ID: PMRREP34731| 160 Pages | 13 Aug 2024 | Format: PDF, Excel, PPT* | Chemicals and Materials

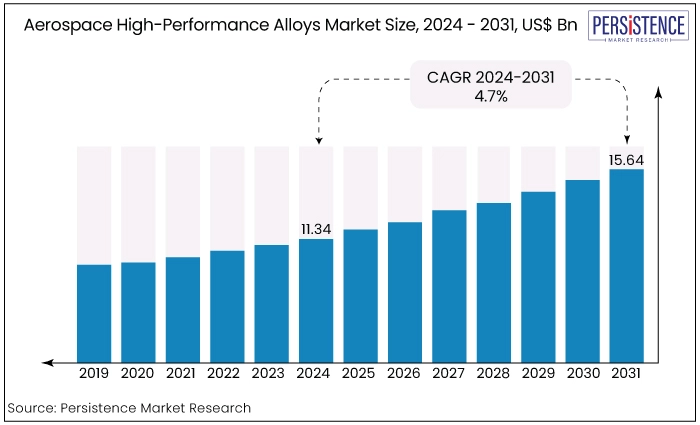

The global aerospace high performance alloys market is set to expand at a CAGR of 6.9% and expected to increase from US$237.8 Mn in 2024 to reach US$379.4 Mn by the end of 2031.

|

Attributes |

Key Insights |

|

Aerospace High Performance Alloys Market Size (2024E) |

US$237.8 Mn |

|

Projected Market Value (2031F) |

US$ 379.4 Mn |

|

Global Market Growth Rate (2024 to 2031) |

6.9% CAGR |

|

Historical Market Growth Rate (2018 to 2023) |

5.5% CAGR |

|

Revenue Share of Top Four Countries (2024E) |

~55% |

The aerospace high-performance alloys characterized by the use of advanced materials that meet the stringent demands of modern aviation and space exploration. High-performance alloys, including titanium, nickel-based superalloys, aluminum-lithium composites, and advanced stainless steels. These alloys are essential for ensuring the reliability, efficiency, and durability of aerospace components.

High-performance alloys are employed in a variety of applications, from jet engines and turbine blades to aircraft structures and exhaust systems, where they must withstand extreme temperatures, high pressures, and corrosive environments.

The global aerospace high-performance alloys market is characterized by significant regional disparities, with North America and Europe leading the market due to their established aerospace industries and technological advancements.

Asia Pacific region is emerging as a strong contender, driven by its growing aviation sector and increasing investments in aerospace technologies. The Middle East & Africa and Latin America regions offer growth opportunities, although they face challenges such as underdeveloped infrastructure and economic uncertainties.

Light weighting in Aircraft Design

Airlines are increasingly focusing on fuel efficiency to reduce operational costs and minimize environmental impact, which is driving the demand for lightweight high-performance alloys that lower aircraft weight. For instance,

Major carriers like Delta and United Airlines are investing in new aircraft models such as the Boeing 787 Dreamliner and Airbus A350, both of which utilize advanced composite materials and high-performance alloys to achieve significant weight reductions.

According to the International Air Transport Association (IATA), airlines can save up to $3 million annually in fuel costs per aircraft by adopting these lightweight materials. This shift towards fuel-efficient technologies underscores the growing demand for high-performance alloys that support sustainable aviation practices and enhance operational efficiency.

Shift Toward Electric Propulsion

The rising interest in electric and hybrid-electric aircraft is significantly boosting the demand for specialized alloys that can manage high thermal loads and meet electrical conductivity requirements. For example, companies like Airbus and Boeing are heavily investing in electric propulsion systems, such as Airbus’s E-Fan X hybrid-electric aircraft and Boeing’s eVTOL (electric Vertical Takeoff and Landing) prototypes.

Custom Alloy Development

The growing demand for custom-designed alloys tailored to specific aerospace applications reflects the industry's shift toward specialized materials that meet unique performance criteria. For instance, NASA’s Space Launch System (SLS) and Boeing’s 787 Dreamliner both utilize custom alloys designed to meet rigorous standards for strength, weight, and durability.

Advanced Manufacturing Techniques

The adoption of additive manufacturing and other advanced production methods is transforming the aerospace industry by making the manufacturing of high-performance alloys more efficient and cost-effective. For example,

Companies like GE Aviation and Rolls-Royce are leveraging 3D printing technologies to produce complex engine components with intricate geometries that were previously impossible to achieve with traditional methods.

GE’s LEAP engine, for instance, features fuel nozzles made using additive manufacturing, which has led to a 25% reduction in fuel consumption and a 75% decrease in lead time compared to conventional manufacturing techniques.

Increased Collaboration Across the Supply Chain

Aerospace companies are increasingly forming strategic partnerships with alloy manufacturers to secure a stable supply of high-performance materials and collaborate on developing next-generation alloys. For example,

Boeing has established a strategic alliance with suppliers such as Allegheny Technologies International (ATI) to co-develop advanced titanium and stainless steel alloys specifically designed for their new aircraft models. Similarly, Airbus has partnered with materials science companies like Constellium to create lightweight, high-strength aluminum alloys for its A350 XWB.

The global aerospace high performance alloys market experienced a moderate growth trajectory, achieving a CAGR of 5.5%. This growth was attributed to several factors including increased production of fighter jets, global rise in military spending, and boost in international space research.

The necessity to improve the efficacy of engines and turbines has shifted the manufacturers to use advanced alloys.

The global aerospace high performance Alloys market is expected to accelerate with a projected CAGR of 6.9%. As the aerospace sector continues to evolve, driven by advancements in technology, increasing defence and commercial aircraft orders, and a push toward sustainability, the demand for these specialized alloys is expected to grow.

This market is also witnessing significant innovation, with developments in additive manufacturing and recycling practices enhancing production efficiency and environmental sustainability. The global aerospace high-performance alloys market is thus poised for robust growth, reflecting the ongoing advancements and expanding needs within the aerospace industry.

The Rise in Global Defense Budgets

The rise in global defense budgets, particularly in the U.S., Europe, and Asia-Pacific, is a significant driver for the aerospace high-performance alloys market. For instance, the U.S. defense budget for 2023 reached $816 billion, with substantial investments in advanced military aircraft such as the F-35 fighter jet.

These jets require high-performance alloys for their airframes and engines due to the need for materials that can withstand extreme conditions while offering lightweight properties. European nations, in response to geopolitical tensions, are increasing defense spending, with Germany committing to a $100 billion defense fund, partly aimed at upgrading its air force.

Countries in Asia Pacific such as like India and China are also ramping up defense budgets, focusing on modernizing their military aircraft fleets, which further boosts the demand for high-performance alloys. These examples underscore the critical role of defense spending in driving the aerospace high-performance alloys market.

Technological Advancements

Innovations in material science are significantly advancing the development of high-performance alloys, essential for next-generation aerospace applications. For example, the development of alloys like titanium-aluminum intermetallic compounds has improved strength-to-weight ratios, making them ideal for components like turbine blades in jet engines.

These alloys can withstand extreme temperatures and stresses, enhancing the performance and efficiency of modern aircraft. Additionally, nickel-based superalloys, used in the hot parts of jet engines, offer remarkable resistance to thermal creep and oxidation, crucial for maintaining engine integrity at high speeds. Such advancements enable the aerospace industry to design robust, lightweight, and fuel-efficient aircraft, meeting the stringent demands of modern aviation.

Commitment to Reduce Carbon Emissions

The aerospace industry’s commitment to reduce carbon emissions is driving the demand for lightweight, fuel-efficient aircraft, creating significant opportunities for high-performance alloys. For instance, Airbus is focusing on reducing its carbon footprint by developing aircraft that are 15-20% more fuel-efficient, largely through the use of advanced materials like aluminum-lithium alloys.

Alloys offer high strength-to-weight ratios, reducing aircraft weight and fuel consumption, which aligns with global sustainability goals. This trend opens up opportunities for manufacturers of aerospace alloys to innovate and supply materials that support the industry's environmental targets.

High Cost of Raw Materials

The production of aerospace high-performance alloys is heavily reliant on costly raw materials such as titanium, nickel, and cobalt, which can significantly increase manufacturing costs. For instance, titanium, a key component in aerospace alloys, has seen price volatility due to supply chain disruptions and geopolitical factors, leading to high costs for manufacturers.

Nickel and cobalt, critical for superalloys used in jet engines, are also subject to price fluctuations due to limited global supply and high demand in other industries like electric vehicles. These rising material costs can make aerospace components prohibitively expensive, potentially limiting market growth and making it challenging for manufacturers to offer competitively priced products.

Stringent Regulatory Requirement

The aerospace industry is governed by stringent safety and performance standards, making it challenging for new alloy materials to gain approval. For example, the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) require extensive testing and certification processes for any new material used in aircraft, often taking years before approval is granted.

Rigorous requirements are essential for ensuring passenger safety, but they also slow down the adoption of innovative alloys that could enhance aircraft performance. As a result, manufacturers may be hesitant to invest in new materials, preferring to stick with tried-and-tested alloys, even if newer alternatives offer superior properties. This cautious approach can limit the pace of technological advancement in the aerospace sector, affecting overall market growth.

Supply Chain Disruptions

Geopolitical tensions, trade restrictions, and global events like pandemics can severely disrupt the supply chain of critical materials used in aerospace alloys, impacting production and market stability. For example, the U.S.-China trade war led to tariffs on key materials like aluminum and titanium, increasing costs for aerospace manufacturers.

The COVID-19 pandemic caused widespread logistical challenges, such as shipping delays and factory shutdowns, which interrupted the supply of essential raw materials. These disruptions can lead to production delays, high costs, and uncertainty in the aerospace high-performance alloys market, hindering its growth.

|

Product Category |

Projected CAGR through 2031 |

|

Titanium Alloys |

7.7% |

Titanium alloys are a key component in the global aerospace high-performance alloys market due to their exceptional strength-to-weight ratio, corrosion resistance, and ability to withstand high temperatures. For instance, titanium alloys such as Ti-6Al-4V are extensively used in the aerospace industry for critical components, including aircraft engines and structural parts.

The Boeing 787 Dreamliner utilizes titanium in its landing gear and engine components, contributing to the aircraft’s lightweight design and fuel efficiency. Additionally, the ability of titanium alloys to maintain structural integrity under extreme conditions makes them ideal for high-performance applications.

Applications include such as those required by military and space exploration programs. These properties make titanium alloys indispensable for meeting the rigorous demands of modern aerospace engineering.

|

Application Sector |

Projected CAGR through 2031 |

|

Turbine Blades |

7.4% |

Turbine blades are a key application where high-performance alloys are crucial due to their extreme operating conditions and critical role in engine efficiency. For instance, the turbine blades in modern jet engines are subjected to high temperatures, intense mechanical stresses, and corrosive environments.

Manufacturers use advanced nickel-based super alloys to withstand these demands such as Inconel 718, which offer exceptional heat resistance, strength, and oxidation resistance. For example, the Rolls-Royce Trent 1000 engine, used in the Boeing 787 Dreamliner, incorporates turbine blades made from these high-performance alloys to ensure optimal performance and durability.

The use of these specialized alloys enhances engine efficiency, fuel economy, and overall reliability, making them indispensable for high-performance aerospace applications.

|

Region |

CAGR through 2031 |

|

North America |

7.1% |

The aerospace high-performance alloys market in North America is experiencing significant growth driven by increased defence spending, technological advancements, and a strong aviation sector.

The United States, as a lead player, has seen significant investments in aerospace projects, such as the development of the F-35 Lightning II fighter jet, which utilizes advanced titanium and nickel-based superalloys for enhanced performance and durability. Additionally,

The commercial aviation sector is expanding, with major manufacturers like Boeing and Lockheed Martin leading innovations and driving demand for high-performance alloys. North America aerospace alloys market is projected to expand at a CAGR of 7.1% from 2023 to 2031

Market growth in North America is supported by the ongoing modernization of military aircraft and the increasing focus on fuel-efficient commercial airliners, further solidifying North America's position as a key region in the global aerospace alloys market.

|

Region |

CAGR through 2031 |

|

Europe |

6.5% |

The aerospace high-performance alloys market in Europe is experiencing notable growth, fuelled by significant investments in both commercial and defence aerospace sectors. Europe’s key players, such as Airbus and Rolls-Royce, are leading the development and adoption of advanced alloys. For instance,

Airbus’s A350 XWB aircraft features high-performance aluminum-lithium alloys and titanium components to enhance fuel efficiency and reduce weight. Rolls-Royce’s Trent engines, used in various aircraft, utilize nickel-based superalloys for turbine blades to withstand high temperatures and pressures.

This growth is driven by increased demand for new aircraft models, advancements in alloy technologies, and the region’s strong focus on sustainable aviation practices, further establishing Europe as a crucial hub for aerospace high-performance alloys.

The global aerospace high-performance alloys market features a dynamic competitive landscape with several prominent players and emerging trends shaping its evolution. Major aircraft producers such as Boeing, Airbus, Rolls-Royce, and GE Aviation are key market pullers of demand, pushing for advanced alloys to meet the stringent requirements of aerospace applications.

Alloy manufacturers like Allegheny Technologies International (ATI), Precision Castparts Corp., and Carpenter Technology Corporation play a vital role in supplying these specialized materials. The market is characterized by intense competition, with companies focusing on innovation to deliver superior alloys with enhanced properties.

Recent developments include advancements in additive manufacturing, exemplified by GE Aviation’s use of 3D printing for fuel nozzles in its LEAP engine, which highlights the shift towards more efficient production methods. Key technological trends involve the development of next-generation alloys with improved strength-to-weight ratios and better thermal resistance, as well as the integration of digital technologies and data analytics to enhance manufacturing precision.

Recent Developments

The aerospace high performance alloys market is valued at US$ 237.8 Mn in 2024.

The market is projected to expand at a CAGR of 6.9% during the forecast period from 2024 to 2031.

The market is estimated to reach US$ 379.4 Mn by the end of 2031.

Precision Castparts Corp., CRS Holdings, LLC (Carpenter), HAYNES INTERNATIONAL, ATI Materials, and ThyssenKrupp Aerospace, etc. are the top players operating in the market.

Turbine blades is the significantly growing application in the market.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2018 to 2023 |

|

Market Analysis |

US$ Million for Value Tons for Volume |

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Alloy Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author