Thermostatic Mixing Valves Market: U.S. and Canada Industry Analysis and Forecast

Industry: Industrial Automation

Published Date: May-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 183

Report ID: PMRREP33071

The North America thermostatic mixing valves market is currently valued at around US$ 451.1 Mn. Sales are projected to increase steadily at a CAGR of 4.2% to reach a market valuation of US$ 682.1 Mn by the end of 2032.

The United States thermostatic mixing valves market leads the way and accounts for three-fourths market share in North America.

| Attribute | Key Insights |

|---|---|

|

North America Thermostatic Mixing Valves Market Size (2021A) |

US$ 434.2 Mn |

|

Estimated Market Value (2022E) |

US$ 451.1 Mn |

|

Projected Market Value (2032F) |

US$ 682.1 Mn |

|

Market Growth Rate (2022-2032) |

4.2% CAGR |

|

Collective Value Share: Top 5 Players (2022E) |

45.8% |

The thermostatic mixing valves market in North America saw sluggish growth over the past few years at 0.77% CAGR, mainly due to the onset of COVID-19. However, the market is expected to grow at a faster rate of 4.2% CAGR through 2032, backed by steadily rising demand from various end-use industries such as residential, commercial, and industrial.

According to the research, year-on-year change in the growth of the North American market for thermostatic mixing valves in 2021 was 3.6%, reason being increased population and rising urbanization in the United States and Canada, which will have a substantial influence on the expansion of numerous end-use sectors, and consequently on thermostatic mixing valve installations over the forecast period.

Leading manufacturers of thermostatic mixing valves are focusing on launching innovative solutions to provide better quality solutions to end customers, with consumer appreciation of environmental health and safety issues on the rise. Companies are developing and launching lead-free thermostatic mixing valves to drive more sales in North America.

Such initiatives are laying the way for additional thermostatic mixing valve sales prospects over the coming years.

Lead content in plumbing fixtures, valves, and pipe fittings needs to be minimized owing to increasing severity of the dangers it poses on the health of people of all ages. The U.S. government has put in place regulations to maintain lead levels within acceptable limits, mandating the maximum allowable concentration in thermostatic mixing valves.

This encourages manufacturers to offer products that are free of lead, which is a key winning strategy adopted by prominent manufacturers present in the market.

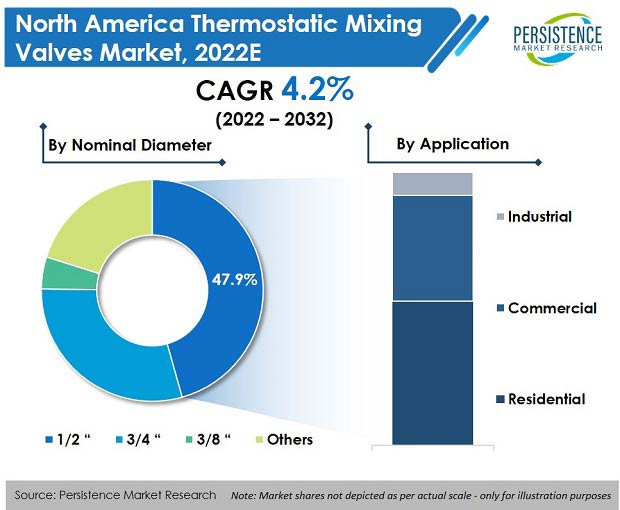

The above chart signifies market share based on end-use industry, in which, the residential sector holds a major share of around 50% in North America. The market is projected to expand at 4.2% CAGR in terms of value through 2032.

Thermostatic mixing valve systems are largely used in the healthcare, institutional, and residential sectors. Safe warehousing and distribution of residential warm water are critical in any application, as rising scalding incidents have resulted in significant demand for advanced plumbing solutions for hot water supply in both, residential and commercial applications, thus creating an enormous market opportunity for thermostatic mixing valve manufacturers.

Scalding can be just as bad as fire burns, regardless of whether it's triggered in water or not, prompting construction developers to utilize the integration of temperature sensors for hot water in residences and offices and devise smart plumbing solutions for water supply.

In the North American real estate industry, incorporating smart plumbing solutions is becoming more and more common. Sophisticated building designs and stringent safety regulations are making it necessary for developers to find new ways to optimize their properties. One way they're doing this is by implementing smart plumbing solutions that can help save on water and energy costs.

“Rising Smart Home Trend Driving Installation of Thermostatic Mixing Valves”

Increased number of smart homes in North America is a major factor driving market growth of thermostatic mixing valves. Smart home penetration in the United States reached 69 percent in 2019, or 22 million households, according to the Consumer Technology Association (CTA). Consumption of thermostatic mixing valves in North America is growing as smart shower systems become more popular in the region.

Rising hotel industry in the scope of renovations of old hotels and the construction of new hotels with modern amenities will create demand for thermostatic mixing valve units. Robust growth in this industry is likely to bode well for building thermostatic mixing valve suppliers. The hospitality industry remains a leading end-use industry for thermostatic mixing valves.

Which is the Most Attractive Market for Thermostatic Mixing Valves in North America?

“U.S. Residential Sector Driving Demand for Thermostatic Mixing Valves”

The U.S government is looking to diversify its economy by driving growth in the residential sector. The residential sector is one of the key growing segments driving demand for thermostatic mixing valves, and is estimated to hold around 50% of market value share.

The residential sector is projected to expand steadily at a 3.4% CAGR over the forecast period. The U.S. is expected to see high demand for thermostatic mixing valves owing to the growing infrastructure projects in the residential as well as the construction sectors.

The desire for energy-efficient, environmentally friendly, and low-maintenance goods is driving demand for thermostatic mixing valves in the U.S.

The U.S. thermostatic mixing valves market is projected to expand steadily at 3.6% CAGR through 2032.

Should Thermostatic Mixing Valve Producers Concentrate on Canada?

“Canada Thermostatic Mixing Valves Market to See Higher Growth in North America”

Canada has high growth in the HVAC sector and space heating equipment, which is expected to drive building thermostatic mixing valve demand. Due to expanding residential demand and better living conditions, Canada will be the fastest-growing market for thermostatic and digital mixing valves throughout the projection period.

Furthermore, the country's economy is likely to be aided by a fast-developing real estate industry and an increase in the number of residential building projects. In Canada, demand for thermostatic mixing valves is projected to increase 4% in 2022.

Which Thermostatic Mixing Valve Type is Most Demanded?

“High Usage of Point-of-use Thermostatic Mixing Valves”

The U.S. market for point-of-use thermostatic mixing valves is estimated to grow at 3.3% CAGR over the next five years. The will provide more than one-third of market share in terms of value. This valve type is frequently used in plumbing systems in situations where water flow is constant.

Standard thermostatic mixing valves are also expected to be one of the most important segments over the forecast period, expanding at a CAGR of around 4.2%.

Which Application Drives Most Revenue Generation of Thermostatic Mixing Valve Manufacturers?

As per Persistence Market Research analysis, government initiatives have assisted in the development of the residential construction industry, thereby driving thermostatic mixing valve usage. Continuous developments within the commercial industry have resulted in increased demand for TMV-licensed valves, especially in Canada.

Growth of the residential sector is expected to be one of the primary factors responsible for the rise in the demand for thermostats and other valves. Thus, the residential sector is forecasted to expand steadily at 3.4% CAGR.

Ongoing growth in the North American industrial and commercial sectors has increased employment opportunities in the region; employment ratio decreased in 2020 due to the global COVID-19 pandemic, but this effect is not expected to last for long period.

Increased government investments have boosted employment opportunities and supported the growth of new commercial and industrial facilities. This growth factor is expected to have a positive impact on thermostatic mixing valve consumption in North America.

The COVID-19 outbreak in the United States had an extraordinary impact on the whole industrial sector, including project cancellations, supply chain, logistics disruptions, and so on, all of which influenced demand for thermostatic mixing valves. The pandemic had a severe impact on the economy at various levels, and the impact was seen in the HVAC and construction sectors as well.

However, in the recovery phase of COVID-19, the rising economic conflict between Russia and Ukraine will impact market growth due to increase in raw material prices, rising energy rates, and disturbance in the supply chain.

Over the past few years, acquisition and expansion activities have increased to improve the supply chain of thermostatic mixing valves.

Several key manufacturers of thermostatic mixing valves are developing new technology-driven systems. Emergence of several manufacturers has also been seen in this market space.

| Attribute | Details |

|---|---|

|

Forecast Period |

2022-2032 |

|

Historical Data Available for |

2017-2021 |

|

Market Analysis |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon Request |

By Capacity:

By Nominal Diameter:

By Valves Type:

By Application:

By Country:

To know more about delivery timeline for this report Contact Sales

The North America thermostatic mixing valves market is currently valued at over US$ 451.1 Mn.

Governmental regulations compelling the use of thermostatic mixing valves will majorly drive market growth.

Demand for point-of-use thermostatic mixing valves is set to rise at the fastest rate over the coming years.

From 2017 to 2021, consumption of thermostatic mixing valves increased at a CAGR of 0.77%.

Sales of thermostatic mixing valves are projected to increase at 3.8% CAGR and be valued at US$ 682.1 Mn by 2032.

The emergency thermostatic mixing valves market is expected to expand faster at 5% CAGR over the decade.

Danfoss A/S, Reliance Worldwide Corporation, Misumi Corporation, Watts Water Technologies, and Zurn are prominent thermostatic mixing valve manufacturers, accounting for 46% market share.

The U.S. market accounts for a major share of around 75%, while the market in Canada is projected to expand faster at 4.8% CAGR.