Industry: Automotive & Transportation

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Report Type: Ongoing

Report ID: PMRREP34647

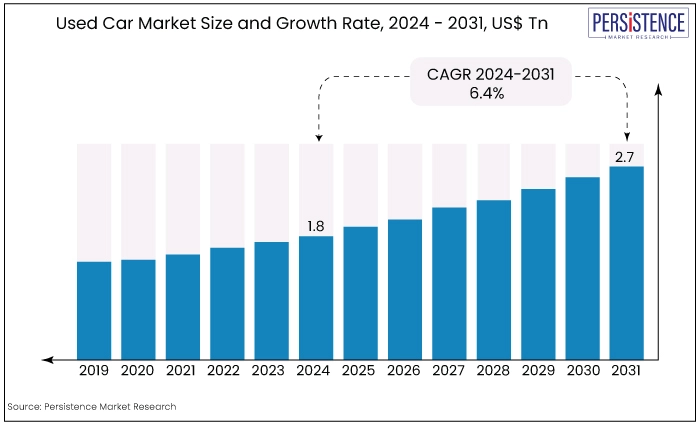

The used car market is estimated to reach a valuation of US$2.7 Tn by the year 2031, at a CAGR of 6.4%, during the forecast period 2024 to 2031.

Key Highlights of the Market

|

Attributes |

Key Insights |

|

Used Car Market Size (2024) |

US$1.8 Tn |

|

Used Car Market Size (2031) |

US$2.7 Tn |

|

Forecast Growth Rate (CAGR 2024 to 2031) |

6.4% |

|

Historical Growth Rate (CAGR 2019 to 2023) |

4.8% |

The used car market remains substantial and expanding as a result of the increasing average age of vehicles on roadways and the pressure on consumers' budgets caused by the rising prices of new cars.

Over the past decade, there has been a consistent expansion in the used car market, and this market has been influenced by a variety of trends, such as the escalating average age of vehicles and the growing preference for personal vehicle ownership over public transportation as a result of the pandemic outburst in the year 2020-21.

A stable demand is the result of the increasing cost of new vehicles, which has led to a significant number of buyers transitioning to the used car market. It has also been advantageous for numerous consumers to streamline the process of purchasing a used automobile through online sales and improved digital shopping experiences.

The shipment of used cars was recorded at 120.3 million units in the year 2023, which shows the potential of the market. In the past few years, the used car industry has experienced substantial growth due to the price competitiveness of new participants.

One of the factors contributing to the increasing volume of used car sales is the inability of consumers to purchase new vehicles. This is further exacerbated by the investments made by industry participants to establish their dealership networks in the market. These dealership networks facilitated the marketing of the brand of the participants and the viability of used car options.

The period from 2019 to 2023 marked a transformative phase for the global used car market, characterized by resilience, technological advancement, and evolving consumer preferences.

Understanding these historical trends and anticipating future developments will be crucial for stakeholders aiming to navigate the complexities of the global used car market and sustain growth in a competitive environment.

In 2019, the global used car market continued its upward trajectory, supported by a combination of factors including economic stability in key regions, increasing consumer confidence, and a growing preference for cost-effective transportation solutions.

Established markets in North America, Europe, and parts of Asia Pacific led in terms of transaction volumes, with consumers opting for used cars due to their lower upfront costs compared to new vehicles.

The market dynamics were also influenced by advancements in online platforms and digital marketplaces, which streamlined the buying and selling processes, enhancing market accessibility and transparency. Further, in 2023, the global used car market continued its upward trajectory with sustained growth momentum.

The integration of artificial intelligence (AI) and machine learning (ML) technologies in vehicle valuation, pricing algorithms, and customer relationship management further optimized operational efficiencies for industry stakeholders.

Regional variations in market dynamics persisted, with emerging economies witnessing accelerated growth driven by rising middle-class populations and increasing urbanization rates.

Changing Consumer Preferences

Changing consumer preferences and demographics play a significant role in driving the global used car market. Millennials and Gen Z, in particular, prioritize affordability, sustainability, and value for money when purchasing vehicles.

This demographic shift towards urbanization, environmental awareness, and flexible mobility solutions has contributed to the rising demand for used cars, especially compact and fuel-efficient models.

Additionally, preferences for SUVs, electric vehicles (EVs), and vehicles with advanced safety features have influenced the market dynamics, prompting dealerships and online platforms to diversify their inventory to cater to evolving consumer needs.

Rapid Urbanization

Emerging markets and rapid urbanization present significant growth opportunities for the global used car market. As urban populations expand and infrastructure developments progress, the demand for personal mobility solutions increases.

Rising middle-class populations in regions such as Asia Pacific, Latin America, and Africa are driving demand for affordable and reliable used cars as primary modes of transportation.

Leading used car market participants can leverage these opportunities by establishing strategic partnerships, expanding dealership networks, and offering tailored financing solutions to cater to diverse consumer preferences and purchasing power levels.

Supply Chain Disruptions

Supply chain disruptions have been a critical restraint for the global used car market, particularly exacerbated by events such as the COVID-19 pandemic and semiconductor shortages.

These disruptions have significantly affected both the production of new vehicles and the availability of used cars in the market. The shortage of semiconductors, essential components in modern vehicles for electronic systems, has disrupted automotive production worldwide.

Automakers prioritized semiconductor allocation for new vehicle production, resulting in reduced availability of new cars and a trickle-down effect on the availability of trade-ins and lease returns entering the used car market.

Extended lead times for new car deliveries have led consumers to retain their existing vehicles longer or opt for used cars as immediate substitutes. This has reduced the supply of used cars typically sourced from trade-ins, further limiting inventory in the used car market and potentially driving up prices due to increased demand.

Limited availability and increased prices of both new and used cars have affected affordability for consumers, particularly in lower-income brackets.

The constrained supply has created a seller's market scenario, where dealerships and private sellers can command higher prices for their available inventory, potentially pricing out some prospective buyers.

Reluctant Consumer Behavior

Another significant restraint for the global used car market share revolves around issues related to quality assurance, vehicle history transparency, and maintaining consumer trust in the purchase process.

Unlike new cars that come with manufacturer warranties and assurances of quality, used cars vary widely in condition and maintenance history. Buyers often face uncertainty about potential hidden issues, previous accidents, or undisclosed mechanical problems, which can deter purchases.

There is a lack of standardized inspection and certification processes across different regions and markets, leading to inconsistencies in how used cars are assessed and marketed.

Variations in regulatory standards, vehicle histories, and inspection criteria can complicate cross-border transactions and diminish consumer confidence in the reliability and safety of used vehicles.

Negative experiences or perceptions regarding used car purchases, such as encountering undisclosed repairs or unexpected maintenance costs shortly after purchase, can erode consumer trust. This can discourage repeat business and referrals, impacting dealership reputations and the overall market growth.

Digital Transformation

The shift towards digitalization has revolutionized the used car market, offering significant opportunities for industry participants. Continued growth in online marketplaces and digital platforms for buying and selling used cars presents a substantial opportunity.

Used car industry players can invest in enhancing user experience, implementing virtual showroom technologies, and improving digital payment systems to facilitate seamless transactions and reach a broader consumer base globally.

Digital auctions and bidding platforms provide efficient mechanisms for dealers and consumers to acquire and sell vehicles. These platforms offer transparency in pricing, vehicle conditions, and bidding processes, fostering trust and enabling fair market value determination.

Implementing real-time analytics and AI-driven pricing algorithms can further optimize these platforms, and eventually create immense opportunities for the global used car market players.

Hatchback Vehicles Make up for 48% Total Used Car Purchases

|

Market Segment by Vehicle Type |

Market Value Share 2024 |

|

Hatchbacks |

48% |

Based on vehicle type, the global used car market is further segmented into hatchbacks, sedans and SUV, where the hatchback vehicle type dominates the market share accumulating around 48% of the total market share.

Hatchbacks, being one of the most compact body styles, provide a practical amount of cargo space without taking up excessive space on the road.

Hatchbacks are able to attain higher fuel efficiency compared to other vehicle categories due to their smaller engines and light-bodied designs. This makes them a desirable choice for used car buyers who are looking for affordable transportation without sacrificing utility.

Hatchbacks are advantageous for navigating through crowded city streets because of their small size and agile manoeuvring capabilities.

The wide range of hatchback models offered by various brands enables consumers to discover a pre-owned choice that aligns with their lifestyle and financial requirements.

In general, hatchbacks have become widely popular in the market for used cars because of their practicality in terms of space-saving and their affordability in the long run of ownership.

Petrol to be the Sought-After Fuel Type with 42% Market Share

|

Market Segment by Fuel Type |

Market Value Share 2024 |

|

Petrol |

42% |

Based on fuel type, the used car market is further divided into petrol, diesel and hybrid, where the petrol used cars dominates the market share owing to its widespread availability and reliability.

Petrol provides users with unparalleled convenience, in contrast to other powertrains that necessitate speciality fuels or lengthy charging periods. In most of cities and regions, the number of petrol stations continues to be significantly greater than that of alternatives such as CNG or electric vehicle recharge points.

Petrol vehicles are a reliable option in a variety of travelling conditions due to the extensive refuelling infrastructure. Petrol engines are also simpler mechanically, as they have fewer moving elements than other technologies.

Consequently, they are known to have a lengthy lifespan in used car applications when subjected to routine maintenance.

The cost of possession remains low over time due to the ease of obtaining generic spare parts and repairs. The unmatched convenience and accessibility of petrol have solidified its dominance among purchasers who are seeking a practical yet hassle-free used car experience.

North America’s Dominance Intact

|

Region |

Market Value Share 2024 |

|

North America |

38% |

North America holds the greatest portion of the global used car market share, accounting for approximately 30% of sales worldwide. The vast expanse of the region and the high number of registered vehicles in use make a substantial contribution to the annual resale volumes.

Prominent economies like the US, and Canada, having the presence of major metropolitan cities such as New York, Los Angeles, and Chicago have firmly established used car retailers catering to the needs of customers around the country.

Dealers benefit from being close to major car manufacturing centres, as it gives them convenient access to trade-in vehicles. Additionally, the use of Internet advertising helps dealers distributes their inventory across the entire country.

The extensive selection of brands and designs greatly attracts purchasers, regardless of whether they are seeking cost-effective means of transportation or unique and specialized cars.

The secondary market in the US benefits from a consistent inventory of trade-ins and off-lease returns, which helps to maintain several listings keeps prices competitive and aids the market's growth in the North American region.

June 2023

Jardine Cycle & Carriage Limited signed a collaboration deal with Carro to provide Carro access to a broader selection of high-quality used cars.

August 2022

Lexus, a major subsidiary of Toyota Motors, introduced its Lexus Certified Programme in the Indian market.

December 2023

Truecar Inc. signed an acquisition deal with Digital Motors to enhance the consumers of Truecar to have a seamless digital car buying and selling experience.

The global used car market is highly competitive, characterized by a diverse range of players from traditional dealerships to online platforms.

With the changing consumer preferences, key players in the industry are trying to cater for the demand by offering convenience and transparency in pricing and services.

With this, the global used car market is undergoing a significant transformation driven by digitalization and evolving consumer preferences. The advent of AI, block chain, and IoT are reshaping inventory management, customer engagement, and transaction security.

Success in this competitive landscape requires agility, technological integration, and a deep understanding of regional market dynamics and consumer behaviours.

|

Attributes |

Details |

|

Forecast Period |

2023 - 2033 |

|

Historical Data Available for |

2019 - 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Companies Profiled |

|

|

Pricing |

Available upon request |

By Vehicle Type

By Fuel Type

By End Use

By Region

To know more about delivery timeline for this report Contact Sales

The changing consumer preferences and the rapid urbanization are major driving factors for the market’s growth.

The global used car market is estimated to exhibit a CAGR of 6.4% during the forecast period.

North America is the leading region in the market.

Hatchback is the dominant used vehicle type in the market.

Alibaba.com., CarMax Enterprise Services, LLC, Asbury Automotive Group, TrueCar, Inc., and Scout24 SE are some of the major key companies in the market.