Comprehensive Snapshot of Food Flavors Market Report Including Regional and Country Analysis in Brief.

Industry: Food and Beverages

Published Date: April-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 140

Report ID: PMRREP32024

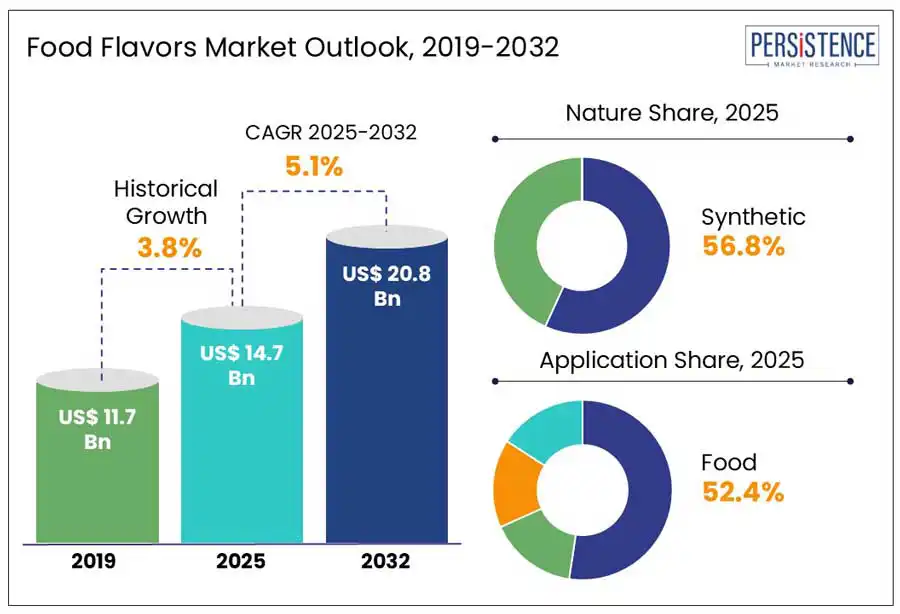

The Global Food Flavors Market size is estimated to grow from US$14.7 billion in 2025 to US$20.8 billion at a CAGR of 5.1% by 2032. According to the Persistence Market Research report, shift in dietary trends and increased customer interest for different flavor experiences are revolutionizing the global food flavor landscape. Evolving lifestyles, increasing travel exposure, and a growing emphasis on clean-label, plant-based, and natural options is pushing flavor manufacturers to cater to both traditional preferences and emerging wellness trends.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Food Flavors Market Size (2025E) |

US$ 14.7 Bn |

|

Market Value Forecast (2032F) |

US$ 20.8 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

3.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.1% |

The global shift toward ready-to-eat and convenience food is driving up demand for food flavors. With increasingly busy lifestyles, people are increasingly looking for quick meal options that don't compromise taste or quality. To achieve these expectations, food manufacturers are relying on innovative flavoring technologies that recreate handmade and authentic taste sensations.

According to the British Heart Foundation, over 50% of the energy intake of an average person in the UK comes from ultra-processed foods, highlighting the growing consumption of packaged and ready-to-eat products. This trend opens up numerous opportunities for flavor companies to innovate and appeal to both indulgent and health-conscious consumers. Flavor enhancers are necessary in processed foods to enhance flavor and satisfy changing consumer preferences.

Today’s consumers are increasingly prioritizing natural and nutrient-rich ingredients, and artificial additives no longer align with their evolving preferences. This shift is putting pressure on manufacturers to reduce or eliminate synthetic components from their offerings. Additionally, intense market competition and fluctuating consumer awareness are making it harder for synthetic flavors to maintain relevance. Compounding the issue, natural and plant-based flavors, which are often preferred over synthetic ones, face challenges such as raw material price volatility due to seasonality and weather conditions. Furthermore, dairy-derived flavor alternatives are also impacted by complex extraction processes and a growing lactose-intolerant population, limiting their adoption.

As consumers demand more personalized eating experiences, flavor manufacturers are developing specialized solutions to fulfill health goals, cultural preferences, and sensory desires. The rise of personalized nutrition, fueled by advances in data analytics and artificial intelligence, is allowing companies to develop hyper-targeted flavor profiles. For example, Symrise has developed proprietary tools like trendscope™ and Symvision AI™ to decode emerging consumer behaviors and flavor trends. These tools help the company identify new market opportunities and design flavors that resonate with distinct demographic segments, such as keto-friendly, low-sugar, or allergen-free flavor systems.

Customization not just increases customer satisfaction, but it also helps companies in fostering loyalty and premiumizing their products, making personalized flavors an important tool for market differentiation and long-term growth in the evolving food ecosystem.

Increasing awareness, driven by digital platforms and social media, is shaping consumer consciousness about the environmental and health impacts of food choices. In developed regions like North America and Europe, concerns over animal cruelty and lifestyle-related diseases such as obesity and cancer are prompting a widespread reduction in meat consumption. As a result, consumers are increasingly seeking vegetarian diets, fueling the demand for plant-based food and flavor options.

Addressing this shift, T. Hasegawa has introduced PLANTREACT™, a cutting-edge flavor platform crafted to replicate the rich, savory complexity of animal proteins like chicken and beef in vegan applications. By targeting the unique molecules that define these flavors, PLANTREACT™ enables the creation of truly satisfying plant-based food experiences, perfectly aligned with evolving consumer values.

Natural flavors are seeing strong momentum in the global market as consumer preferences shift towards healthier and more transparent food choices. With growing awareness around the adverse effects of synthetic additives, more people are adopting healthier lifestyles, leading to a sharp rise in the demand for natural and clean-label products. Natural and organic health products are widely perceived as safer and higher-quality alternatives, reinforcing this trend.

According to a survey conducted by Persistence Market Research (PMR), 67% of respondents indicated that organic, natural, or non-GMO labeling plays a crucial role in their purchasing decisions for food products and health supplements.

This rising demand is pushing manufacturers to reformulate products and innovate with natural ingredients to fulfill changing expectations. As a result, the food and beverage industry is experiencing a surge in new product launches featuring natural flavors, positioning them as a foundation for future product development and brand differentiation.

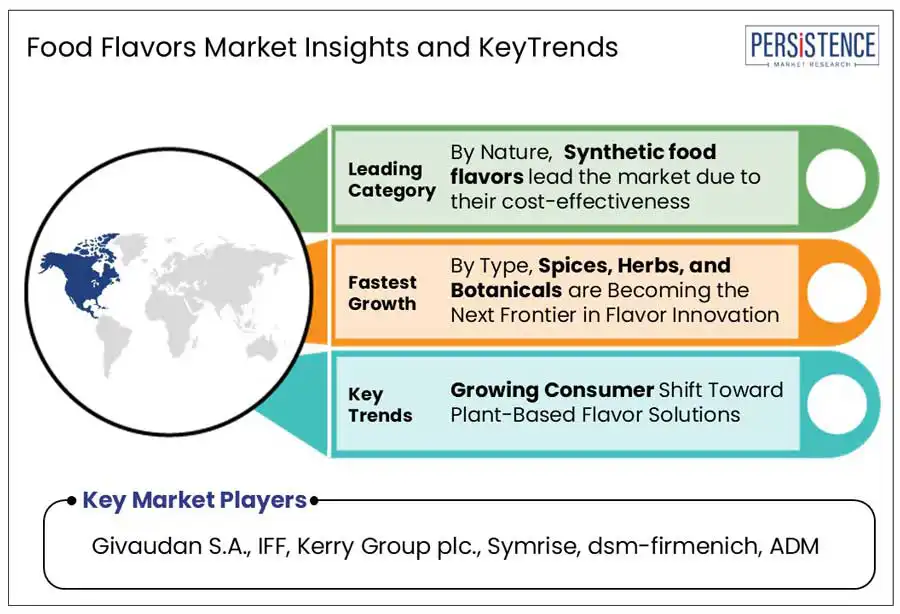

Spices, herbs, and botanicals are expected to grow at a CAGR of 6.2%, positioning them as the next frontier in flavor innovation. These natural flavorings are gaining traction among customers who seek authentic, adventurous, and health-conscious taste experiences. Herb and botanical ingredients add pleasant, earthy, or aromatic characteristics and also help enhance product complexity by bridging and elevating other flavor components. Innovative pairings of niche botanical profiles with familiar fruits or vegetables are redefining the flavor landscape, offering unique yet approachable taste journeys.

Botanical flavor combinations offer surprising freshness and elegance to everyday products such as yogurt and pizza crusts, as well as refreshing beverages and craft cocktails. Their versatility enables food and drink companies to create multidimensional, clean-label solutions that appeal to modern palates. As the demand for authenticity, wellness, and culinary novelty rises, the role of herbs, spices, and botanicals in flavor development will only become more central and transformative.

The European food flavor industry is growing rapidly, driven to changing consumer preferences and a rich cultural food heritage. Countries such as France, Germany, Italy, the UK, Spain, and the Netherlands offer numerous opportunities as they are among the major food and beverage manufacturers by turnover.

European consumers are increasingly leaning toward organic, natural, and plant-based food and beverages, which is driving demand for clean-label and natural taste solutions. The region’s vibrant cultures are fueling innovation in multi-ethnic and fusion flavors. As awareness of health and sustainability grows, consumers increasingly prefer natural ingredients such as botanicals, fruits, and herbs over synthetic additives. This shift promotes both authentic tastes and a commitment to healthier dining choices. This unique mix of market maturity, multiculturalism, and health consciousness makes Europe as a high-value region for natural and premium flavors development.

North America accounts for a significant 23.7% share of the global food flavor market, driven by a strong food and beverage processing industry and a culture of innovation. Leading companies like Givaudan, IFF, and ADM are investing in cutting-edge research to meet the growing demand for natural and clean-label flavors. Supported by FDA regulations and industry organizations like FEMA, high safety and quality standards are guaranteed. The health-conscious trends in the U.S. and Canada are fueling interest in organic, plant-based, and functional flavor solutions. With technological advancements and heightened consumer awareness, North America is emerging as a dynamic hub for flavor innovation and diversification.

Asia Pacific food flavors market is experiencing significant growth, driven by rapid urbanization, changing tastes, and an increasing demand for processed foods. According to Persistence Market Research, 31% of consumers in the region enjoy meat and poultry products two to three times a week, which boosts the demand for robust and savory flavor profiles. Additionally, Asia’s travel revival is opening new avenues for consumers to explore unique meals, snacks, and beverages while on the move. Japan is at the forefront, experimenting with pop-up products that cater to sweet and savory cravings, adding excitement and novelty to flavor innovation across the region.

The global food flavor market is a highly competitive and dynamic marketplace, fueled by evolving consumer preferences and rapid innovation. The growing demand for vegan, natural, and organic-labeled products forces companies to offer cleaner, healthier flavor alternatives. Sustainability has become central, with firms prioritizing ethical sourcing and environmentally responsible production practices. Stringent regulatory standards across regions are encouraging the development of safer, compliant formulations. The industry has a wide range of applications, including dairy and drinks, snacks, and plant-based meals, which encourages ongoing innovation. Key companies are fostering innovation with proprietary technology and trend-tracking tools, enabling the creation of bold, unique, and tailored taste experiences for sophisticated and health-conscious consumers.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Nature

By Type

By Form

By Application

By Region

To know more about delivery timeline for this report Contact Sales

The global Food Flavors market is projected to be valued at US$ 14.7 Bn in 2025.

Growing Demand for Ready-to-Eat and Convenience Foods is Fueling Demand for the Global Food Flavors Market.

The Global Food Flavors market is expected to witness a CAGR of 5.1% between 2025 and 2032.

Tapping into Custom Flavors Tailored to Individual Taste and Dietary Preferences is the key market opportunity.

Key players in the Global Food Flavors market include Givaudan S.A., IFF, Kerry Group plc., Symrise, dsm-firmenich, ADM, and others.