Industry: Healthcare

Published Date: March-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 180

Report ID: PMRREP32486

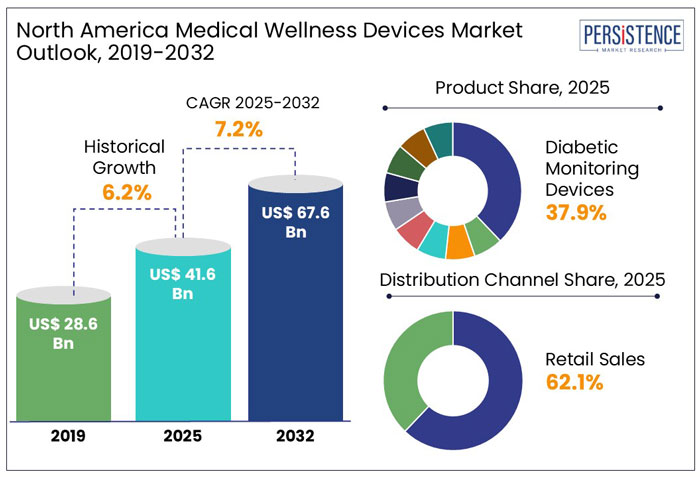

North American revenue from the medical wellness devices market is set to reach US$ 41.6 Bn at the end of 2025, with the global market estimated to surge ahead at a CAGR of 7.2% to reach a valuation of US$ 67.6 Bn by the end of 2032.

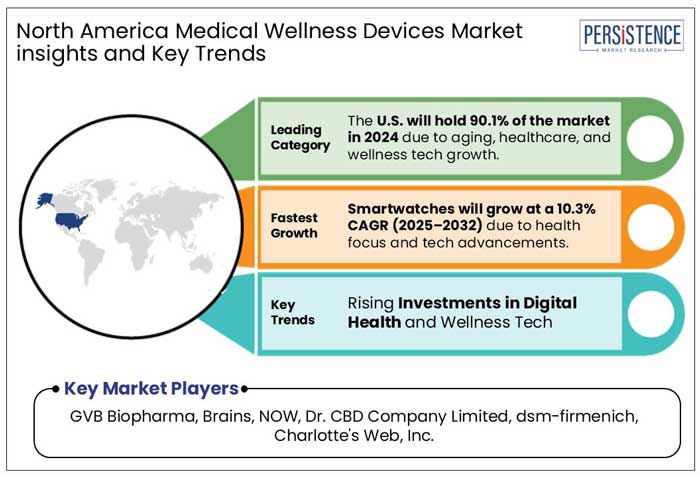

The North American medical wellness market is experiencing significant expansion, driven by increasing health awareness, rising chronic diseases, and growing adoption of wearable health technologies. Innovations in remote monitoring, AI-powered wellness devices, and digital health solutions are enhancing preventive care and personal well-being. Government initiatives, expanding telehealth services, and advanced healthcare infrastructure further support market growth across the region.

|

Attribute |

Key Insights |

|

Medical Wellness Devices Market Size (2025E) |

US$ 41.6 Bn |

|

Market Value Forecast (2032F) |

US$ 67.6 Bn |

|

Projected Growth (CAGR 2025-2032) |

7.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.2% |

The North American medical wellness devices market registered a CAGR of 6.2% from 2019 to 2024, driven by rising health awareness, technological advancements, and the increasing prevalence of chronic diseases.

Wearable health devices, smart medical monitors, and fitness trackers have gained significant adoption, supported by the region’s strong healthcare infrastructure and high consumer spending capacity. Integrating artificial intelligence (AI) and the Internet of Things (IoT) into wellness devices has further enhanced their accuracy and usability, boosting market expansion.

The market is expected to continue its upward trajectory at a CAGR of 7.2%, reaching a market size of US$ 67.6 Bn by 2032. This growth is expected to be fueled by the rising demand for remote patient monitoring, personalized wellness solutions, and preventive healthcare measures. Regulatory support for digital health innovations and increasing investments in research and development will further accelerate expansion.

“Technological Advancements”

Technological advancements in the design and operation of thermometers, mobility aids, light therapy devices, pulse oximeters, and orthotics are a critical aspect that can create market expansion opportunities. Pulse oximeter technology has improved dramatically over the past few years as a result of efforts to recover haemoglobin oxygen saturation and pulse rate (PR) analysis in unfortunate conditions. Mercury thermometers gave way to digital and infrared thermometers as this technology advanced over time.

“Prevalence of Lifestyle-Disorders to Demand Connected Health Devices”

Over the course of the forecast period, it is predicted that demand for medical wellness devices like as wearable devices for medical purpose and remote monitoring of patients would rise as consumer preferences shift in favour of a healthier lifestyle, propelling market expansion. Additionally, during the course of the forecast period, demand for connected health devices is anticipated to increase due to the rising prevalence of lifestyle-associated disorders that requires continuous health monitoring.

“Growing Trend for Wearable Medical Devices”

Since smart watches has become more and more popular in recent years, medical wellness devices such as wearable medical devices have been popular in the healthcare industry and particularly among young people. Wearable technology tends to gather or transmit biometric data, from tracking one's activities and movements to monitoring vital signs. These devices also assist diabetic people in monitoring their blood glucose levels.

“Reliability and Safety of Oximeters Are Doubtful”

The reliability and safety of over-the-counter pulse oximeters are in question. The PAHO recommends that while pulse oximetry may be a useful tool in clinical decision-making, it is neither a replacement for clinical assessment nor a basis for diagnosis in and of itself.

“Growing Adoption of Pain Medications & Minimum Patient Qualification for Orthopaedic Treatment”

Market growth is anticipated to be constrained by a lack of clinical evidence supporting the treatment effectiveness of orthopaedic braces and a low level of patient awareness of bracing-mediated orthopaedic treatment. Due to the frequent use of painkillers, braces and supports are being marketed for much less. More and more people are taking painkillers to treat the discomfort caused by orthopaedic disorders instead of the proper orthopaedic solutions.

Why is the U.S. Market Booming?

“High Disposable Income”

The U.S. market held around 90.1% market share in the North America medical wellness devices market at the end of 2024.

Among the most important macroeconomic factors that allow people to select the best solutions for various medical conditions are reimbursements and high disposable income. A significant element driving individuals to choose improved thermometers, smart watches, thermometers for diabetes, orthotic devices, and other health monitoring equipment is rising healthcare costs. Thus, increased investment in the U.S. is fuelling rapid market expansion.

Will the Canada Be a Lucrative Market for the Manufacturers?

“Product Innovations and More Focus on After Sale Services to Drive the Market”

The Canada market for medical wellness devices accounted for around 9.9% at the end of 2024.

Market players are incorporating new technologies into their products. For instance, digital and infrared versions of mercury thermometers are now being introduced. New products that can satisfy customers in terms of quality, quantity, durability, and cost are being produced by manufacturers. Companies are also concentrating on after-sales services that will help in generating significant income in the race for revenue development.

Which Product is Driving Growth of the North America Market?

“High Number of Diabetic Patients”

Diabetic monitoring devices accounted for a revenue share of 37.9% in 2024.

As per NIH estimates, about 34.2 million U.S. citizens have diabetes. An estimated 26.9 million people of all ages have been received a diagnosis of diabetes. Diabetes has been diagnosed in 210,000 teens and children, including 187,000 cases of type 1 diabetes. 7.3 million adults over the age of 18 are thought to have diabetes yet lack a diagnosis. Owing to such estimates, it is anticipated that diabetic monitoring devices will be in greater demand in the region during the projected period.

Which Distribution Channel is Expected to Emerge as a Market Leader in the Future?

“Wide Availability of Products and Easy Access”

Retail sales accounted for a revenue share of 62.1% by the end of 2024 within the North America medical wellness devices market.

The expansion of retail and independent pharmacies, as well as the accessibility of medical wellness devices in mass retailers and supermarkets and because medical wellness devices can be used directly by patients, the segment is growing as more walk-in patients visit retail pharmacies.

The market for medical wellness devices is competitive. To improve their market penetration, a number of the major market players make strategic alliances, prosper regionally, and introduce new products. The manufacturer's long-term goal of extending their operations in emerging markets focuses on mergers and acquisitions among local players.

Key instances include:

|

Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn/Bn Volume: As Applicable |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies’ Profile |

|

|

Report Highlights |

|

|

Customization & Pricing |

Available upon Request |

Product:

End User:

Country:

To know more about delivery timeline for this report Contact Sales

The market is estimated to increase from US$ 41.6 Bn in 2025 to US$ 67.6 Bn in 2032.

The North America medical wellness devices market is driven by rising healthcare awareness, increasing chronic disease prevalence, growing geriatric population, technological advancements, and higher consumer demand for personalized and preventive healthcare solutions.

The market is projected to record a CAGR of 7.2% during the forecast period from 2025 to 2032.

Abbott, Dexcom, Inc., Masimo Corporation, Garmin Ltd, Omron Healthcare, Inc. among others, are the key players within this market.

Retail sales, accounting for 62.1%, are the primary distribution channel driving sales in the market.