Industry: Healthcare

Published Date: December-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 194

Report ID: PMRREP4456

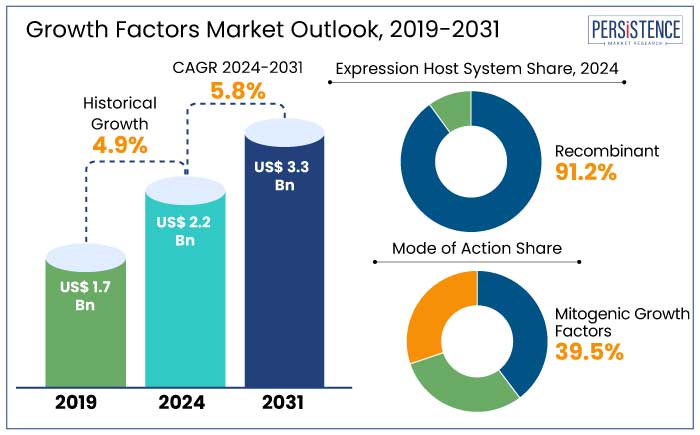

The global growth factors market is projected to witness a CAGR of 5.8% during the forecast period from 2024 to 2031. It is anticipated to surge from US$ 2.2 Bn recorded in 2024 to a decent US$ 3.3 Bn by 2031.

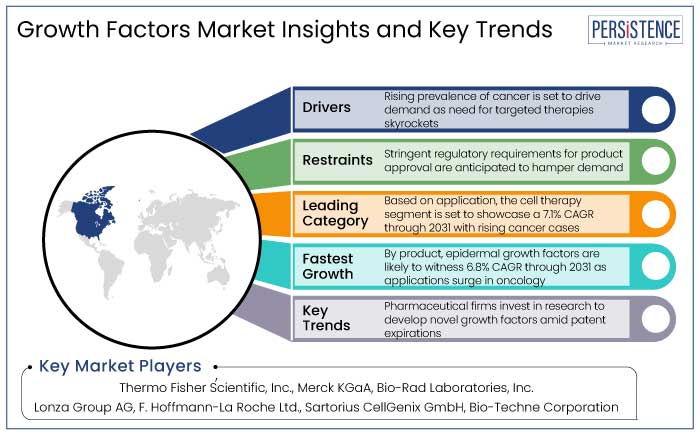

The global market is rising due to increasing applications in regenerative medicine, oncology, and chronic disease management. Growth factors, essential for cell proliferation and differentiation, are being extensively used in tissue engineering and wound healing therapies.

Innovations in biotechnology have enabled the production of recombinant growth factors, enhancing their availability and efficacy. Additionally, rising prevalence of cancer and other chronic diseases has driven demand for growth factors in targeted therapies. According to the World Health Organization (WHO), there were around 19.3 million new cancer cases in 2020, and this number is projected to rise to 28.4 million by 2040.

Supportive government initiatives and increasing investments in biomedical research further bolster the market. The aging population globally is anticipated to increase the need for innovative therapeutic solutions, thereby augmenting the market.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Growth Factors Market Size (2024E) |

US$ 2.2 Bn |

|

Projected Market Value (2031F) |

US$ 3.3 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

5.8% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

4.9% |

North America dominates the growth factors market due to its novel healthcare infrastructure, robust biotechnology sector, and high investment in research and development. The region benefits from the presence of leading pharmaceutical companies and extensive adoption of innovative therapies. These include regenerative medicine and targeted cancer treatments.

Favorable government policies, such as funding for biomedical research and accelerated regulatory approvals, boost market growth. Additionally, increasing prevalence of chronic diseases and rising aging population amplifies demand for growth factor-based solutions.

Awareness of novel treatments among patients and healthcare providers further solidifies North America's dominance in the global market. The region will likely account for a considerable share of 40.4% in 2024.

Recombinant growth factors dominate the global market with a 91.2% share in 2024 in terms of expression host systems. This is due to their high efficiency, scalability, and ability to produce biologically active proteins with precision.

Recombinant growth factors are synthesized using unique DNA technology, enabling consistent quality and enhanced purity compared to natural sources. Their adaptability to various host systems ensures optimized production for diverse applications in biopharmaceuticals, research, and industrial processes. A few host systems include bacterial, yeast, and mammalian cells.

Recombinant production also reduces dependence on animal-derived sources. These help in aligning with ethical considerations and regulatory standards, further driving widespread adoption across industries.

The mitogenic segment is set to dominate the global growth factors market in terms of mode of action. This is due to their critical role in promoting cell proliferation and tissue regeneration. The segment is projected to hold a market share of 39.5% in 2024.

Growth factors, such as epidermal and fibroblast, are essential in wound healing, cancer research, and regenerative medicine, where rapid cell division and repair are required. Their ability to activate signaling pathways that drive cellular growth and differentiation makes them indispensable in developing therapeutic solutions and research applications. Rising demand for targeted therapies and developments in biotechnology further bolster the prominence of mitogenic growth factors in this category.

The growth factors market represents a critical segment in biotechnology, focusing on proteins essential for cellular processes such as growth, differentiation, and healing. These factors have gained prominence across various therapeutic and industrial applications, including regenerative medicine, oncology, and biomanufacturing.

Increasing prevalence of chronic diseases and high demand for targeted and effective therapies have made growth factors pivotal in accelerating treatments such as stem cell therapies and tissue engineering. Introduction of recombinant technologies has further improved accessibility, scalability, and therapeutic efficiency. It is further driving their adoption across diverse sectors.

Emerging trends in the market highlight the rising adoption of personalized medicine and cell-based therapies, including CAR-T therapies and stem cell applications, which rely on growth factors. Additionally, developments in bioprocessing technologies are enhancing the ex-vivo use of growth factors, particularly in biomanufacturing and drug development.

The global growth factors industry recorded a decent CAGR of 4.9% in the historical period from 2019 to 2023. It was driven by innovations in biotechnology and increasing applications in healthcare.

Early adoption focused on wound healing and tissue repair, laying the foundation for broader applications in regenerative medicine and oncology. Introduction of recombinant growth factors marked a pivotal moment, improving their efficacy and extending their therapeutic use.

Rising awareness of their role in cell signaling and immune modulation further boosted their demand. It was particularly evident in chronic disease management and innovative treatments like stem cell therapy.

The market is poised for accelerated growth in the next ten years, fueled by emerging trends such as personalized medicine and cell-based therapies. Innovations in biomanufacturing and ex vivo production methods are enhancing the scalability and precision of growth factor applications.

Rising healthcare infrastructure in developing countries further offers untapped opportunities for key players. Additionally, ongoing investments in research and development, supported by favorable government policies, are set to drive new product launches and therapeutic developments.

Increasing Focus on Cancer Research to Propel Demand

Cytokines and growth factors play a key role in cancer research by providing insight into carcinogenesis and offering new targets for chemotherapy. The connection between growth factor families and oncogenes has enhanced understanding of tumor progression. It is especially evident in how growth factors contribute to therapeutic resistance.

Key growth factors such as vascular endothelial, epidermal, fibroblast, and platelet-derived are pivotal in cancer research and diagnosis. Additionally, cell therapy and ex vivo manufacturing have improved research work, as cancer cells are more responsive to vitro culture. For instance,

The surge in oncology research funding is anticipated to further accelerate the global growth factors market revenue.

Innovations in Diagnostic Technologies to Augment Demand

Early and precise cancer detection is made possible by improved diagnostic technologies including liquid biopsies, Next-Generation Sequencing (NGS), and sophisticated imaging systems. For instance,

Stringent Regulatory Requirements for Product Approval to Limit Growth

The growth factors industry faces significant challenges due to stringent regulatory requirements for product approval. It can delay the development and commercialization of growth factor-based products, particularly in wound healing.

Regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) enforce strict guidelines. These demand extensive preclinical and clinical testing to ensure safety and efficacy. These rigorous processes can be time-consuming and costly, posing a barrier for companies, especially small-scale ones with limited resources.

While growth factors have shown significant promise in accelerating healing and improving patient outcomes, the lengthy approval process can hinder the availability of these treatments. To address these challenges, industry players and regulators are exploring innovative strategies to streamline approval.

They are seeking adaptive clinical trial designs and using real-world evidence. These approaches aim to accelerate the development of growth factor-based therapies, making them more accessible to patients while maintaining high safety and efficacy standards.

Patent Expirations and Generic Competition to Create New Avenues

Patent expirations and the subsequent entry of generic competitors can significantly impact the growth factors market. When patents expire, pharmaceutical companies lose their exclusive rights to manufacture and sell their products, allowing other companies to produce generic versions. This competition can lead to a decline in the original brand's market share and revenue. However, it also brings several advantages.

Increased competition often results in lower prices for end users, making growth factors more accessible to a broad patient population. Additionally, generic competitors may introduce new formulations or delivery systems to improve the efficacy and convenience of growth factors.

Patent expirations can stimulate innovation, as pharmaceutical companies may invest in research and development to create new growth factors or improved versions of existing ones. This dynamic competition encourages companies to stay at the forefront of technology and science, ultimately benefiting patients and the healthcare industry.

The competitive landscape of the growth factors industry is characterized by the presence of both established players and emerging biotech companies. Key pharmaceutical and biotechnology companies dominate the market. They are investing heavily in research and development to extend their growth factor product portfolios.

A few leading players include Amgen, Genentech (Roche), Novartis, and Merck. They mainly offer a wide range of recombinant growth factor therapies for applications in oncology, wound healing, and regenerative medicine.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Product

By Grade

By Application

By Expression Host System

By Mode of Action

By Species Origin

By End User

By Region

To know more about delivery timeline for this report Contact Sales

Yes, the market is set to reach US$ 3.3 Bn by 2031.

The U.S. is estimated to hold a high market share in 2031.

Thermo Fisher Scientific, Inc. Merck KGaA are considered the leading players.

The global market is set to witness a CAGR of 5.8% from 2024 to 2031.

These are responsible for cellular migration, proliferation, and differentiation.