Medical Beds Market Segmentation by Product - Acute Care Beds | Long-term Care Beds | Psychiatric Care Beds | Maternity Beds

Industry: Healthcare

Published Date: November-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 250

Report ID: PMRREP33191

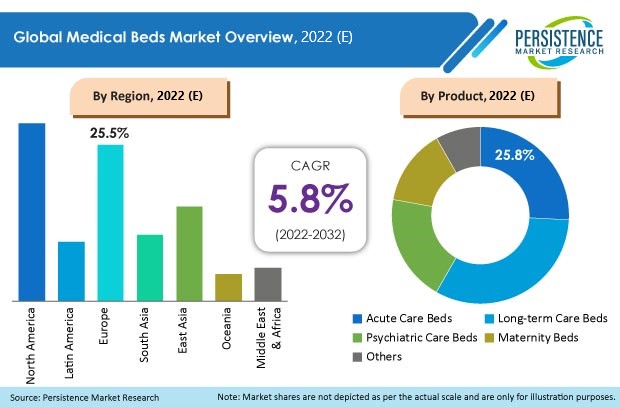

Worldwide revenue from the medical beds market was US$ 12.2 Bn in 2021, with the global market estimated to move ahead at a CAGR of 5.8% to reach a valuation of US$ 22.6 Bn by the end of 2032.

As assessed by Persistence Market Research, long-term care beds are expected to show growth at a CAGR of 6.5% over the forecast period. Overall, medical beds market sales account for approximately 52.5% revenue share of the global medical furniture market, which was valued at around US$ 23.17 Bn in 2021.

The global market for medical beds recorded a historic CAGR of 6.2% in the last 9 years from 2012 to 2021.

Hospitals and local communities all around the world were overwhelmed by COVID-19's rapid global expansion in the first months of 2020. To avoid overflow and saturation, one of the major tasks was to quickly and effectively manage medical beds and other health resources. This is especially crucial in nations where there are not many beds accessible, there are not enough medical personnel, and there is not enough organizational assistance.

Before any emergency occurs, it is vital to analyze the hospital's capacity and the effectiveness of managing its structural elements. This analysis serves as a useful starting point for further investigation of the emergency's management. Thus, the market for medical beds offers considerations for growth in a medical environment.

Hospital beds are essential components necessary in healthcare facilities because the majority of patients are unable to move to receive treatment and require rest.

Factors such as an aging population coupled with an increase in the prevalence of chronic diseases, an increase in hospitalization due to recent outbreaks of the COVID-19 pandemic and other infectious diseases, an increase in the number of well-equipped, well-furnished, and sophisticated infrastructure hospitals, and the introduction of technologically improved beds are likely to boost worldwide market growth.

|

Medical Beds Market Size (2022) |

US$ 12.9 Bn |

|

Projected Market Value (2032) |

US$ 22.6 Bn |

|

Global Market Growth Rate (2022-2032) |

5.8% CAGR |

|

Market Share of Top 5 Countries |

43.8% |

“Introduction of Technologically Incorporated Smart-Beds”

The history of electric medical beds dates back approximately 100 years. The medical bed is a crucial component of the healthcare environment and is used to assess its scope, effectiveness, growth, and diversity.

These automated, electric devices have undergone substantial changes in terms of both looks and expected operation throughout the course of this time, while still preserving the original characteristics that served as the foundation for the development of this medical device's earliest proponents.

Recently, these devices have reached an entirely unknown, innovative stage in their development, utilizing every technological tool at their disposal and creating new vectors of benefit for their products. This period is known as the era of smart medical beds.

Thus, with the emergence of new technologies for the varied requirements of patients, as well as to incorporate the purpose of such medical equipment within a medical setting, the market for medical beds is set to present opportunities to manufacturers for expansion of their product portfolio, and exceed their geographical presence.

“Product Recalls, High Cost, and Adoption of Ambulatory Procedures”

Increasing demand for minimally invasive procedures and the use of ambulatory surgical and healthcare facilities by patients, as well as the shrinking budget for public hospitals, which results in a lower uptake of advanced beds in the facilities, may restrain the growth of the total market during the course of the projected period.

Moreover, product recalls in the medical beds sphere have further presented a hindering impact on the market. Moreover, the cost of electric medical beds is quite high, posing a burden on the facilities adopting their installation, as well as to the patients opting for in-patient admissions.

In addition, compared to manual or standard beds, electric hospital beds are heavier because they have more components. The cost of maintenance may be greater than conventional bed settings, and this may pose a restrictive stance toward the growth of medical bed sales in low-income and emerging nations.

Why is the U.S. Medical Beds Market a Profitable One?

“Established Medical System and Availability of Reimbursements”

The U.S. accounted for 70.7% share of the North American market in 2021, and a similar trend is expected over the forecast period.

The U.S. has an established medical care system. With the presence of several reimbursement policies supporting treatment plans, the adoption of in-patient stays within medical facilities is greater in the country. This subsequently provides a scope for the expansion of the medical beds market in the country, as capacity management maintains upgradation as per the growing patient and infrastructural needs.

Will India Be a Lucrative Market for Medical Bed Manufacturers?

“Advancements in Healthcare Structure and Growing Medical Tourism”

India held 4.7% share of the global market in 2021. India's medical bed market is being propelled by the country's expanding healthcare sector and growing need for better patient care. The market is also anticipated to grow over the forecast period due to the rising number of private hospital beds outfitted with the newest accessories, technology, and modifications as per patient needs.

Additionally, the demand for medical beds has significantly grown due to the sudden coronavirus pandemic (COVID-19). Furthermore, beds created by manufacturers for specific groups of patients, together with rising medical tourism in India, are likely to generate profitable prospects for market participants in the coming years.

How is China Emerging as a Prominent Market for Medical Beds?

“Increasing Medical Bed Capacity as Plan to Manage High Illness Burden”

China held the largest share of 54.4% of the East Asian medical beds market in 2021.

The Chinese government encourages market participants to both develop their own technologies and import those from other nations. China introduced 89,000 new medical beds as part of a five-year health strategy for the years 2016–2020.

Moreover, in just 10 days in 2020, China established an emergency hospital comprising 1,000 beds, thirty intensive care units, and multiple isolation wards, owed to the COVID-19 pandemic. These factors are set to present a lucrative growth within the country for medical beds throughout the forecast period.

Which Product is Driving Substantial Market Growth?

“High Need for Long-term Care Beds in Community and Elderly Care”

Long-term care beds held 32.5% share of the total market in 2021.

Typically, patients are transferred to long-term care wards from acute or subacute medical wards after receiving acute therapies or from home because their illness conditions have gotten worse.

For instance, under the national healthcare insurance system, long-term care wards offer long-term care for senior citizens with serious physical and cognitive issues.

Simplifying operational trends in long-term care units is crucial for formulating regional healthcare policies in a society that is aging quickly and has encouraged radical reforms in the health sector. For community-based collaborative care systems, long-term care wards at healthcare facilities play a significant role, thus presenting a large market share presence for long-term care beds, within the global market.

Which Type of Medical Bed is Most Widely Used?

“Wave of Technological Advancements and Incorporation in Conventional Medical Beds”

Manual beds held the largest market share of around 41.4% in 2021.

Aspects of design, materials that integrate a far more hygienic and resilient design, population-specific models, ergonomic manual controls, and morphological changes connected to updated mobility options, while embedded with new technologies, have been the trends and most pertinent innovations to manual medical beds over the past years.

Because of developments in equipment design and functioning, the manual beds segment has emerged as a dominating section within the global market.

Which Usage Accounts for Higher Adoption of Medical Beds Globally?

“Surge in Number of Critically-Ill Patients”

Intensive care usage holds a larger share of about 50.8% with a market value of around US$ 6.2 Bn in 2021.

In most medical facilities around the world, decisions about the expenditure and potential benefits of retaining or expanding a staffed ICU reserve capacity during the pandemic wave and preparing for subsequent pandemic waves had been made in light of the impact of the COVID-19 pandemic and the associated rates of hospital admissions for infectious and chronic illnesses.

Increase in patients requiring intensive care has had an impact on the rise in the number of medical beds and their usage.

The global market for medical beds is fragmented and fiercely competitive. Market participants are concentrating on brand-new product introductions, product innovations, and geographic expansion.

For instance:

|

Attribute |

Details |

|

Forecast Period |

2022-2032 |

|

Historical Data Available for |

2012-2021 |

|

Market Analysis |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon Request |

By Product:

By Bed:

By Usage:

By End User:

By Region:

To know more about delivery timeline for this report Contact Sales

The global medical beds market was valued at US$ 12.2 Bn in 2021.

Sales of medical beds are set to increase at a CAGR of 5.8% and reach US$ 22.6 Bn by 2032.

Demand for medical beds increased at 6.2% CAGR from 2012 to 2021.

The U.S., China, Japan, India, and Germany account for the most demand for medical beds, currently holding 43.8% market share.

The U.S. accounts for 70.7% share of the North American market.

Hill-Rom Holdings, Inc., Invacare Corporation, Drive Medical, and Stryker Corporation are the top four companies in this market.

China held a share of 54.4% of the East Asia market in 2021, while Japan accounted for a share of 32.4%.

The market in India is set to grow at a CAGR of 4.9% during the forecasted years.