Comprehensive Snapshot for U.S. Seafood Market Including Zone and Segment Analysis in Brief.

Industry: Food and Beverages

Published Date: April-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 180

Report ID: PMRREP35226

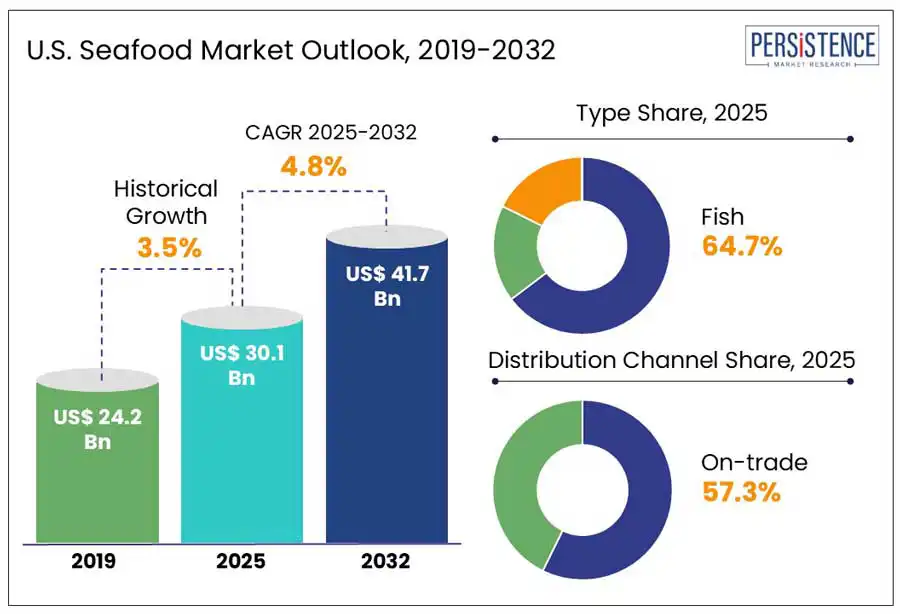

The U.S. seafood market size is projected to rise from US$ 30.1 Bn in 2025 to US$ 41.7 Bn by 2032. It is anticipated to witness a CAGR of 4.8% during the forecast period from 2025 to 2032.

The U.S. heavily relies on international trade with substantial imports complementing domestic production. As per a new study, the country produced around 7.8 million tons of fish, including crustaceans and mollusks in 2022 alone. Conventional fisheries contributed 83% and aquaculture accounted for 17% of the total value. Nearly 70 to 85% of seafood consumed in the country comes from international sources. This has resulted in the rapid development of innovative cold storage infrastructure and supply chain networks to meet high domestic demand and maintain product quality.

Key Industry Highlights

|

Market Attribute |

Key Insights |

|

U.S. Seafood Market Size (2025E) |

US$ 30.1 Bn |

|

Market Value Forecast (2032F) |

US$ 41.7 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.5% |

Changing cultural fabric and demographic of the U.S. is poised to be one of the key market growth drivers. As per the U.S. Census Bureau, in 2022, there were over 46.2 Mn foreign-born individuals in the country, accounting for around 14% of the total population. Several of these communities come from regions where seafood is a daily staple rather than just a delicacy.

Communities from Asia Pacific have mainly propelled demand for seafood. Cuisines such as Filipino, Thai, Chinese, Korean, and Vietnamese heavily emphasize seafood, thereby spurring demand for fish, squid, shrimp, and shellfish. Communities from Latin America, specifically those from coastal countries such as Colombia, Peru, and Mexico have further pushed demand for seafood-based dishes, including fried whole fish, ceviche, and fish tacos.

The U.S. is heavily dependent on foreign imports to cater to the increasing demand for seafood. Seafood shipping is considered a significant logistical issue owing to the requirement of specialized cold chain infrastructure. Reefers or refrigerated shipping containers are expensive to acquire.

As per Drewry’s World Container Index, between 2019 and 2022, shipping costs of reefer containers from Asia to the U.S. West Coast tripled. These surges affected the other aspects of the value chain, leading to hike in retail prices of imported species, such as basa from Vietnam and tilapia from China. This factor is estimated to negatively affect the U.S. seafood market growth in the foreseeable future.

Leading retailers in the U.S. focus on the promotion and launch of lesser-known and underutilized fish species. The National Fisheries Institute stated that in the country, 90% of seafood consumption is concentrated around only 5 species, namely, pollock, shrimp, tilapia, canned tuna, and salmon. Because of this limited pattern of consumption, just a few species are in high demand while others are mainly neglected. Hence, retailers have started promoting underutilized varieties such as barramundi, monkfish, branzino, sheepshead, and Arctic char to reduce environmental strain and balance consumption.

Wegmans Food Markets, Inc., for example, recently extended its Arctic char offerings, which are similar to salmon but more sustainable, cold-water fish. In 2023, the company also reported a 12% surge in sales of non-conventional species. Similarly, Walmart launched barramundi, a fast-growing fish native to Southeast Asia and Australia, in its frozen and fresh seafood aisles. The retailer aims to cater to the rising demand for low-mercury, high-protein options.

The U.S. is showcasing a rapid shift in seafood consumption patterns due to climate change. Various warm-water fish species are migrating northward into the country’s waters due to rising ocean temperatures and changing ecosystems. It is bringing seafood that was previously unknown or difficult to obtain into domestic markets. This ecological phenomenon is gradually increasing the availability of fresh, cost-effective, and appealing fish options for local consumers.

The National Oceanic and Atmospheric Administration (NOAA) stated that since the early 20th century, coastal waters in the U.S. have warmed by an average of 0.83°C. More than 70 marine species have moved northward or to deeper waters as a result of this warming. For example, black sea bass, once only harvested in the southeast, is now accessible off the coasts of New York and New Jersey. Hence, due to increasing localized abundance, several species have become more affordable and accessible in the U.S., raising consumer demand.

Based on type, the market is bifurcated into fish and shrimp. Among these, the fish segment will likely generate a share of around 64.7% in 2025, says Persistence Market Research. This is attributed to the easy availability and relatively lower prices of fish in the U.S. compared to other types of seafood.

Rising awareness of several health benefits of fish, such as its rich phosphorus, calcium, vitamins, and omega-3 fatty acid content, is also projected to create a high demand. These nutrients help lower the risks of health issues, including stroke and heart disease. Frozen fish is estimated to gain momentum in the U.S. with increasing desire for convenience among busy consumers looking for easy-to-prepare yet healthy meals.

Shrimp on the other hand, is expected to witness a steady CAGR from 2025 to 2032 because of its high adaptability in multiple cuisines. It is often incorporated into dishes such as stir-fries, salads, and pastas, which makes it an ideal choice for various restaurants and households. Ongoing expansion of domestic shrimp farming in the country is envisioned to create lucrative opportunities, especially in coastal areas such as Florida and Texas. According to the U.S. Department of Agriculture’s March 2024 aquaculture census, the number of shrimp farming facilities in the country has surged by 23%, with a yearly total production of 50 Mn pounds.

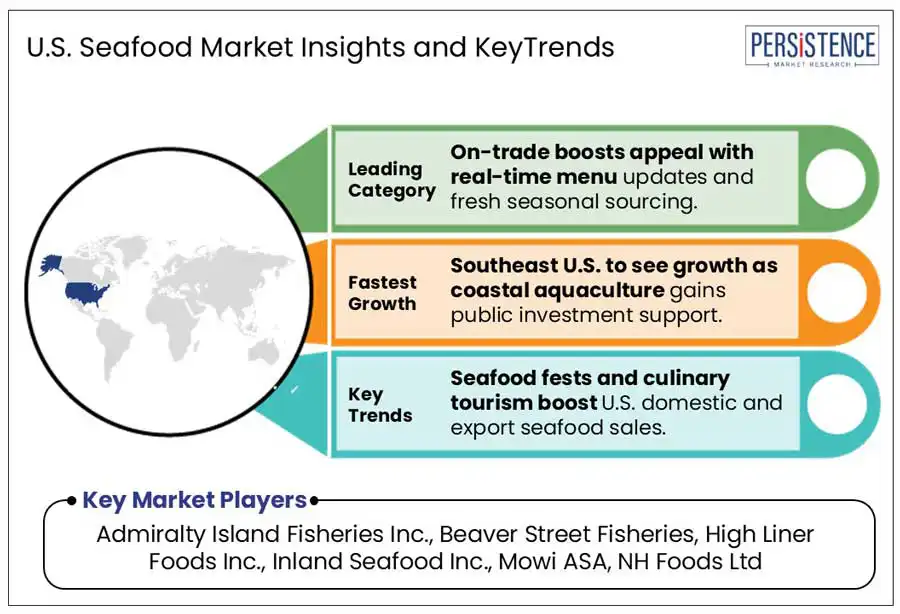

Based on distribution channel, the market is bifurcated into off-trade and on-trade. Out of these, the on-trade segment is predicted to account for about 57.3% the U.S. seafood market share in 2025. Rising preference of modern consumers for consuming seafood at foodservice establishments and restaurants instead of home preparation likely propels the segment growth.

The dominance is specifically noticeable in midscale and casual dining restaurants, which are constantly adding more seafood to their menus to attract a large consumer base. Tuna and salmon are considered the most popular seafood options served in restaurants across the U.S. Consumption patterns are also changing as consumers are increasingly shifting away from conventional quick-service joints toward casual dining locations to experience several seafood flavors and preparations.

Under the off-trade segment, the online channel sub-segment is poised to showcase considerable growth through 2032. Surging adoption of contactless delivery services since the COVID-19 pandemic back in 2020 and innovations in digital payment technologies are responsible for augmenting this sub-segment. Various online platforms are providing a wide range of products as well as following strict quality control norms to offer fresh items at the doorstep, which is spurring demand.

The West Coast in this zone, mainly Alaska, California, Washington, and Oregon, plays a key role in boosting the national seafood economy. The National Oceanic and Atmospheric Administration (NOAA) mentioned that in 2022, the Pacific region contributed more than US$ 5.6 Bn in terms of sales from seafood and commercial fishing industries. Based on volume, over half of seafood landings were accounted for by Alaska alone.

Chinook salmon and Dungeness crab, the most important fisheries on the West Coast, are, however, under constant pressure. Due to the presence of a neurotoxin called domoic acid, which is associated with warming ocean waters, the Dungeness crab fishery has seen repeated closures and delays. The fishery was otherwise responsible for generating US$ 80 to US$ 100 Mn in landings every year. Chinook salmon fisheries also faced setbacks as California closed its entire ocean salmon season in 2023 due to reduced river returns.

Southeast U.S., specifically the Gulf of Mexico, is considered the hub of domestic shrimp production. The zone is estimated to hold a share of around 23.6% in 2025. Florida, Alabama, Texas, and Louisiana are at the forefront of growth. Together, these states provide most of the locally harvested warmwater shrimp. In 2022, Louisiana alone accounted for more than 35,000 metric tons of shrimps, according to NOAA.

Low-cost imports from Vietnam, India, and Ecuador, however, have swamped the market. Over 90% of shrimp consumed in the U.S. as of 2023 came from imports, which drove down costs for local farmers. For example, the dockside price of wild-caught shrimp in Louisiana dropped from US$ 2.50 per pound in 2021 to less than US$ 1.00 by late 2023. Small-scale, family-run shrimpers have hence found it nearly impossible to pay for gasoline and labor, while a few have halted operations or left the business completely.

In the Midwest, Missouri, Ohio, Minnesota, and Chicago are considered the major distribution hubs for imported seafood. Every year, Chicago alone handles more than 200 Mn pounds of seafood, which is distributed through a wide cold chain infrastructure. Logistics firms such as Preferred Freezer Services and Lineage Logistics have already extended operations in the Midwest to enhance seafood storage.

Indiana is emerging as a key state, with more than 50 aquaculture farms, including technologically innovative operations such as Superior Fresh and Bell Aquaculture. These use closed-loop systems to produce steelhead trout and Atlantic salmon. The state’s aquaculture output is rising at 15 to 20% every year, found Indiana Soybean Alliance, with prominent demand from restaurants and regional grocers.

The market for seafood in the U.S. is highly competitive with the presence of several domestic and international companies. The entry of international firms from different parts of the world is highly evident as they seek geographic expansion. Domestic companies are focusing on targeting specific consumers, especially children, with new marketing campaigns. They also launch new products to cater to varying consumer demands.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Type

By Form

By Distribution Channel

By Zone

To know more about delivery timeline for this report Contact Sales

The market is projected to be valued at US$ 30.1 Bn in 2025.

Changing demographics and development of modern cold storage infrastructure are the key market drivers.

The U.S. seafood market is poised to witness a CAGR of 4.8% from 2025 to 2032.

Promotion by retailers for lesser-known seafood species and easy availability of cost-effective options are the key market opportunities.

Admiralty Island Fisheries Inc., Beaver Street Fisheries, and High Liner Foods Inc. are a few key players.