ID: PMRREP34554| 189 Pages | 5 Mar 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

The global rare earth elements market is set to expand at a CAGR of 10.6% between 2025 and 2032. It will likely rise from US$ 7.2 Bn in 2025 to US$ 14.7 Bn by 2032.

Rare earth elements (REEs) are extensively used in making permanent magnets, which are widely used in the manufacturing of electric motors for electric vehicles, wind power, and several other areas. Magnets are set to be the fastest-growing application area for rare earth elements globally.

Demand for neodymium magnets has been soaring primarily due to the shift toward new energy vehicles such as Battery Electric Vehicles (BEVs), Fuel Cell Electric Vehicles (FCEVs), and Plug-in Hybrid Electric Vehicle (PHEVs) from Internal Combustion Engine (ICE) vehicles. Also, rising inclination toward sustainable energy sources is estimated to spur demand.

-market.webp)

Key Highlights of the Rare Earth Elements Industry

|

Global Market Attributes |

Key Insights |

|

Rare Earth Elements Market Size (2025E) |

US$ 7.2 Bn |

|

Market Value Forecast (2032F) |

US$ 14.7 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

10.6% |

|

Historical Market Growth (CAGR 2019 to 2024) |

10.2% |

Price Volatility Hit Rare Earth Elements Projects Globally during the Historical Period

The global rare earth elements market was valued at US$ 4.0 Bn in 2019, experiencing substantial growth at a CAGR of 10.2% through 2024. Demand peaked between 2020 and 2024, largely driven by increased demand from new electric vehicles and other high-tech products. China reaped significant benefits from this trend during this post-pandemic wave.

Geopolitical factors also played a significant role in price fluctuations of REEs. Efforts to diversify supply chains and secure sustainable sources, such as partnerships with Australia, emerged but remained limited in terms of impact. Price volatility had potentially deterred investment in rare earth element projects, as China-based manufacturers remained the most cost-efficient worldwide.

Increasing Popularity of Electric and Hybrid Vehicles to Fuel Future Growth

The rare earth elements industry is poised to experience steady growth from 2025 to 2032, with a projected CAGR of 10.6%. The popularity of electric and hybrid vehicles in developed regions, fueled by environmental concerns and high per capita expenditure, will likely sustain demand for rare earth metals in vehicle production.

The emerging applications of REE in the clean energy sector are also expected to create lucrative growth prospects for the market in the coming years.

Growth Drivers

Vehicle Electrification Revolution to Drive Demand for Rare Earth Elements

The global Electric Vehicle (EV) market is on the rise, translating to a high demand for materials that are used in their manufacturing. Rare earth elements are widely used in EV motors.

In the next few years, 80% of all EVs are projected to use Permanent Magnet Synchronous Motors (PMSMs). Automotive OEMs are planning on massive jumps in EV production and are looking for sustainable partners to fulfill their demand for these motors. For example,

With the rising EV infrastructure across both developed and developing countries, as well as increasing initiatives and push from the government sector, the EV market continues to experience a flourishing outlook worldwide. The automotive industry’s decarbonization goal further uplifts this demand surge.

The global rare earth elements industry is hence projected to thrive with the evolution of the EV industry.

Growth of Clean Energy Technologies such as Wind Power Generation to Support the Market

Rare earth elements are crucial for advancing clean energy technologies such as wind turbines, electric vehicles, and solar panels. The efficiency improvements in wind turbines, enabled by permanent magnets, are expected to fuel a CAGR of over 50% in wind turbine installations. The clean energy technologies sector is anticipated to increase demand for rare earth elements considerably, as strong magnets are important in the construction of direct-drive wind turbines.

Neodymium, dysprosium, praseodymium, and terbium are vital for creating powerful permanent magnets for usage in wind turbine generators. For instance,

Price Unpredictability Remains the Dominant Factor in the Market, Affecting Profitability

The price dynamics of rare earth elements between 2019 and 2023 reflect diverse market influences driven by global demand, supply constraints, and geopolitical factors. While prices of light REEs like lanthanum and cerium dropped due to oversupply and limited demand for their traditional applications, the value of critical heavy REEs like terbium surged significantly, up by 76.3%. It is due to their indispensable role in green technologies like wind turbines and electric vehicles.

Yttrium's 50% price hike aligns with its rising demand across high-tech applications like lasers and superconductors. Terbium's steep rise highlights its limited availability and high demand for phosphors and advanced magnet technologies.

Recycling has Become a Critical Route to Maintain Steady Sourcing

Currently, only 1% of the total REE is recovered through end-products such as magnets, batteries, catalysts, and fluorescent lamps. Considering the importance of these strategic minerals to modern technologies and sustainable energy sources, several companies have started investing in recycling rare earth elements. For instance,

Rare earth is usually mixed with other elements, thereby making the recycling process complex and economically challenging. However, recycling or reusing REEs can contribute to ethical sourcing and conflict-free value chains. For instance,

These advancements in recycling technologies offer a sustainable solution to alleviate the dependence on traditional mining and contribute to meeting the high demand for rare earth metals.

Product Type Insights

Light Earth Elements like Neodymium Continue to Gain Traction in Permanent Magnets Production

In 2025, the global light rare earth elements market is anticipated to reach a value of around US$ 6.0 Bn, with a CAGR of 11% expected till 2032. In value terms, neodymium and praseodymium hold paramount importance in the rare earth elements industry, particularly for their indispensable role in manufacturing permanent magnets, a critical cog across sectors such as green technologies, industrial applications, consumer electronics, and robotics.

Neodymium, on the other hand, stands out as a cornerstone element in rare earth minerals due to its pivotal contribution to high-performance magnets. One of the neodymium's attributes is its high melting point, making it well-suited for applications involving elevated temperatures like electric motors.

Lanthanum to be the Second-most Abundant REE

The global market for lanthanum is estimated to reach a value of US$ 140 Mn in 2025, with a projected growth rate of 8.6% by 2032. Lanthanum finds extensive use in nickel metal hydride rechargeable batteries, where it constitutes a significant portion of the negative electrode as lanthanum hydride.

Lanthanum also plays a crucial role in glass and ceramic manufacturing by improving the alkali resistance of glass. It is also being utilized in specialized optical glasses like infrared-absorbing glass.

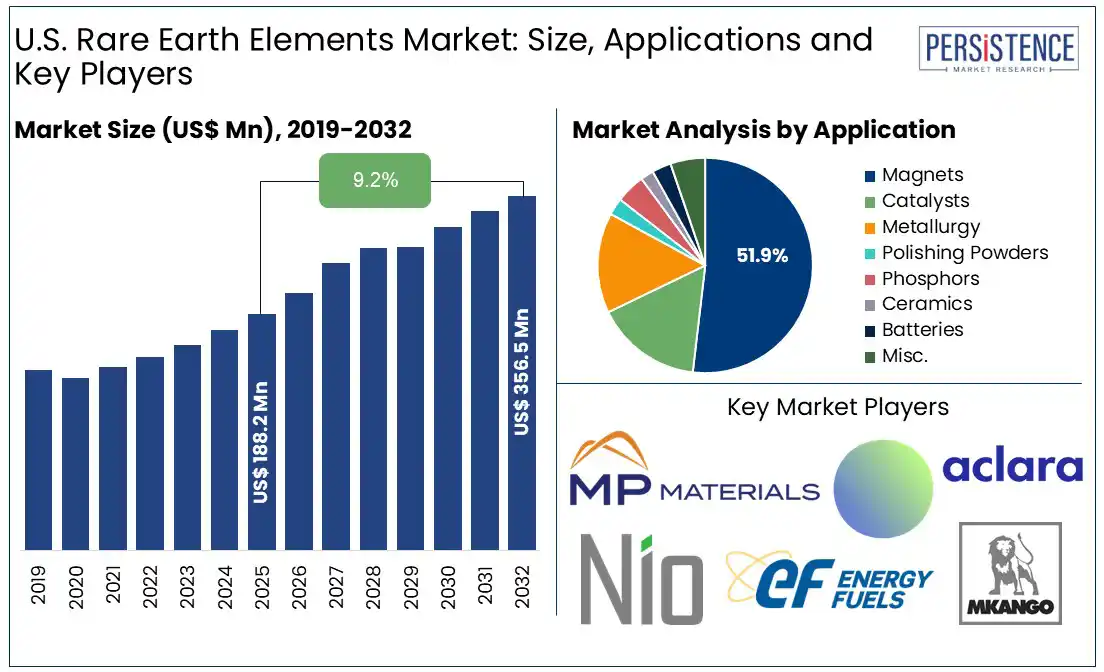

Application Insights

Search for Permanent Magnets and Catalysts from Green Technology Providers Continues to Support Growth

In 2025, permanent magnets are set to capture around 80% of the global requirements of rare earth elements. Rare earth metal-based magnets such as neodymium-praseodymium (NdPr) and samarium cobalt (SmCo) have become essential building blocks for sectors such as automotive, HVAC, robotics, green energy technologies, and consumer electronics.

Neodymium is crucial for making powerful magnets used in mobile phones, medical equipment, electric cars, wind turbines, and hard drives. Praseodymium, on the other hand, is essential for aircraft engines and studio lighting.

Traditionally, the NdPr magnets market is primarily taken up by electronic goods, e-bikes, and other automotive moving components. However, with the rise in EV sales and shift toward sustainable energy pockets, demand for Nd and Pr is likely to exhibit a substantial rise.

The luminescent properties of yttrium, terbium, and europium enhance fluorescent tubes, LED lights, and LCD screens in smartphones and TVs. Lanthanum is key for digital camera lenses and hybrid vehicle batteries.

Rare earth elements such as lanthanum and cerium are widely used as catalysts in automotive and petrochemical sectors. La and Ce are used as catalysts in petrochemical refining, automobile emission catalytic controllers, industrial waste gas purification, fossil fuel catalytic combustion, and solid oxide fuel cells. Rare earth oxides are also used significantly in metallurgy, ceramics, batteries, and polishing powders.

Asia Pacific Rare Earth Elements Market

China’s Leadership in Asia Pacific to be Strengthened by Processing and Mining Innovations

Asia Pacific has been the largest consumer of rare earth elements globally, accounting for more than 90% of the global demand. China currently accounts for approximately 70% of the world's rare earth elements production and processes close to 85%, as well as controls around 90% of the permanent magnet production, effectively granting it a monopoly in the market.

To maintain this dominant position, China has imposed a ban on the export of processing technology. Furthermore, the country is investing in technological developments in the mining sector to support its value chain.

Japan and India are also among the key contributors to the rare earth elements industry in Asia Pacific. India’s IREL Limited and Japan’s Toyota Tsusho Corporation through their joint venture operate a separation and refining facility in Andra Pradesh, India. This partnership may open a plethora of opportunities in terms of technological investments and best practices.

Europe Rare Earth Elements Market

Europe’s High Demand for Rare Earths is Encouraging Domestic Resource Development

Europe is one of the largest importers of Rare Earth Elements (REEs) globally, with the region importing more than 98% of its REEs from China. Although the region is rich in rare earth oxide deposits, manufacturing companies cannot compete commercially with the likes of China owing to higher energy costs and technological challenges.

Despite the region's security significance, governments and private companies in Europe have struggled to escape China’s orbit of rare earths. Germany, France, and the U.K. are the region’s largest markets for rare earth elements accounting for over half of the demand, primarily targeting catalysts, metallurgy, and magnets.

Other countries in Europe such as Sweden, Finland, Norway, and Spain are also planning to invest in the rare earth value chain to reduce the reliability of heavy rare earth elements on imports. For instance,

North America Rare Earth Elements Market

Demand to Take Off in North America with Booming Military and Defense Manufacturing Activities in the U.S.

By 2032, the North America rare earth elements market is estimated to be valued at US$ 300 Mn with a robust CAGR anticipated between 2025 and 2032. Both the U.S. and Canada have large rare earth reserves and resources. However, the complex separation and refining process poses substantial economic challenges for them.

In the U.S., MP Materials owns the sole rare earth elements mine, accounting for approximately 2.3 million metric tons of proven reserves. However, despite this significant reserve base, the U.S. heavily relies on imports for REEs, with nearly 78% sourced from China. For example,

Demand for REEs is also set to be propelled by the renewable energy and defense sectors, utilizing these elements to advance their technologies.

With the growing orders for this advanced fighter jet from across the world, demand for rare earth elements will likely flourish in the defense sector of the country.

The global rare earth elements industry is largely dominated by China-based firms, prompting top players to innovate new extraction techniques with reduced carbon footprints. These initiatives aim to mitigate environmental impact and address sustainability concerns associated with rare earth element extraction. Manufacturers are also exploring environmentally sustainable recycling methods to minimize waste and reliance on virgin materials, thereby promoting circular economy principles. For example,

Key Industry Developments

By Product Type

By Application

By Sector

By Region

The market is anticipated to reach a value of US$ 7.2 Bn in 2025.

China is considered one of the largest producers of rare earth minerals in the world.

The industry is estimated to rise at a CAGR of 10.6% through 2032.

Light rare earth elements such as neodymium and praseodymium are set to be the key products.

Permanent magnets are anticipated to be the leading application segment.

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author