Industry: IT and Telecommunication

Published Date: January-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 192

Report ID: PMRREP35069

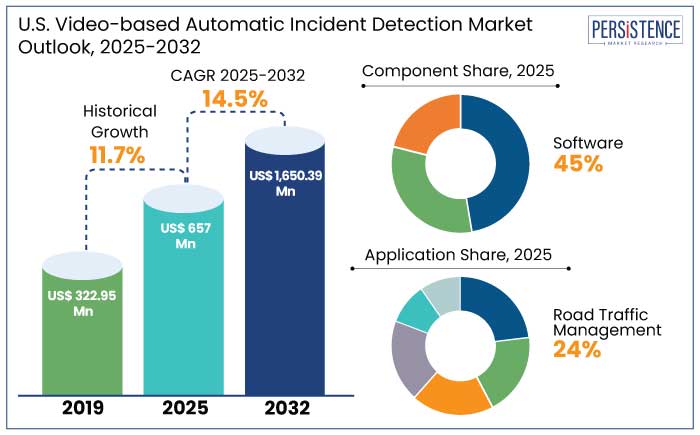

The U.S. Video-based automatic incident detection market is estimated to increase from US$ 657.2 Mn in 2025 to US$ 1650.39 Mn by 2032. The market is projected to record a CAGR of 14.5% during the forecast period from 2025 to 2032.

Integrating artificial intelligence (AI) and machine learning (ML) in video analytics has significantly improved the accuracy and efficiency of incident detection systems.

AI and ML-enhanced video analytics systems have achieved detection accuracy rates exceeding 95% for specific traffic incidents, including stopped vehicles, wrong-way drivers, and congestion anomalies.

As of 2024, AI-powered video analytics account for approximately 65% of the total video-based automatic incident detection (AID) market, reflecting the rapid adoption of intelligent systems.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

U.S. Video-based Automatic Incident Detection Market Size (2025E) |

US$ 657 Mn |

|

Projected Market Value (2032F) |

US$ 1650.39 Mn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

14.5% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

11.7% |

Based on component, the market for U.S. video-based automatic incident detection is divided into hardware, software and services. Among these three categories, the software component category dominates the market.

Software solutions are integral to the functionality of these systems, enabling real-time analysis and detection of incidents through unique algorithms and machine learning techniques. This growth is driven by increasing need for efficient traffic management and enhanced road safety measures across the country.

Software components play a crucial role in processing and analyzing video data to detect incidents such as accidents, congestion, and other anomalies, facilitating prompt responses from authorities. Software component is projected to be the leading segment in the U.S. video-based automatic incident detection market in 2025, holding a share of 45%.

Based on application, the U.S. video-based automatic incident detection market is divided into road traffic management, railway and metro systems, airport, tunnels, parking management, and bridges. The road traffic management segment is likely to lead the U.S. video-based automatic incident detection industry by holding a share of 24% in 2025. It is projected to be driven by growing need for efficient traffic management solutions amid increasing vehicular activities.

Increasing number of vehicles on roads has led to rising traffic congestion and a surge in road accidents, underscoring the need for novel traffic management and safety mechanisms. Video-based automatic incident detection systems play a key role in this context by providing real-time monitoring and rapid detection of incidents such as accidents, congestion, and other anomalies. These systems enable traffic authorities to respond promptly, enhancing road safety and improving traffic flow.

The U.S. video-based automatic incident detection market is rapidly rising, driven by increasing need for novel traffic management and enhanced public safety. AID systems utilize cutting-edge technologies, including video analytics, machine learning, and Artificial Intelligence (AI), to monitor and detect real-time traffic congestion, accidents, as well as other anomalies.

The systems are widely adopted across various applications, including road traffic management, railway and metro systems, airport monitoring, tunnel operations, parking management, and bridge surveillance. Demand for these systems is fueled by rising vehicular traffic, urbanization, and surging emphasis on infrastructure modernization as well as smart city initiatives.

Government agencies, private organizations, and technology providers invest heavily in these solutions to improve efficiency, minimize response times, and enhance safety. The market is further supported by regulatory frameworks and federal initiatives to reduce traffic-related fatalities and improve transportation infrastructure. For example,

The U.S. video-based automatic incident detection (AID) market experienced steady growth from 2019 to 2023, driven primarily by increasing urbanization and the gradual adoption of smart city initiatives.

During this period, government agencies and private organizations invested in upgrading traffic monitoring systems and prioritizing safety and efficiency. Technological advancements, such as improved video analytics and integrating sensors and high-definition cameras, enabled real-time detection of traffic incidents. However, market expansion was constrained by limited awareness and the high initial implementation costs.

Over the forecast period, the market is projected to grow significantly, owing to the widespread adoption across diverse applications, including road traffic management, railway systems, and tunnel surveillance.

The emphasis on infrastructure modernization, bolstered by federal safety initiatives, is expected to accelerate demand. Key innovations such as AI-powered video analytics, machine learning algorithms, and cloud-based data processing have positioned AID systems as critical tools for reducing traffic congestion and improving road safety.

Urbanization and Traffic Congestion Spurs Market Demand

Rapid urbanization across the United States has led to a significant increase in vehicular traffic and congestion on roadways. As cities expand, maintaining efficient traffic flow and ensuring road safety have become critical challenges.

Video-based automatic incident detection (AID) systems address these issues by providing real-time monitoring and detection of traffic anomalies such as accidents, congestion, and other incidents. By enabling quick response times and reducing secondary accidents caused by delays, these systems improve overall traffic management.

Urban planners and transportation agencies are increasingly adopting AID solutions to mitigate congestion, enhance commuter safety, and optimize infrastructure utilization. The continuous growth of metropolitan areas ensures the persistent demand for these advanced traffic monitoring technologies.

Government Regulations and Safety Initiatives Augments Market Growth

The U.S. government has implemented stringent regulations and initiatives to reduce traffic-related fatalities and enhance road safety. Federal and state agencies invest in intelligent transportation systems (ITS) as part of their commitment to infrastructure modernization.

Video-based AID systems are critical components of ITS, aligning with these safety objectives by enabling rapid incident detection and response. Funding from government programs for smart city projects and roadway improvements has boosted the adoption of AID solutions.

Initiatives such as Vision Zero, which aims to eliminate traffic fatalities, have created a favourable regulatory environment for deploying advanced incident detection technologies. This strong governmental backing continues to be a significant driver for market growth.

Privacy Concerns and Data Security Issues Hinders Market Growth Potential

The widespread use of video-based AID systems raises significant concerns about privacy and data security. These systems rely on continuous video surveillance to monitor traffic and detect incidents, which can lead to potential misuse or unauthorized access to personal data.

Public apprehension about being constantly monitored may result in resistance to the deployment of such technologies, particularly in urban areas. Cyberattacks on traffic management systems can compromise sensitive data and disrupt operations, making security a critical challenge.

Organizations must invest in robust data encryption and privacy-preserving technologies to address these concerns, which can further escalate costs and complicate implementation, which poses significant restraints to market growth.

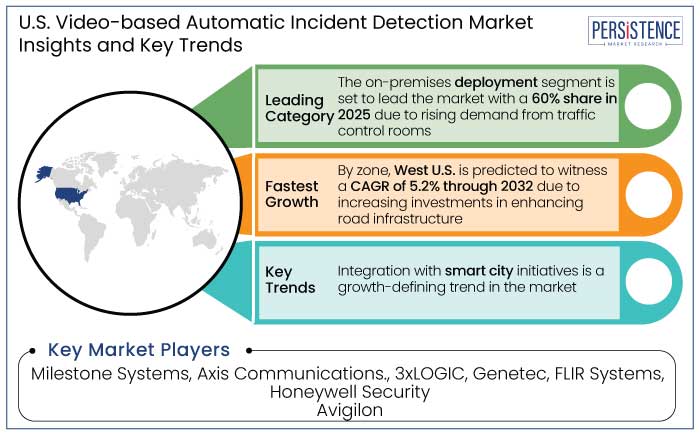

Integration with Smart City Initiatives to Strengthen Market Growth Prospects

The growing focus on smart city development in the U.S. presents a transformative opportunity for the video-based automatic incident detection (AID) market. Smart city projects prioritize interconnected systems to improve urban living, with transportation management being a key component.

AID systems with artificial intelligence (AI) and Internet of Things (IoT) technologies can seamlessly integrate into smart city ecosystems. The systems enhance real-time traffic monitoring and provide predictive analytics for pre-emptive incident management.

As federal and state governments increasingly invest in smart city infrastructures, the demand for advanced AID solutions is expected to surge, enabling companies to capture significant market share.

Expansion into Non-Roadway Applications Presents Key Opportunities for Market Players

While road traffic management dominates the market, significant growth opportunities lie in non-roadway applications such as railway and metro systems, airport monitoring, and tunnel operations.

These sectors are increasingly adopting AID technologies to ensure operational safety and reduce downtime caused by incidents. AID systems in railway networks can monitor track conditions, detect unauthorized access, and identify accidents.

Airports and tunnels require constant surveillance to prevent disruptions and ensure passenger safety. The expansion of AID applications into these domains not only diversifies revenue streams for market players but also accelerates the adoption of these technologies across broader use cases.

The U.S. video-based automatic incident detection market is highly competitive, driven by developments in AI, IoT, and machine learning technologies. Key players include Axis Communications, FLIR Systems, VIVOTEK Inc., and Bosch Security Systems, which focus on developing innovative AID solutions to enhance traffic management and safety. Emerging companies like Invision AI and MicrotransInfratech are also gaining traction by targeting niche applications such as tunnel operations and railway systems.

Partnerships and collaborations, such as VIVOTEK’s alliance with Vaxtor Technologies, emphasize enhancing product portfolios and expanding market reach. Increasing investments in smart city initiatives and government regulations supporting Intelligent Transportation Systems (ITS) further intensify competition, fostering technological innovation and market growth.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Zones Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Component

By Deployment

By Application

By Zone

To know more about delivery timeline for this report Contact Sales

The U.S. video-based automatic incident detection market is estimated to be valued at US$ 657 Mn in 2025.

The U.S. video-based automatic incident detection market is estimated to grow at a CAGR of 14.5%.

The U.S. video-based automatic incident detection market is estimated to be valued at US$ 1650.39 Mn by 2032.

Milestone Systems, Axis Communications, 3xLOGIC, are some of the key players.

Anomaly-based, Signature-based and Hybrid are the three detection types.