Industry: Chemicals and Materials

Published Date: October-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 190

Report ID: PMRREP34847

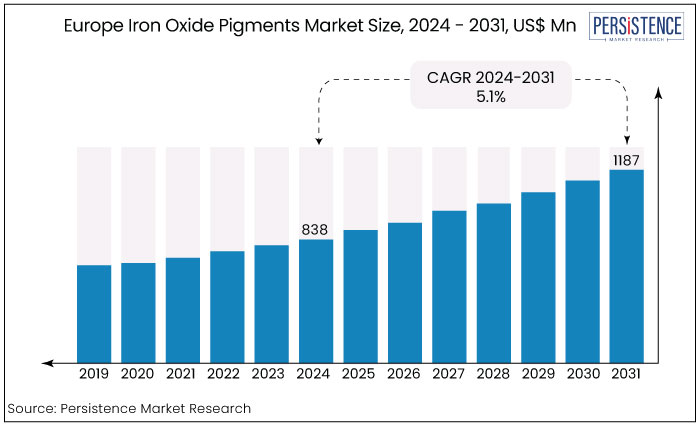

Europe iron oxide pigments market is estimated to increase from US$838Mn in 2024 to US$1187Mn by 2031. The market is projected to record a CAGR of 5.1% during the forecast period from 2024 to 2031. Market growth is attributed to strong demand in construction and coatings with a significant shift toward eco-friendly and bio-based solutions.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Europe Iron Oxide Pigments Market Size (2024E) |

US$838 Mn |

|

Projected Market Value (2031F) |

US$1187 Mn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

5.1% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

4.4% |

|

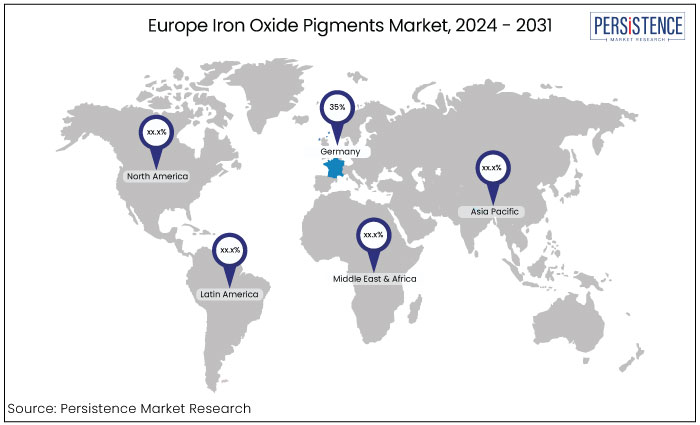

Country |

Market Share in 2024 |

|

Germany |

35% |

Germany is the leading country in the Europe iron oxide pigments market accounting for around 35% of the market share in 2024. Germany’s leadership stems from its advanced industrial base, strong construction sector, and focus on innovation and sustainability in pigment production.

Leading iron oxide pigment manufacturers such as Laxness have a significant presence in Germany, further cementing its role as the market leader. The market is driven by strong demand across industries such as construction, coatings, plastics, and cosmetics.

Iron oxide pigments are widely used for their durability, colour stability, and non-toxicity, making them ideal for applications like concrete colouring, paints, coatings, and cosmetics. Key factors influencing the Europe market include robust construction activity, growing infrastructure projects, and the expansion of environment-friendly pigment production processes.

European Union environmental regulations such as the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), have pushed manufacturers toward producing eco-friendly pigments. This trend influences the development of sustainable, low-impact iron oxide pigments that comply with environmental standards. This regulatory push further fosters market growth as industries shift toward greener alternatives.

|

Category |

Market Share in 2024 |

|

Type - Synthetic |

54% |

The market is divided into natural and synthetic. Among these, the natural type dominates the market. Synthetic pigments are produced in regulated environments to precisely mimic dispersion, particle size, and shape yielding enhanced colour quality, consistency, and chemical purity.

Iron oxide pigments are predominantly produced during the steelmaking process. Steel regenerates acid for recycling and yields iron oxide when subjected to hydrochloric acid to eliminate surface oxides.

Regenerated iron oxides are utilized in diverse filters, inductors, transformers within electronic household appliances and industrial machinery. Recent advancements in the synthetic iron oxide pigment business encompass granular iron oxide forms and Nano-sized variants utilized in computer disk drives, high-performance loudspeakers, and applications in biology and medicine.

|

Category |

CAGR through 2031 |

|

End Use - Construction |

4.5% |

The market is segmented into construction, paints & coatings, plastics, paper and pharmaceuticals based on end use. Among these, the construction segment dominates the market and is estimated to capture a CAGR of 4.5% CAGR through 2031.

Iron oxide pigments, a key category of inorganic pigment stand out for their unique properties. They maintain stability across a range of temperatures, show low reactivity, have minimal toxicity, and boast superior tinting strength, making them highly valued in various industries.

It is extensively utilized in the construction sector because of the always-rising demand for infrastructure development. The construction sector constitutes one-third of the global market for iron oxide and its pigments.

Iron oxides are natural pigments that vary from black and brown to yellow and red. Natural iron oxides consist of one or more ferrous or ferric oxides mixed with impurities such as manganese, clay, or organic materials.

Commercial forms are synthesized through the thermal breakdown of iron salts or compounds, precipitation of iron salts, and oxidation or reduction of organic compounds. Unlike specific vibrant and pristine colours, they yield pastel shades. These materials are non-toxic, non-bleeding, weather-resistant, and lightfast. They possess a strong tinting capacity, exhibit greater opacity than other hues, and can, therefore, frequently be utilized at a reduced ratio relative to natural pigments.

The swiftly expanding construction sector in emerging nations is anticipated to be the primary growth driver for the market during the forecast period. The increasing use of iron oxide pigments in the coating industry due to their superior dispersibility and high strength is anticipated to drive market growth during the forecast period.

Iron oxide pigments are extensively utilized in diverse plastic items such as automotive components, fenders, beverage containers, food packaging, toys, and vinyl siding. Iron oxide pigments serve as colorants in the specified items.

Before 2023, the Europe iron oxide pigments market experienced steady growth driven primarily by robust demand from the construction, paints, coatings, and plastics industries.

Iron oxide pigments were widely used for coloring concrete, bricks, and tiles, which saw high demand due to increased European construction and infrastructure projects. Western Europe, particularly Germany, France, and the UK played a key role, with Germany being the dominant producer and consumer of iron oxide pigments.

The market also benefited from environmental regulations such as REACH, which pushed manufacturers toward sustainable pigment production, further supporting market expansion. However, economic uncertainties, especially due to the COVID-19 pandemic, temporarily slowed growth.

Post-2024, the Europe iron oxide pigments market is expected to accelerate significantly, driven by increasing construction activities particularly in Eastern Europe. Europe Green Deal and other sustainability initiatives will fuel demand for eco-friendly and non-toxic pigments.

Advancements in pigment production technology, focusing on reducing environmental impact, will provide new opportunities for manufacturers. Emerging economies in Eastern Europe are expected to contribute strongly to market expansion, with infrastructure development being a key driver. The market is projected to grow at a healthy compound annual growth rate (CAGR), with the construction sector remaining a dominant end-user.

Booming Construction and Infrastructure Development

The construction sector is one of Europe's largest consumers of iron oxide pigments, and the steady growth of infrastructure projects is a significant driver of market demand. Iron oxide pigments are widely used in construction materials like concrete, bricks, roof tiles, and pavements due to their colour stability, durability, and weather resistance.

Europe, mainly Western Europe has seen a consistent rise in construction activities including residential, commercial, and industrial projects driven by urbanization and government investments in infrastructure.

Germany, France, and the UK lead the market due to their robust construction industries. In Eastern Europe emerging economies such as Poland and the Czech Republic are experiencing rapid infrastructure development further propelling the demand for iron oxide pigments.

As governments across the continent continue to prioritize sustainable and long-term infrastructure investments, the construction sector will remain a key driver for market growth.

Increasing Demand for Eco-Friendly Pigments

Environmental regulations and sustainability trends are crucial in driving the Europe iron oxide pigments market. The European Union’s stringent environmental standards, particularly REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), have compelled manufacturers to adopt eco-friendly production methods.

There is a growing demand for non-toxic, recyclable, and sustainable pigments, particularly in the construction and paint industries, which need pigments that meet performance and environmental requirements. Iron oxide pigments, known for being safe and environmentally friendly, have become the go-to choice for manufacturers aiming to reduce their carbon footprint.

There is a rising trend toward green buildings and sustainable construction materials, further amplifying the need for eco-friendly pigments. Developing bio-based and low-impact iron oxide pigments is expected to be a significant growth driver as consumers and industries shift toward green and more sustainable products.

Regulatory Challenges and Compliance Costs

One of the significant restraints on the Europe iron oxide pigments market is the stringent regulatory environment surrounding the use of chemicals and pigments. The European Union has implemented regulations such as REACH, which impose rigorous safety assessments and compliance requirements for chemical substances, including iron oxide pigments.

While these regulations aim to protect public health and the environment, they can create substantial compliance costs for manufacturers. Small and medium-sized enterprises (SMEs) may find it particularly challenging to meet these regulations potentially limiting their ability to compete effectively in the market.

The time-consuming processes for regulatory approvals can delay product launches and innovations, hindering market growth. As manufacturers navigate these complex regulations, the associated costs and challenges may deter investment in new product development, restricting market expansion and the adoption of innovative solutions.

Expansion of Sustainable and Bio-Based Pigments

The growing demand for sustainable and bio-based pigments is a transformative opportunity in the Europe iron oxide pigments market. As environmental concerns rise and regulations tighten regarding the use of conventional chemical pigments, manufacturers are increasingly investing in developing eco-friendly alternatives.

Iron oxide pigments, known for their non-toxicity and environmental safety, can be formulated from renewable resources, opening the door for innovative, sustainable product lines. The shift toward sustainable pigments align with the broad trends of green building and eco-conscious consumer behaviour particularly in the construction and paint industries.

Companies that can develop and market bio-based iron oxide pigments stand to gain a competitive edge as they meet the dual demand for high-performance colorants and eco-friendly solutions. Additionally, this transition can enhance brand reputation and customer loyalty in an increasingly environmentally aware market.

The Europe iron oxide pigments market is characterized by a competitive landscape featuring key players such as BASF SE, Lanxess, Huntsman Corporation, and Tronox Holdings. These companies dominate the market by leveraging advanced manufacturing processes, extensive product portfolios, and strong distribution networks.

The focus on sustainability has led many firms to invest in eco-friendly and bio-based pigment solutions to meet evolving regulatory standards and consumer preferences. Small and regional manufacturers are emerging offering specialized and cost-effective products to cater to niche markets.

Strategic partnerships, mergers, and acquisitions are common as companies seek to expand their market presence and enhance their technological capabilities. Innovation and sustainability are critical factors shaping competition in this dynamic market.

Recent Industry Developments in the Europe Iron Oxide Pigments Market

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Million for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Type

By Colour

By End Use

By Country

To know more about delivery timeline for this report Contact Sales

The market is estimated to be valued at US$1187 Mn by 2031

The market is estimated to exhibit a CAGR of 5.1% over the forecast period.

Huntsman International LLC, Venator Materials PLC, Applied Minerals, Inc., are some of the key players operating in the market.

Germany dominates the Europe iron oxide pigments market.

Synthetic type of iron oxide pigments leads the market with significant market share.