RF Filters Propel the Next Connectivity Wave with the Ongoing Rollout of 5G Networks, and Increasing Expansion of Wireless Communication Networks, Says PMR’s Report

Industry: Semiconductor Electronics

Published Date: June-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 172

Report ID: PMRREP24187

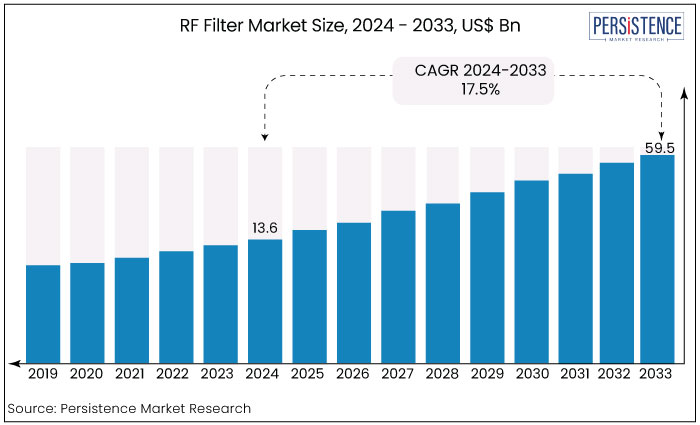

The global RF filter market is expected to rise from US$13.6 Bn in 2024 to US$59.5 Bn by the end of 2033. The market is anticipated to secure a CAGR of 17.5% during the forecast period from 2024 to 2033.

Key Highlights of the Market

|

Attributes |

Key Insights |

|

Market Size (2024E) |

US$13.6 Bn |

|

Projected Market Value (2033F) |

US$59.5 Bn |

|

Forecast Growth Rate (CAGR 2024 to 2033) |

17.5% |

|

Historical Growth Rate (CAGR 2019 to 2023) |

14.5% |

An RF filter is an electronic circuit component used to allow specific radio frequency signals to pass through while blocking or attenuating others. RF filters are used in electronic devices and systems to separate, isolate, or clean up signals at different frequencies.

The design of filter and configuration determine its characteristics, such as the frequency range it operates in, the level of attenuation or rejection of unwanted signals, and the amount of signal loss or insertion loss.

RF filters are used in a wide range of applications, including radio communication, wireless networking, radar, medical devices, and many other electronic systems.

Increasing demand for smartphones & other mobile devices together with rising demand for wireless infrastructure are the key factors influencing the growth of the RF filters market.

With the increasing use of smartphones and other mobile devices, there is an increasing need for RF filters to help improve the performance of these devices.

Rising demand for wireless infrastructure, such as base stations and small cells, is also driving the growth of the RF filter market. The market for RF filters accounts for 15% of the global filter market.

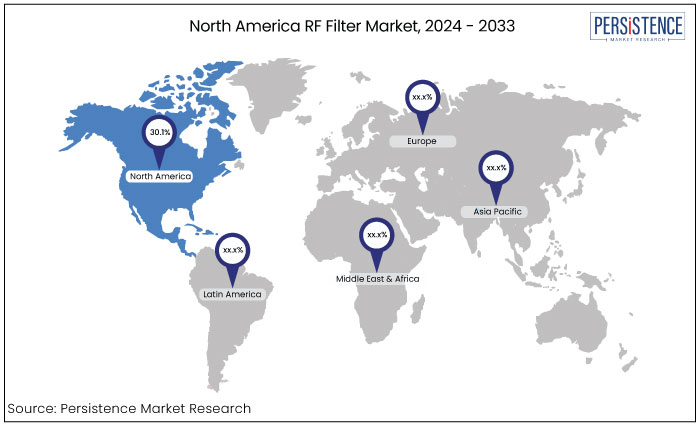

North America accounted for 30.1% of the global market in 2022, according to geographical market projections. Consumption of these solutions in South Asia & Pacific region accounted for around 26.3% of the market in 2023.

RF Filter Market Historic Growth and Course Ahead

The RF filter market exhibited substantial growth fueled by advancements in wireless technology and the growing adoption of tablets, smartphones and other mobile devices.

The rising penetration of IoT devices including wearable devices, connected cars and smart home appliances has increased the demand for RF filters for supporting wireless connectivity and data transmission.

The market expanded at a CAGR of 14.5% during the historical period. The future growth forecast for the RF filter remains favourable and fueled by numerous key factors.

Market fueling factors include constant expansion of 5G networks, the proliferation of IoT devices, and developments in wireless communication technologies.

These technologies include satellite communication, Internet of Vehicles, and Wi-Fi. All these factors will bring new opportunities for the manufacturers of RF filter for developing specialized filters catering to specific frequency bands as well as applications.

Sales of RF filters are estimated to secure a CAGR of 17.5% during the forecast period from 2024 to 2033.

Increasing Advancements in Semiconductor Technology

The growing demand for wireless communication technologies, such as smartphones, IoT devices, and the 5G network, is driving the adoption of RF filters in the US.

Rising advancements in semiconductor technology have enabled the development of RF filters with improved performance and reduced size, leading to increased adoption of these filters.

As the demand for high-speed and reliable wireless connectivity increases, there is a corresponding need for RF filters to manage signal interference, ensure signal quality, and optimize spectrum utilization.

Increasing adoption of IoT devices in the US is driving the demand for RF filters as these devices rely on wireless communication technologies that require RF filtering.

These aspects are aiding the acceptance of these technologies in the US accounting to the region's considerable market share of 24.1% in 2022.

The Proliferation of Mobile Devices

The growing adoption of the smartphones, tablets, wearables, and other mobile devices fuels the demand for RF filters. These devices require RF filters to support multiple frequency bands, enable seamless connectivity, and enhance overall performance.

With the increasing penetration of mobile devices globally, the demand for RF filters continues to grow. Modern mobile devices feature increasingly complex RF front-end architectures to support multiple wireless communication standards and bands.

Architectures typically include a variety of RF components, such as power amplifiers, low-noise amplifiers, mixers, switches, and filters, to ensure optimal performance across diverse frequency bands.

RF filters play a crucial role in these architectures by filtering out unwanted signals, reducing interference, and improving signal quality, making them essential components in mobile device designs.

Technical Complexity, Coupled with High Development Costs

The development of new RF filters can be expensive that could restrict the innovation in the market and make it tough for small players to complete.

RF filters require specialized expertise and advanced technologies to design and manufacture, which can make it difficult for new entrants to enter the market.

RF filter market is dependent on the semiconductor industry for its growth, which could be impacted by fluctuations in the semiconductor market.

Intense Price Competition and Cost Pressure

The RF filter market is characterized by intense price competition and cost pressure, particularly in high-volume consumer electronics markets such as smartphones and tablets.

Key players face challenges in reducing production costs while maintaining product quality and performance.

Price competition may also result into margin compression and reduced profitability for RF filter manufacturers, especially in commoditized segments of the market.

Intense price competition often leads to a race to the bottom in terms of pricing. As companies try to undercut each other, profit margins get squeezed. This can be particularly challenging for smaller players who may not have the economies of scale to withstand such pressures.

The Rising adoption of IoT Services

India has one of the rapidly growing smartphone markets in the world, with increasing adoption of mobile devices driving the demand for RF filters.

Country is also expanding its 5G network, which is expected to create new opportunities for RF filter manufacturers as the 5G network requires a large number of filters.

Indian government has launched several initiatives, such as Make in India, and Digital India, aimed at promoting the development of the electronics industry and increasing the adoption of digital technologies, which could boost the demand for RF filters. These factors enable India's market to expand at a CAGR of 19.1% during the predicted period.

Specialty Filters for Niche Applications

Key players can grab opportunities in developing speciality RF filters tailored to specific applications and industries. These include filters with temperature stability, customized frequency response characteristics and environmental applications such as automotive radar, aerospace, and defense.

By targeting niche markets and addressing specialized needs, key players can also differentiate themselves and capture niche segments of the market. Niche applications often represent high-value market segments with specialized requirements and stringent performance standards.

Market players that specialize in developing filters for niche applications can target these high-value segments and command premium prices for their specialized products. This allows market players to achieve higher profit margins and increase their revenue streams.

Band-pass Segment Experienced Significant Market Share in RF Filters Market?

|

Category |

Market Share in 2022 |

|

Band-pass Type |

35.6% |

The band-pass segment holds a significant market share for the RF (Radio Frequency) filters as it is used in a wide range of applications across various industries, such as telecommunications, consumer electronics, automotive, and healthcare.

Band-pass filters are designed to allow a specific frequency range to pass through while attenuating all other frequencies. This makes them well-suited for applications that require high-frequency signals, such as mobile communication, radar systems, and wireless networks.

Band-pass filters provide efficient and accurate signal processing, which is essential for many applications. They help to reduce interference from unwanted signals and noise, resulting in clearer and more reliable data transmission. These factors are influencing the notable share of 35.6% of band-pass segment in the market.

Adoption of RF Filters is Maximum for Mobile Phone Communication

|

Category |

Market Share in 2022 |

|

Mobile Phone Communication |

22.2% |

Mobile phones operate in the high-frequency range, typically in the range of 800 MHz to 2.6 GHz. RF filters are necessary in mobile phones to ensure that signals are transmitted and received accurately and without interference from other frequencies.

This is particularly important in densely populated areas, where there are many devices competing for the same frequency spectrum.

Mobile phone networks are constantly evolving to support higher data rates. RF filters are necessary to ensure that the phone can transmit and receive data accurately at these high rates.

This is particularly important for applications such as video streaming and online gaming, which require high data rates to function properly. Market share of RF filters for mobile phone communication recorded 22.2% in 2022.

North America Held Significant Market Share during Historical Period

|

Region |

Market Share in 2022 |

|

North America |

30.1% |

North America, particularly the US has the most advanced telecommunications infrastructures in the world.

This region has been at the forefront of wireless technology development and deployment including the transition from 2G and 3G to 4G LTE networks and now the ongoing rollout of 5G networks.

High level of technological development fuels the demand for RF filters that are vital elements in wireless communication systems for interference suppression, frequency selection and interference suppression.

North America records a notable market share because of the presence of leading market players in the region. Moreover, the growing adoption of smartphones and other mobile devices is also fueling the regional market growth.

February 2022

Ansys introduced RF Filter Design Software. The RF filter software helps in the synthesis, design and optimization of RF, digital filters and microwave cutting development costs while increasing performance.

June 2022

Smiths Interconnect launched its Planar X Series of thin film bandpass RF filter solutions. It is intended for harsh-environment applications and provides system developers with a compact high-performance solution for crucial RF filtering.

October 2021

Qualcomm Technologies, Inc. launched Qualcomm ultraBAW which is an RF filter technology. The system was developed for frequencies up to 7 GHz and is based on the modem-to-antenna technology that is powering high-performance 5G & connectivity systems across wireless market sectors.

June 2020

Johanson launched WiFi 6E, and WiFi 7 Band Pass Filter for faster speeds, a larger amount of connected devices & improved communications efficiency.

The radio frequency filter market is highly competitive, with many players vying for market share.

Various companies have a significant presence in the RF filter market and are constantly striving to develop new technologies and products to maintain their competitive edge.

Leading players in the RF filter market implement various strategies to expand their market presence and gain a competitive edge. This includes mergers and acquisitions, strategic partnerships, joint ventures, and collaborations with other companies, research institutions, or government agencies.

Market expansion strategies may also involve geographical expansion into new regions with growth potential.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2033 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Type

By Application

By Region

To know more about delivery timeline for this report Contact Sales

Increasing advancements in semiconductor technology remains a key driver for the market growth.

A few of the leading industry players in the market are NXP Semiconductors N.V, Analog Devices, Inc., and STMicroelectronics.

A key opportunity lies in the rising adoption of IoT Services

North America exhibited significant market share.

The band-pass segment represents a notable market share.