ID: PMRREP18604| 197 Pages | 26 Nov 2025 | Format: PDF, Excel, PPT* | Food and Beverages

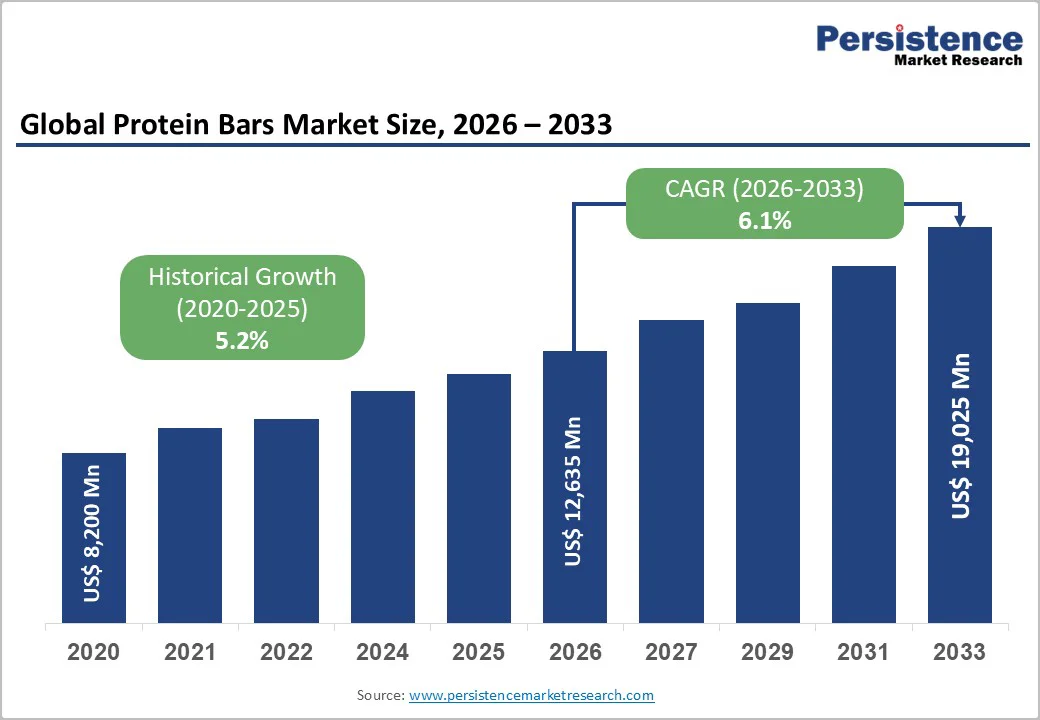

The global protein bars market size is estimated to grow from US$12.6 billion in 2026 to US$19 billion, at a CAGR of 6.1% during the forecast period from 2026 to 2033.

The global protein bars industry is expanding at a substantial pace, driven primarily by rising health consciousness, busy work schedules, and the growth of a fitness-enthusiast population that seeks protein-rich diet options for muscle building. The protein bars market has grown much beyond basic nutrition bars. Flavour innovations, textural variations, and functionalities are the major highlights shaping the industry.

| Key Insights | Details |

|---|---|

| Global Protein Bars Market Size (2026E) | US$ 12,635.7 Mn |

| Market Value Forecast (2033F) | US$ 19,025.7 Mn |

| Projected Growth (CAGR 2026 to 2033) | 6.1% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.2% |

The rising demand for healthy and convenient snack options is a key driver of growth in the global protein bar market. With busy lifestyles and increasing health awareness, sales of protein bars have continued to rise in recent years.

Consumers increasingly view protein bars as a quick, portable source of nutrition that supports muscle recovery, weight management, and overall wellness. This perception is expected to boost market expansion significantly in the coming years. As more individuals seek healthier, on-the-go alternatives, protein bars are positioned as an ideal choice for a nutritious snack that fits seamlessly into fast-paced routines.

Protein bars are gaining market appeal owing to added health benefits such as muscle development, weight management, and improved energy levels. Products tailored to specific dietary needs, like gluten-free, plant-based, and low-sugar options, are seeing rising demand as health-conscious consumers expand.

At the same time, the growing emphasis on clean-label formulations and natural ingredients are emerging as a key trend influencing overall market performance

Protein bars generally cost more than other snack options. This premium is largely attributed to manufacturing expenses and the use of high-quality ingredients. However, price sensitivity remains a significant factor, making it challenging for manufacturers to balance health, nutrition, and affordability.

The issue is particularly pronounced in developing and emerging markets, where cost-conscious consumers limit wider adoption. High prices are a significant barrier to wider adoption of protein bars, especially in emerging markets, where affordability strongly influences consumer choices.

A variety of alternative products are readily available in the market. While protein intake has been increasing and is currently in the limelight, various products are experiencing rapid growth in popularity, including protein powders, cookies, infused beverages, and shakes.

The market also offers a range of attractive products in equivalent segments, such as snack bars and multivitamin bars. This will pose a substantial challenge for the protein bars market. Moreover, growing consumer awareness of the potential health hazards of synthetic sweeteners and hydrogenated fats will also limit the surge in demand.

Protein bars thrive by aligning with diverse consumer preferences, making them one of the most versatile functional foods. High-protein formulations appeal to athletes and fitness enthusiasts seeking muscle recovery, while low-sugar and keto-friendly options attract weight-conscious individuals. Plant-based bars resonate with vegans, vegetarians, and those avoiding dairy, while indulgent flavors satisfy mainstream snackers.

Fortified varieties with added vitamins, minerals, or fiber cater to wellness-focused consumers. Busy professionals and students value their portability as convenient meal replacements or on-the-go snacks. Clean-label, organic, and sustainable offerings further meet ethical and health-conscious demands, ensuring protein bars remain relevant across multiple lifestyle segments.

Protein bars are evolving into specialized formats tailored to meet diverse nutritional needs. Many consumers now choose protein bars that align with their fitness routines or dietary goals. Options designed for paleo, keto, diabetes-friendly, or other functional lifestyles present lucrative opportunities for manufacturers.

The incorporation of added nutrition, such as probiotics, prebiotics, fiber, and superfoods, enhances health benefits and boosts profitability for brands. As consumer dietary preferences grow more complex, leveraging these evolving trends will be key to sustaining growth and ensuring long-term success in the protein bar market.

Protein bar brands are increasingly moving beyond traditional flavors like chocolate and peanut butter, embracing the trend toward distinct, gourmet profiles. As consumers seek more sophisticated yet health-conscious snacking options, companies are experimenting with indulgent varieties such as savory blends, salted caramel, coffee walnut, mint, and dark chocolate.

The focus is shifting toward combining exciting taste experiences with nutritional value, enabling brands to appeal to premium consumer segments with more discerning preferences. This evolution is expected to create a new niche in the protein bar market: premium and gourmet offerings designed to elevate healthy snacking into a refined experience.

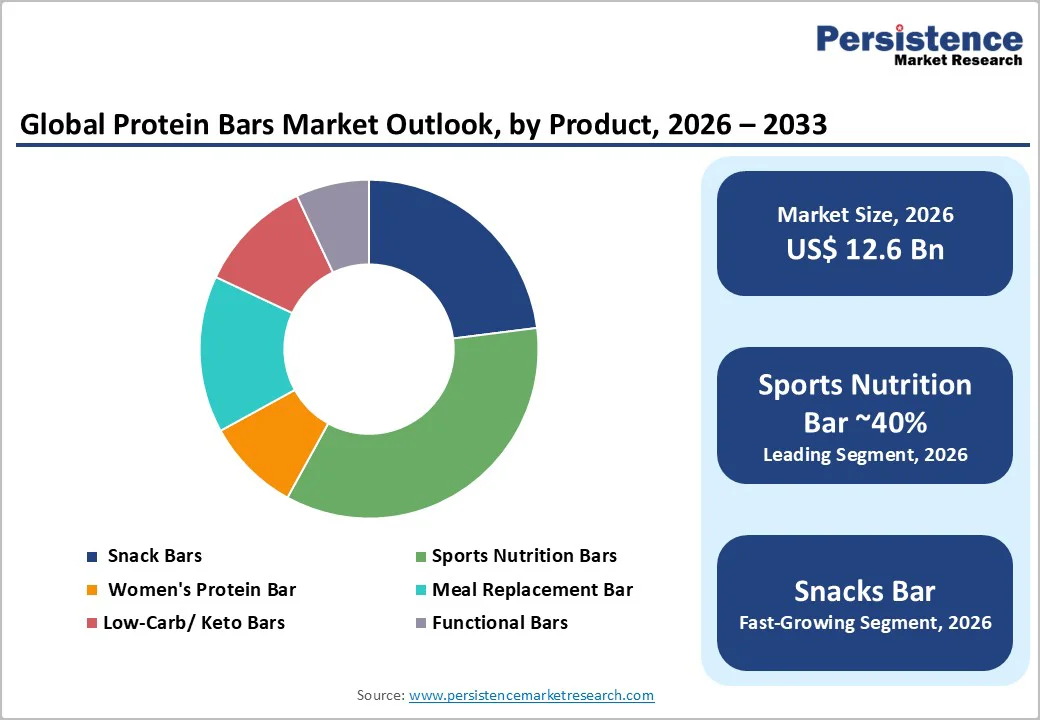

Sports nutrition bars continue to dominate the market by application. These bars are specifically formulated to meet the demands of athletes and fitness enthusiasts who are seeking protein for muscle building and recovery. The high protein content of sports nutrition bars, along with additional nutrients and energy-boosting ingredients, makes them a perfect pre- or post-workout snack.

However, the market is experiencing exciting diversification. Research also points to the potentially higher popularity of meal replacement bars soon, suggesting a probable shift in dominance across the global market for protein bars.

Animal-based protein bars continue to dominate the market due to their broad availability and lower production costs. Yet, the landscape is shifting. Growing numbers of consumers are cutting back on animal protein for ethical, environmental, and health-related reasons. In response, plant-based protein bars are gaining traction, fueled by rising awareness of their nutritional benefits and moral appeal.

Plant proteins are often considered easier to digest and are especially suitable for those who are lactose-intolerant or who avoid dairy. Although extracting plant proteins tends to be more expensive, this category is positioned for strong future growth. Shoppers are increasingly drawn to products that highlight organic, non-GMO, and natural ingredients, which plant-based options often deliver.

High-protein content bars dominate the protein bar market because they meet the growing demand for functional, performance-oriented nutrition. Consumers increasingly seek snacks that provide sustained energy, support muscle recovery, and promote satiety, making protein-rich options more appealing than traditional carbohydrate-heavy bars.

Fitness enthusiasts, athletes, and busy professionals view these products as convenient meal replacements or post-workout fuel. Manufacturers emphasize protein levels in marketing, often highlighting whey, casein, or plant-based sources to attract diverse audiences. With rising awareness of health and wellness, high-protein bars remain the most influential segment, driving innovation and setting the standard for the industry’s growth trajectory.

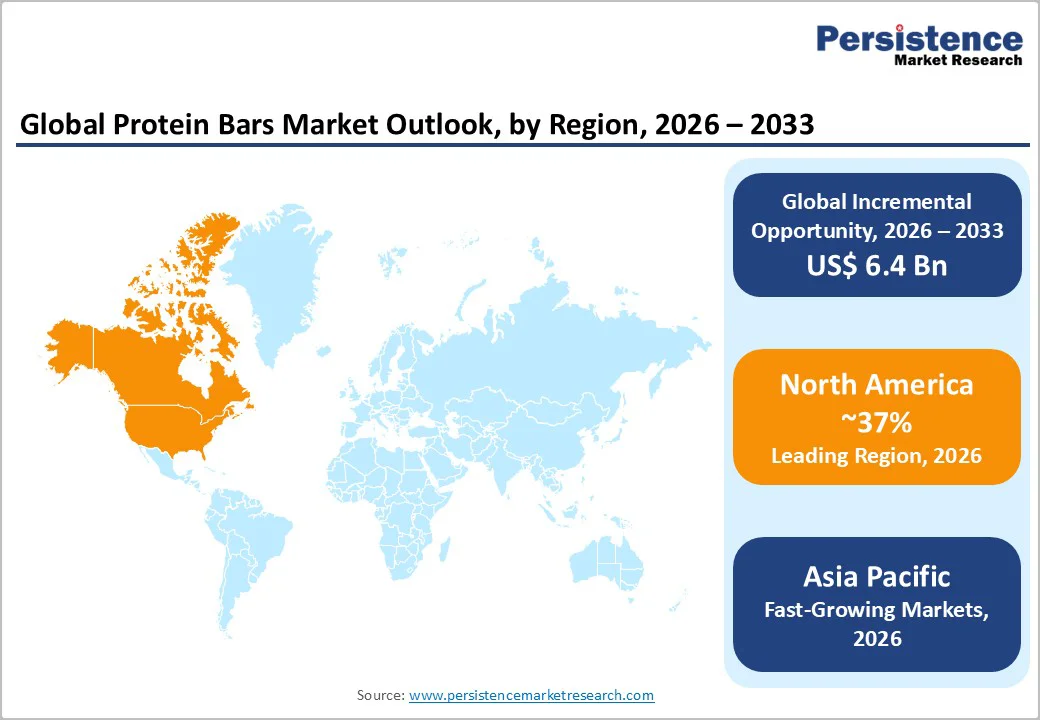

North America, led by the United States, continues to dominate the global protein bars market. This leadership is driven by a large base of health-conscious consumers, a growing preference for nutritious food choices, and the widespread popularity of on-the-go snacking. The region’s strong focus on fitness and well-established healthy-living trends further reinforce market growth.

Protein bars are widely accepted as convenient, wholesome snacks, positioning the U.S. and Canada as top-performing markets. Additionally, advanced retail infrastructure, strategic brand-building efforts, and increasingly busy lifestyles ensure that North America maintains its leading role in shaping the global outlook for the protein bars industry.

Asia Pacific is emerging as the fastest-growing protein bars market, driven by rising living standards, increased spending on lifestyle and diet, and greater access to health and wellness products. Rapid urbanization and busier routines, similar to those in Western regions, are fueling demand for convenient processed foods.

Awareness of the benefits of high-protein diets has surged, with China leading growth and India showing strong future potential. The healthy snacking trend, the popularity of functional foods, and openness to diverse flavors and ingredients are key growth drivers. Additionally, plant-based protein bars using rice, pea, and hemp proteins are shaping market performance.

Protein bar demand in Europe is being driven by rising health awareness, the popularity of plant-based diets, busy lifestyles requiring convenient nutrition, and innovation in clean-label functional products. Plant-based and vegan bars are gaining traction, especially in markets such as Germany, the UK, and France, where clean-label and sustainable products are highly valued.

The surge in gym participation, outdoor sports, and active living is fueling demand for protein bars as quick-recovery solutions for fitness-focused consumers. Supermarkets and hypermarkets remain the largest channels, but online retail is growing rapidly, supported by subscription models and influencer marketing.

The global protein bars market is highly fragmented. The global giants continue to lead the sports and lifestyle segments, while regional brands in India and the Asia?Pacific are establishing niches with clean-label, plant-based, and cost-effective offerings. Strategic players are setting themselves apart through functional innovations such as probiotics and adaptogens, leveraging e-commerce channels, and building influence via partnerships.

The protein bar market is evolving from a sports?nutrition niche into mainstream snacking, pushing brands to innovate beyond protein levels. Future success will hinge on differentiation through vegan, functional, and clean?label offerings, coupled with strong digital marketing and regional growth strategies.

The global protein bars market is projected to be valued at US$12,635.7 Mn in 2026.

Growing awareness of health, increased engagement in fitness, the popularity of plant-based diets, and the demand for convenient nutrition options are the key drivers for global protein bars market.

The global protein bars market is poised to witness a CAGR of 6.1% between 2026 and 2033.

Targeting niche segments, direct-to-consumer strategies, collaboration to expand reach, and alignment with ESG goals are certain strategic opportunities for the market players.

Major players in the global Protein Bars market include Mondelez International Inc. (Grenade, Clif Bar & Company), GreQuest Nutrition, RXBAR, Mars Inc., Nestle, Atkins Nutritionals, RiteBite Max Protein, The Whole Truth, Yoga Bar and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn/Bn; Volume: Units (If applicable) |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Protein Source

By Protein Content

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author