ID: PMRREP34643| Upcoming | Format: PDF, Excel, PPT* | Healthcare

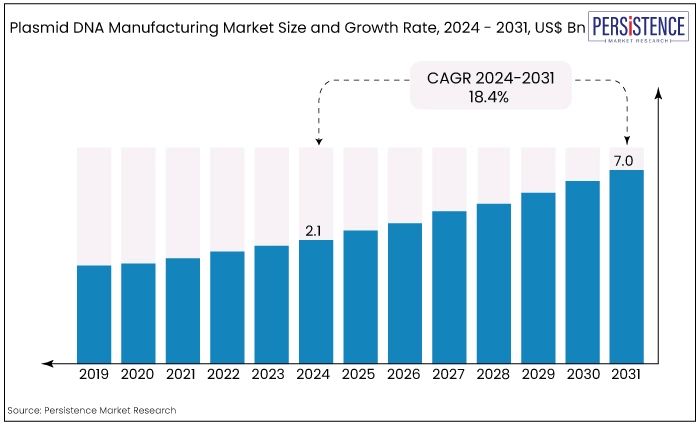

The global market is estimated to value at US$7.0 Bn by the end of 2031 from US$2.1 Bn estimated to be recorded in 2024. The market is expected to secure a CAGR of 18.4% in the forthcoming years from 2024 to 2031.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Plasmid DNA Manufacturing Market Size (2024E) |

US$2.1 Bn |

|

Projected Market Value (2031F) |

US$7.0 Bn |

|

Forecast Growth Rate (CAGR 2024-2031) |

18.4% |

|

Historical Growth Rate (CAGR 2019-2023) |

16.9% |

The Plasmid DNA Manufacturing Market is experiencing substantial growth due to rising demands for gene therapies, genetic vaccines, and advanced medical treatments.

pDNA plays a crucial role as a carrier for delivering therapeutic genetic material into cells, a key factor in treating various genetic disorders and diseases. This expansion is primarily driven by advancements in biotechnology and the increasing adoption of gene therapies.

The COVID-19 pandemic further accelerated this trend as pharmaceutical companies and researchers raced to develop genetic vaccines, underscoring the critical importance of high-quality pDNA in modern medical solutions.

Consequently, there has been a notable increase in investments aimed at improving pDNA production, purification, and formulation processes.

Market analysis indicates a significant shift towards more efficient and scalable manufacturing technologies within the pDNA sector. Innovations in bioprocessing and purification methods are enhancing production yields and product quality, making pDNA manufacturing more cost-effective and accessible.

Furthermore, there is heightened regulatory oversight to ensure the safety and effectiveness of pDNA products, leading to the development of standardized protocols and stringent quality control measures.

Companies are increasingly leveraging strategic partnerships and collaborations to broaden their capabilities and expand market presence.

Overall, the pDNA manufacturing market is poised for sustained growth, driven by ongoing technological advancements, increased investment in research and development, and growing recognition of genetic-based therapies' potential in addressing critical medical needs.

Automation is gaining solid traction as it enhances efficiency, reduces human error, and ensures consistency in production. On the other hand, AI aids in optimizing production parameters, predicting maintenance needs, and improving overall yield and quality. This integration is crucial for scaling up production to meet the growing demand.

The Plasmid DNA Manufacturing Market has seen substantial growth in recent years, propelled by rapid advancements in biotechnology and the increasing use of gene-based therapies.

Early breakthroughs in gene therapy research demonstrated pDNA's potential to treat various genetic disorders, laying a foundation for broader adoption and investment in manufacturing.

The COVID-19 pandemic further accelerated market expansion, emphasizing the critical role of pDNA in developing genetic vaccines. This period witnessed heightened funding, technological innovations in manufacturing processes, and intensified research and development efforts, all contributing to robust market growth.

The market is poised for sustained and dynamic expansion. Key trends shaping its future include the development of more efficient and scalable production technologies, such as automated and AI-driven manufacturing processes that enhance yield and reduce costs.

Strengthened regulatory frameworks will ensure the safety and effectiveness of pDNA products, fostering increased confidence and adoption. Strategic collaborations among biopharmaceutical firms, research institutions, and technology providers will drive innovation and market penetration.

Additionally, rising incidences of genetic disorders and growing demand for personalized medicine will continue to drive demand for high-quality pDNA. As the market evolves, it will play a crucial role in advancing gene therapy, genetic vaccination, and cell therapy, offering promising solutions for complex medical conditions.

Rising Demand for Gene Therapies

The rising demand for gene therapies is a pivotal driver in the plasmid DNA (pDNA) manufacturing market, as these advanced treatments rely heavily on high-quality pDNA as vectors for gene delivery.

Gene therapies offer the potential to cure or significantly mitigate the effects of genetic disorders, which has led to an increased focus on their development and commercialization.

Successful clinical trials and regulatory approvals of pioneering gene therapies have bolstered confidence and investment in this field. Consequently, the need for efficient, scalable, and high-purity pDNA production has surged, driving advancements in manufacturing technologies and processes.

As gene therapies become more prevalent in treating a wide range of diseases, the pDNA manufacturing market is set to experience sustained growth, underscoring its critical role in the future of medical innovation.

Technical Challenges

Manufacturing Plasmid DNA Manufacturing Market poses significant technical challenges that affect both production efficiency and scalability. One primary hurdle involves preserving the integrity and stability of plasmid sequences throughout the production process.

Plasmids are susceptible to mutations and structural changes during replication and purification, potentially compromising their effectiveness as gene delivery vectors.

Maintaining sequence fidelity demands meticulous control of production conditions and stringent quality control measures to identify and eliminate defective plasmids.

Another critical challenge is achieving high yields of pDNA while ensuring purity. The production process includes multiple stages like fermentation, cell lysis, and purification, each requiring optimization to maximize yield without introducing contaminants.

Impurities such as endotoxins and host cell proteins can degrade the quality of the final pDNA product, necessitating rigorous purification methods like chromatography and filtration. These techniques must be precisely calibrated to effectively remove impurities while preserving yield.

Scaling up from laboratory to industrial production presents another technical obstacle in pDNA manufacturing. Larger-scale production demands substantial adjustments to production processes.

Infrastructure investments in technologies like large-scale bioreactors are necessary to create optimal conditions for host cell growth and pDNA production.

Additionally, downstream processing steps such as cell lysis and purification must handle increased volumes without compromising efficiency or product quality.

Furthermore, maintaining precise environmental conditions is crucial in pDNA manufacturing. Factors such as temperature, pH, and oxygen levels significantly influence the growth of host cells and the stability of plasmid DNA.

Variations in these parameters can lead to reduced yields and compromised efficacy of the final product. Implementing robust process controls and monitoring systems is essential to ensure consistent and high-quality pDNA production under optimal conditions.

Expansion of Gene Therapy Applications

The expanding applications of gene therapy represent a significant growth opportunity for the plasmid DNA (pDNA) manufacturing market.

Gene therapy's potential to treat a wide spectrum of genetic disorders and chronic diseases continues to drive demand for high-quality pDNA, essential for delivering therapeutic genetic material into cells.

As research uncovers new therapeutic targets and treatments, pDNA manufacturers are poised to meet increased production needs.

Advancements in bioprocessing technologies and regulatory frameworks further support this expansion, positioning companies to innovate and scale production to address diverse medical needs effectively. This trend underscores pDNA's pivotal role in shaping the future of genetic medicine.

|

Category |

Projected CAGR through 2031 |

|

Development Phase - Clinical Therapeutics |

18.9% |

|

Application - Cell & Gene Therapy |

19.2% |

Clinical Therapeutics Take the Lead in the Development Phase Category

Clinical therapeutics hold a leading position in the development phase category of the market due to their advanced stage in the regulatory approval process and proximity to commercialization.

Such therapies have progressed beyond pre-clinical studies and are undergoing human clinical trials, where they are rigorously evaluated for safety, efficacy, and dosage requirements. This phase not only validates the therapeutic potential observed in pre-clinical stages but also positions clinical therapeutics closer to market entry.

Companies and investors prioritize clinical-stage candidates for their potential to address unmet medical needs and generate revenue upon regulatory approval, making them pivotal in shaping the future landscape of genetic medicine.

Cell & Gene Therapy Remains the Largest Application Category

Cell and gene therapy leads in the application category for the global market due to its innovative approach in treating a wide range of genetic and acquired diseases.

Unlike DNA vaccines, which primarily focus on preventing infectious diseases through immune stimulation, cell and gene therapy involves modifying or replacing genes within patient cells to treat or cure diseases.

The therapeutic approach has shown promising results in clinical trials for conditions such as cancer, genetic disorders, and autoimmune diseases, driving significant demand for high-quality plasmid DNA as vectors for delivering therapeutic genes.

The rapid advancements and successful clinical outcomes in cell and gene therapy applications highlight its leading role in shaping the future of genetic medicine, attracting substantial investment and research focus within the industry.

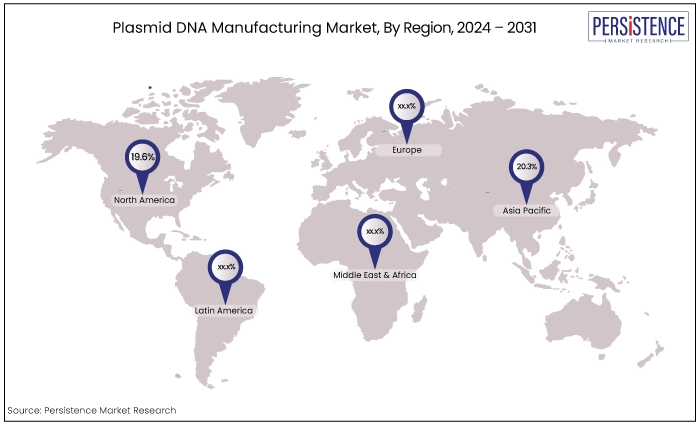

|

Region |

Projected CAGR through 2031 |

|

North America |

19.6% |

|

Asia Pacific |

20.3% |

North America Gains from Robust Biotech Infrastructure, and Supportive Regulatory Environment

North America stands at the forefront of the market due to its robust biotechnology infrastructure, technological prowess, and supportive regulatory environment.

The region, particularly the United States, boasts a dense network of biopharmaceutical companies, research institutions, and academic centres specializing in genetic medicine. This concentration of expertise fuels continuous innovation in bioprocessing technologies and genetic engineering, crucial for advancing plasmid DNA production.

Moreover, North America's well-established regulatory frameworks, such as those provided by the FDA, ensure rigorous standards in product safety and efficacy, facilitating faster market entry for new therapies.

Access to ample funding and a strong market demand for cutting-edge medical treatments further solidify North America's leadership in driving forward the plasmid DNA manufacturing industry.

Europe Expects a Rapid Growth Drive

Asia Pacific is poised to achieve the fastest CAGR in the market due to several strategic advantages. The region is witnessing rapid advancements in biotechnology and pharmaceutical sectors, supported by substantial investments in research and development.

Countries like China, Japan, South Korea, and India are expanding their capabilities in genetic medicine, fostering innovation in bioprocessing technologies essential for efficient plasmid DNA production.

Additionally, improving regulatory frameworks and increasing healthcare expenditure are driving the adoption of advanced therapies, including gene therapies and genetic vaccines, further boosting the demand for high-quality plasmid DNA.

Collaborations and partnership to develop innovative products and accelerate the grant by regulatory bodies are the key growth strategies followed by the key players in the market. Companies are continuously investing in research and development to introduce innovative and break-through plasmid DNA products.

Recent Industry Developments

April 2024

Charles River Laboratories International, Inc. and Ship of Theseus, a therapeutics company developing degradation-resistant homeobox (HOX) family biologics, announced a Good Manufacturing Practice- (GMP) plasmid DNA contract development and manufacturing organization (CDMO) agreement.

June 2024

Charles River Laboratories International, Inc. (NYSE: CRL) and Captain T Cell, a spinoff from the renowned Max Delbrück Center Berlin, Germany, today announced a plasmid DNA and retrovirus vector production program agreement.

As of 2024, the market is approximately US$2.1 billion.

Charles River Laboratories, VGXI, Inc., Danaher (Aldevron), Kaneka Corp., Cell and Gene Therapy Catapult, and Eurofins Genomics are some of the top players.

The cell & gene therapy segment records a significant market share as of 2024 in the application category.

There is a growing focus on gene therapies as potential treatments for a wide range of genetic disorders, cancers, and chronic diseases.

The clinical therapeutics segment records a significant market share as of 2024.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2018 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Grade

By Development Phase

By Application

By Disease

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author