U.S. Industrial Enzymes Market

Industry: Chemicals and Materials

Published Date: January-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 193

Report ID: PMRREP35046

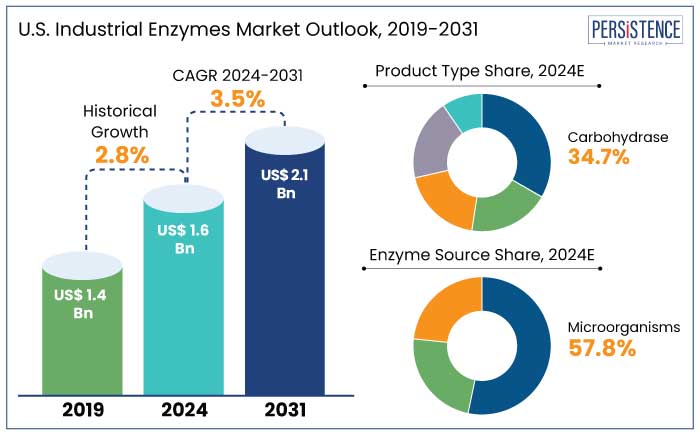

The U.S. industrial enzymes market is poised for significant growth, with a projected CAGR of 3.5% from 2024 to 2031. The market, valued at around US$ 1.6 Bn in 2024, is set to reach US$ 2.1 Bn by 2031.

Market growth is primarily driven by innovations in enzyme technologies. Increasing demand for enzyme-assisted solutions in industries such as food and beverages, biofuels, agriculture, and pharmaceuticals is also set to propel demand. Innovations in sustainable and bio-based products are helping companies meet consumer preferences for clean-label and natural ingredients, further boosting demand.

Surging use of enzymes in renewable energy production and environmental solutions contributes to the positive outlook. As leading players in the market invest in research and development, the industry is projected to experience a steady influx of new enzyme products and applications.

Over time, the price of the enzymes needed to produce cellulosic ethanol has dropped dramatically. The cost of enzymes was more than US$ 3.00 per gallon of ethanol produced in 2001. By 2020, this price has decreased to about US$ 0.40 per gallon, increasing the process's viability.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

U.S. Industrial Enzymes Market Size (2024E) |

US$ 1.6 Bn |

|

Projected Market Value (2031F) |

US$ 2.1 Bn |

|

U.S. Market Growth Rate (CAGR 2024 to 2031) |

3.5% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

2.8% |

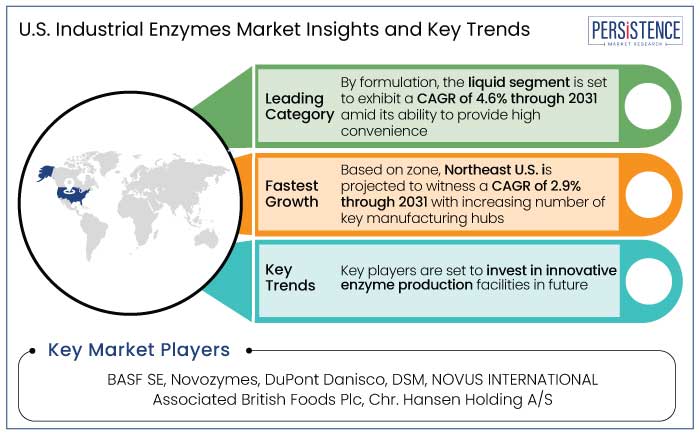

The Northeast zone is anticipated to witness a CAGR of 2.9% through 2031, driven by the strong presence of key industries such as food and beverages, pharmaceuticals, and personal care. This zone is home to leading manufacturing hubs and research institutions that foster innovation in enzyme technologies.

Growing demand for processed foods, clean-label products, and bio-based solutions further boosts the need for enzymes. Additionally, the Northeast zone’s established infrastructure and well-developed supply chain networks provide a solid foundation for sustained growth in the industry. Due to the aforementioned factors, the zone is anticipated to hold a share of 29.4% in 2024.

The West zone is anticipated to experience an average CAGR of 3.3% through 2031, primarily driven by growth in biotechnology, agriculture, and biofuels. With biotechnology hubs like California leading developments in enzyme applications for renewable energy and sustainable practices, demand for industrial enzymes continues to rise.

The zone’s focus on innovation and sustainability, particularly in agricultural applications, wastewater treatment, and environmental solutions, contributes to its strong market position. The West zone’s robust research and development initiatives further drive growth of enzyme usage across various industries.

Proteases hold the most prominent market share in the U.S. due to their widespread application across multiple industries, particularly in food and beverages, detergents, pharmaceuticals, and animal feed. Their ability to break down proteins makes them vital for processes such as meat tenderization, brewing, and dairy production. In the pharmaceutical industry, proteases are also used for therapeutic purposes, further driving demand.

The enzyme’s versatility and critical role in enhancing product quality and efficiency fuels its consistent demand. With a CAGR of 3.2% through 2031, growth is supported by increasing consumer demand for protein-rich foods, developments in biotechnology, and rising trend of sustainable solutions in industrial applications.

The food and beverages segment holds the leading U.S. industrial enzymes market share, driven by growing demand for processed and convenience foods. Enzymes play a key role in improving the efficiency of food production processes, such as fermentation, flavor enhancement, and preservation.

Rising trend toward healthier, clean-label products is enabling manufacturers to develop enzymes that meet consumer preferences for natural ingredients. The segment is estimated to surge at a CAGR of 3.4% through 2031. This is due to rising demand for enzyme-assisted production in food and beverage processing units.

The U.S. industrial enzymes market is experiencing robust growth, driven by rising demand across various industries, including food and beverages, agriculture, biofuels, and pharmaceuticals. Rising focus on sustainability, combined with innovations in enzyme applications and technological developments, is making enzymes indispensable for enhancing process efficiency. These are also set to be used for improving product quality and meeting consumer demand for cleaner and natural ingredients.

Growth is further bolstered by increased use of enzyme-assisted solutions in energy production, waste management, and food manufacturing. As industries adopt more biotechnological solutions, demand for these products is likely to continue rising.

From 2019 to 2023, the U.S. industrial enzymes market grew at a CAGR of 2.8%. This was mainly fueled by rising application of enzymes in food processing, animal feed, and biofuels.

Technological breakthroughs in enzyme products and rising consumer preference for natural, clean-label ingredients played a significant role in driving growth during this period. Companies focused on developing sustainable solutions and extending their enzyme offerings, supporting steady market expansion.

The U.S. industrial enzyme industry is projected to surge at a CAGR of 3.5% from 2024 to 2031. This growth will likely be propelled by continued innovation in enzyme technologies, particularly in renewable energy, agriculture, and environmental solutions.

Increasing demand for enzyme applications in sustainable practices, along with regulatory support for biotechnological solutions, will likely foster further development. As industries continue to invest in research, innovations in enzyme formulations are set to improve performance and cater to evolving consumer preferences.

Focus on Raising Sustainability to Address Climate Change Spurs Demand

In the U.S., strategic partnerships and collaborations have become pivotal in driving innovations in enzyme technologies across various industries. For instance,

Such collaborations are essential as these help combine expertise from different sectors, accelerating the development and adoption of sustainable technologies. These partnerships are not only shaping the sustainability landscape but are also positioning U.S.-based companies at the forefront of global enzyme technology innovations. As these collaborations progress, they drive new applications for industrial enzymes in areas like waste recycling and carbon reduction.

Growth of these partnerships will likely contribute to the dominance of the U.S. in the global enzyme industry. Companies are set to focus on sustainable solutions that align with regulatory requirements and consumer demand for eco-friendly products.

Constant Innovations in Enzyme-based Processes to Bolster Demand

Technological developments in enzyme-based processes are key drivers of growth in the U.S. industrial enzymes market. Novozymes has made significant strides with its breakthrough in enzymatic corn separation technology, which enhances biofuel production. This innovation is particularly important for the U.S. given its prominent role in the biofuels industry. It is providing a more efficient and sustainable method of producing bioethanol.

Novozymes’ introduction of Quara LowP, a new enzyme product for renewable diesel and Sustainable Aviation Fuel (SAF) production, demonstrates the role of industrial enzymes in the renewable energy sector. These developments are essential for improving fuel production processes and reducing dependence on fossil fuels, aligning with the country's push for clean energy sources.

Focus on enzymatic solutions for biofuel production is also evident in the high demand for renewable diesel, a sector where U.S. companies are investing heavily. Novozymes’ innovation in computer-assisted models for biocatalytic production is streamlining enzyme production efficiency, which further bolsters the U.S. industrial biotechnology industry.

By bolstering the technology behind biocatalysis, companies in the U.S. are enhancing production capabilities while reducing costs. They are contributing to the wide adoption of enzyme-based solutions in energy, manufacturing, and other sectors.

High Cost of Enzyme Production and Research Activities to Hamper Demand

Enzyme production involves complex biochemical processes and requires specialized equipment, leading to high operational costs. Significant investments in research and development are needed to improve enzyme efficiency and develop new products.

High costs are often passed down to consumers, making enzyme-based solutions less cost-competitive compared to traditional chemical alternatives. As industries like biofuels, food processing, and detergents seek cost-effective solutions, high expenses related to enzyme development and production could limit market growth. It is especially evident for small and medium-sized enterprises looking to adopt such technologies.

Investments in Enzyme Production Facilities to Create New Opportunities

The U.S. is witnessing significant opportunities in enzyme production as companies broaden their facilities to meet rising demand for enzyme-based solutions. BASF’s recent expansion of its enzyme production plant in Ludwigshafen, Germany, coupled with its investment in Sandoz GmbH’s enzyme production campus in Austria, demonstrates a rising trend in the enzyme production landscape. U.S.-based companies are increasingly looking to ramp up their production capacity to cater to booming industries such as bioenergy, food, and agriculture.

Increasing investments ensure that U.S.-based manufacturers can meet the evolving needs of industries that are adopting enzyme-based technologies for more sustainable processes. With the U.S. market's focus on innovation and sustainability, enzyme manufacturers are investing in extending their production capabilities. This is crucial as demand for biotechnological solutions surges, driven by industries seeking eco-friendly alternatives.

As U.S.-based companies enhance their production facilities, they gain a competitive edge in offering scalable, high-quality enzyme solutions that cater to both domestic and global markets. These investments will likely continue to play a key role in establishing the U.S. as a leader in the global enzyme industry.

Strategic Collaborations to Drive Innovations in the U.S.

In the U.S., product launches and regulatory approvals for enzyme solutions have become a significant trend, reflecting rising demand for specialized enzyme products in diverse industries. BASF’s recent launch of enzymes for detergents and cleaners at the SEPAWA 2023 Congress highlights the increased focus on tailored enzyme solutions for specific applications.

DSM-firmenich’s introduction of ProAct 360™ for poultry demonstrates how new enzyme innovations are transforming industries like animal feed. Such targeted product launches reflect the ongoing need for efficient, sustainable, and eco-friendly alternatives across U.S. manufacturing sectors, boosting the adoption of biotechnological solutions.

U.S.-based companies are increasingly seeking regulatory approvals for novel enzyme products to extend their market presence. DSM-firmenich’s approval of HiPhorius™ for use in poultry, sows, and finfish reflects the rising emphasis on specialized enzyme products for animal nutrition. These approvals not only facilitate market entry but also position companies to tap into booming sectors, such as agriculture and food processing.

As regulatory bodies continue to support the adoption of biotechnological solutions, the trend of new product introductions will likely fuel growth in enzyme production. This is set to make it an essential part of the U.S. industry for sustainability and innovation.

The U.S. industrial enzymes market is characterized by intense competition, with key manufacturers focusing on technological developments, strategic partnerships, and extending production capabilities. Companies like Novozymes, BASF, and DSM-Firmenich are leading the way, with innovations in enzyme products and biotechnological processes driving their growth.

Novozymes focuses on enzymatic technologies for sustainable solutions, such as biocatalysis for renewable diesel and carbon capture. BASF has extended its enzyme production with investments in new facilities in Europe and technological innovations.

DSM-firmenich is also making strides with new enzyme products for animal feed and approvals for poultry applications. Strategic mergers and acquisitions, such as Novozymes' merger with Chr. Hansen and IFF's acquisition of DuPont's Nutrition and Biosciences, further consolidate the industry, enhancing their enzyme portfolios and market reach.

The competitive landscape highlights a clear trend toward innovation, collaboration, and increased production capacity. Companies aim to meet growing demand across various sectors, including agriculture, food, and biofuel.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Zones Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Enzyme Source

By Formulation

By Application

By Zone

To know more about delivery timeline for this report Contact Sales

The market is projected to witness a CAGR of 3.5% through 2031.

Proteases are set to showcase a CAGR of 3.2% through 2031, attributed to their superior performance characteristics.

The Northeast zone is poised to dominate with a CAGR of 2.9% through 2031.

The West zone is predicted to witness a significant CAGR of 3.3% through 2031.

A few key manufacturers include Novozymes, DuPont (Danisco), BASF, DSM, Amano Enzyme Inc., Chr. Hansen, and AB Enzymes.