U.S. Bottled Water Market Segmented By 3 Gallons, 5 Gallons Capacity with PET, HDPE Material for Screw Cap, Snap-on Cap, Sports Cap, Screw Snap Cap

Industry: Consumer Goods

Published Date: March-2017

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 104

Report ID: PMRREP14596

The U.S. bottled water market is estimated to be valued at nearly US$ 17 Bn in 2017 and is projected to reach a market valuation of nearly US$ 22.5 Bn by the end of 2024. The U.S. bottled water market is slated to register a CAGR of 4.0% during the forecast period 2016 – 2024. The U.S bottled water market is anticipated to represent absolute dollar opportunity of more than US$ 6 Bn in 2024 over 2016.

There are increasing concerns regarding various health problems such as neurological disorders, gastrointestinal diseases and reproductive problems caused by the consumption of contaminated water, which is leading to an increase in demand for clean and hygienic bottled water in the U.S. If the water is properly packaged, it is protected against any kind of bacterial contamination, regardless of the storage time. There is a marked shift in consumers in favor of safe, healthy and refreshing beverages that are free from calories, caffeine and preservatives.

This trend is fueling the demand for bottled water in the U.S. Carbonated water contains caffeine and phosphoric acid that can lead to digestive issues, weight gain, heart burn, etc. Also, there is high acid content in carbonated water due to which consumers are preferring a healthier option that is low calorie flavored water. Due to this shift, companies are refocusing their efforts towards the development of healthy beverages such as flavored water and functional water.

The companies producing bottled water are facing increasing criticism for their manufacturing processes from environmentalists, as a large amount of energy is needed for water extraction, water processing and bottling. Another dimension to this aspect is the environmental pollution caused due to improper disposal of plastic bottles – this factor is expected to hinder the growth of the U.S. bottled water market in the future.

For example, in February 2016, sale of plastic water bottles was banned in the U.S. city of San Francisco to check environmental pollution. Moreover, increasing number of norms and regulations related to the packaging of bottled water is expected to have a negative impact on the growth of the U.S. bottled water market.

Environment-friendly packaging of bottled water

As stated above, there are increasing concerns regarding environmental degradation due to the packaging of bottled water. Hence, there is an increased emphasis on the development of recyclable and ecofriendly packaging materials for bottled water.

This is expected to open up opportunities for various players operating in the U.S. bottled water market, making it a lucrative business for key players operating in this space in the long run. For example, in July 2015, Nestlé launched its new bottled water brand called ‘Natural Spring Water’. The water packaged under this brand comes in 100% recycled plastic (rPET) bottles, excluding the label and cap.

Introduction of products with various health benefits gaining traction in the U.S. bottled water market

Consumers in the U.S. are opting for healthier beverages instead of carbonated drinks. As a result, bottled water companies are focusing on establishing new and enhanced water products and ensuring that all primary qualities of naturalness and hydration of conventional plain water are maintained.

This has given rise to various product launches and developments in the bottled water industry that is revolving around the various health benefits acquired by consuming such products.

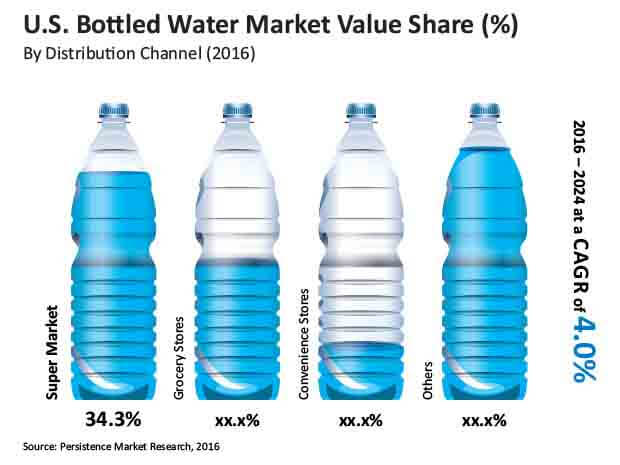

By distribution channel, the others segment is expected to maintain its dominance in the U.S. bottled water market during the forecast period, with 38.3% value share and a CAGR of 4.1% by 2024. The super market segment is expected to register a CAGR of 4.4%. The super market segment is estimated to account for 35.3% value share by 2024 end. It is followed by the grocery store segment, which is expected to account for a market share of 20.4% by 2024 end. The grocery store segment is anticipated to register a CAGR of 3.8% during the forecast period.

High price of PET segment is adversely affecting the U.S. bottled water market

PET segment is widely used due to its relatively low cost and can be recycled. PET is reliable and environmental friendly because 100% recycling is possible. This will open newer avenues of growth for the bottled water market in the U.S. However, the market expansion of the U.S. bottled water market is somewhat walled by the high pricing structure of the PET segment. Moreover, the use of PC polycarbonates bottles is diminishing greatly due to its adverse environmental impact.

| Attribute | Details |

|---|---|

|

By Capacity Type |

|

|

By Material Type |

|

|

By Cap Type |

|

|

By Distribution Channel |

|

To know more about delivery timeline for this report Contact Sales