Industry: Food and Beverages

Published Date: April-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 185

Report ID: PMRREP35183

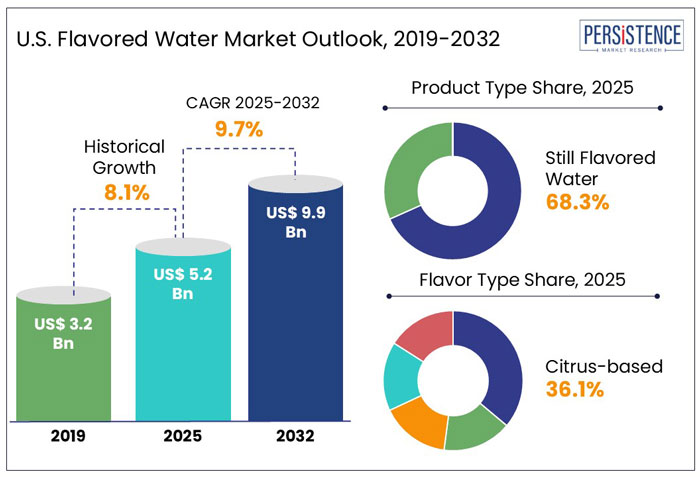

The U.S. flavored water market size is estimated to rise from US$ 5.2 Bn in 2025 to US$ 9.9 Bn by 2032. The market is projected to record a CAGR of 9.7% during the forecast period from 2025 to 2032.

Consumers in the U.S. are now showing interest in trying out new beverages infused with healthy ingredients like herbs and fruits. It is likely to create a considerable demand for flavored hydration products like flavored water that come with the benefits of vitamins and minerals.

Millennials and Gen Z consumers in the U.S. are mainly driving demand for clean-label hydration infused with natural energy boosters. As health-conscious generations quit sugary sodas and artificial energy drinks, preference for practical, transparent, and naturally sourced beverages that provide both hydration and long-lasting energy is rising. Hence, brands are focusing on launching flavored water with exotic ingredients to attract this consumer base.

In May 2023, for instance, Mexico-based Topo Chico extended its presence beyond its mineral water line in the U.S. by launching a new range of sparkling waters called Topo Chico Sabores. These are made with herbal extracts and real fruit juice. With this launch, the company aimed to make it a lifestyle brand by symbolizing originality and authenticity.

Key Highlights of the U.S. Flavored Water Market

|

Market Attributes |

Key Insights |

|

U.S. Flavored Water Market Size (2025E) |

US$ 5.2 Bn |

|

Market Value Forecast (2032F) |

US$ 9.9 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

9.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

8.1% |

Brands Focused on Sustainable Packaging and Collaborations with Renowned Personalities to Attract Consumers

From 2019 to 2024, the U.S. flavored water market grew steadily at a CAGR of 8.1%. The period saw various brands in the country launching new products. A few leading brands focused on strategies like collaborations with social media influencers, music artists, and other renowned personalities to attract a large consumer base. They also started giveaways and contests targeting young adults.

In March 2024, for example, Essentia® Water, a pioneer of ionized alkaline water based in the U.S., launched its first-ever functional and flavored water line called Essentia® Hydroboost. The product contains a blend of 400mg of electrolytes and B-complex vitamins.

The brand joined hands with Tate McRae, a multi-platinum artist, to celebrate this launch. Tate and Essentia gave fans a chance to win a meet-and-greet with the artist as well as 2 tickets to the first U.S. concert stop on her new tour. Apart from that, the fans will be able to get a free supply of Hydroboost for a year.

A handful of brands also focused on increasing sustainability in their packaging to attract eco-conscious consumers. In February 2024, PATH, for example, launched its flavored sparkling water range in reusable aluminum bottles. It offered refill stations across public spaces like airports to encourage consumers to live a more sustainable and healthier lifestyle.

Forecast Period to See Emerging Brands Optimize E-commerce Presence to Enhance Accessibility

The market for flavored water in the U.S. is set for considerable growth at a CAGR of 9.7% from 2025 to 2032. Changing consumer preferences for functional, innovative, and healthy beverages is projected to bolster growth. Key players are also set to capitalize on this trend by considering various actionable strategies.

The U.S. is anticipated to witness the entry of several start-up companies. They are projected to extend their distribution channels to improve convenience and raise accessibility. They are set to enhance their e-commerce presence, join hands with leading retailers, and strengthen both offline and online channels. At the same time, they are likely to adapt offerings to local preferences and tastes to gain a large consumer base and improve market penetration.

Consumers to Shift toward Low-calorie, Zero-sugar Flavored Water to Prevent Health Issues like Diabetes

Modern consumers are more concerned with ingredient transparency, choosing beverages free from artificial ingredients, preservatives, and high fructose corn syrup. This trend is having a considerable influence on the U.S. flavored water industry, with businesses reformulating their products to meet increasing consumer demand for natural, sugar-free, low-calorie alternatives.

According to a survey by Persistence Market Research, around 72% of respondents opted for sugar-free, zero-sugar, low-calorie, or natural beverages over traditional sugary drinks. This change is primarily propelled by growing awareness of obesity, diabetes, and other health problems associated with excessive sugar consumption. As a result, key brands are launching naturally sweetened and fruit-infused flavored water to meet changing consumer preferences.

The rise of functional hydration has resulted in the incorporation of electrolytes, vitamins, minerals, and collagen in flavored waters, which increases their attractiveness. As transparency and wellbeing become more important, brands that focus on non-GMO, organic, and naturally enhanced formulas will continue to dominate the U.S. flavored water market.

Athletes and Young Adults May Choose Energy Drinks with High Caffeine Content, Limiting Growth

The U.S. flavored water industry faces intense competition from energy drinks, sports drinks, and functional beverages, which offer hydration with added benefits such as caffeine, electrolytes, protein, and adaptogens. Consumers seeking an energy boost or post-workout recovery may choose these options over flavored water, restricting market growth.

Energy drinks, with their high caffeine content and performance-enhancing chemicals, appeal to young adults, athletes, and professionals seeking long-lasting energy. Brands such as Red Bull, Monster, and Celsius dominate this segment, diverting consumer focus away from flavored water. To compete, flavored water companies must differentiate themselves through premium formulas, clean-label ingredients, and sustainability initiatives.

Brands to Sponsor Fitness Festivals, Concerts, and Sporting Events to Create Direct Consumer Engagement

Sponsoring fitness festivals, concerts, and athletic events offers an excellent opportunity for brands in the U.S. to increase product awareness and interact with consumers directly. These high-energy venues appeal to health-conscious, energetic, and social consumers, who are an important demographic for flavored water brands seeking to establish themselves as a go-to hydration option. Similarly, music festivals and concerts allow brands to integrate into young consumers’ lifestyle choices.

A notable example of this strategy is LaCroix’s College Brand Ambassador Program. It leverages student representatives to promote the brand at campus events, tailgates, and fitness activities. This grassroots marketing strategy helps develop brand loyalty among young customers, social media influencers, and trend setters.

Citrus-based Water to Be Highly Preferred with Rising Demand for Refreshing Beverages

Citrus-based flavors like lemon, lime, grapefruit, and orange are becoming popular as these provide a refreshing, crisp experience that enhances hydration. These are likely to generate a share of 36.1% in 2025. Various citrus-based flavored waters offer a balanced combination of acidity and mild sweetness, making these a popular choice for consumers looking for a natural and refreshing beverage.

Citrus flavors go well with other exotic and herbal infusions, leading to a growth in flavor fusions like lemon-ginger, lime-mint, and grapefruit-rose. As a result, flavored water companies continue to widen their citrus-based options to meet rising demand, linking citrus as the most popular option in the U.S. market.

Herbal and botanical flavors, on the other hand, are projected to exhibit a steady growth rate through 2032. Emergence of specialized formulations like gut-health-supporting, energy-enhancing, detox, and immune-boosting herb-infused water is set to create new opportunities. Brands are mainly utilizing rosemary, basil, and mint to prepare flavored water due to their excellent anti-inflammatory and digestive properties.

Still Flavored Water Gains Momentum as Brands Launch New Products Infused with Vitamins and Minerals

Still flavored water is projected to account for a share of nearly 68.3% in 2025. Brands are launching a wide range of still water products infused with caffeine, vitamins, antioxidants, and minerals. Some of the consumers, especially athletes, often perceive sparkling flavored water as a reason to cause tooth decay and low bone mineral density. Hence, they are now shifting rapidly toward still waters.

Sparkling flavored water, on the other hand, is likely to see average growth through 2032 as the young demographic is looking for flavored fizzy and bubbly hydration products. Brands are anticipated to launch zero-sweetener and zero-calorie flavored sparkling waters in multiple fruit flavors across the U.S.

The U.S. flavored water market is highly competitive, with key players constantly innovating to meet customer demand for healthier, naturally flavored, and functional beverages. As customer preferences change, brands are adding sugar-free, clean-label, and exotic flavor infusions to their product lineups. To strengthen market presence, a few key players are investing in brand partnerships, influencer marketing, and event sponsorships, creating direct engagement with consumers.

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Flavor Type

By Packaging Type

By Sales Channel

By Zone

To know more about delivery timeline for this report Contact Sales

The market is estimated to be valued at US$ 5.2 Bn in 2025.

Growing demand is driven by customer preferences for healthier, sugar-free hydration options with natural flavors and functional benefits.

Citrus-based water is highly preferred among consumers in the U.S.

Nestlé, The Coca‑Cola Company, PepsiCo, Inc., and Primo Brands are a few key players.

The U.S. market will likely witness a CAGR of 9.7% from 2025 to 2032.