Industry: Food and Beverages

Published Date: April-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 182

Report ID: PMRREP35184

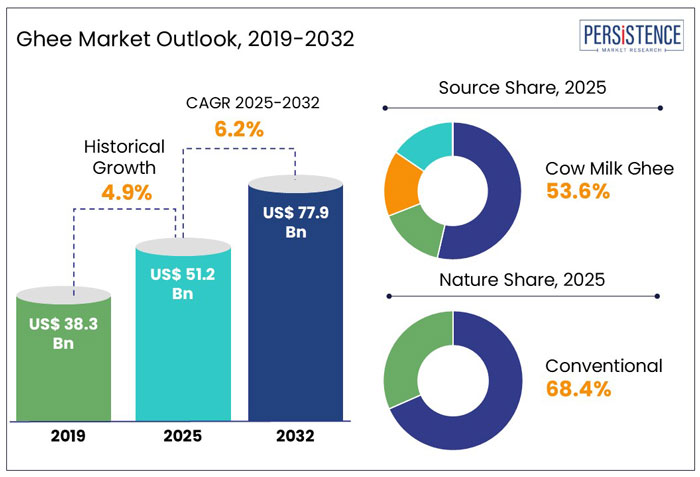

The global ghee market size is projected to rise from US$ 51.2 Bn in 2025 to US$ 77.9 Bn by 2032. It is anticipated to exhibit a CAGR of 6.2% during the forecast period from 2025 to 2032.

Ghee has been a staple of traditional diets for thousands of years, valued for its rich flavor as well as its cultural significance and potential health advantages. Due to the popularity of traditional diets like Ayurveda and Keto and surging uses in the foodservice and nutraceutical industries, ghee, once a mainstay of South Asian and Middle Eastern cuisines, has become a highly sought-after product globally.

Ghee has established itself as a high-end and useful substitute for hydrogenated oils and artificially processed fats as consumers move away from them. As a result, it has entered mainstream markets in North America and Europe.

Local producers and key dairy players are launching novel ghee variants like A2, spiced, and infused ghee made from indigenous cow breeds to attract consumers. Ghee is no longer limited to conventional households as the market grows. It is now considered an important ingredient in high-performance nutrition, gourmet cuisine, and functional wellness products.

Key Highlights of the Ghee Market

|

Global Market Attributes |

Key Insights |

|

Ghee Market Size (2025E) |

US$ 51.2 Bn |

|

Market Value Forecast (2032F) |

US$ 77.9 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.9% |

Demand for Ghee Surged during COVID-19 as Individuals Looked for Immunity-boosting Food Items

The global market for ghee witnessed a CAGR of 4.9% between 2019 and 2024. During the COVID-19 pandemic, the market grew substantially as consumers demanded food items that were natural and helped improve their immunity.

Ghee gained traction as a staple in immunity-boosting diets as it is rich in healthy fats and antioxidants, particularly in areas such as India, the Middle East, and North America. The market also benefited from an increase in premium and organic ghee exports from New Zealand, the Netherlands, and India, where producers use traditional manufacturing techniques to cater to targeted consumers looking for authentic, superior products.

Online Food Delivery Services and Cloud Kitchens Emphasizing Entirely Ghee-based Cooking to Emerge through 2032

The market for ghee is set to rise significantly at a CAGR of 6.2% between 2025 and 2032 due to the booming foodservice sector, which is demanding ghee to prepare various dishes, especially Indian cuisine. Food entrepreneurs and chefs are set to use ghee in their menus due to its perceived health benefits and rich taste.

Ongoing expansion of online food delivery services and cloud kitchens are further projected to open the door to growth avenues. Various direct-to-consumer brands and meal-kit firms are likely to focus on ghee-based cooking to attract consumers seeking convenient yet traditional meal options.

The Ghee Khichdi Project, for example, is a delivery-only restaurant specializing in khichdi, a traditional Indian dish made from lentils and rice. The restaurant uses 100% ghee in its cooking, which is a flavorful and conventional ingredient. The emergence of similar platforms focusing on ghee-based cooking in various parts of the world is set to propel the market through 2032.

Rising Adoption of Ghee in Traditional and Ethnic Cuisines to Surge Demand

Ghee has been used for several generations in baking, cooking, and even religious events, making it an integral part of South Asian and Middle Eastern cuisines. Ghee is becoming immensely popular among consumers who want to mimic traditional tastes and cooking methods as a result of the high demand for authentic ethnic dishes across the globe.

Demand for Middle Eastern and Indian food is surging outside of their native nations, which is further driving the consumption of ghee in Western markets. Restaurants, food chains, and home cooks are using ghee in their dishes for its rich taste, aroma, and nutritional benefits, thereby propelling demand.

High Cost of Ghee Compared to Commonly Used Cooking Oils May Limit Sales in Price-sensitive Areas

The traditional method for making ghee is a labor-intensive process that involves slow-cooking butter to remove milk solids and water, producing a rich, concentrated fat. This process raises production costs, as does the requirement for premium raw resources like cow or buffalo milk.

Cooking oils like soybeans, canola, sunflower, and palm oil, on the other hand, are prepared in large quantities using industrial refining techniques, making these more affordable for consumers. For instance, regular dairy ghee costs US$ 10 to US$ 20 per liter, whereas premium A2 cow ghee costs between US$ 25 and US$ 40 per liter.

Common cooking oils like palm oil, soybean oil, and sunflower oil cost US$ 1 to US$ 3, US$ 1.50 to US$ 4, and US$ 2 to US$ 5 per liter, respectively. This cost difference becomes an important issue, especially in price-sensitive areas across Asia, Africa, and Latin America, where people prefer affordable options for everyday cooking.

Companies to Capitalize on the Trend of Grass-fed and Organic Ghee by Acquiring Certifications

Rising demand for organic and grass-fed ghee is anticipated to create new opportunities in the global market through 2032. It is considered a premium option in the market as health-conscious consumers are looking for pure, chemical-free, and nutrient-rich products.

Organic ghee is thought to be healthier as it contains more vitamins, antioxidants, and healthy fatty acids. It also does not include synthetic hormonal substances or pesticides. As consumers become more aware of environmental and animal welfare issues, there is a rising demand for ethically sourced and sustainably produced dairy products.

The U.S. Department of Agriculture (USDA) reports that organic milk production in key markets has increased by more than 10% annually, indicating steady growth in the global organic dairy sector. Growth of organic and grass-fed ghee manufacturing is directly aided by this trend.

Ghee manufacturers can capitalize on this demand by obtaining organic certifications, acquiring milk from grass-fed cows, and using transparent supply chain processes. By investing in organic farming associations and promoting clean-label products, these manufacturers can increase their share of the high-value organic dairy market.

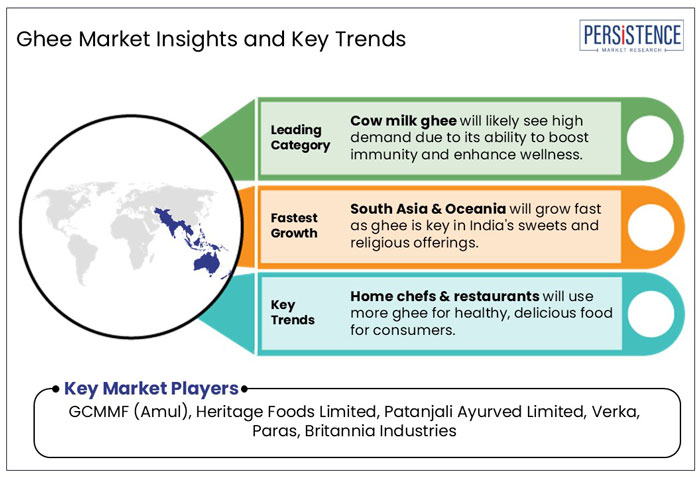

Cow Milk Ghee to Gain Impetus due to Its Superior Immunity Boosting Properties

The global market is dominated by cow milk ghee because of its excellent nutritional profile and several health advantages. It is mainly preferred by consumers due to its high content of important fatty acids, such as omega-3 and omega-6, as well as its superior digestion properties.

It is also known to boost immunity and enhance wellness. Furthermore, A2 cow ghee, which comes from native cow breeds, has become extremely well-liked by health-conscious consumers as it is lactose-free and linked to Ayurvedic advantages. Owing to the aforementioned factors, cow milk ghee is estimated to generate a share of nearly 53.6% in 2025.

Buffalo milk ghee, on the other hand, is anticipated to see steady growth through 2032. It is attributed to its high content of fat-soluble vitamins such as K, E, D, and A. These are considered significant for several bodily functions like bone health, eye health, blood clotting, and immune function.

Food Processing Companies to Replace Hydrogenated Oils with Ghee to Cater to Clean-label Demands

Ghee is becoming increasingly popular as a key ingredient in food processing due to its rich flavor and long shelf life. It is used in the global food business to enhance the flavor and texture of bread, confectionery, ready-to-eat meals, and traditional snacks.

As consumers seek natural and clean-label ingredients, food processing companies are replacing artificial fats and hydrogenated oils with ghee, positioning it as a premium alternative. Furthermore, ghee's high nutritional value, which includes essential fatty acids and fat-soluble vitamins, makes it a popular ingredient in functional and fortified foods.

Governments around the world are also encouraging the establishment of food processing enterprises, which is driving demand for ghee. Such initiatives provide financial, technical, and business assistance to start and extend food processing businesses, increasing ghee use in packaged and value-added food products.

In India, for example, the Ministry of Food Processing Industries (MoFPI) has launched several initiatives such as the Pradhan Mantri Kisan SAMPADA Yojana (PMKSY), PM Formalization of Micro Food Processing Enterprises (PMFME) Scheme, and Production Linked Incentive Scheme for Food Processing Industry (PLISFPI). Other developing countries are set to witness the implementation of similar initiatives by governments, thereby boosting demand.

Household consumption, on the other hand, is estimated to exhibit considerable growth in the foreseeable future. It is no longer considered an occasional or festive ingredient, especially in Asia Pacific. Consumers now utilize it in everyday cooking, mainly for baking, sautéing, and stir-frying as its rich flavor helps improve taste.

Cultural and Religious Traditions to Propel Ghee Consumption across India through 2032

South Asia and Oceania is estimated to hold a share of 24.8% in 2025. It will likely be dominated by India owing to its rich cultural and culinary heritage. As a land of festivals, India's year-round celebrations such as Diwali, Holi, and Navratri drive up demand for ghee, which is required for preparing traditional sweets.

Ghee is considered sacred and is often used in temple offerings, fire rituals, and auspicious celebrations. Events such as the Maha Kumbh Mela, which hosts millions of devotees, propel ghee use as it is used in holy offerings and community feasts.

India's culinary landscape further contributes significantly to the market's long-term growth. Ghee is a staple in the country’s households, whether in rural villages or metropolitan centers, and is used in everyday cooking. This makes it a key ingredient in India, thereby boosting the market.

In New Zealand, on the other hand, awareness of the negative effects of consuming refined vegetable oils and hydrogenated fats is rising. It is hence making ghee an important ingredient as it is rich in fat-soluble vitamins, conjugated linoleic acid, and omega-3 fatty acids. It is anticipated to attract consumers following clean-eating, paleo, and keto diets.

U.S. to See Consumers Seeking Flavored Ghee Infused with Herbs to Enhance Gourmet Cooking

Persistence Market Research estimates that North America will rise at a CAGR of 6.7% during the forecast period from 2025 to 2032. The region is led by the U.S. ghee market.

The country is anticipated to surge due to the growing awareness of ghee's nutritional benefits, such as its high smoke point, rich flavor, and lactose-free composition. These properties are projected to fuel its popularity as a healthier substitute for butter and cooking oils. Furthermore, the demand for flavored ghee, which is infused with herbs and spices, is attracting consumers looking for gourmet culinary experiences.

Demand for organic and grass-fed ghee is also increasing, with rising imports from New Zealand due to their high level of purity and quality. As more customers emphasize natural and clean-label products, the U.S. is likely to showcase steady growth, making ghee a key ingredient in both household and professional kitchens.

Spiced and Infused Variants Like Kermanshah Ghee and Niter Kibbeh to Gain Popularity in Middle East and Africa

Ghee has been used in North African, Persian, and Arab cuisines since time immemorial. In Countries like Iran, Kuwait, Oman, the UAE, and Saudi Arabia, the ingredient is mainly used for making rice dishes like Mandi and Kabsa, grilled meats, stews, as well as sweets like Basbousa and Baklava. Kermanshah Ghee has gained traction in Iran. It is considered a unique type of clarified butter made from local sheep’s milk.

In Africa, countries like Kenya, Sudan, Uganda, Somalia, and Ethiopia mainly use ghee as a key ingredient in preparing ceremonial dishes, conventional breads, and spiced stews. In Eritrea and Ethiopia, Niter Kibbeh, which is spiced ghee infused with herbs, ginger, and garlic, is an essential part of local cuisine. In Somalia and Sudan, ghee is mainly mixed with honey and dates as an energy-rich food for children and pregnant women.

Companies in the global market are launching organic, grass-fed, and A2 cow ghee variations in response to the rising demand for premium, natural products. Ghee brands are improving productivity and maintaining high quality standards by investing in innovative processing facilities and automation technologies.

Brands are also launching flavored ghee, made with herbs, spices, and other natural ingredients, catering to both gourmet and health-conscious consumers. In addition, leading companies are embracing sustainability initiatives, innovative packaging, and digital marketing tactics to maintain a strong presence in the ghee industry.

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Source

By Variety

By Nature

By End Use Application

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

The market is estimated to be valued at US$ 51.2 Bn in 2025.

A key driver for the market is the widespread use of ghee in a variety of food applications.

India leads in ghee consumption worldwide.

Demand for A2 ghee is set to rise steadily in the forecast period.

GCMMF (Amul), Heritage Foods Limited, Patanjali Ayurved Limited, and Verka are a few key players.