigeration technologies, such as automated storage facilities, energy-efficient cold chains, and intelligent temperature monitoring, in response to high consumer demand for quality frozen bakery items. These developments contribute to the optimal delivery of products such as frozen bread, pastries, and desserts to consumers.

Last-mile delivery innovations like temperature-controlled logistics and expedited delivery services further help improve convenience for both retailers and the end consumer. Prioritizing investments in innovative cold chain solutions will likely give businesses a competitive edge as e-commerce sales of frozen bakery products continue to rise. This is projected to reduce wastage and help cater to consumer demand for superior frozen bakery products.

Brand Collaborations with Food Bloggers to Propel Demand for Frozen Pancakes and Waffles

The U.S. market for frozen bakery products is experiencing significant growth, with frozen croissants and donuts gaining impetus. Direct-to-consumer frozen bakery subscriptions and online grocery platforms are anticipated to contribute to increasing sales of frozen croissants and donuts. Various companies like Pastreez, Wildgrain, and Goldbelly have started providing these products directly to consumers, enabling them to enjoy bakery-quality items at home.

Frozen pancakes and waffles, on the other hand, are set to showcase a considerable CAGR through 2032. Brands are projected to collaborate with food bloggers and influencers to show visually appealing presentations and new recipes. Viral trends like pancake charcuterie boards and waffle cereal are likely to result in high consumer demand.

Rising Awareness of Sugar-related Health Risks to Spur Demand for Sugar-free Frozen Bakery Items

By claims, the sugar-free segment will likely generate a share of 56.7% in 2025. Demand for sugar-free frozen bakery products is anticipated to rise in the U.S. with surging awareness of health risks related to excessive sugar consumption. The International Food Information Council (IFIC), for instance, revealed that in 2023, nearly 72% of consumers in the U.S. had reduced their sugar intake.

The American Heart Association further recommends a daily sugar intake of no more than 36 grams for men and 25 grams for women. With similar recommendations, several companies have started reformulating their products with sugar substitutes. Frozen items like sugar-free muffins, cookies, and pastries are hence projected to remain in high demand.

Low-carb, on the other hand, is anticipated to witness a steady CAGR through 2032 with increasing shift of modern consumers toward high-protein, ketogenic diets. Consumers are striving to reduce their carbohydrate intake to enhance metabolic health, control blood sugar levels, and manage weight. Online platforms like iHerb, Thrive Market, and Amazon Fresh have become key distributors of low-carb frozen bakery products, providing high convenience.

Key companies in the U.S. frozen bakery products industry are focusing on launching various types of frozen baked products to cater to a large consumer base. They are also targeting specific sections of the population like those seeking gluten-free and low-calorie items to surge sales.

A few firms are aiming to collaborate with foodservice companies to provide them with new frozen products. Some of the other firms are striving to broaden their presence across the U.S. by opening new outlets or enhancing their distribution networks.

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographic Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Nature

By Claims

By Sales Channel

By Zone

To know more about delivery timeline for this report Contact Sales

The market is estimated to be valued at US$ 5,674.6 Mn in 2025.

Demand is set to be pushed by surging consumer preference for convenience, long shelf life, and ready-to-bake options.

Bread is estimated to hold a considerable share in the U.S. in 2025.

Grupo Bimbo, Conagra Brands, Sara Lee Frozen Bakery, and Kellanova are a few key providers.

The U.S. industry is set to rise at a CAGR of 5.9% through 2032.