- Executive Summary

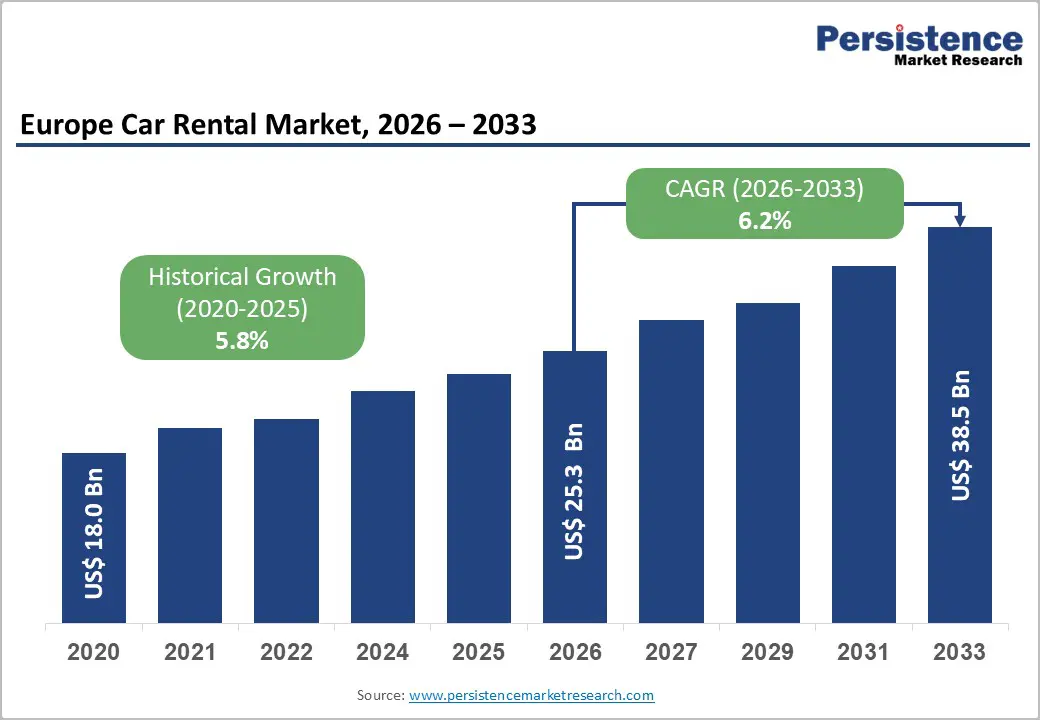

- Europe Car Rental Market Snapshot 2026 and 2033

- Market Opportunity Assessment, 2026-2033, US$ Bn

- Key Market Trends

- Industry Developments and Key Market Events

- Demand Side and Supply Side Analysis

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definitions

- Value Chain Analysis

- Macro-Economic Factors

- GDP Outlook

- Europe Car Rental Demand by Region

- Water Car & Hybrid Fairway Mowers – Adoption Overview

- Europe Labor Cost Inflation

- Europe Capital Equipment Financing & Leasing Availability

- Forecast Factors – Relevance and Impact

- COVID-19 Impact Assessment

- PESTLE Analysis

- Porter's Five Forces Analysis

- Geopolitical Tensions: Market Impact

- Regulatory and Technology Landscape

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Trends

- Price Trend Analysis, 2020 – 2033

- Region-wise Price Analysis

- Price by Segments

- Price Impact Factors

- Europe Car Rental Market Outlook:

- Key Highlights

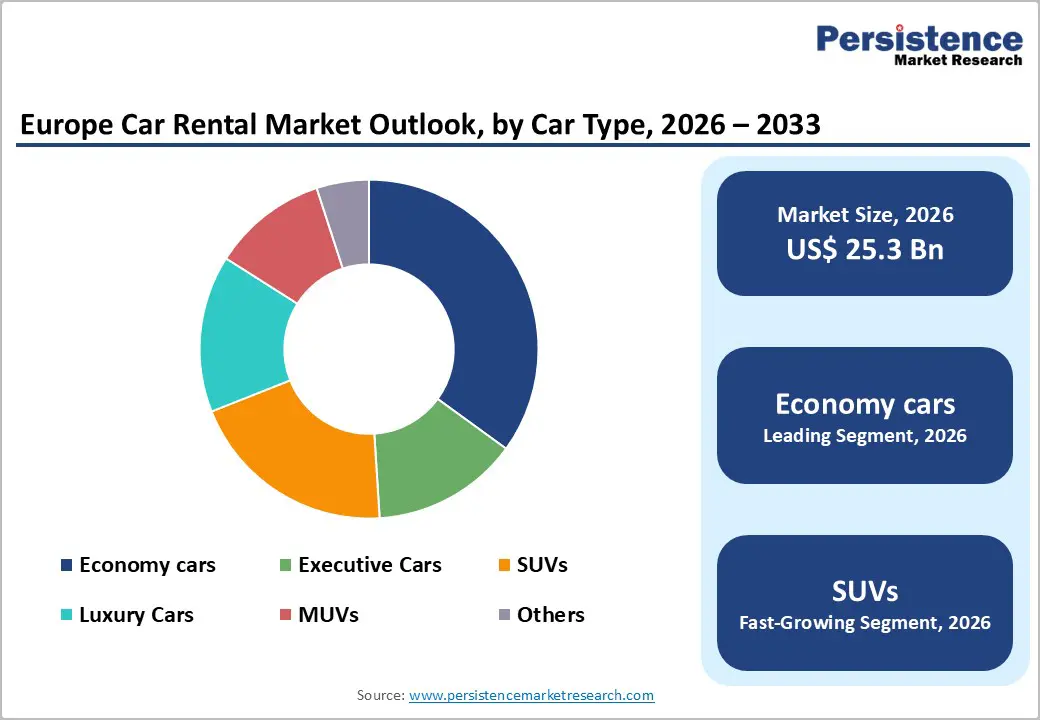

- Europe Car Rental Market Outlook: Car Type

- Introduction/Key Findings

- Historical Market Size (US$ Bn) and Volume (Units) Analysis by Car Type, 2020-2025

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Car Type, 2026-2033

- Economy cars

- Executive Cars

- Luxury Cars

- SUVs

- MUVs

- Market Attractiveness Analysis: Car Type

- Europe Car Rental Market Outlook: Power Source

- Introduction/Key Findings

- Historical Market Size (US$ Bn) and Volume (Units) Analysis by Power Source, 2020-2025

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Power Source, 2026-2033

- Petrol

- Diesel

- Fully Electric

- Hybrid

- Market Attractiveness Analysis: Power Source

- Europe Car Rental Market Outlook: Duration

- Introduction/Key Findings

- Historical Market Size (US$ Bn) and Volume (Units) Analysis by Duration, 2020-2025

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Duration, 2026-2033

- Short-Term Rental

- Long-Term Rental

- Market Attractiveness Analysis: Duration

- Europe Car Rental Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Bn) and Volume (Units) Analysis by Region, 2020-2025

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Region, 2026-2033

- Germany

- Italy

- France

- UK

- Spain

- BENELUX

- Russia

- Rest of Europe

- Market Attractiveness Analysis: Region

- Germany Europe Car Rental Market Outlook:

- Key Highlights

- Pricing Analysis

- Germany Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Car Type, 2026-2033

- Economy cars

- Executive Cars

- Luxury Cars

- SUVs

- MUVs

- Germany Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Power Source, 2026-2033

- Petrol

- Diesel

- Fully Electric

- Hybrid

- Germany Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Duration, 2026-2033

- Short-Term Rental

- Long-Term Rental

- Italy Europe Car Rental Market Outlook:

- Key Highlights

- Pricing Analysis

- Italy Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Car Type, 2026-2033

- Economy cars

- Executive Cars

- Luxury Cars

- SUVs

- MUVs

- Italy Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Power Source, 2026-2033

- Petrol

- Diesel

- Fully Electric

- Hybrid

- Italy Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Duration, 2026-2033

- Short-Term Rental

- Long-Term Rental

- France Europe Car Rental Market Outlook:

- Key Highlights

- Pricing Analysis

- France Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Car Type, 2026-2033

- Economy cars

- Executive Cars

- Luxury Cars

- SUVs

- MUVs

- France Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Power Source, 2026-2033

- Petrol

- Diesel

- Fully Electric

- Hybrid

- France Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Duration, 2026-2033

- Short-Term Rental

- Long-Term Rental

- UK Europe Car Rental Market Outlook:

- Key Highlights

- Pricing Analysis

- UK Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Car Type, 2026-2033

- Economy cars

- Executive Cars

- Luxury Cars

- SUVs

- MUVs

- UK Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Power Source, 2026-2033

- Petrol

- Diesel

- Fully Electric

- Hybrid

- UK Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Duration, 2026-2033

- Short-Term Rental

- Long-Term Rental

- Spain Europe Car Rental Market Outlook:

- Key Highlights

- Pricing Analysis

- Spain Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Car Type, 2026-2033

- Economy cars

- Executive Cars

- Luxury Cars

- SUVs

- MUVs

- Spain Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Power Source, 2026-2033

- Petrol

- Diesel

- Fully Electric

- Hybrid

- Spain Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Duration, 2026-2033

- Short-Term Rental

- Long-Term Rental

- BENELUX Europe Car Rental Market Outlook:

- Key Highlights

- Pricing Analysis

- BENELUX Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Car Type, 2026-2033

- Economy cars

- Executive Cars

- Luxury Cars

- SUVs

- MUVs

- BENELUX Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Power Source, 2026-2033

- Petrol

- Diesel

- Fully Electric

- Hybrid

- BENELUX Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Duration, 2026-2033

- Short-Term Rental

- Long-Term Rental

- Russia Europe Car Rental Market Outlook:

- Key Highlights

- Pricing Analysis

- Russia Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Car Type, 2026-2033

- Economy cars

- Executive Cars

- Luxury Cars

- SUVs

- MUVs

- Russia Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Power Source, 2026-2033

- Petrol

- Diesel

- Fully Electric

- Hybrid

- Russia Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Duration, 2026-2033

- Short-Term Rental

- Long-Term Rental

- Rest of Europe Car Rental Market Outlook:

- Key Highlights

- Pricing Analysis

- Rest of Europe Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Car Type, 2026-2033

- Economy cars

- Executive Cars

- Luxury Cars

- SUVs

- MUVs

- Rest of Europe Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Power Source, 2026-2033

- Petrol

- Diesel

- Fully Electric

- Hybrid

- Rest of Europe Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, by Duration, 2026-2033

- Short-Term Rental

- Long-Term Rental

- Competition Landscape

- Market Share Analysis, 2025

- Market Structure

- Competition Intensity Mapping

- Competition Dashboard

- Company Profiles

- SIXT SE

- Company Overview

- Product Portfolio/Offerings

- Key Financials

- SWOT Analysis

- Company Strategy and Key Developments

- Europcar Mobility Group

- Hertz Holdings

- Avis Budget Group

- Enterprise Holdings

- Auto Europe

- Green Motion

- Drivalia

- OK Mobility Group

- Virtuo & Getaround

- SIXT SE

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment