Industry: Energy & Utilities

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Report Type: Ongoing

Report ID: PMRREP34619

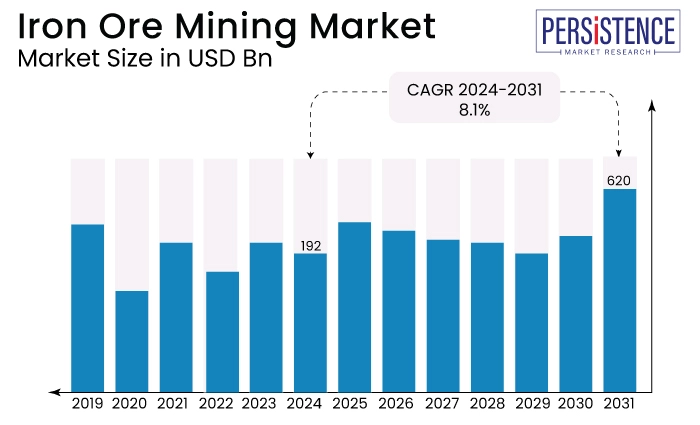

The iron ore mining market is estimated to reach a valuation of US$620 Bn by the year 2031, at a CAGR of 8.1%, during the forecast period 2024 to 2031.

Key Highlights of the Market

|

Attributes |

Key Insights |

|

Market Size (2024) |

US$192 bn |

|

Market Size (2031) |

US$620 bn |

|

Forecast Growth Rate (CAGR 2024 to 2031) |

8.1% |

|

Historical Growth Rate (CAGR 2019 to 2023) |

4.8% |

The global iron ore mining market is primarily characterized by significant volatility and is mainly influenced by increased demand over the past few years.

The iron ore mining market's development is primarily driven by the extent of global industrialization in emerging economies, including China and India, from 2024 to 2031.

Major key competitors in the market typically participate in the export of their products to foreign markets. Recently, China accounted for more than 62% of the iron ore demand. The global iron ore mining market is expected to experience growth during the forecasted period of 2024 to 2031 as a result of the increasing import and export activities across the globe.

Further, the assets consist of premium-grade hematite and magnetite ores, which are highly sought after on a global scale due to their high iron concentration and minimal impurities.

The efficient transportation of iron ore from mine areas to export terminals is facilitated by the maintenance of infrastructure, such as ports, railroads, and processing facilities. The commitment ensures the reliability and efficiency of the iron ore export supply chain and eventually drives the global iron ore mining market forward.

High Iron Ore Production

The increasing global demand for iron ore, particularly from the steel sector, is met by increased output, which ensures a sufficient supply to meet the growing needs of steel producers globally.

For iron ore mining companies, increased production results in increased sales and revenue. A mining operation's financial performance is frequently enhanced by an increase in revenue, which is frequently the result of an increase in output volume.

Further, state-owned mining companies like NMDC reported a 19% increase in iron ore production to 2.44 million tons in July 2023 compared to the same month the previous year, and a 2.7% increase in sales to 3.03 MT.

In July 2023, the National Mineral Development Corporation (NMDC), a Navratna miner that operates under the Ministry of Steel, declared a record-breaking production.

The increased production further exhibits the growth ratio of the global iron ore mining market and is predicted to witness a surge in the global iron ore mining market share over the forecast period.

Increased Steel Production

Steelmaking necessitates the utilization of nearly 98% of mined iron ore in order to manufacture steel.

Steel is a versatile and indispensable substance that is utilized in numerous industries, which is why the demand for iron ore is significantly influenced by it.

Steel is indispensable for the development and expansion of infrastructure, including buildings, bridges, roads, railroads, and other infrastructure initiatives.

In turn, the price of iron ore rises as a result of the steel demand being fueled by global infrastructure projects and increasing urbanization.

Further, India's domestic steel consumption experienced a significant increase in the demand for iron ore, indicating that Indian manufacturing is continuing to expand rapidly in defiance of external challenges.

Depletion of resources

Resource depletion is the term used to describe the gradual reduction of high-grade iron ore reserves, which can significantly impede the growth of the global iron ore mining industry.

As the availability of high-grade iron ore reserves decreases, mining companies may be compelled to relocate to more remote locations or lower-grade ores.

The necessity for more extensive processing and beneficiation when extracting lower-grade ores results in increased extraction costs.

The extraction costs are typically higher, and the yields are inferior for every ton of ore removed when mining lower-grade iron ore.

The profit margins of mining companies may be impacted, particularly if the iron ore market prices do not increase to compensate for the increased production costs.

Technological Challenges

The implementation of cutting-edge mining technologies requires substantial financial investments.

Certain mining companies may encounter challenges in allocating substantial financial resources to the integration of digital technologies, automation, and machinery upgrades.

The utilization of state-of-the-art technology requires personnel who possess the requisite abilities to operate and maintain intricate machinery.

It may be challenging to identify and train qualified personnel who can adapt to new technologies during the transition phase, which could result in operational complications.

Iron mineral resources are abundant in remote or difficult-to-reach locations. In these regions, the establishment and maintenance of infrastructure, such as electrical supplies, railroads, and roadways, can be costly and logistically difficult, which can impede operational efficiency.

Innovative Technological Advancements

Innovative technological tools are being developed by companies in the iron ore market, and they are utilizing sophisticated technologies to expand their market presence.

Further, one of the major players in the industry, Metso Outotec, created a series of solutions that will enhance process efficiency, production capability, and product quality.

With this, the offered solution simultaneously reducing energy consumption, environmental impact, and maintenance and operating expenses.

The Metso Outotec Optimizing Control System OCS-4D, the Planet Positive Optimus advanced process control system, the VisioPellet pellet size-control system, and the Pallet Car Condition Monitoring System are among the most recent digital solutions that improve preventive maintenance planning and execution.

Metso Outotec is also announcing its new prduct, which is a novel operator training program that employs state-of-the-art simulation technologies in a secure virtual plant environment.

Hematite segment dominates with 35% of the market share

|

Market Segment by Type |

Market Value Share 2023 |

|

Hematite |

35% |

Based on type, the iron ore mining market is further segmented into hematite, magnetite and other types, where the hematite segment dominates the market share.

During the forecast period, the Hematite segment is anticipated to be the fastest-growing segment. The steady growth of the hematite segment can be attributed to the fact that it has higher reducibility and porosity than magnetite ore, which enables reducing gases to penetrate it more effectively.

In terms of quantity used and economic significance, hematite is the most significant industrial ore and is more abundant than other ore varieties. Nevertheless, it has a marginally lower iron content than magnetite.

The iron content of hematite ore is typically between 50-60%, while magnetite, the greatest quality ore, has a content of up to 70%. Additionally, magnetite is more valuable in the electrical industry due to its superior magnetic properties.

Steel Production segment accounted for 75% of the market share

|

Market Segment by Application |

Market Value Share 2023 |

|

Steel Production |

75% |

Based on application, the iron ore mining market, the steel production segment owns major market share of around 75% of the total market share.

The primary basic material used in the production of steel is iron ore, while global steel production is anticipated to be stimulated by the increasing global demand for steel.

The demand for steel, particularly in regions with robust industrial and construction sectors, will subsequently impact market growth.

Steelmaking technology innovations have the potential to improve the efficacy of product utilization.

In the steel production process, the utilization of these products can be more efficient through the implementation of new methods and technologies.

The production of radioactive iron, pulverized iron, black iron oxide, and iron blue are among the other applications of iron ore.

Radioactive iron is employed as a tracer element in biochemical and metallurgical research within the medical sector.

Asia Pacific region owns the major market share with 25% of the global market share

|

Region |

Market Value Share 2023 |

|

Asia Pacific |

25% |

The Asia Pacific region dominates the regional market share in terms of market value and growth rate. The demand for steel in the APAC region, which is the world's largest producer of steel, is being driven by the rapid expansion of steel production.

Steel production is significantly influenced by major emerging economies like China, India, and Japan. China and India are also prevalent in product consumption as a result of the presence of major steel manufacturers.

Europe possessed the second-largest regional market share in terms of volume. It is anticipated that the industrial sector will experience positive growth during the forecast period.

Steel products are in high demand in a variety of industrial sectors, such as automotive, construction, and medicine. The swift expansion of the automotive and building & construction sectors is anticipated to drive substantial growth in North America.

Brazil, one of the region's most critical economies, is on the brink of substantial market expansion in Latin America. The country's market development is anticipated to be driven by the product's increased usage in steel production and rapid industrialization.

The market growth in the Middle East & Africa region will be driven by the increased demand for steel in other industries, including the pulp and paper, chemicals, and medical sectors.

March 2023

Anglo American & Brazil's Bamin signed a collaboration deal for a sales contract for iron ore, by purchasing an undisclosed quantity of iron ore.

August 2023

H2 Green Steel, a leading Swedish steel company announced its decision to import iron ore from its steel plant in Northern Sweden, leading to the implementation of agreements with other major iron ore producers.

January 2023

Cyclone Metals Limited, a major Australia-based iron ore company, signed an acquisition with Labrador Iron Pvt. Ltd. to expand its iron ore portfolio with the largest magnetite iron ore deposit project.

The global iron ore mining market is highly competitive, with several companies providing better commercial opportunities to their end consumers while utilizing new and high-end technologies with smart features.

To remain competitive in the business, several key players in the market are allocating more resources to partnerships, new product launches, and market expansions.

Innovative developments in the natural food preservatives market are further stimulated by manufacturers' extensive integration of technology into their production processes.

Some of the key manufacturers in the mining sector introduce new techniques for mass production to be in the revenue generation game and attract more consumers.

|

Attributes |

Details |

|

Forecast Period |

2024 - 2031 |

|

Historical Data Available for |

2019 - 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Companies Profiled |

|

|

Pricing |

Available upon request |

By Type

By Application

By Region

To know more about delivery timeline for this report Contact Sales

The global iron ore mining market size is estimated to be valued at US$620 billion in 2031.

Asia Pacific is the leading region in the market.

Asia Pacific is predicted to exhibit the highest growth rate during the forecast period.

BHP, Rio Tinto, Northern Iron and Machine, Shree Minerals Ltd., and Mt Gibson Iron are some of the major key companies in the market.

Steel production is the dominant application segment in this market.