U.S. Hummus Market

Industry: Food and Beverages

Published Date: November-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 181

Report ID: PMRREP34899

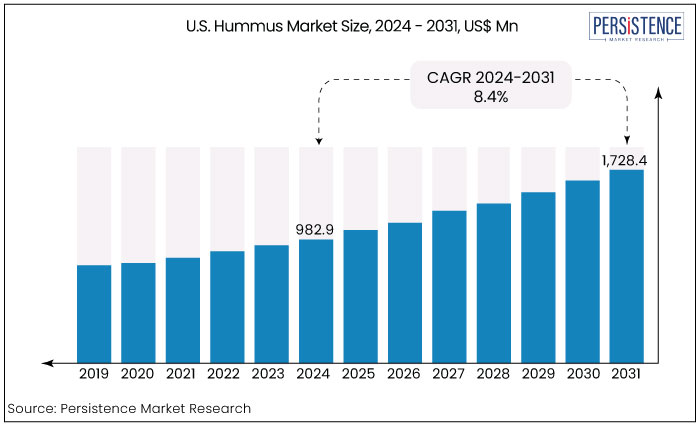

The U.S. hummus market is estimated to be valued at US$ 1,728.4 Mn by 2031 from US$ 982.9 Mn recorded in 2024. The market is expected to secure a CAGR of 8.4% in the forecast period from 2024 to 2031. Rising demand from millennials for plant-based protein sources is projected to create new opportunities for hummus brands in the U.S.

Brands such as Sabra and Tribe, for instance, have benefited from this trend by offering a range of hummus varieties that appeal to different palates. They have been launching classics like roasted red pepper and garlic as well as creative items like cocoa hummus and sweet flavors. In February 2024, Sabra launched a unique hummus blend infused with new toppings and bold flavors. The new range provides a wide variety of spices, herbs, and vegetables.

Hummus sales have also increased as a convenient, high-protein alternative for on-the-go snacking due to an influx of health-conscious customers who emphasize high-protein snacks. This trend has been aided by the appeal of meal kits and nutritious snack alternatives found in supermarkets, which have made hummus a common home staple.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Market Size (2024E) |

US$ 982.9 Mn |

|

Projected Market Value (2031F) |

US$ 1,728.4 Mn |

|

U.S. Hummus Market Growth Rate (CAGR 2024 to 2031) |

8.4% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

6.8% |

|

Category |

CAGR through 2031 |

|

Type- Classic |

8.2% |

By type, the classic hummus segment is projected to dominate the U.S. in the forecast period. Classic hummus is primarily made of chickpeas, tahini, olive oil, garlic, and lemon juice, which appeals younger demographics in the country. This variety is celebrated for its simplicity and adaptability, catering to a wide range of taste preferences with a balanced, subtle flavor profile. Its versatility makes it an ideal pairing of foods like fresh vegetables, pita bread, and crackers, solidifying its place in various households as a healthy, easy-to-include snack.

The classic hummus option also benefits from high cultural acceptance, as hummus has become a familiar and widely enjoyed food in the U.S. over recent years. Despite the growing popularity of flavored alternatives, the traditional version’s enduring appeal, combined with its nutritional benefits, helps it maintain a leading position in the market. It is mainly favored by millennial consumers for its timeless taste and healthy ingredients.

|

Category |

CAGR through 2031 |

|

Nature- Organic |

9.6% |

Modern consumers are becoming increasingly aware of the benefits of organic food items. They are mainly avoiding foods infused with synthetic additives, pesticides, and GMOs. This shift reflects a preference for transparency, as a growing number of people prioritize foods that are sustainably and ethically sourced. Organic hummus aligns well with these preferences, appealing to those committed to environmental responsibility. Also, as organic farming practices generally have a lower ecological footprint, demand is projected to rise.

To cater to the rising demand, U.S.-based hummus brands are launching organic versions with a range of flavors to attract a large consumer base. The U.S. Department of Agriculture’s organic label has become a key influence on purchases, providing consumers with confidence in product quality and authenticity.

Organic products often carry a premium price, which appeals to health-focused, affluent buyers seeking both quality and taste. As organic foods become central to the health food sector, the organic hummus market in the U.S. is anticipated to surge significantly, driven by consumer values and preferences.

The rise of global and ethnic cuisine exploration among modern consumers in the U.S. is anticipated to boost demand in the evaluation period. The popularity of Mediterranean cuisine, especially hummus, has increased dramatically as consumers seek real exotic flavors and ingredients.

Companies like Cedar's and Athenos, for example, have jumped on this trend by providing a variety of handmade hummus products that are inspired by classic recipes from the Middle East. They have also frequently used premium, organic ingredients to attract consumers.

The proliferation of Mediterranean food trucks and restaurants serving cuisines from the Middle East has further introduced consumers to hummus in a variety of ways. These places have launched traditional dips as well as promoted its use in gourmet dishes like hummus bowls or as a spread on wraps. In addition to satisfying consumers' increasing desire for international flavors, this culinary experiment raises the market's perception of the genuineness of hummus.

From 2019 to 2023, the U.S. hummus market witnessed steady growth at a CAGR of 6.8%. It was propelled by rising consumer demand for plant-based, nutritious snack options. The popularity of global and Mediterranean flavors, along with the health benefits of chickpeas, drove sales as consumers increasingly favored high-protein, vegan foods. To capture diverse consumer tastes, brands introduced varied flavor profiles, organic options, and even sweet or dessert hummus, broadening its appeal across multiple demographics.

From 2024 to 2031, the U.S. market is projected to continue its upward trajectory at a CAGR of 8.4%. Demand is expected to remain strong among health-conscious and vegan consumers. Rising emphasis on innovative flavors, organic certifications, and functional ingredients like probiotics is also set to push sales.

E-commerce boom will likely enhance accessibility, while digital marketing efforts aim to capture younger audiences. Additionally, sustainable packaging and sourcing are set to become central as brands seek to align with eco-conscious consumer values. This evolving landscape is likely to encourage both established brands and new entrants to extend their offerings, catering to increasingly diverse preferences in the plant-based foods segment.

Rising Demand for Convenient, On-the-go Snacking Options to Push Sales

As a nutritious, plant-based snack high in protein, fiber, and essential nutrients, hummus attracts a broad consumer base. It appeals especially to those prioritizing fitness, wellness, and healthy lifestyle choices. With snacking increasingly substituting traditional meals, whether during a hectic workday or while traveling, hummus has become a preferred option across diverse demographics. Its versatility and satisfying nature make it an ideal pairing with popular dippable items like vegetables, pita chips, and crackers, adding to its appeal as a convenient, energy-sustaining grab-and-go snack.

Manufacturers have enhanced hummus’s portability and convenience through innovative portion-controlled, single-serve packaging. These individual packs appeal to health-conscious consumers. At the same time, these help align with sustainability efforts, catering to consumers who prioritize waste reduction.

Brands have also broadened their flavor offerings within single-serve hummus options, introducing varieties like spicy, garlic, roasted red pepper, and even dessert flavors. This diversification allows for a broad consumer reach, addressing varied taste preferences while reinforcing its position as a versatile, nutritious snacking choice in the evolving market.

Launch of Hummus with Functional Ingredients to Bolster Demand

Hummus has recently gained traction in the U.S. as a functional food with added health benefits beyond basic nutrition. The use of superfoods and nutrient-dense ingredients in hummus recipes, which appeal to consumers seeking more than simply a conventional snack, is driving this trend. For instance,

Customers are set to be drawn to products that offer ingredient transparency and extra health advantages, which supports the demand for specialized hummus. This trend also coincides with the rapid shift toward clean-label products.

Competition to be Intense from Plant-based Dips and Spreads

The U.S. hummus market is facing rising competition from a growing variety of plant-based dips and spreads, as consumers increasingly seek options beyond traditional chickpea hummus. Brands are introducing alternatives like avocado guacamoles, almond and cashew-based dips, black bean spreads, and lentil options. Each of these offer unique flavors, textures, and nutritional profiles that attract consumers interested in exploring new plant-based options.

A few of the alternative products also meet specific dietary needs, such as nut-free, dairy-free, and gluten-free requirements, which have become significant in today’s market. These new offerings challenge hummus’s position as a popular healthy dip. To stay competitive, leading brands must innovate by introducing new flavors, enhancing ingredient quality, and targeting diverse consumer preferences within the broad plant-based product market.

Brands Target Health-conscious Consumers with Single-serve Options

Hummus is becoming a popular option for health-conscious consumers as demand for high-protein, vegan-friendly choices rise in tandem with the growing popularity of plant-based diets. This change creates chances for businesses to go beyond the conventional chickpea-based hummus by investigating types like avocado-, lentil-, or black bean-based items. Substitutes, such as gluten-free or low-carb products, are designed to satisfy both experimental eaters and people with specific dietary requirements.

Rising convenience trends are set to create a high demand for innovative packaging, such as single-serve and on-the-go formats or snack packs with vegetables or crackers. These formats suit active lifestyles and align with the booming snacking culture across the U.S. Furthermore, with sustainability becoming a central consumer concern, companies have the chance to adopt eco-friendly packaging and sustainable ingredient sourcing. These mainly appeal to environmentally conscious buyers who prioritize responsible consumption.

The U.S. hummus market is highly competitive, driven by both established brands and innovative newcomers. Key players like Lakeview Farms, LLC, Nestlé SA, Strauss Group, and Cedar’s Mediterranean Foods, Inc., dominate the market. They are leveraging brand recognition and diverse product lines to capture consumer interest.

Reputable food companies, including Nestlé also play a significant role by extending distribution channels and promoting hummus as a healthy snack option across mainstream grocery and specialty stores. Small-scale brands emphasize unique flavors and clean-label ingredients to attract health-conscious consumers. With rising demand, competition continues to intensify, fostering innovation and variety in the U.S. healthy hummus landscape.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Million for Value |

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

|

By Type

By Nature

By Sales Channel

By Zone

To know more about delivery timeline for this report Contact Sales

The market is set to rise from US$ 982.9 Mn in 2024 to US$ 1,728.4 Mn in 2031.

It will likely rise at a CAGR of 8.4% through 2031.

Hummus prices can remain high due to ultra-processed ingredients, supply chain issues, and chickpea shortages.

Hummus has gained traction due to its savory flavor and creamy texture.

Lakeview Farms, LLC and Nestlé S.A. are a few leading brands in the U.S.