Industry: Food and Beverages

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Report Type: Ongoing

Report ID: PMRREP34646

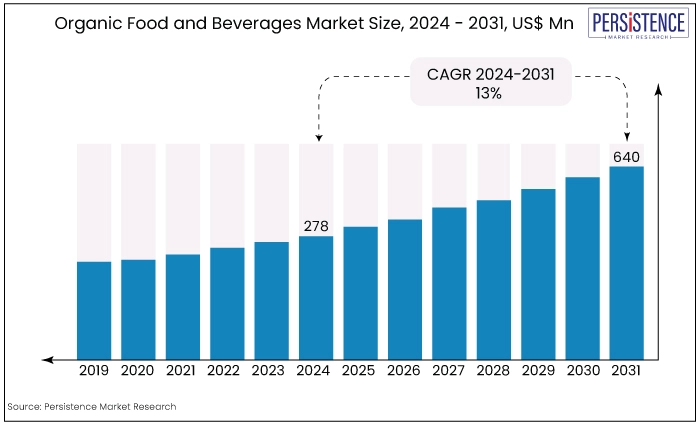

The market is estimated to reach a valuation of US$640 Mn by the year 2034, at a CAGR of 13%, during the forecast period 2024 to 2034.

Key Highlights of the Market

|

Attributes |

Key Insights |

|

Organic Food and Beverages Market Size (2024) |

US$278 Mn |

|

Market Size (2034) |

US$640 Mn |

|

Forecast Growth Rate (CAGR 2024 to 2034) |

13% |

|

Historical Growth Rate (CAGR 2019 to 2023) |

11% |

The increasing consumer knowledge and recognition of the health advantages associated with consuming organic food and drinks have stimulated the expansion of the global organic food and beverages market.

The escalating environmental apprehensions regarding the utilization of detrimental chemicals in agriculture and farming, and their adverse impact on consumers' wellbeing, have led to a surge in the request for organic food and beverages.

Factors such as the growing prevalence of chronic diseases like cancer, diabetes, and cardiovascular diseases, the rise in the burden of infectious diseases, the increase in healthcare spending, and the growing trend of health consciousness are leading consumers to prioritize the consumption of healthy and high-quality food and beverages worldwide.

An important factor for market growth is the increasing recognition of the health advantages linked to the consumption of organic products.

Consumer purchasing behaviour is expected to drive an increase in sales of organic food and beverages. Furthermore, the increasing favorability of non-GMO products among customers is propelling market expansion.

The organic food and beverages market has experienced significant expansion as a result of the enhanced availability of organic goods and beverages. Organic items have expanded beyond specialized retailers or farmers' markets, which eventually aids the market's growth.

The organic product business has witnessed a sustainable growth trajectory over the historical period from 2019 to 2023, valuing at US$124 Mn in 2019 while experiencing a rapid growth rate of 11% to reach a valuation of US$250 Mn in the year 2023.

In comparison to conventional fruits and vegetables found in markets, they possess exceptional health benefits and are environmentally advantageous. The demand for organic food and beverages is increasing due to consumers' growing understanding of the benefits of natural products that are not genetically engineered.

The sales of organic veggies have increased due to the availability of subscription packages on e-commerce websites specifically designed for the sale of organic food and beverages. The sales of organic goods, and beverages through e-retailers have significantly increased due to the widespread adoption of online delivery services.

Increased Demand for Clean Label Products

The organic food and beverage industry is expected to experience substantial growth due to the increasing demand for clean-label food and beverage goods. Consumers possess a significantly heightened level of awareness regarding the meals and beverages they eat.

To guarantee the organic and sustainable nature of each product, they aim to acquire knowledge regarding the substances used in food and beverages, their origins, and the certificates issued by government authorities.

Due to the evolving lifestyle, customers have become increasingly aware of their health. Consumers have a greater preference for organic food and beverages compared to other confectionery food items.

France, for instance, has experienced a notable rise in the number of organic food consumers who consume these products primarily for their health benefits.

This attributes to the fact that organic food and beverages provide consumers with significant health advantages, as these items are free from preservatives and are made using natural components.

Meat and chicken, which are derived from animals raised using organic methods, are also free from genetically modified organisms (GMOs). The increasing demand for organic food is leading to a simultaneous rise in sales growth.

The demand for organic food is rising due to customers' preference for natural food and beverages over chemically preserved items. This is a major factor driving the growth of the global market share.

High Costs

Organic farming practices often require more labour-intensive methods, such as manual weeding and natural fertilizers, which can increase production costs compared to conventional farming. This leads to higher costs for organic farmers in terms of labour, organic certification, and sourcing organic inputs.

Conventional farming benefits from economies of scale due to large-scale production, mechanization, and sometimes government subsidies. In contrast, organic farms generally operate at smaller scales and may not achieve the same cost efficiencies, resulting in higher retail prices.

Consumers typically pay a premium for organic products, often ranging from 10-50% higher than their conventional counterparts. While some consumers are willing to pay this premium for perceived health benefits and environmental concerns, others may find organic products too expensive, limiting market penetration, especially in price-sensitive markets.

Expanding Consumer Base

Increasing consumer awareness about health benefits, environmental sustainability, and ethical considerations associated with organic products is expanding the consumer base.

This includes not only traditional organic consumers but also younger generations and urban populations seeking healthier and more sustainable food options.

Rising health concerns, such as obesity, allergies, and food intolerances, are driving consumers to seek out organic products perceived as healthier and free from synthetic chemicals and pesticides.

Consumers are increasingly prioritizing ethical considerations, such as fair trade practices, animal welfare, and support for local farmers, which align well with organic farming principles, which in turn drives the market forward.

New Innovations & Product Diversification

There is a growing trend towards innovation in organic food and beverages, including new product formulations, flavours, and packaging designs to appeal to diverse consumer preferences.

The development of organic functional foods and beverages that offer additional health benefits beyond basic nutrition is gaining traction. Examples include organic probiotic drinks, fortified organic foods, and organic superfoods.

Demand for organic ingredients extends beyond consumer products to include organic ingredients for food service, restaurants, and institutional buyers, providing opportunities for suppliers and distributors.

Organic Food Products Account for 54% of Total Sales

|

Market Segment by Product Type |

Market Value Share 2023 |

|

Organic Food |

54% |

Based on product type, the organic food and beverages market is further segmented into organic food and organic beverages, where the organic food dominates the market share accumulating around 54% of the total market share.

The emergence of organic veggies began in industrialized regions, specifically North America and Europe, and has since spread to growing economies like India, and China. The continents of North America, and Europe are the primary regions where organic foods are most extensively consumed.

From 2024 to 2030, the demand for organic meat, fish, and poultry products is projected to experience the highest CAGR of 15.8%. The growing apprehensions surrounding artificial preservatives and chemicals are expected to boost the demand for the product in the coming years.

Supermarkets Capture the Lion’s Share in Sales

|

Market Segment by Distribution Channel |

Market Value Share 2023 |

|

Supermarket |

60% |

Based on distribution channel, the global market is further segmented into supermarket, convenience stores, speciality stores, where the supermarket stores segment dominates the global market share with 60% of the total market share.

The supermarket stores offer a wide range of both branded and domestic products. The brick-and-mortar stores offered by this distribution channel, together with their capacity to carry popular brands, have been contributing to the expansion of the global organic food and beverages market.

The growing presence of supermarket and hypermarket chains, along with the changing retail environment, especially in emerging economies, is driving the sales of products through this distribution channel.

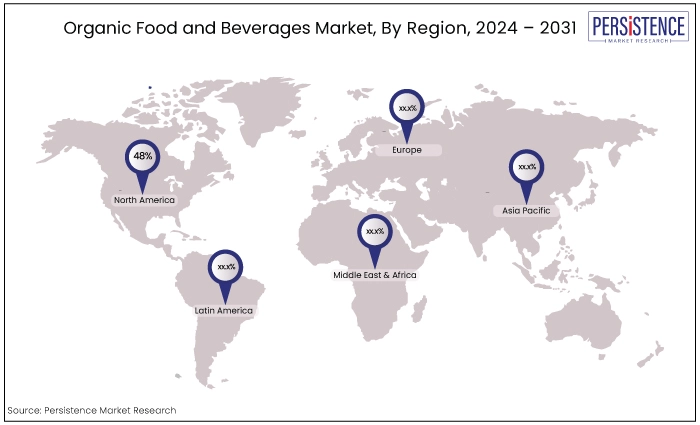

North America dominates the global market share with 48% of the market share

|

Region |

Market Value Share 2023 |

|

North America |

48% |

The North American organic food & beverages market accounted for 48% of the global market share, owing to the distinct advantages of these products, including their eco-friendly nature, lack of chemicals and residues, and superior health benefits compared to traditional food.

The North American market is expected to be driven by the growing public awareness of the advantages of consuming non-genetically modified or engineered products. The Asia Pacific organic food & beverages market is projected to experience a CAGR of 18.1% from 2024 to 2034.

This growth is primarily fuelled by the increasing popularity of ready-to-eat foods among the working-class population and the significant presence of millennials in countries like India, as China, India, and Japan are the primary markets in terms of consumer expenditure on food.

Furthermore, the regional market for organic frozen food is experiencing significant growth due to an increased demand for frozen food resulting from limited time available for preparation and cooking.

The organic food and beverages market is characterized by a dynamic competitive environment, with numerous essential organic food and beverage vendors competing for global market share.

Whole Foods Market L.P., Organic Valley, and Amy's Kitchen, Inc. are acknowledged for their dedication to quality and sustainability, which has propelled the organic food market forward.

The market is under the control of reputable manufacturers while emerging producers like SpartanNash Company, and EVOL Foods are conducting innovations and introducing innovative products and distribution plans.

Organic food and beverage providers are expected to continue to experience sustained growth as they adapt to changing consumer preferences and market dynamics.

October 2023

Dole Food Company, Inc. introduced its 'GO Organic!' consumer brands and the establishment of Dole Organics, a specialized division for the promotion of cross-sector collaboration, the optimization of supply chains, and the maintenance of the ongoing consistency and continuity of organic products.

April 2023

So Delicious Dairy Free, a division of Danone North America, introduced Organic Oatmilk as its inaugural product in the oat milk segment.

March 2022

The Wine Group announced the launch of a new wine brand called Lemonade Stand at Main & Vine, which are a new wine variant and are merged with natural flavors of freshly squeezed lemonade and ripe sun-kissed fruit.

|

Attributes |

Details |

|

Forecast Period |

2024 - 2034 |

|

Historical Data Available for |

2019 - 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Companies Profiled |

|

|

Pricing |

Available upon request |

By Product

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

The global organic food and beverages market size was valued at US$278 Mn as of 2024.

North America is the leading region in the market.

Asia Pacific is predicted to exhibit the highest growth rate during the forecast period.

Amy’s Kitchen, Inc., Organic Valley, Conagra Brands, Inc., Nestlé, Eden Foods, and SunOpta are some of the major key companies in the market.

The organic food segment is the dominant product category.