U.S. Market Study on Commercial Water Storage Tanks: Installation of Welded Tanks to Remain High

Industry: Industrial Automation

Published Date: June-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 206

Report ID: PMRREP33109

The U.S. commercial water storage tank market is valued at US$ 1.72 Bn in 2022 and is projected to expand steadily at a CAGR of 5% to reach a market valuation of US$ 2.8 Bn by the end of 2032.

| Attribute | Key Insights |

|---|---|

|

U.S. Commercial Water Storage Tank Market Size (2022A) |

US$ 1.72 Bn |

|

Projected Market Value (2032F) |

US$ 2.8 Bn |

|

Value CAGR (2022-2032) |

5% |

|

Collective Value Share: Top 3 Countries (2022E) |

60% |

Storage tanks are used across the oil and gas industry for the bulk containment of water at different stages of the refinery process. Most often, products are stored for a short time before being transported for further processing.

Demand for water storage tank services is increasing as a result of population and demographic changes as well as economic growth. Manufacturers of commercial water storage tanks are directly signing contracts with end users to understand their specific needs and provide appropriate products.

Wastewater tanks have a wide range of commercial applications. In the United States, more than 16,000 wastewater treatment plants are running at 81 percent of their design capacity, with 15 percent having met or exceeded the same.

These water reservoirs are created by first researching the waste stream and then choosing the most appropriate carbon steel or stainless steel. The tanks can be constructed above or below ground and from a range of steel tank standards.

In the United States, wastewater treatment plants process roughly 34 billion gallons of wastewater per day. Demand for water storage & supply tanks in wastewater treatment plants is increasing, resulting in steady market growth.

Custom water storage tanks are placed based on the size of the structure and fire safety regulations. Most commercial water storage tank manufacturers are also working on methods that will allow them to easily connect the tank with their existing fire prevention systems.

Storage tanks are widely used in the oil and gas sector to hold huge amounts of water at various phases of the refining process. Products are frequently held for a brief period before being transferred for further processing.

The continuously rising chemical sector in the U.S. coupled with the growing oil and gas sector is expected to drive demand for commercial water storage tanks in the country at a CAGR of 5% over the decade (2022-2032).

“Use of High-quality Standardized Materials to Extend Life of Storage Tanks”

According to current breakthroughs, manufacturers are developing new material compositions that are more resilient and have longer life spans under harsh conditions. Increased thermal insulation, sun protection, algae protection, rust proofing, virgin polymers, multi-layer, and leak proofing are some of the primary factors driving demand for commercial water storage tanks.

Furthermore, as the environment becomes more volatile and uncertain, major manufacturers are obtaining materials that are standardized according to Federal regulations, include fewer chemicals, and do not employ hazardous components in the creation of the water storage tanks.

The desire to link communities to urban waterways and establish programs relevant to underprivileged groups in metropolitan areas are two significant factors driving the commercial water storage tank industry in the U.S.

“Upcoming Government Projects & Modernization Efforts to Complement Market Expansion”

Commercial and residential end users of commercial water storage tanks remain the most popular, and investments in these sectors will provide a chance to increase water supply tank market development.

Nowadays, urban infrastructure and construction development are quickly expanding as a result of increased government infrastructure plans, leading the building and infrastructural sectors to drive demand for commercial water storage tank systems.

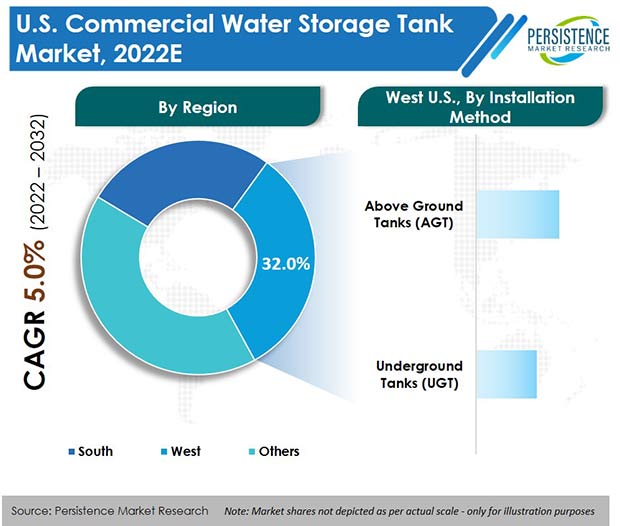

Which U.S. Region is a Lucrative Market for Commercial Water Storage Tank Manufacturers?

“South U.S. to Account for Higher Demand for Commercial Water Storage Tanks”

Persistence Market Research has projected the South U.S. (26.4%) to remain one of the most lucrative markets throughout the forecast period.

The South U.S. has become a major consumer of water storage tank devices in the country, attributed to the region being a large market for the chemical and oil & gas sectors, which invariably makes it a lucrative pocket for key commercial water storage tank suppliers.

The oil and gas industry both, consumers and produces water. Water is used in drilling and hydraulically fracturing wells, refining and processing oil and gas, and generating electricity in certain natural gas power plants.

Forecasts for crude oil production anticipate a West Texas Intermediate crude oil price of US$ 79 per barrel in 2022 and US$ 64 per barrel in 2023, meaning that drilling activity and crude oil output in the United States, especially the southern region, will continue to climb, parallelly driving consumption of commercial water storage tanks.

Which Type of Commercial Water Storage Tank is More Popular?

“Welded Water Storage Tanks Enjoy Highest Popularity across Country”

Welded steel water storage tanks are intrinsically more resistant to seismic damage than bolted steel water storage tanks of equal capacity and dimensions. Every bolt on a bolted water tank is a possible weak point.

Stainless steel water tanks are extremely resistant to corrosion and other natural factors such as heat. In fact, stainless steel is so resistant to rust and corrosion that internal and exterior coatings aren't even required to preserve the basic metal.

Stainless steel is also ductile throughout all temperature ranges, fire-resistant, and unaffected by UV radiation that can harm paints and other coatings. Well-maintained welded steel water tanks can have a lifespan of more than 100 years, whereas bolted steel water storage tanks only last for around 30 odd years.

As such, the welded steel water tanks segment is expected to expand at a CAGR of around 4.8% to reach a market valuation of US$ 1.28 Bn by 2032.

Which Installation Method is Expected to Provide Most Revenue for Suppliers of Commercial Water Storage Tanks?

“Installation of Above-Ground Water Storage Tanks to Surge across the U.S.”

The above-ground storage water tanks segment is estimated to be valued at US$ 1.67 Bn by 2032, and exhibit a CAGR of 5.3% through the decade.

Above-ground commercial water storage tanks are becoming increasingly common. The primary reason for the surge in the demand for above-ground water tanks is their low installation costs. They are easier and less expensive to install as compared to subterranean storage tanks as they require significantly less digging, filling, and paving. This is why several worldwide environmental protection authorities promote them.

Above-ground storage tanks are also easier to transport than underground water storage tanks. Also, if needed to be relocated for new development, the task can be done effortlessly.

Over the past few years, increasing acquisition and expansion activities have been witnessed to improve the supply chain of commercial water storage tanks in the U.S.

Several key manufacturers of commercial water storage tanks are focusing on developing new technology-driven equipment. The emergence of various manufacturers has also been witnessed in this market space.

| Attribute | Details |

|---|---|

|

Forecast Period |

2022-2032 |

|

Historical Data Available for |

2017-2021 |

|

Market Analysis |

|

|

Key Region Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon Request |

U.S. Commercial Water Storage Tank Market by Type:

U.S. Commercial Water Storage Tank Market by Material:

U.S. Commercial Water Storage Tank Market by Capacity:

U.S. Commercial Water Storage Tank Market by Installation Method:

U.S. Commercial Water Storage Tank Market by End Use:

U.S. Commercial Water Storage Tank Market by Design:

U.S. Commercial Water Storage Tank Market by Region:

To know more about delivery timeline for this report Contact Sales

The U.S. commercial water storage tank market is currently valued at US$ 1.72 Bn.

Demand for bolted water storage tanks is set to rise the fastest over the coming years.

Surging chemical industry in the U.S. is set to drive high consumption of commercial water storage tanks in the country.

From 2017 to 2021, sales of commercial water storage tanks across the U.S. increased at a CAGR of 2.3%.

Commercial water storage tank sales are projected to increase at 5% CAGR and be valued at US$ 2.8 Bn by 2032.

The U.S. is using high-quality standardized material that extends the life of storage tanks.

Shawcor, Superior Tanks, CST Industries, and Pioneer Water Tanks are prominent manufacturers of commercial water storage tanks.