U.S. Combined Heat and Power (CHP) System for Data Center Market Segmented By Institutional, Commercial, Healthcare End Use with Retrofit Systems, Newly Installed Systems

Industry: Industrial Automation

Published Date: January-2017

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 102

Report ID: PMRREP12958

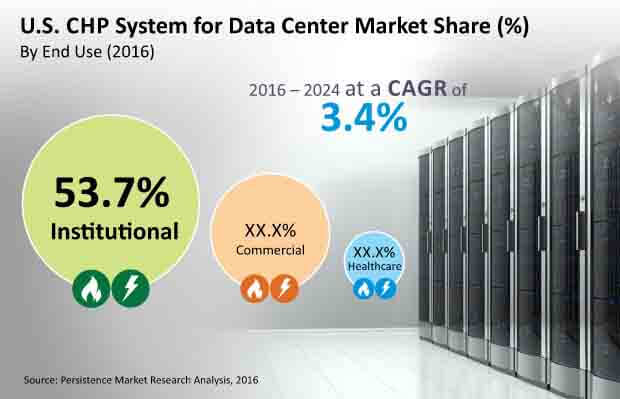

The institutional segment in the U.S. combined heat and power system for data center market is expected to gain 10 BPS during the assessment period. This segment is expected to be valued at close to US$ 150 Mn by 2024 end and is estimated to expand at a CAGR of 3.4 % in terms of value over the forecast period.

The institutional segment is expected to be the most attractive segment with respect to market share index and CAGR index. Colleges/universities, general government offices, military/national security, miscellaneous education, schools and space research and technology centers have been included in the institutional segment. Colleges/universities are estimated to account for a major revenue share in the institutional segment in the U.S combined heat and power system for data center market growth

In terms of market attractive analysis, the institutional segment is expected to be rated close to 5.0 on the basis of attractiveness index over the forecast period. This indicates an inclination towards high growth high value during the period 2016 – 2024.

The provisions given under the Public Utility Regulatory Policies Act of 1978 (PURPA) legalized the sale of non-utility-generated electricity to the grid, which helps increase the usage of combined heat and power systems in all sectors. The use of combined heat and power systems, further advanced by provisions in the Energy Policy Act of 1992 and Clean Air Act, offer cost-effective greenhouse gas emission reduction.

An increasing preference for combined heat and power systems by end users over conventional power generation systems and lower natural gas prices further fuels the U.S. combined heat and power system for data center market.

Considerable economic recovery and relatively lower natural gas prices is another factor which is creating a robust development in the U.S combined heat and power system for data center market. The continuous fall in the prices of natural gas has propelled the end users in the institutional segment towards the use of combined heat and power systems as natural gas.

Expanded tax incentives for combined heat and power are driving the growth of the U.S. combined heat and power system for data center market. Combined heat and power systems that are up to 50 MW in capacity and that exceed 60% energy efficiency are eligible for incentives, subject to certain limitations and reductions for large systems. This tax incentive policy is attracting various institutional organizations across the U.S to adopt combined heat and power systems.

The healthcare end user segment of the U.S combined heat and power system for data center market is expected to lose market value share towards the close of the forecast period. This segment, estimated to be valued more than US$ 20 Mn by 2016 end, is anticipated to reach close to US$ 30 Mn towards the close of the forecast period.

The healthcare segment is expected to exhibit the lowest CAGR of 3.3% in terms of value over the forecast period. The primary reason behind this loss in the market value of this segment is there is no scope for expansion in this particular segment of the U.S combined heat and power system for data center market.

The investment in this sector has already been done by the various state governments in the U.S. and no further investments are likely to be done like in other segments such as commercial and institutional. In terms of attractiveness index, the healthcare end use segment has been rated only 1.0 during the projected period. Overall, this segment is estimated to incline towards low growth low value from 2016 to 2024.

|

By Facility Size |

|

|

By Application |

|

|

By Installation Type |

|

To know more about delivery timeline for this report Contact Sales