Industry: Chemicals and Materials

Published Date: March-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 175

Report ID: PMRREP35158

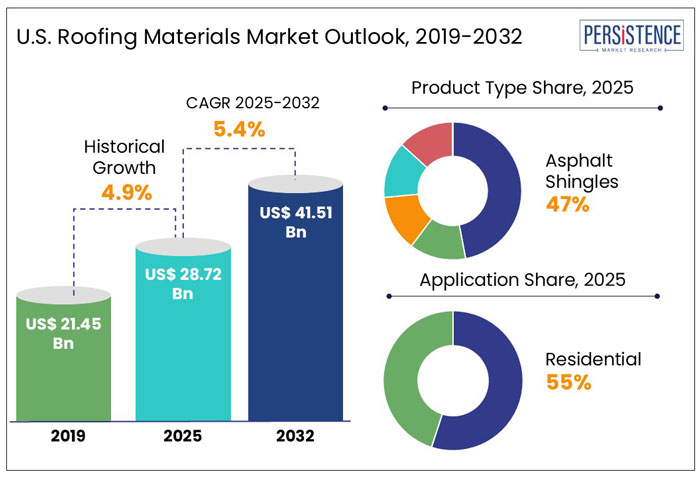

The roofing materials market size in the U.S. is anticipated to rise from US$ 28.72 Bn in 2025 to US$ 41.51 Bn by 2032. It is projected to witness a CAGR of 5.4% from 2025 to 2032. The roofing materials industry in the U.S. is a vital segment of the construction sector, offering a diverse range of solutions for residential, commercial, and industrial applications.

As of 2022, the roofing contracting industry ranked 17th largest in construction and 213th overall. The sector employed 212,000 workers between 2018 and 2023, with projections indicating growth to 220,989 workers by 2028.

States like California, Texas, and Florida lead in the number of roofing contractor businesses. Advancements in roofing technologies, particularly in sustainable and energy-efficient materials, are expected to drive market expansion in the forthcoming years.

Key Highlights of the U.S. Roofing Materials Market

|

Global Market Attributes |

Key Insights |

|

U.S. Roofing Materials Market Size (2025E) |

US$ 28.72 Bn |

|

Market Value Forecast (2032F) |

US$ 41.51 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.9% |

Surge in Residential Re-Roofing Influence the Sales of Roofing Materials in the U.S.

As per Persistence Market Research, from 2019 to 2024, the roofing materials industry in U.S. is estimated to record a CAGR of 4.9%. In the observed period, the roofing materials industry in the U.S. experienced steady growth, driven by housing demand, infrastructure upgrades, and extreme weather events.

In 2020, sales of construction materials slightly dipped due to the pandemic-related construction slowdowns, but the market rebounded in 2021, with roofing material sales exceeding US$ 20 Bn.

The surge in residential re-roofing projects and solar-integrated roofing systems fueled demand. In 2023, sales of asphalt shingles accounted for over 60% of the market, while metal roofing saw a 6.5% annual growth rate.

The industry's expansion continued in 2024, supported by increased investments in commercial and industrial roofing solutions.

Emphasis on Green Building Standards in the U.S. Encourages Sustainable Roofing

The expansion of green building certifications and sustainability standards in the U.S. propels the demand for eco-friendly roofing materials with recycled content. Programs like LEED (Leadership in Energy and Environmental Design) and the Living Building Challenge encourage builders to adopt sustainable materials, boosting the market for recycled metal, rubber, and solar-reflective roofing products.

According to the United States Census Bureau, in 2023, over 40% of commercial buildings pursued LEED certification, increasing the demand for sustainable roofing systems. Additionally, cool roofing materials, which lower energy consumption, are projected to showcase a CAGR of 5.4% through 2032.

Major manufacturers like Owens Corning and GAF are investing in recycled asphalt shingles and solar-integrated roofing to meet growing demand. California's Title 24 Energy Efficiency Standards have pushed builders to use high-performance, energy-efficient roofing, advancing the market. As cities implement stringent environmental regulations, the U.S. sustainable roofing industry is set for significant growth in the coming years.

Budding Home Renovation Trends Boost Demand for Aesthetically Appealing Materials

The rising trend of home renovation and remodeling in the U.S. is boosting demand for aesthetically appealing and high-performance roofing materials. Homeowners' preference for long-lasting, energy-efficient, and aesthetically pleasing roofing options such architectural shingles, metal roofing, and solar-integrated roofs propelled the U.S. home renovation industry to US$ 475 Bn in 2023.

Projects like the Hudson Yards redevelopment in New York and the SoFi Stadium renovation in California have incorporated advanced roofing technologies, setting a precedent for high-performance materials in residential and commercial projects. Along with that, the National Association of Home Builders (NAHB) reported that roof replacements accounted for 25% of all remodeling projects in 2023.

The demand for innovative roofing solutions is expected to rise as homeowners prioritize weather-resistant and energy-efficient materials like cool roofs and impact-resistant shingles.

Robust Environmental Regulations Limits the Use in Commercial Construction

Strict environmental restrictions and labor issues influence manufacturing and installation prices for the roofing materials business in the U.S. The Environmental Protection Agency (EPA) has implemented regulations governing volatile organic compound (VOC) emissions from roofing materials, raising compliance costs for producers.

Additionally, asphalt prices surged by 12% in 2023, and metal roofing costs rose by 8% due to global supply chain disruptions. Labor shortages in the country impact installation costs, with the average U.S. roofing labor wage reaching US$ 24.50 per hour in 2024. Such factors contribute to higher roofing expenses, limiting market growth despite increasing housing and commercial construction demand in the U.S.

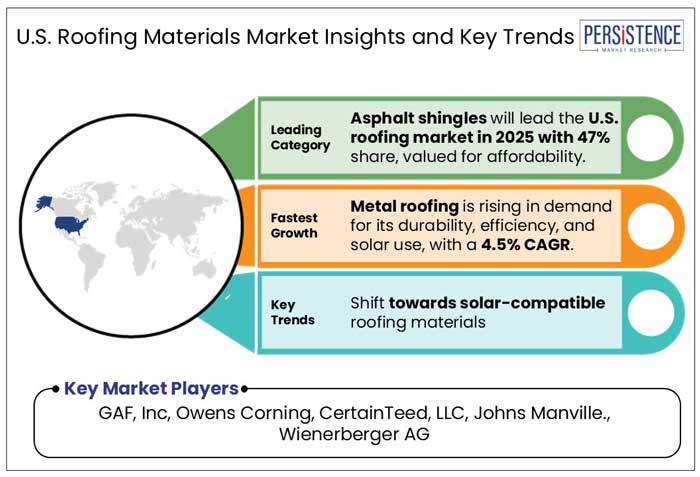

Shift Towards Solar-compatible Roofing Materials Presents Opportunities in the U.S.

The roofing industry in the U.S. shifts toward solar-compatible roofing materials as demand for photovoltaic (PV) installations increases. With state mandates such as California’s Title 24, which requires solar panel installations on new residential buildings, manufacturers are developing solar-integrated roofing solutions to meet growing demand. The Solar Energy Industries Association (SEIA) reported that U.S. solar installations grew by 32% in 2023, with over 6.4 million homes equipped with solar energy.

Projects like Tesla's Solar Roof and GAF Energy's Timberline Solar Shingles are transforming the roofing industry by integrating PV cells into traditional materials. In an effort to promote sustainable growth and comply with state and federal energy regulations, manufacturers such as CertainTeed and Owens Corning are investing in solar-ready roofing choices to increase energy efficiency and structural compatibility.

Homeowners in the U.S. Opt for Asphalt Fiberglass Shingles with High-Performance

Asphalt fiberglass shingles are anticipated to hold a 44.2% market share in 2025, leading the U.S. roofing materials industry. Their affordability, durability, and ease of installation make them the most popular choice for residential roofing. With rising home renovation trends and government incentives for energy-efficient roofing, asphalt fiberglass shingles continue to dominate the market.

Companies like GAF, Owens Corning, and CertainTeed are investing in impact-resistant and cool-roofing technologies to improve their product offerings in North America.

In the U.S., membrane roofing, which is utilized in commercial and industrial structures, is anticipated to account for 25.7% of the market. Because of their longevity, energy efficiency, and resilience to weather, TPO, EPDM, and PVC roofing membranes are becoming increasingly popular in the upcoming years. Prominent companies such as Firestone Building Products and Carlisle SynTec are diversifying their membrane roofing offerings.

Metal shingles and shakes are expected to account for 16.7% of the market because of their fire resistance and incorporation of solar panels. The demand for metal roofing is estimated to record a CAGR of 4.5% through 2032. The U.S. Department of Energy's drive for cool metal roofing has boosted acceptance, especially in California and Texas.

Affordable Housing Projects in the U.S. Caters Demand for Roofing Materials in Residential Regions

In 2025, the residential sector is expected to account for 55% of the U.S. roofing materials market. The demand for new housing developments and renovations is fueled by rising homeownership rates and government incentives for housing infrastructure projects. Programs such as the Bipartisan Infrastructure Law and HUD's Affordable Housing initiatives continue to support residential construction, driving increased sales of asphalt shingles, metal roofs, and sustainable roofing solutions.

Followed by, the commercial roofing sector, comprising 35% of the market, is expanding due to the rise of energy-efficient buildings, solar-integrated roofing systems, and corporate investments in sustainable infrastructure. Cities like New York and Los Angeles are implementing cool roofing mandates, boosting demand for reflective and insulated roofing materials.

On the other hand, the industrial segment is anticipated to hold a 10% market share, with demand coming from warehouses, manufacturing plants, and logistics hubs. The boom in e-commerce and data centers has driven investment in durable, long-lasting roofing solutions, particularly in metal and TPO roofing systems.

Numerous companies have set up their manufacturing facilities across the U.S., contributing to the growth and advancement of diverse construction sectors.

In developing areas, the U.S. government is diligently working to improve infrastructure, focusing on the construction of vital facilities such as hospitals, educational institutions, commercial buildings, and residential complexes.

Such ambitious initiatives, when paired with strategic business approaches, are expected to drive a substantial increase in the demand for roofing materials in the years to come.

Key Industry Developments

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Application

By Region

To know more about delivery timeline for this report Contact Sales

The market is set to reach US$ 28.72 Bn in 2025.

Asphalt fiberglass shingles are the most widely used roofing materials in U.S. due to their versatility in all environmental conditions.

GAF, Inc, Owens Corning, CertainTeed, LLC, and Johns Manville are few of the key players in U.S.

The industry is estimated to rise at a CAGR of 5.4% through 2032.

The use of cool roofs for energy efficiency, increased solar-ready roof usage, and the development of innovative materials with longer lifespans are on the rise.