Industry: Chemicals and Materials

Published Date: September-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 161

Report ID: PMRREP34812

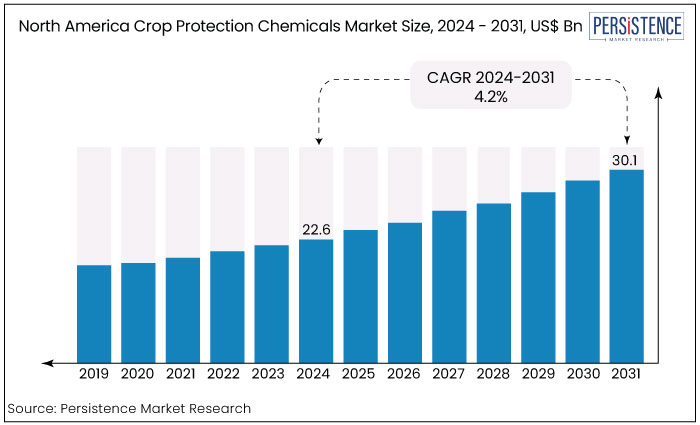

North America crop protection chemicals market is estimated to reach a valuation of US$30.1 Bn in 2031 from a value of US$22.6 Bn recorded in 2024. The market is estimated to capture a CAGR of 4.2% during the forecast period from 2024 to 2031.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

North America Crop Protection Chemicals Market Size (2024E) |

US$22.6 Bn |

|

Projected Market Value (2031F) |

US$30.1 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

4.2% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

3.7% |

|

Country |

Market Share in 2024 |

|

U.S. |

70.3% |

The U.S. leads the market due to its large agricultural sector, advanced farming techniques, and strong investment in agricultural innovation. The country’s vast arable land and diverse climate support high crop yields necessitating efficient crop protection solutions.

U.S. farmers utilize advanced technologies such as precision agriculture, which increases the demand for herbicides, insecticides, and fungicides. Government policies promoting sustainable agriculture and crop protection research further strengthen the market. The presence of major agrochemical companies and a well-established regulatory framework also contribute to the U.S. dominating this sector in North America.

|

Category |

Market Share in 2024 |

|

Product - Herbicides |

31.4% |

Herbicides to lead the market accounting for 31.4% market share due to their critical role in modern agriculture. Weeds compete with crops for essential resources like water, nutrients, and sunlight, leading to reduced yields. Herbicides offer an efficient and cost-effective solution to manage weeds on a large scale, especially in crops like corn, soybeans, and wheat, which dominate North America agriculture.

The widespread adoption of herbicide-tolerant genetically modified (GM) crops has further driven the demand for herbicides making them a preferred choice among farmers for enhancing productivity and reducing manual labor associated with traditional weeding methods.

|

Category |

Market Share in 2024 |

|

Crop Type - Cereal and Grains |

40.1% |

Cereal and grains lead the market and to account for 40.1% of the total market share in 2024 due to their large-scale cultivation and economic significance. Crops like corn, wheat, and barley are staples in North America agriculture accounting for a significant portion of total crop production.

Crops are critical for both domestic consumption and export driving the demand for crop protection chemicals such as herbicides, fungicides, and insecticides to ensure high yields and protect against pests, weeds, and diseases. Additionally, cereal and grains are often grown on vast acreages requiring more intensive use of chemical solutions to maximize productivity and meet global food demand.

Crop protection chemicals market plays a pivotal role in enhancing agricultural productivity by safeguarding crops from pests, diseases, and weeds. This market includes various chemical types such as herbicides, insecticides, fungicides, and biopesticides, which are essential in maintaining crop health and optimizing yield.

With growing global food demand and the rising need for efficient farming practices, the use of crop protection chemicals has become indispensable. The market is driven by technological advancements, an increase in genetically modified (GM) crops, and the adoption of precision agriculture techniques to manage resources effectively.

Recent trends in the market show a shift toward sustainable and eco-friendly solutions. Biopesticides, in particular are gaining traction due to regulatory pressures and consumer demand for environmentally safe products.

While herbicides continue to dominate the market, the rise of integrated pest management (IPM) systems and organic farming has opened new opportunities for biopesticides and reduced-risk chemicals. Additionally, advances in formulation technologies and digital farming tools are helping farmers optimize chemical application, further driving market growth and reducing environmental impact.

The market has experienced steady historical growth driven by increasing agricultural activity and the adoption of modern farming practices. Over the past few decades, the market saw significant expansion particularly with the widespread use of herbicides and genetically modified (GM) crops, which allowed for more efficient weed control and enhanced yields. Advances in chemical formulations and the introduction of pest-resistant crops further bolstered demand.

The market is expected to evolve with a great emphasis on sustainability and innovation. The growing adoption of biopesticides driven by strict environmental regulations and consumer preference for organic products will likely to shape the future. Additionally, precision agriculture and digital tools will continue to influence the sector enabling more targeted and efficient application of crop protection chemicals.

The Need to Increase the Yield of the Crops

In 2022, the average pesticide usage in North America reached 9.2 kg per hectare of agricultural land, with herbicides accounting for the largest share at 5.7 kg per hectare. The adoption of conservation tillage practices, such as no-till and reduced-till farming, has gained popularity across North America due to their environmental and soil health benefits.

From 2012 to 2017, farms using intensive tillage in the United States, Canada, and Mexico declined by 35%. However, this shift has resulted in a heavier reliance on herbicides for effective weed control.

Fungicide consumption averaged 1.8 kg per hectare in 2022. Between 2016 and 2019, the U.S. and Canada faced an average economic loss of USD 138.13 per hectare due to reduced corn yields from fungal diseases. These significant financial setbacks have pushed farmers to increase the use of chemical fungicides to protect their crops and minimize losses. Consequently, the growing demand for fungicides to manage and control disease outbreaks has led to a rise in chemical inputs in agriculture.

Increasing High-Quality and Quantity of Crops

The increasing global population and rising incomes have driven higher demand for both large quantities and high-quality crops. According to the United Nations, the world’s population is projected to grow from 7.7 billion in 2021 to 9.7 billion by 2050. In response, farmers worldwide are boosting crop production by either expanding agricultural land or enhancing productivity on existing lands through the use of fertilizers, pesticides, irrigation, and innovative products.

Rising demand for fresh, high-quality crops has fueled the need for crop protection chemicals like glyphosate, azoxystrobin, and pyrethroids, leading to improved crop yields.

In 2022, Canada’s wheat production for the 2022-2023 marketing years reached 34.0 million metric tons (mmt), an increase of 3 percent from the previous month, 57 percent higher than the previous year, and 12 percent above the five-year average, according to the United States Department of Agriculture (USDA).

In Mexico, corn production also saw a rise from 27.55 mmt in 2021 to 27.60 mmt in 2022. This growing demand for high-quality and large quantities of crops is expected to drive the growth of the North American crop protection chemicals industry.

Rising Toxicity and Side-Effects of Crop Protection Chemicals

The toxicity of crop protection chemicals to humans and animals is a significant concern for industry. These chemicals are known to cause dermal and eye irritation and may lead to allergic reactions. Inhalation of spray mist or dust from these chemicals can result in throat irritation, coughing, and sneezing. Consequently, the use of crop protection chemicals in both agricultural practices and pest control in buildings is highly regulated in the U.S.

With the global population projected to reach nearly 10 billion by 2050, the demand for crop protection chemicals has risen to safeguard plantations and crop yields. According to the Food and Agriculture Organization (FAO), pesticide use increased by 36% between 2000 and 2019. However, the growing health risks associated with the rising use of these chemicals are likely to pose challenges to market growth.

Technological Advancements in Precision Agriculture

The adoption of precision agriculture technologies, such as drones, satellite monitoring, and automated equipment, enables more targeted application of crop protection chemicals, reducing waste and enhancing efficiency. This creates opportunities for companies to develop innovative solutions tailored to precision farming practices.

Data-driven tools and IoT integration offer new ways to manage crop health and predict pest infestations further driving demand for advanced crop protection products that align with these emerging technologies.

Biopesticides and Organic Farming

The growing concerns over the environmental and health impacts of chemical pesticides have increased the demand for biopesticides offering significant market opportunities. These biological products are less harmful to the environment and align with the rising preference for organic farming practices.

As organic agriculture in North America continues to expand with its restrictions on synthetic chemicals, the demand for natural crop protection products is steadily increasing, further driving growth in this sector.

The market is highly competitive with key players like ADAMA Agricultural Solutions Ltd, American Vanguard Corporation, BASF SE and Bayer AG leading the charge. These companies, along with Corteva Agriscience and FMC Corporation, are introducing novel products and leveraging innovative technologies to seize new opportunities.

Industry leaders such as Nufarm Ltd, Sumitomo Chemical Co. Ltd, Syngenta Group and UPL Limited are diversifying their portfolios and expanding their global presence and also investing heavily in research and development to maintain a competitive edge and drive market growth.

Recent Developments in the North America Crop Protection Chemicals Market

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Product

By Crop Type

By Form

By Application

By Country

To know more about delivery timeline for this report Contact Sales

The market is estimated to increase from US$22.6 Bn in 2024 to US$30.1 Bn by 2031.

Rising food demand, and increased environmental regulations are the key factors propelling the industry growth.

ADAMA Agricultural Solutions Ltd, American Vanguard Corporation, BASF SE and Bayer AG are some of the leading industry players.

The market is projected to record a CAGR of 4.2% during the forecast period from 2024 to 2031.

A prominent opportunity in the crop protection chemicals industry is the growing demand for eco-friendly biopesticides and organic farming solutions.