U.S. Individual Health Insurance Market

Industry: Healthcare

Published Date: September-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 181

Report ID: PMRREP34794

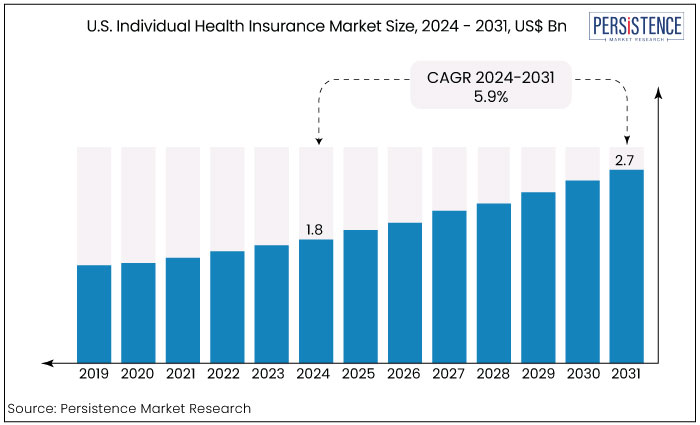

The U.S. individual health insurance market is expected to increase from US$1.8 Bn in 2024 to US$ 2.7 Bn by the end of 2031. The market is anticipated to expand at a CAGR of 5.9% during the forecast period from 2024 to 2031. A surge in insurer engagement and the introduction of innovative product options are key drivers behind the growing demand for individual health insurance in the U.S.

Key Highlights of the Market

|

Attributes |

Key Insights |

|

U.S. Individual Health Insurance Market Size (2024E) |

US$1.8 Bn |

|

Projected Market Value (2031F) |

US$2.7 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

5.9% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

5.4% |

South region emerged as the powerhouse of the individual health insurance market. Florida led the charge within this region, securing the largest slice with a commanding 20.1% share, closely trailed by Texas at 21.0%. These states reflect robust adoption rates of individual health insurance among their populations, contributing substantially to the region's dominance.

The West region positioned itself as the second largest market sand is poised for significant growth with a projected CAGR of 9.9% over the forecast period. This growth is fueled by increasing acceptance and uptake of individual health insurance plans in states like California, Washington, and Arizona. As these states embrace individual health insurance more enthusiastically, they are set to drive significant expansion and innovation within the market landscape.

|

Category |

Market Share in 2022 |

|

Demographics - Seniros |

88% |

The aging population in the United States, consisting of individuals aged 65 and older, is growing rapidly due to factors such as increased life expectancy and the aging of the baby boomer generation. In 2022, the U.S. individual health insurance market was predominantly led by the senior segment, which held more than 88% of the market share

Demographic shift has led to a large pool of seniors seeking health insurance coverage tailored to their specific needs, including Medicare Advantage plans, Medigap policies, and standalone prescription drug plan.

Seniors typically have higher healthcare needs compared to younger populations due to chronic conditions, age-related illnesses, and a greater frequency of healthcare utilization. Insurers cater to these needs by providing comprehensive coverage options that address chronic disease management, specialist care, and long-term care service.

The seniors segment is a critical consumer base for insurers, influencing market trends and product development. Insurers compete to offer competitive premiums, robust networks of healthcare providers, and additional benefits.

The public segment plays a crucial role in leading the U.S. individual health insurance market primarily through government-sponsored programs and initiatives that cater to various demographics and income levels. Managed by the federal government, Medicare provides health insurance primarily for individuals aged 65 and older, as well as young people with certain disabilities.

Medicare is a cornerstone of the public segment, serving over 60 million beneficiaries as of recent statistics, and influencing insurance market trends through its vast enrolment and comprehensive coverage options.

The public segment, particularly Medicare and Medicaid, sets benchmarks for coverage standards, reimbursement rates, and regulatory requirements that influence private insurers' product offerings and pricing strategies. Insurers participating in Medicare Advantage or Medicaid managed care programs must adhere to government guidelines and quality standards, fostering competition and innovation in the market.

The market is expected to continue growing with the changes in employment patterns that lead individuals to seek coverage outside of employer-sponsored plans is one of the significant factors influencing market growth.

Increased focus on personal health and wellness coupled with ever-growing healthcare costs are driving individuals towards securing health insurance. The trend towards personalized coverage, with plans catering to specific needs and budgets, is attracting more customers. The rise of telehealth makes healthcare more accessible, and insurers are integrating these services into plans, adding further value.

The rising prevalence of chronic diseases such as diabetes, cancer, cardiovascular conditions, and neurodegenerative disorders is anticipated to drive a surge in the adoption of individual health insurance. For example, the International Diabetes Federation reported approximately 32.2 million cases of diabetes in the U.S. in 2021, with projections suggesting this number could escalate to 34.7 million by 2030.

This increase underscores the growing demand for comprehensive health coverage that can provide access to necessary treatments, medications, and specialized care, particularly as healthcare costs continue to rise. As individuals seek reliable and affordable ways to manage chronic conditions, the flexibility and coverage options offered by individual health insurance plans are likely to become increasingly attractive, shaping the future growth trajectory of the market

Changes in government regulations and policies, including potential adjustments to the Affordable Care Act (ACA) or new legislative initiatives, will significantly impact the market. For example, modifications to subsidies, medical expansion, or the introduction of public options could alter the landscape of individual health insurance offerings.

The historic growth of the U.S. Individual health insurance market has been shaped by several key factors over the past few decades. Initially, before the Affordable Care Act (ACA) was enacted in 2010, the market faced challenges such as limited access for individuals with pre-existing conditions and high premiums for those without employer-sponsored coverage.

The ACA's implementation brought about significant changes, including the establishment of Health Insurance Marketplaces, expansion of Medicaid eligibility in some states, and subsidies to help lower-income individuals afford coverage. This led to a notable increase in the number of Americans covered by individual health insurance plans. The market captured a CAGR of 5.4% during the historical period.

The market is likely to expand as more individuals shift from employer-sponsored plans to individual coverage, driven by trends in employment patterns such as the rise of freelancing, gig economy work, and entrepreneurship.

Future growth will also depend on regulatory changes and reforms. Potential adjustments to the ACA, including modifications to subsidies, Medicaid expansion, or the introduction of new public options, could significantly impact market dynamics. The market is expected to record a CAGR of 5.9% during the forecast period from 2024 to 2031.

Regulatory Shifts at Both the Federal and State Levels

Regulatory shifts at both the federal and state levels have had a profound impact on the individual health insurance market in the United States. The ACA has undergone various adjustments aimed at stabilizing premiums, expanding coverage options, and improving market competition. Recent updates include changes to subsidy structures, expansion of short-term plans, and modifications to essential health benefits requirements.

Several states have implemented their own reforms and mandates, often in response to federal policy changes or to address local healthcare needs. These initiatives range from state-specific marketplaces to Medicaid expansion efforts, all influencing the availability and affordability of individual health insurance plans.

Federal programs such as risk adjustment, reinsurance, and risk corridors have been used to stabilize premiums and encourage insurer participation in the individual market. Adjustments to these programs have a direct impact on premiums and plan availability.

Shifts in Consumer Behavior

Consumer behavior within the individual health insurance market has evolved significantly, driven by several key factors. Consumers increasingly seek personalized health insurance options that meet their specific needs and financial circumstances. This has led to the proliferation of high-deductible plans, health savings accounts (HSAs), and other flexible coverage options.

There has been a notable increase in digital engagement among consumers, with many preferring to research, compare, and purchase health insurance online. Insurers have responded by enhancing their digital platforms and offering virtual tools for enrolment and customer service.

Consumers are becoming more conscious of healthcare costs and outcomes, prompting a shift towards value-based care models. This includes increased interest in provider networks that emphasize quality of care and cost-effectiveness.

The entrance of non-traditional providers, such as technology companies and retail giants, into the healthcare space has introduced new competition and innovation. These entities often offer alternative insurance products or healthcare services, disrupting traditional market dynamics.

Affordability Remains a Critical Restraint

Affordability remains a critical restraint in the U.S. individual health insurance market, affecting both consumers and insurers alike. One of the primary affordability challenges is the continuous increase in health insurance premiums.

Despite efforts to stabilize premiums through regulatory measures like risk adjustment and reinsurance programs, premiums for individual health plans have risen steadily over the years. This rise can be attributed to factors such as increasing healthcare costs, including the cost of medical services, prescription drugs, and administrative expenses.

High deductibles, copayments, and coinsurance requirements contribute to out-of-pocket expenses that strain household budgets. Many plans, especially those with lower premiums, come with higher cost-sharing features, which can deter individuals from seeking necessary healthcare services due to fear of financial burden.

Market Instability and Uncertainty

Instability and uncertainty within the U.S. individual health insurance market pose another significant restraint, impacting insurers, consumers, and regulatory bodies. The market has experienced volatility due to frequent policy and regulatory changes at both the federal and state levels.

Changes in administration, court rulings on key provisions of the ACA, and shifts in subsidy structures create uncertainty for insurers in planning premiums and benefits, leading to hesitancy in entering or staying in the market.

Adverse selection occurs when individuals with higher healthcare needs are more likely to enroll in comprehensive plans, while healthier individuals may opt for less comprehensive or no coverage at all. This imbalance in risk pools can destabilize insurers' financial projections, leading to premium increases and plan withdrawals.

Efforts to stabilize the market, such as risk adjustment and reinsurance programs, are crucial but may not always effectively mitigate market volatility. Changes to these programs or funding cuts can disrupt insurer participation and affect premium stability.

Personalization and Consumer Engagement

There is a growing demand for personalized healthcare experiences. Insurers can leverage data analytics to segment their customer base and offer personalized plan options that align with individual health needs, preferences, and financial capabilities. This can include flexible deductible options, coverage for specific conditions or treatments, and wellness incentives.

Investing in user-friendly mobile apps, online portals, and virtual customer service platforms can improve consumer engagement and satisfaction. These tools can provide real-time access to benefits information, allow for virtual consultations with healthcare providers, and offer health management resources such as fitness trackers and medication reminders.

Providing educational resources on healthcare literacy, preventive care, and wellness initiatives can empower consumers to make informed decisions about their health. Insurers can collaborate with healthcare providers and community organizations to offer workshops, webinars, and personalized health coaching programs.

Expanding Access and Affordability

There remains a significant segment of the population that is underinsured or uninsured. Industry participants can develop innovative, cost-effective insurance products tailored to meet the needs of these individuals, such as low-cost plans with basic coverage options or bundled packages that include preventive services and wellness programs.

Advocating for or participating in reforms that enhance subsidy structures under the Affordable Care Act (ACA) can increase affordability for lower-income individuals. Insurers can collaborate with policymakers to design subsidy programs that are more responsive to regional variations in healthcare costs and income levels.

Implementing technology-driven solutions like telehealth, AI-powered claims processing, and blockchain for secure data management can help streamline administrative processes and reduce operational costs. These savings can potentially be passed on to consumers through lower premiums or enhanced benefits.

Market players in the U.S. individual health insurance market are actively pursuing strategic initiatives to bolster their market presence and enhance service accessibility. These initiatives encompass a range of strategies tailored to meet evolving consumer needs and market dynamics.

Market leaders are forging strategic alliances with healthcare providers, technology firms, and community organizations. These partnerships aim to expand service offerings, improve care coordination, and leverage technological advancements to enhance the consumer healthcare experience.

Recent Developments in the U.S. Individual Health Insurance Market

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Type

By Demographics

By Region

To know more about delivery timeline for this report Contact Sales

Shifts in consumer behavior is a key drive for market growth.

A few of the leading industry players operating in the market are Elevance Health (formerly Anthem, Inc., Cigna, and Health Care Service Corporation.

The market is anticipated to expand at a CAGR of 5.90% during the forecast period from 2024 to 2031.

Personalization and consumer engagement presents a prominent opportunity for the market players.

Seniors segment leads the market with a significant share.