Industry: Automotive & Transportation

Published Date: February-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 180

Report ID: PMRREP35121

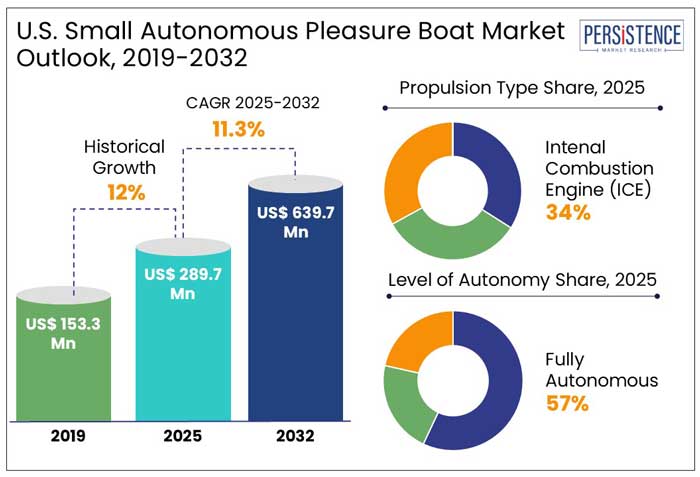

The U.S. small autonomous pleasure boat market is predicted to reach a size of US$ 289.7 Mn by 2025. It is anticipated to witness a CAGR of 12% during the forecast period to attain a value of US$ 639.7 Mn by 2032.

Integration of autonomous navigation, GPS-based control systems, and collision avoidance technologies are driving the adoption of small autonomous pleasure boats in the U.S. Increasing demand for boats integrating smart technologies, like remote control capabilities and sensor-based functionalities, is fueling growth. According to a report, 68% of new boat owners show interest in boats with smart features like automatic docking, real-time weather data, and navigation assistance.

Key Highlights of the Industry

|

Market Attributes |

Key Insights |

|

Market Size (2025E) |

US$ 289.7 Mn |

|

Projected Market Value (2032F) |

US$ 639.7 Mn |

|

Market Growth Rate (CAGR 2025 to 2032) |

12% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

11.3% |

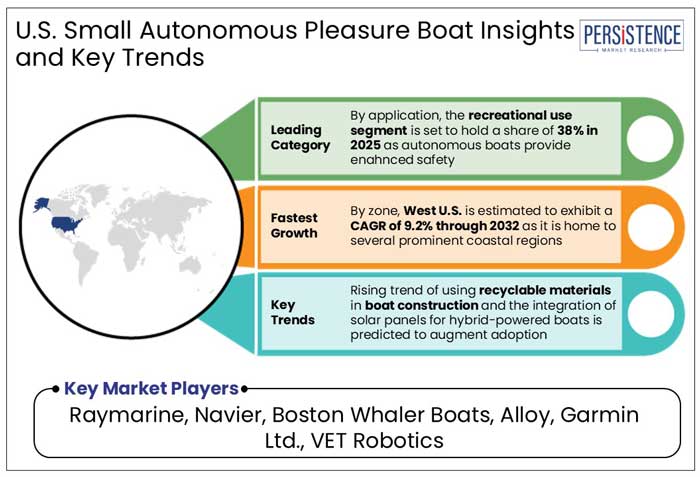

West U.S. is predicted to lead the U.S. small autonomous pleasure boat market with a share of 38% in 2025. The West is home to several prominent coastal regions like California, Oregon, and Washington, with direct access to the Pacific Ocean. The zone also boasts several large lakes, rivers, and reservoirs ideal for recreational boating.

The sheer number of boating enthusiasts in these coastal and lakefront areas drives demand for pleasure boats, including autonomous boats. California's stringent environmental regulations and zero-emission goals are encouraging the development of clean technologies in the boating sector. This has accelerated the development and adoption of autonomous and electric boats in the region.

The West U.S. has one of the highest concentrations of recreational boaters in the U.S., with states like California, Washington, and Oregon being known for their boating communities. With a population that is both affluent and passionate about outdoor recreational activities, demand for luxury and high-tech autonomous pleasure boats is expected to remain high in the zone.

Internal combustion engines (ICE) are projected to hold a share of 34% in 2025. These engines are widely used propulsion systems in the boating industry, having been in use for decades. Several boat manufacturers and consumers are already familiar with the technology, making it the default choice for propulsion.

ICE-powered boats offer proven reliability, extensive service networks, and well-established maintenance systems. This makes it easier for consumers to find support and service for their vessels.

ICE propulsion systems provide a higher power-to-weight ratio, making them ideal for boats that require significant speed, acceleration, or towing capabilities. For many pleasure boaters, particularly those who enjoy activities like water sports or fishing, the power offered by internal combustion engines remains unmatched by electric motors.

Small autonomous pleasure boats, particularly those that operate in areas requiring high speeds or longer distances, benefit from ICE technology's ability to deliver high performance over extended periods.

Fully autonomous is anticipated to hold a share of 57% in 2025. Recent developments in AI, ML, and sensor technologies have enhanced the ability of autonomous systems to safely navigate and control boats. These innovations make it easier for fully autonomous boats to handle complex tasks in various weather conditions.

Technologies like LiDAR, radar, camera sensors, and GPS enable boats to perceive their environment accurately, making it possible for them to navigate autonomously without human intervention. These advancements have brought us closer to reliable and safe fully autonomous vessels.

Fully autonomous boats promise the ultimate convenience for consumers by eliminating the need for constant manual control. This ease of use is especially appealing to recreational boaters who seek a relaxing experience without worrying about the complexities of operating a boat.

Government support and regulatory frameworks for autonomous vehicles are expanding, with a focus on ensuring safety standards and operational guidelines.

Recreational use is anticipated to hold a share of 38% in 2025. As consumers seek to enjoy boating without the technical challenges of handling a vessel, the demand for autonomous pleasure boats, especially suited for recreational use, is increasing

Autonomous technology allows recreational boaters to enjoy a completely hassle-free experience on the water. It automatically performs functions, enabling users to relax and enjoy the surroundings without the need for constant attention.

Autonomous boats provide an elevated recreational experience, which aligns with the broader trend of consumers seeking convenient, high-tech solutions for leisure activities. One of the key reasons recreational boaters are adopting autonomous boats is due to the safety benefits they provide. Autonomous boats are equipped with collision avoidance, automatic emergency response systems, and real-time situational awareness, making them safer than manually operated boats.

Potential growth in the U.S. small autonomous pleasure boat industry is predicted to be driven by technological advancements that are predicted to make next-generation autonomous boats more affordable. Small autonomous pleasure boats are estimated to incorporate advanced sensors, AI-powered autonomy, 5G connectivity, and battery technology.

Millennials and Gen Z are projected to drive the demand for autonomous pleasure boats. This is because these groups are generally inclined toward technology-driven, eco-friendly, and convenient solutions for leisure.

The U.S. small autonomous pleasure boat market growth was steady at a CAGR of 11.3% during the historical period. The industry witnessed an initial rise in interest owing to the broader developments in autonomous vehicle technology. Increasing awareness regarding the safety and convenience provided by autonomous systems further bolstered growth.

Regulatory support played a crucial role in expansion as the U.S. government began offering more support for the autonomous vehicle and maritime sector. It established clear regulatory frameworks for the testing and deployment of autonomous boats on public waters.

In the forecast period, autonomous boats are predicted to become mainstream in the recreational boating sector. Manufacturers are likely to focus on making boats more accessible, with emphasis on improving navigation accuracy, environmental sustainability, and user-friendliness.

Boom of Maritime Tourism and Rental Services

U.S. maritime tourism has seen steady growth, with over 142 million visitors participating in water-based activities annually, including boat rentals and tours. Popular coastal destinations like Florida, California, and the Great Lakes are experiencing a surge in demand for self-guided boating experiences.

Companies like GetMyBoat and Boatsetter are integrating autonomous options to cater to customers seeking hassle-free boating experiences. Autonomous pleasure boats offer tourists the opportunity to explore waters independently without needing a licensed skipper.

Rental companies are leveraging app-based reservation systems for easy booking, operation instructions, and real-time monitoring of autonomous boats.

Demand for Autonomous Water Sports and Experiences

Activities like wakeboarding, tubing, and personal watercraft experiences are being paired with autonomous vessel technology for enhanced user convenience. Tech-savvy consumers, especially millennials and Gen Z, are drawn to autonomous boats for the convenience of automated navigation and smart features.

Advanced autonomous pleasure boats now come equipped with features like real-time navigation, obstacle detection, and route optimization for smoother water sports experiences. Voice-controlled systems and mobile apps allow users to manage boat functions while focusing on their sporting activities.

Autonomous water sports packages are gaining traction as they provide a safer and more private alternative to traditional group-based activities.

Limited Infrastructure for Charging and Connectivity

Electric and hybrid-powered autonomous boats require charging stations at marinas and docks. However, the infrastructure remains limited across the U.S.

The high cost of installing charging infrastructure, which ranges from US$ 30,000 to US$ 50,000 per station, has deterred small and private marinas from making the investment.

Autonomous pleasure boats rely heavily on continuous connectivity for real-time data exchange, GPS navigation, and remote monitoring systems. 5G maritime network coverage in the U.S. is still in its infancy. Most coastal areas rely on 4G or weaker signals, leading to potential interruptions in autonomous operations.

Rising Demand for Recreational Boating Activities

An estimated 100 million Americans participate in recreational boating annually, driving the demand for advanced and autonomous watercraft. Higher disposable income levels in the U.S. have encouraged increased spending on recreational activities.

Integration of advanced navigation systems, obstacle detection, and fully autonomous controls has made small autonomous pleasure boats highly attractive to consumers.

Development of new boating destinations along coastal and inland waterways has spurred recreational boating activities.

Increasing Focus on Luxury and Customization

The luxury segment now constitutes approximately 22% of the total pleasure boat market, highlighting a growing interest in premium offerings. Customers are willing to pay 15% to 20% more for tailored designs and exclusive features.

Fully autonomous capabilities, advanced navigation systems, self-docking features, and AI-driven controls are increasingly becoming standard in luxury pleasure boats.

Premium boats are adopting next-generation infotainment systems, voice-activated commands, and IoT-enabled smart systems.

Use of premium materials, such as carbon fiber hulls, teak wood decks, and high-quality upholstery, is driving interest in the luxury segment. High-end interior design and yacht-inspired aesthetics are emerging as prominent selling points.

Companies in the U.S. small autonomous pleasure boat market are integrating unique technologies like AI and ML to enhance autonomous navigation and decision-making capabilities. Leading companies like Torqeedo and Brunswick Corporation are developing fully autonomous systems having real-time obstacle detection and route optimization.

Businesses are forming strategic alliances with technology providers, battery manufacturers, and software developers to accelerate product innovation. For instance, Sea Machines collaborated with Boston Whalers to develop autonomous recreational boats.

Adoption of hybrid and electric propulsion systems is a growing trend to meet the environmental regulations and cater to eco-conscious consumers. Companies like Navier and X Shore are pioneering electric-powdered small autonomous boats, focusing on zero-emission solutions.

Recent Industry Developments

|

Attributes |

Detail |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Million for Value |

|

Key Zones Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Propulsion Type

By Level of Autonomy

By Application

By Zone

To know more about delivery timeline for this report Contact Sales

The market is anticipated to reach a value of US$ 639.7 Mn by 2032.

Internal combustion engine (ICE) is predicted to hold a share of 34% in 2025.

West U.S. is anticipated to emerge as the leading zone with a share of 38% in 2025.

Prominent players in the market include Raymarine, Navier, and Boston Whaler Boats.

The market is predicted to witness a CAGR of 12% throughout the forecast period.