Industry: Food and Beverages

Published Date: July-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 217

Report ID: PMRREP34693

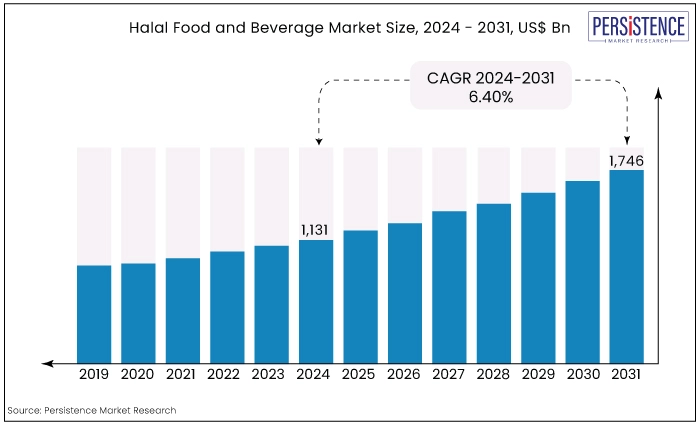

The global market for halal food and beverage is expected to increase from US$1,131 Bn in 2024 to US$1,746 Bn by the end of 2031. The market is estimated to secure a CAGR of 6.40% during the forecast period from 2024 to 2031.

Key Highlights of the Market

|

Attributes |

Key Insights |

|

Market Size (2024E) |

US$1,131 Bn |

|

Projected Market Value (2031F) |

US$1,746 Bn |

|

Forecast Growth Rate (CAGR 2024 to 2031) |

6.40% |

|

Historical Growth Rate (CAGR 2018 to 2023) |

4.80% |

Halal refers to products that are prepared and manufactured according to Islamic dietary guidelines, which prohibit certain ingredients such as pork and alcohol and require specific slaughtering methods for meat.

The global halal food and beverage market has been experiencing robust growth driven by changing preferences of the Muslim populations worldwide, and regulatory advancements. The market encompasses a wide range of products beyond meat, including dairy, beverages, snacks, confectionery, and even cosmetics and pharmaceuticals.

The halal F&B market is particularly strong in regions housing prominent Muslim communities such as Southeast Asia, the Middle East, and parts of Africa. Countries like Malaysia, Indonesia, Saudi Arabia, UAE, and Turkey are key players in both production and consumption of halal products.

The escalating emphasis on food safety, hygiene, and product reliability are poised to propel market growth in the upcoming years.

As reported by the Pew Research Centre in April 2019, the global Muslim community totals around 1.8 billion individuals, underscoring a significant demographic driving demand for Halal-certified products.

This demographic shift, coupled with increasing consumer awareness and regulatory advancements is likely to foster robust expansion in the halal food and beverage market.

Halal products are increasingly available through mainstream retail channels, including supermarkets, hypermarkets, specialty stores, and online platforms. This accessibility is expanding the market reach beyond traditional ethnic markets to cater to diverse consumer segments globally.

The halal food and beverage market is influenced by factors such as cultural and religious practices, health and wellness trends, globalization, and economic development.

As consumer preferences shift towards healthier and more sustainable options, there is a growing demand for organic, natural, and ethically sourced halal products.

As the global economy gradually recovered, the halal market rebounded strongly. Market expansion accelerated with increased investments in halal production facilities, technological advancements in certification processes, and growing adoption of digital platforms for halal verification and consumer education.

The market continued its upward trajectory, surpassing previous growth rates. Innovations in product development, such as the introduction of organic and eco-friendly halal products, catered to evolving consumer preferences for healthy and sustainable options.

The growth was underpinned by robust demand across various product categories including halal meat, dairy, beverages, and processed foods, as well as increased international trade and strategic partnerships among key market players. The market recorded a CAGR of 4.80% during the historical period.

The market is expected to witness accelerated growth with advancements in digital platforms for halal verification, supply chain transparency, and consumer engagement. Innovations in halal product offerings, including organic and eco-friendly options, will cater to health-conscious consumers seeking sustainable and ethical choices.

Governments and certification bodies are going to play a pivotal role in standardizing halal certification processes, enhancing consumer confidence and market transparency. The market is expected to hold a CAGR of 6.40% during the forecast period.

Changing Consumer Preferences

Muslim populations typically adhere to dietary laws outlined in religious teachings, which specify permissible (Halal) and prohibited (Haram) foods. This adherence creates a steady and growing demand for halal-certified food and beverages across various categories including meat, dairy, beverages, snacks, and processed foods.

The economic influence cannot be overlooked. With rising disposable incomes, particularly in emerging and developing economies, there is a corresponding increase in spending power on quality and ethically sourced halal products. This economic factor drives investment in halal food production, distribution, and retail infrastructure to meet growing consumer demand.

Growing Awareness Regarding Halal Dietary Laws and Certifications

Awareness of halal dietary laws empowers consumers to make informed choices about the foods they consume. Muslims adhere to strict dietary guidelines that prohibit certain ingredients such as pork and alcohol and require specific slaughtering methods for meat.

Non-Muslim consumers, increasingly health-conscious and concerned about food safety and ethics, also perceive halal-certified products as symbols of quality, transparency, and ethical sourcing.

Halal certification signifies compliance with Islamic dietary laws, which are not only religiously significant but also encompass ethical considerations such as humane treatment of animals and sustainable sourcing practices. This resonates with consumers who prioritize ethical consumption and seek products that align with their values and beliefs.

As globalization facilitates cultural exchange and integration, awareness of halal dietary laws has transcended traditional Muslim-majority regions to influence consumer preferences worldwide. This cultural integration fosters market growth by broadening the acceptance and availability of Halal products in multicultural societies.

Cost Implications and Supply Chain Complexities

A prominent restraint for the halal food and beverage market relates to cost implications and supply chain complexities. Producing and distributing Halal-certified products often involves additional costs compared to conventional food production. These costs can arise from sourcing halal-compliant ingredients, implementing specific processing techniques, maintaining separate production lines for halal and non-halal products, and investing in halal certification and compliance measures.

The added expenses associated with halal certification and compliance can impact pricing strategies, making halal products potentially more expensive compared to non-halal alternatives. This pricing differential can influence consumer purchasing decisions, particularly in price-sensitive markets or during economic downturns.

Ensuring the integrity of halal supply chains presents logistical challenges. Maintaining segregation between halal and non-halal products throughout the supply chain—from raw material sourcing to distribution—requires robust traceability systems and stringent quality control measures. Any lapse in these processes can compromise halal integrity and consumer trust, leading to reputational risks for brands and regulatory scrutiny.

Globalization and Multiculturalism

The halal food and beverage market benefits from globalization and multiculturalism, where diverse societies embrace and celebrate different cultural and religious practices. This inclusivity encourages mainstream retailers, foodservice providers, and manufacturers to expand their halal product offerings to reach a wider customer base.

Consequently, there has been a proliferation of halal-certified options in supermarkets, restaurants, and online platforms, catering not only to Muslim consumers but also to non-Muslims who value halal's quality and ethical standards.

Globalization has interconnected economies and facilitated the international trade of goods and services, including food products. This global connectivity enables halal-certified food and beverage manufacturers to access new markets beyond their domestic borders.

Companies can leverage trade agreements, distribution networks, and e-commerce platforms to reach their target markets in different countries more effectively.

Meat and Alternatives Account for the Largest Market Share

The meat and alternatives segment is expected to register significant share in the market during the forecast period.

The meat and alternatives segment within the halal market encompasses a wide range of products to cater to diverse consumer preferences. This includes traditional meat cuts (beef, lamb, chicken) that are halal-certified, as well as emerging alternatives such as plant-based meats and seafood alternatives that are also halal-compliant.

The variety within this segment appeals to different dietary choices and health considerations among consumers, thereby expanding its market reach. There will be growing rise for this product during the anticipation period with the increasing consumer preference for bacteria-free meat.

Online Distribution Channels Anticipate Rapid Growth

|

Category |

CAGR through 2031 |

|

Online – Distribution Channel |

6.0% |

Online platforms provide unparalleled reach, allowing halal food and beverage producers to tap into global markets beyond their traditional geographical boundaries.

This accessibility is crucial for reaching Muslim consumers worldwide who seek halal-certified products, regardless of their location. The online distribution channel is anticipated to register notable growth during the forecast period with a CAGR of 6.0% from 2024 to 2031.

Online channels enable halal food and beverage brands to showcase a wide range of products, including niche and specialty items that may not be readily available in local markets. Consumers can explore detailed product information, including halal certification details and ingredient sourcing, fostering transparency and trust in the purchasing decision.

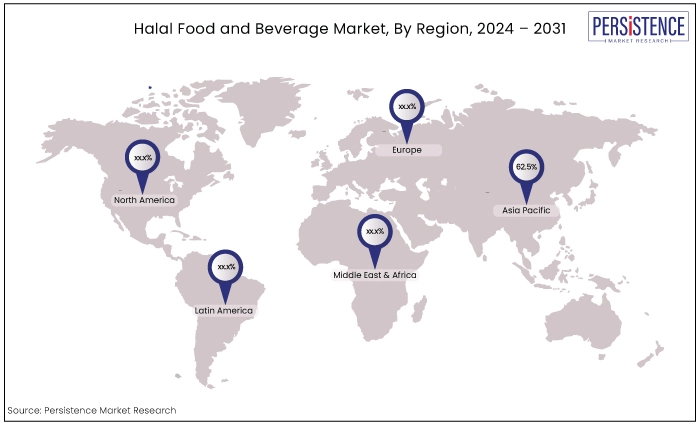

Asia Pacific Holds the Lion’s Share

|

Region |

CAGR in 2022 |

|

Asia Pacific |

62.5% |

Asia Pacific is considered as the leading and rapidly growing region for the halal food and beverage market. Regional growth is clearly attributable to the population rise, particularly in countries like Indonesia, Pakistan, India, and Bangladesh.

Based on findings from a Pew Research Centre article in April 2019, India is projected to accommodate an 11.1% Muslim population by 2060. This demographic shift, alongside evolving socio-psychological dynamics among the Muslim community, is anticipated to significantly propel market growth in the foreseeable future.

Increasing disposable income, and rising concerns about animal welfare are also driving the market in this region. Asia Pacific held the significant market share of 62.5% in the year 2022.

MEA to Record Higher Demand Growth

The Middle East and Africa region has the highest demand for halal products due to the prevalence of Islam as the largest religion. Countries in this region, particularly those in the Arabian Peninsula, have a strong preference for halal meat, following the religious guidelines set out in Sharia law.

Based on insights from the International Halal Accreditation Forum (IHAF), Kuwait stands out among the top 10 nations with a robust Islamic Economy Score worldwide.

Notably, around 60% of the research endeavors at the Kuwait Institute for Scientific Research focus on Halal and its associated advantages. This dedicated research underscores the burgeoning demand for Halal food and beverage within the region.

Market players engage in strategic alliances, mergers, and acquisitions to strengthen their market position, enhance distribution channels, and gain access to new markets.

The shift toward online shopping and digital platforms has prompted companies to invest in e-commerce capabilities and digital marketing strategies. This allows them to reach a broader audience of halal-conscious consumers and provide seamless shopping experiences that emphasize convenience and transparency.

Key Industry Developments

March 2024

Thai Food Products International partnered with Food Farm Hub to bring their halal-certified food ingredients to new international markets.

Organized retailers like Tesco and Aldi are stocking a wider range of halal products under their private labels. Aldi's expansion plans in the US, for example, will likely increase accessibility to halal options for consumers.

February 2022

Chicken Cottage unveiled plans to make its mark in East Africa by joining forces with Express Kitchen, a subsidiary of AAH Limited, through a franchising partnership. This strategic move underscores their commitment to broadening their business footprint and reaching new horizons in the region.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2018 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Product Type

Distribution channel

By Region

To know more about delivery timeline for this report Contact Sales

Increasing muslim population globally is a key driver for market growth.

A few of the leading market players operating in the market are Nestlé S.A, Cargill, and Incorporated.

Globalization and multiculturalism brings opportunity for the market players.

Asia Pacific held remarkable share in the market.

The market is projected to expand at a CAGR of 6.40% during the forecast period.