ID: PMRREP34816| 162 Pages | 24 Sep 2024 | Format: PDF, Excel, PPT* | Food and Beverages

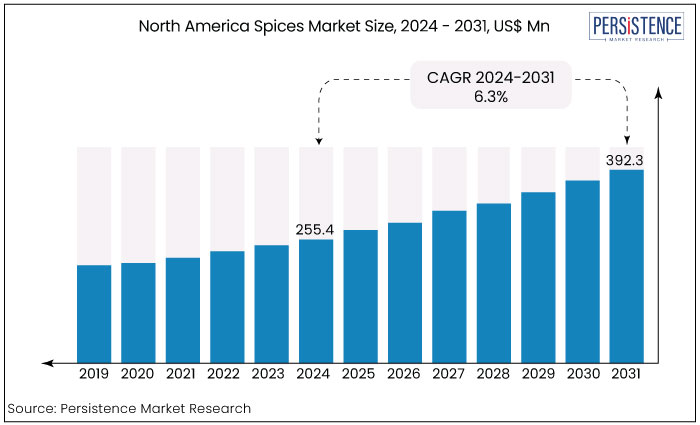

The North America spices market is projected to grow from US$255.4 Mn in 2024 to US$392.3 Mn by 2031, registering a CAGR of 6.3% during the forecast period.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

North America Spices Market Size (2024E) |

US$255.4 Mn |

|

Projected Market Value (2031F) |

US$392.3 Mn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

6.3% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

4.8% |

|

Country |

Market Share in 2024 |

|

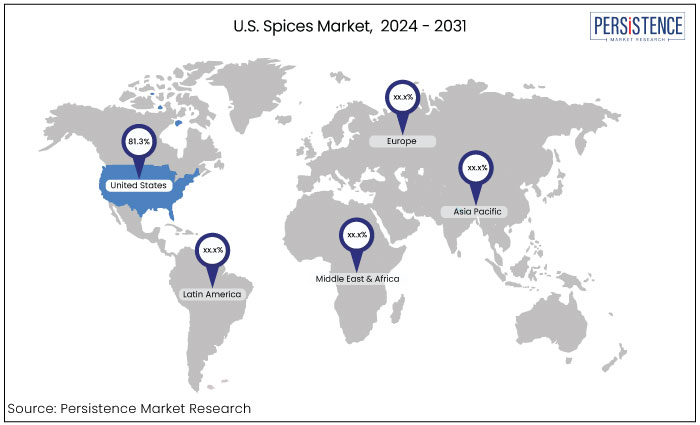

U.S. |

81.3% |

The United States dominates the North America spices industry, holding 81.3% of the total market share. Within the country, notable regional variations exist. The Northeast, including states such as New York and Massachusetts, contributes around 20% of the U.S. market. Its rich food culture and diverse population drive strong demand, particularly for ethnic and exotic spices.

In contrast, the Midwest, with key states like Illinois and Ohio, also represents about 20% of the market. While traditional American spice blends remain highly popular, there is a rising preference for Latin American flavors and international cuisines in the region.

|

Category |

Market Share in 2024 |

|

Form - Powder Spices |

39% |

Powdered spices remain the most widely used form, valued for their convenience and ease of application, allowing quick incorporation into a variety of dishes. Whole spices are preferred by consumers seeking bold flavors and longer shelf life, often used in slow-cooking methods and oil infusions.

Chopped or crushed spices strike a balance between convenience and flavor intensity, making them particularly suitable for marinades and a wide range of versatile culinary applications. Together, these forms cater to diverse consumer preferences and cooking styles, reflecting the market’s adaptability to evolving culinary needs and the rising demand for both convenience and authenticity in spice consumption.

|

Category |

Market Share in 2023 |

|

End-use - Retail/Household |

35% |

Retail/household sector accumulated 35% market share dominating the industry. The food processing sector commands the largest share in the North America spice market primarily driven by the growing popularity of processed foods and ready-to-eat products that rely on spices for enhancing flavor. This sector is expected to continue its strong growth in the future.

Trailing behind, the foodservice industry also captures a notable portion of the market, supplying restaurants and catering services. Additionally, the retail/household segment is steadily expanding as consumers become more adventurous with spice mixtures for home cooking?.

The North America spices market has seen significant expansion in recent years, driven by rising consumer interest in diverse and exotic flavors, health benefits, and natural ingredients. Spices once primarily used for traditional cooking, are now essential in creating global cuisines and fusion dishes, spurred by the growing demand for ethnic foods. Health-conscious consumers are increasingly using spices such as turmeric, ginger, and cinnamon for their medicinal properties, further boosting the market.

Trend analysis reveals a shift toward organic and sustainably sourced products as consumers prioritize clean-label ingredients and transparency. The surge in plant-based diets and demand for healthier food options has also contributed to the rise in spice consumption.

Convenience trends, including pre-mixed spices and ready-to-use seasoning blends, have gained popularity, aligning with the busy lifestyles of many consumers. E-commerce platforms and direct-to-consumer channels are further enhancing access to a wide variety of spices supporting continued market growth.

North America spices market experienced steady growth between 2018 and 2023 driven by increasing consumer interest in ethnic cuisines, health benefits associated with spices, and rising demand for organic and clean-label products.

The growing popularity of global flavors, particularly in home cooking, and the foodservice industry’s expanding use of spices fueled market expansion. The shift toward healthy, natural ingredients, such as turmeric and ginger for their anti-inflammatory properties further contributed to market growth.

The market is poised for continued expansion during the forecast period from 2024 to 2031 driven by trends in plant-based diets, sustainability, and ethical sourcing. The demand for organic and sustainably produced spices will likely to remain strong, supported by health-conscious consumers and environment-friendly practices.

Technological advancements in processing and distribution alongside the rise of e-commerce, will also play pivotal role in shaping the market future, providing opportunities for innovation and growth.

Rising Demand for Processed and Convenience Foods

The growing demand for processed and convenience foods is a key driver for North American spice market. As consumers lead busier lifestyles, they increasingly seek ready-to-eat meals and quick preparation options that save time while still providing satisfying and flavorful experiences. These products, whether frozen dinners, canned meals, or pre-packaged snacks, rely on spices and seasonings to enhance flavor, preserve shelf life, and differentiate them from competitors.

Spices play a crucial role in creating appealing tastes for a variety of processed foods, which helps manufacturers meet consumer preferences. This shift is further fueled by urbanization, dual-income households, and a focus on convenience, making processed foods more popular than ever.

The rise of health-conscious consumers seeking nutritious options without compromising on taste has led to the creation of healthier processed foods that use natural spices as alternatives to artificial flavorings and preservatives.

Impact of Fluctuating Raw Material Prices

Fluctuating raw material prices pose a significant challenge to the North American spice market, creating uncertainty for both manufacturers and consumers.

Spices are predominantly imported from regions such as India, Vietnam, and other parts of Asia, where agricultural production is heavily influenced by unpredictable factors like weather conditions, pests, and natural disasters. These factors can lead to inconsistent crop yields, driving up the costs of raw materials?. For instance, extreme weather events such as droughts or floods can disrupt the supply of key spices like pepper, cinnamon, and turmeric, creating shortages and increasing prices.

Geopolitical tensions, export restrictions, and fluctuating currency exchange rates can further complicate the stability of spice imports, leading to sharp price increases. As a result, spice manufacturers in North America face difficulties in maintaining stable pricing for their products, which can impact profit margins and consumer demand. Increasing costs are often passed on to consumers, making spices less affordable and limiting their use in both households and foodservice sectors.

Growing Consumer Health Consciousness

The increasing focus on health and wellness among consumers presents a strong opportunity for the North America spices market. People are seeking natural, functional ingredients that enhance flavor while providing health benefits.

Spices like turmeric, ginger, and cinnamon are gaining popularity for their anti-inflammatory and antioxidant properties. This shift toward health-conscious eating habits encourages demand for organic, non-GMO, and sustainably sourced spices.

Brands that can highlight the nutritional advantages of their spice offerings, while maintaining quality and transparency in sourcing, stand to capture a growing market of health-focused consumers looking for natural alternatives.

North America spices market is characterized by a diverse and competitive landscape featuring a mix of large multinational corporations established regional players, and emerging niche brands. The competition is driven by factors such as product innovation, quality, price, distribution strategies, and consumer preferences.

Recent Developments in the North America Spices Market

The market is estimated to increase from US$255.4 Mn in 2024 to US$392.3 Mn by 2031.

Rising consumer demand for ethnic flavors is a key driver for market growth.

Some of the leading industry players in the market are McCormick & Company Inc., Olam international, Sleaford Quality Foods Ltd.

The market is projected to record a CAGR of 6.3% through 2031.

The growing consumer preference for organic and sustainably sourced spices presents a significant opportunity for the spices industry.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Country Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Type

By Nature

By Form

By End Use

By Country

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author