Comprehensive Snapshot for Clinical Laboratory Services Market Including Regional and Country Analysis in Brief.

Industry: Healthcare

Published Date: April-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 160

Report ID: PMRREP35208

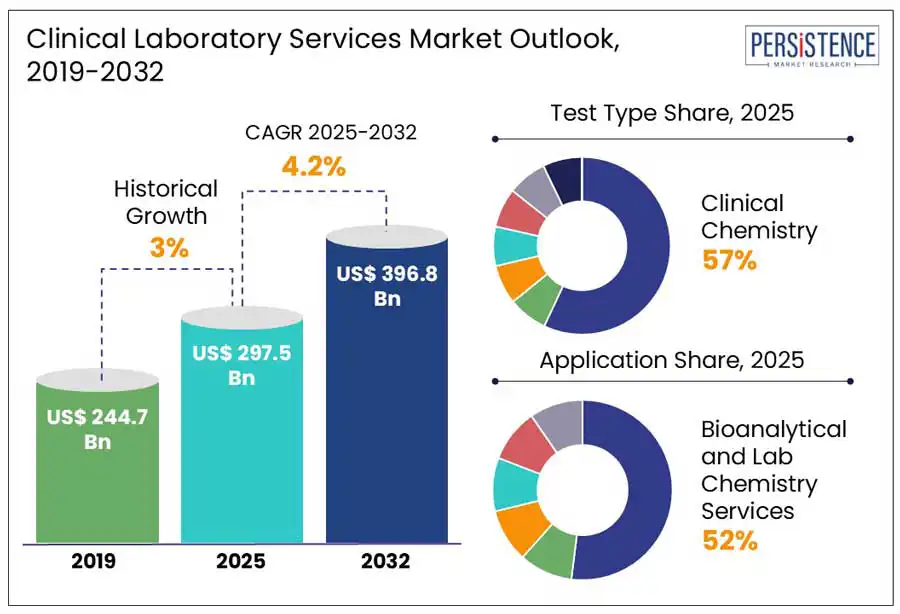

The global clinical laboratory services market size is anticipated to reach a value of US$ 297.5 Bn in 2025 and will likely attain a value of US$ 396.8 Bn to witness a CAGR of 4.2% by 2032.

The clinical laboratory services market is experiencing steady growth, fueled by the rising prevalence of chronic and infectious diseases, increasing demand for early and accurate diagnostics, and the growing adoption of personalized medicine. Technological advancements such as automation, AI-driven diagnostic tools, and integration of laboratory information systems (LIS) are significantly improving testing efficiency and accuracy. The shift toward preventive healthcare and increased awareness of routine health screenings is further accelerating the trails and vaccine developments.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Clinical Laboratory Services Market Size (2025E) |

US$ 297.5 Bn |

|

Market Value Forecast (2032F) |

US$ 396.8 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.0% |

The increasing prevalence of chronic disorders such as sickle cell disease, cystic fibrosis, autoimmune diseases such as rheumatoid arthritis and celiac disease, and various cancers, including breast cancer, are on the rise globally. This surge is largely attributed to factors such as an aging population, sedentary lifestyles, tobacco use, and poor dietary habits. As the burden of chronic diseases grows, there is a corresponding increase in hospital admissions leading to diagnostic testing. For instance, a study published by Elsevier B.V. in May 2022 revealed that approximately 162,428 individuals lived with cystic fibrosis across 94 countries, with 57,076 cases remaining undiagnosed. Such statistics highlight the critical role of accurate and timely lab testing in managing chronic conditions and are expected to significantly drive market growth during the forecast period.

Despite the steady market growth, high operational costs and infrastructure demands continue to challenge. Establishing a modern diagnostic lab involves significant investments in advanced equipment, quality control systems, and skilled personnel. These costs deter expansion, especially in low-resource settings. According to a report by the World Health Organization (WHO), more than 47% of low-income countries lack basic laboratory services at the primary care level due to inadequate funding, infrastructure, and trained staff. Such limitations hinder the accessibility and scalability of laboratory services, especially in rural or underserved regions, thereby restraining market growth.

The growing adoption of personalized and precision medicine presents a major opportunity. These medical approaches rely heavily on advanced diagnostic testing, including genetic, molecular, and biomarker-based analyses to tailor treatments to individual patient profiles. As healthcare systems shift from a one-size-fits-all model to more targeted therapies, clinical labs play a crucial role in enabling accurate diagnosis, risk assessment, and treatment selection.

According to the National Institutes of Health (NIH), as of 2022, over 55,000 genetic tests were available for clinical use, with more than 10 new tests entering the market daily—reflecting the rapid growth and demand in the precision medicine space.

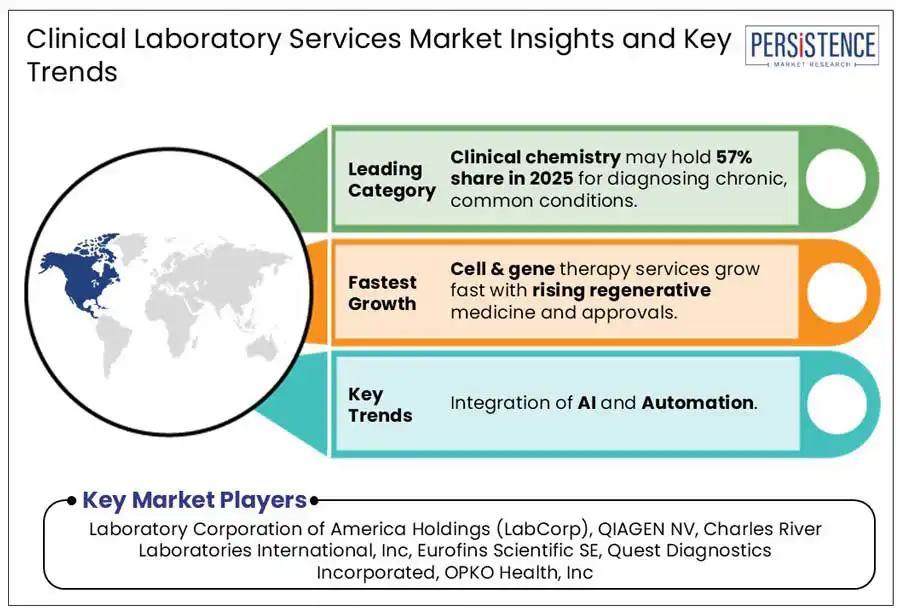

Clinical chemistry leads the test type category due to its essential role in diagnosing and monitoring a wide range of common and chronic conditions. Tests such as blood glucose, lipid profiles, liver and kidney function tests are widely used in both inpatient and outpatient settings. These tests are fundamental in managing diseases such as diabetes, cardiovascular disorders, and renal issues, which have high global prevalence. According to the Centers for Disease Control and Prevention (CDC), over 14 billion laboratory tests are ordered annually in the U.S., with more than 70% of medical decisions based on lab test results. Among these, clinical chemistry tests account for the majority, driven by routine screening and chronic disease monitoring.

Bioanalytical and lab chemistry services lead the application category due to their broad use in drug development, therapeutic monitoring, and clinical diagnostics. These services support essential testing such as pharmacokinetics, biomarker analysis, and method validation across all trial phases. Their versatility, high testing volume, and relevance in both pharmaceutical R&D and routine diagnostics drive strong demand. As biologics and personalized therapies rise, the need for precise analytical testing grows, making this segment more scalable and widely applicable than others such as cell & gene therapy or toxicology.

?North America leads the clinical laboratory services market primarily due to its advanced healthcare infrastructure, high healthcare expenditure, and strong presence of accredited laboratories. The U.S. clinical laboratory services market plays a central role, driven by large insured population, widespread adoption of preventive care, and integration of advanced technologies such as automation and AI in diagnostics. According to the Centers for Medicare & Medicaid Services (CMS), U.S. national health expenditure reached approximately $4.5 trillion in 2022, representing 17.3% of the GDP. Additionally, data from the CDC indicates that over 14 billion laboratory tests are ordered annually in the U.S., underscoring the critical role of diagnostics in clinical decision-making and chronic disease management.

?Europe accounts for a significant share in the clinical laboratory services market due to its well-established public healthcare systems, stringent quality standards, and widespread access to diagnostic services. Germany exemplifies this trend with a robust network of clinical laboratories and high per capita healthcare spending. According to Germany’s Federal Statistical Office (Destatis), healthcare expenditure in the country reached 13.2% of GDP in 2022. Additionally, Germany has a large number of accredited laboratories and a strong emphasis on early diagnosis and preventive care further boosting test volumes. The country's aging population and a high incidence of chronic diseases contributes to consistent demand for clinical lab testing.

?East Asia is expected to witness fast-growth due to the increasing healthcare access, technological adoption, and rise in disease burden. China's healthcare reforms, aging population, and a high prevalence of chronic diseases such as diabetes and cancer have boosted demand for diagnostic testing. According to the China’s National Health Commission, the country had over 11,000 tertiary hospitals by 2022 many equipped with advanced laboratory facilities. Additionally, government data shows that health expenditure in China reached USD 1.1 trillion in 2022, reflects a growing commitment to strengthening healthcare infrastructure, including diagnostics. This expansion along with a shift toward personalized medicine and preventive care accelerates market growth across the region.

The global clinical laboratory services market is highly competitive with key players including hospital-based labs, independent laboratories, and diagnostic chains. Companies focus on technological innovation, strategic partnerships, and service expansion to gain market share. Automation, AI integration, and mergers are shaping competition, enhancing efficiency and diagnostic accuracy across the industry.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Test Type

By Provider Type

By Application

By Region

To know more about delivery timeline for this report Contact Sales

The global market is estimated to increase from US$ 297.5 Bn in 2025 to US$ 396.8 Bn in 2032.

Rising chronic diseases, demand for early diagnostics, and technological advancements are propelling the global clinical laboratory services market.

The market is projected to record a CAGR of 4.2% during the forecast period from 2025 to 2032.

Opportunities include expanding services in emerging markets, growth in personalized medicine, AI integration, and home-based diagnostic testing.

Major players include Laboratory Corporation of America Holdings (LabCorp), QIAGEN NV, Charles River Laboratories International, Inc, Eurofins Scientific SE, Quest Diagnostics Incorporated, Others.