Industry: IT and Telecommunication

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Report Type: Ongoing

Report ID: PMRREP34671

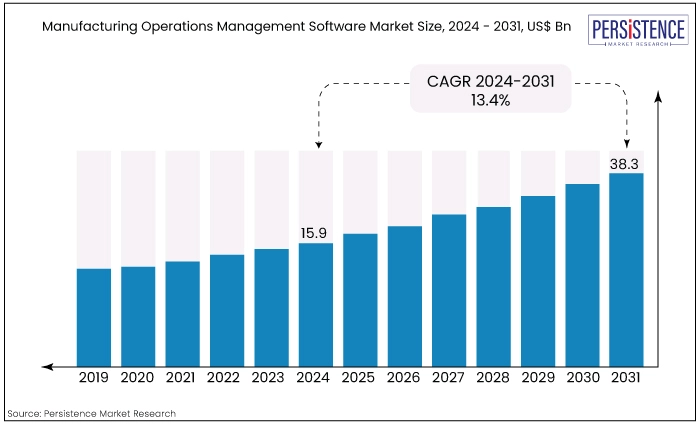

The manufacturing operations management software market value has been estimated at US$15.9 Bn in 2024 and is expected to be valued at US$38.3 Bn by 2031. The market for manufacturing operations management software is expected to achieve an expanding, robust CAGR of 12.6% from 2024 to 2031.

Key Highlights of the Market

|

Attributes |

Key Insights |

|

Market Size (2024E) |

US$15.9 Bn |

|

Projected Market Value (2031F) |

US$38.3 Bn |

|

Forecast Growth Rate (CAGR 2024 to 2031) |

13.4% |

|

Historical Growth Rate (CAGR 2019 to 2023) |

12.6% |

The manufacturing operations management software market size is a rapidly growing sector that focuses on providing software solutions to optimize and streamline manufacturing operations.

The market is driven by the increasing demand for automation, digitalization, and smart manufacturing, as well as the need to enhance operational visibility and traceability. Manufacturing operations management (MOM) software integrates various aspects of the manufacturing process.

The market is expected to grow from US$15.9 Bn in 2024 to US$38.3 Bn by 2031. The market is witnessing a growing trend towards the adoption of cloud-based solutions.

The prominence of industrial analytics, coupled with the emergence of the Industrial Internet of Things (IoT), artificial intelligence (AI), and data analytics, has significantly increased the adoption of manufacturing operations management software in the manufacturing industry.

Additionally, the manufacturing industry is undergoing a transformation with the advent of Industry 4.0. This concept involves the integration of automation, data exchange, and advanced manufacturing technologies to create a "smart factory."

Such market trends and the growing emphasis on regulatory compliance and environmental sustainability are driving the adoption of MOM software.

According to manufacturing operations management software market analysis, the market shows a promising future. The market was valued at US$8.8 Bn in 2019. It expanded at a robust CAGR of 12.6% from 2019 to 2023.

The market is expected to continue its growth trajectory. The market is projected to reach US$ 38.3 Bn by 2031, growing at a CAGR of 13.4% between 2024 and 2031.

The growth can be attributed to several factors. One reason is a rising demand for tracking and monitoring manufacturing operations in real-time networks.

The adoption of Industry 4.0 principles is another important trend, which involves the integration of automation, data exchange, and advanced manufacturing technologies, and has created exponential growth opportunities for businesses of all sizes.

Additionally, the adoption of cloud-based solutions is expected to drive market growth. The integration of emerging technologies such as artificial intelligence (AI), data analytics, and the Industrial Internet of Things (IoT) will continue to drive market growth.

Further, the growing need for effective inventory management tools and greater emphasis on quality management and regulatory compliance are propelling the market growth.

Expansion of Automation and Digitalization

The growing demand for automation and digitalization in manufacturing and production processes is a key driver of market growth. Manufacturers are increasingly adopting manufacturing operations management software to optimize their operations, enhance productivity, and improve efficiency.

The automation of processes, such as advanced planning and scheduling, inventory management, and quality management, is driving the adoption of these software solutions.

Rise of Industry 4.0

The adoption of Industry 4.0 principles, which involve the integration of automation, data exchange, and advanced manufacturing technologies, is fueling the growth of the market.

Industry 4.0 enables manufacturers to create smart factories with interconnected systems, real-time data analysis, and predictive maintenance capabilities. This trend is driving the demand for software solutions that can support the implementation of Industry 4.0 practices.

Focus on Operational Visibility and Traceability

Manufacturers are increasingly seeking solutions that provide operational visibility and traceability across their production processes.

Manufacturing operations management software offers real-time monitoring, data analytics, and reporting capabilities that enable manufacturers to track and analyse their operations, identify bottlenecks, and make data-driven decisions.

The need for enhanced operational visibility and traceability is driving the adoption of these software solutions.

High Initial Costs, and Implementation Challenges

The high initial cost associated with the implementation and upgradation of manufacturing operations management software can act as a barrier to market growth.

Implementing these software solutions requires significant investment in terms of software licenses, hardware infrastructure, and training. Additionally, integrating the software with existing systems and processes can pose implementation challenges, especially for large enterprises with complex operations.

Resistance to Change, and Organizational Culture

Resistance to change and the existing organizational culture can impede the adoption of operations management software in manufacturing. Implementing new software solutions often requires changes in processes, workflows, and employee roles.

Resistance from employees, lack of buy-in from management, and a reluctance to embrace new technologies can hinder the successful implementation and utilization of this software. This mainly affects the manufacturing operations management software market sales.

Emergence of Edge Computing

The emergence of edge computing presents a significant opportunity for the market. Edge computing enables real-time data processing and analysis at the edge of the network, closer to the manufacturing equipment.

By leveraging edge computing capabilities, manufacturers can achieve faster response times, reduce latency, and enable decentralized decision-making. market expansion becomes promising with the integration of edge computing infrastructure.

Integration with Supply Chain Management

The integration of manufacturing operations management software with supply chain management systems offers a promising opportunity. Manufacturers are increasingly focusing on end-to-end visibility and collaboration across the supply chain.

With integration of the manufacturing operations management software with supply chain management systems, manufacturers can streamline production processes, improve demand forecasting, and optimize inventory management. This integration enables seamless data flow and raises the market value.

Software Segment Leads the Way with Faster and Simpler Deployment

Based on components, the software segment dominated the market with a 71.6% share in 2023. It simplifies decision-making, eliminates the need to switch applications, and offers reliability, security, cost reduction, and improved efficiency.

The services segment is expected to grow at a 15.0% CAGR. Software as a Service (SaaS) provides easy distribution, flexibility, and cost advantages. SaaS deployment is faster and simpler compared to traditional software. These benefits will drive the growth of the services segment and manufacturing operations management software market sales.

Aerospace and Defense Registers Maximum Adoption, Regulatory Support Crucial

Based on end-use, in 2023, the aerospace and defense segment held the largest market share. This industry focuses on creating advanced platforms and systems with high-performance objectives.

Advanced MOM software aids in the continuous planning and execution of processes, integrating technical support, costs, and schedules systematically. It is suitable for commercial and government manufacturers of all sizes. These factors will contribute to the segment's growth and market demand in the forecast period.

On-Premises Deployment Remains Favored as Ensures Enhanced Security

Based on deployment, in 2023, the on premise segment held the largest market share. On-premise software ensures enhanced security and data protection as it is installed on the customer's premises.

This type of deployment provides greater control over applications and allows access even when the internet is disrupted. Regular updates and management of on premise software ensure data safety and privacy, protecting organizations from potential threats.

Large Enterprises Take the Wheel

Based on enterprise size, in 2023, the large enterprise segment held the largest market share. Manufacturing operations management solutions are especially important for large enterprises.

The software provides various functionalities, including supply chain management, quality control, production management, and unified operations management. It enhances efficiency and simplifies operations for large enterprises by offering end-to-end tracking, real-time data monitoring, analysis, and implementation.

This enables timely actions and informed decision-making within large enterprises, increasing manufacturing operations management software market value.

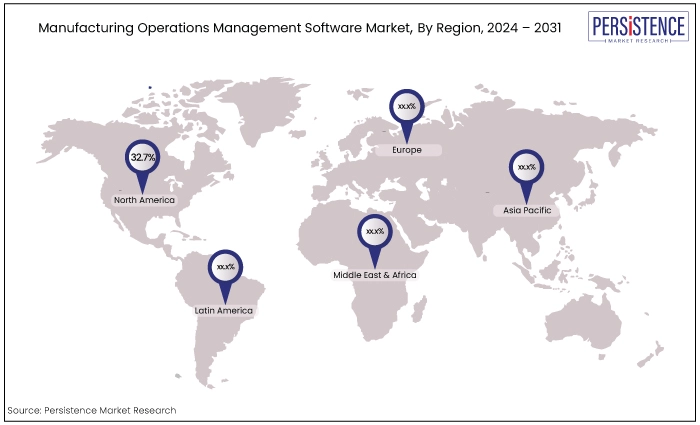

North America Leads the Charge in Market Growth

In 2023, North America accounted for a significant 32.7% share of the global manufacturing operations management software market. This is attributed to the region's key manufacturers offering advanced planning, scheduling, manufacturing execution systems, and more.

North America's expertise in programming and software solutions, driven by automation and manufacturing advancements, positions it as a leader in the market's regional growth.

Market Ramps up in Asia Pacific

Asia Pacific is set to experience the highest CAGR of 15.8% in the manufacturing operations management software market. This growth is fueled by the region's booming industrial sector, cost-effective operations, resource availability, and government support for smart manufacturing, and Industry 4.0 initiatives.

For instance, the Indian government's Smart Udyog Bharat 4.0 initiative aims to digitize and automate the manufacturing industry, creating an advanced technological ecosystem for Indian manufacturing units by 2025.

Europe Expects Gains from Advanced Software Penetration

Europe's manufacturing operations management software market is projected to grow at a 13.1% CAGR from 2024 to 2031. This growth is fueled by the European Union's strict regulations and high standards for product quality and safety.

Manufacturers must adopt advanced software solutions to ensure compliance. MOM software enables detailed record-keeping, production process tracking, and regulatory compliance for industries like pharmaceuticals, automotive, and aerospace, where precision and adherence to regulations are vital.

March 2024

Rockwell Automation and NVIDIA, a US-based technology company, joined forces to expedite the development of an advanced industrial framework. This partnership involves integrating NVIDIA Omniverse Cloud's APIs with Rockwell Automation's Emulate3D tool. By doing so, users can enjoy improved data interoperability, real-time collaboration capabilities, and precise visualization tools. These features are specifically designed to simplify the design, construction, and management of large-scale digital replicas of manufacturing systems.

April 2024

SAP announced AI advancements in its supply chain solutions, aiming to boost productivity, efficiency, and precision in manufacturing. The company's AI-driven insights from real-time data will enable companies to make better decisions across supply chains, streamline product development, and improve manufacturing efficiency. The solutions have already seen benefits, including a 15% increase in supply chain workforce productivity, a 10% decrease in overall supply chain planning costs, and a 10% reduction in inventory carrying costs and stock turnover rate. According to a 2024 IDC InfoBrief sponsored by SAP, 63% of supply chain executives and 52% of operations executives have an AI strategy linked to business objectives.

In the manufacturing operations management software market, companies are actively seeking growth through acquisitions and promoting innovation. The competitive landscape is further enriched by the emergence of startups with distinctive offerings.

To maintain a competitive edge, companies are making significant investments to expand production capabilities and improve technological features. Their goal is to develop innovative functionalities and seamlessly integrate technologies into this evolving sector, ensuring successful market entry and widespread adoption.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Country Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Component

By Deployment

By Enterprise Size

By End-Use Industry

By Regions

To know more about delivery timeline for this report Contact Sales

The market is predicted to rise from US$15.9 Bn in 2024 to US$38.3 Bn by 2031.

Increasing demand for automation, digitalization, and smart manufacturing, as well as the need to enhance operational visibility and traceability, are boosting the market growth.

ABB, Aegis Software, Aspen Technology Inc, AVEVA Group Limited, Dassault Systèmes, and DURR AG are some examples of key industry players.

Challenges like high initial cost, resistance to change, and the existing organizational culture are restraining market expansion.

Integration with supply chain management systems and the emergence of edge computing are the key opportunities in the market.