Medical Image Exchange Systems Market Segmented By Medical Image Exchange Software, Medical Image Exchange Services in Hospitals, Clinical Research, Laboratories, Diagnostic centers, Educational Institutes

Industry: IT and Telecommunication

Published Date: March-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 374

Report ID: PMRREP11464

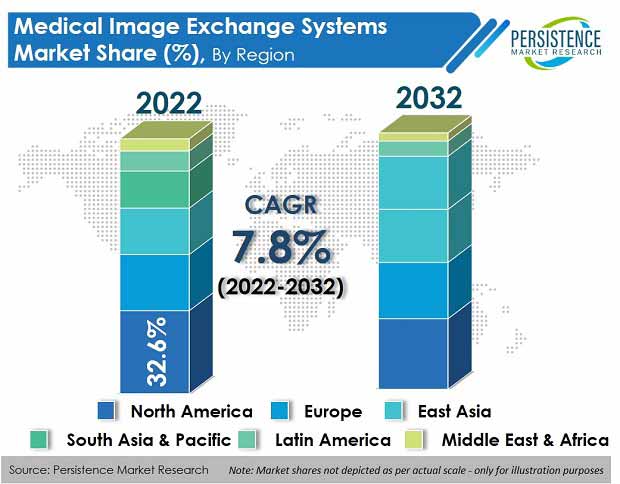

The global medical image exchange systems market is slated to enjoy a valuation of US$ 3.75 Bn in 2022, and further expand at a CAGR of 7.8% to reach US$ 7.97 Bn by the year 2032.

| Attribute | Key Insights |

|---|---|

|

Market Size (2022) |

US$ 3.75 Bn |

|

Projected Market Value (2032) |

US$ 7.97 Bn |

|

Global Market Growth Rate (2022-2032) |

7.8% CAGR |

|

Share of Top 5 Market Players |

40% |

As per detailed industry analysis by Persistence Market Research, sales of medical image exchange systems accounted for almost 15% share of the global medical imaging market in 2021.

Medical image exchange is the ability for healthcare providers across the community to access medical images from all connected Health Information Exchanges (HIEs). Image exchange systems allow the sharing of images outside of institutions through web-based medical image exchange systems and cloud-based medical image exchange systems solutions.

There is growing need for high-quality, secure, and reliable medical image exchange workflows such as image exchange workflows, PACS transfer, health information exchange portals, clinical workflows, automated imaging workflows, and other workflows for different healthcare end users.

The global market for medical image exchange systems expanded at 4.7% CAGR over 2017-2021. Demand for medical image exchange systems has grown due to the continuous modernization of medical equipment.

Implementation of 5G technology will improve digital infrastructure in the healthcare market. Many companies are working on this as there will be fewer hang-ups after 5G implementation. This will help patients share more data with biopharma companies and healthcare professionals at great speed.

As the technology matures, patients will maximize the benefits from the healthcare system with a good data-driven strategy. As such, implementation of 5G technology in healthcare will drive demand growth of medical image exchange systems and solutions at 7.8% CAGR over the decade.

“Eminent Growth of Medical Imaging Providers Shifting to the Cloud”

Medical imaging is an important element of healthcare processes, and helps provide accurate disease diagnosis and treatment. Medical imaging technology is advancing and new devices and techniques are possible for storing, processing, and exchanging of imaging reports and diagnosis. Healthcare providers are rapidly shifting to cloud-based solutions due to cost and time constraints.

Migrating to the cloud enables medical imaging providers to digitize, innovate, and realize various business objectives. It also facilitates interoperability and allows for a secure way for critical data, images, and other information to be transmitted swiftly and easily.

“Increased Adoption of Automation in Diagnostic Services Leading to Huge Amounts of Virtual Data”

Technology advancement and adoption of automation in diagnostic service has generated huge amounts of virtual data. Handling and transferring such data results in increased demand for medical image exchange systems.

According to the Society for Imaging Informatics in Medicine (SIIM), imaging technology such as MRI has a significant number of sequences, and images result in an average of 300 MB of data storage per study, and full body scans take even more storage space.

Such heavy data requires delicate handling and transferring across the healthcare infrastructure. Various medical image exchange software such as IBM I-connect provide cloud-based/web-based accessing of image data remotely. The Medical Image Exchange (MIES) system provides enterprise imaging portfolios that help users leverage a broad range of applications.

How Big is the Opportunity for Medical Image Exchange System Adoption in the U.S.?

The U.S. is projected to remain one of the most attractive markets during the forecast period, according to Persistence Market Research. According to the study, the U.S. is expected to account for 80.2% share of the North America image exchange systems market by 2032.

The U.S. has a dominating market share for medical image exchange systems due to the already penetrated digital healthcare industry and advanced healthcare infrastructure. High growth is primarily attributed to medical image exchange software and service providers who are more investing in healthcare technology and an increase in the number of diagnostic imaging centers across the country.

Why is Demand for Medical Image Exchange Equipment Increasing in France?

Demand for image exchange systems in France is expected to rise at 10.2% CAGR over the forecast period (2022-2032). The European region follows North America with its high demand for medical image exchange devices from various countries such as Spain, the U.K. and France, among others.

Growth of the France medical image exchange systems market is driven by medical imaging technological advancements in diagnostic imaging modalities and medical image management software, growing investments in medical imaging, and European government initiatives to encourage Electronic Health Record (EMR) adoption.

Why is India a Prominent Medical Image Exchange Systems Market?

The India image exchange systems market is set to register the highest growth in South Asia & Pacific, and its market size is expected to expand 3.9X by 2032.

South Asia & Pacific is experiencing the highest growth rate due to rapid digitalization in general as well as in the healthcare industry. Access to devices and services such as computer systems, smartphones, Internet, and cloud-based services is pushing the growth of the healthcare sector, which is also leading to high demand growth for medical image exchange systems.

Which Type of Medical Image Exchange Solution is Most Preferred?

By solution, medical image exchange software dominated the market and constituted the highest market share of 60.6% in 2021. However, the medical image exchange services segment is set to expand at a higher CAGR of 9.5% during 2022-2032.

Medical image exchange software is seeing sustainable growth, especially cloud-based/web-based solutions. These software enable the exchange of medical images across networks between healthcare providers.

Why Do Hospitals Drive Most Demand for Medical Image Exchange Systems?

Among the end users, the market is segmented as hospitals, clinical research, laboratories, diagnostic centers, educational institutes, and others. Hospitals held the highest market share in terms of value in 2021 and are set to experience a CAGR of 10.2% from 2022 to 2032.

Medical imaging technology is in high demand at hospitals as it helps doctors analyze and monitor patients’ conditions. The main use of medical image exchange systems in hospitals is to allow for remote diagnosis and consultations.

How has the COVID-19 Crisis Impacted Medical Image Exchange System Demand?

The COVID-19 pandemic outbreak disrupted many industries, including that of medical image exchange equipment. Demand for medical image exchange, mobile-enabled services, cloud-based medical image exchange services, and automation in diagnostic services increased during lockdowns due to the COVID-19 outbreak.

During the outbreak, sales of medical image exchange systems increased 3.6X in 2021-2022, and would see a further surge in demand amid COVID-19 as improving patient experience and health outcomes is top priority.

Introduction of new solutions and strategic partnerships are key strategies followed by top medical image exchange system manufacturers to increase their business revenue. Several medical image exchange system providers are focusing on innovation in solutions/services to improve their market shares.

| Attribute | Details |

|---|---|

|

Forecast Period |

2022-2032 |

|

Historical Data Available for |

2017-2021 |

|

Market Analysis |

US$ Million for Value |

|

Key regions covered |

|

|

Key countries covered |

|

|

Key market segments covered |

|

|

Key companies profiled |

|

|

Report coverage |

|

|

Customization & pricing |

Available upon request |

By Solution:

By End User:

By Region:

To know more about delivery timeline for this report Contact Sales

South Asia & Pacific is projected to register strong growth in the global medical image exchange systems market, exhibiting a CAGR of nearly 8% through 2032.

Some of the leading manufacturers of medical image exchange systems are IBM Corporation, GE Healthcare, Nuance Communications, and Koninklijke Philips N.V. Nearly 60%-65% market share is currently held by the top 15 to 20 players.

Hospitals dominate the market and are expected to surge at a CAGR of over 10.2% during the forecast period.

The global medical image exchange systems market was valued at US$ 3.5 Bn in 2021, and is estimated to reach US$ 7.97 Bn by 2032.

From 2017 to 2021, demand for medical image exchange systems increased at a CAGR of 4.7%.

Sales of medical image exchange systems are estimated to surge at a CAGR of 7.8% from 2022 to 2032.

Rising digital healthcare technology and advancements in medical imaging equipment are expected to drive market growth.

Top 5 countries driving major demand for medical image exchange equipment include India, the U.S., South Korea, China, and France.

The medical image exchange systems market in Japan and South Korea was valued at US$ 233.6 Mn and US$ 101 Mn, respectively, in 2021.