Outsourced Clinical Trials & Formulation Market Segmented By Oral dosage Forms, Injectable Dosage Forms Product in API Manufacturing, Fill-Finish Product Manufacturing, Drug Product Development, Packaging / labeling

Industry: Healthcare

Published Date: March-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 213

Report ID: PMRREP33016

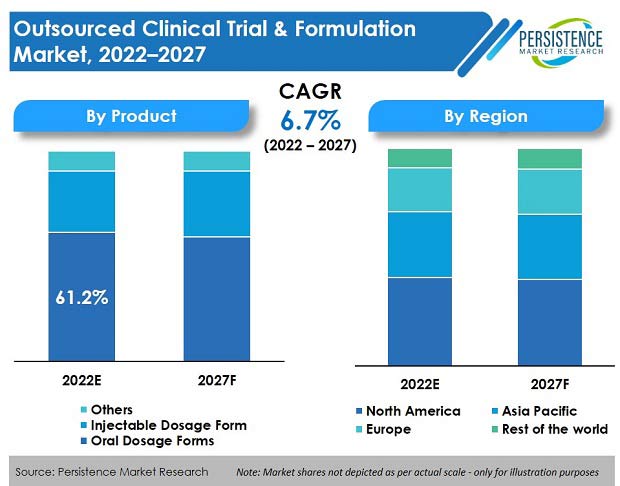

The global outsourced clinical trials & formulation market is set to record a market value of US$ 14.1 Bn in 2022, and expand at a CAGR of 6.7% to reach a market valuation of US$ 19.6 Bn by the end of 2027.

| Attribute | Key Insights |

|---|---|

|

Outsourced Clinical Trials & Formulation Market Size (2021) |

US$ 13.3 Bn |

|

Projected Market Value (2027) |

US$ 19.6 Bn |

|

Global Market Growth Rate (2022-2027) |

6.7% CAGR |

|

Market Share of Top 5 Countries |

63.3% |

As projected by Persistence Market Research, API manufacturing, by application, is valued at US$ 6.6 Bn, which accounts for nearly 46% of the total application segment of outsourced clinical trials & formulations, in 2022.

In 2021, worldwide outsourced clinical trials & formulations accounted for approx. 30.2% of the global contract research outsourcing market.

The global formulation development outsourcing market expanded at a CAGR of 6.5% over the last five years (2017-2021).

Due to increasing reliance of pharmaceutical companies on outsourcing due to lack of well-equipped manufacturing facilities, site constraints, dearth of advanced technologies, or lack of time and the need for backup manufacturing, this market holds great potential.

Active pharmaceutical components are used in the creation of dosage forms, which are typically produced far away from where tablets, suspensions, and liquids are prepared. As a result, more companies are outsourcing API manufacturing to locations where labor is cheap.

Today, many API manufacturers are concentrated in regions such as Asia and Europe. By outsourcing API manufacturing, emerging players can utilize the advantage of a CDMO’s operational expertise in terms of Chemistry, Manufacturing, and Control (CMC) technologies, good manufacturing practice (GMP) facilities, quality, safety, and environmental management systems, and standard operating procedures.

Rise in chronic diseases can affect the growth of CDMOs. Because a large part of the geriatric population is suffering from various diseases, it contributes to the growth of the market. An increase in therapeutic applications of biologics and increased pipeline molecules share will boost contract development and manufacturing market growth.

This will positively impact growth of the formulation development outsourcing industry over the forecast period. Overall, the global outsourced clinical trials & formulation market is expected to expand at a CAGR of 6.7% and record sales worth US$ 19.6 Bn by the end of 2027.

“Collaboration with Pharma & Biotech Companies – A Beneficial Path”

The coming years are set to offer many lucrative opportunities for manufacturers in the outsourced clinical trials & formulation market across the world. Contract development and manufacturing organizations can merge, acquire, collaborate, and partner with small and large pharmaceutical and biotechnology companies to increase their market size.

Furthermore, contract development and manufacturing organizations are focusing on technological advancements in formulations, manufacturing, and testing to increase and strengthen their product portfolios.

“Stringent Formulation Development Outsourcing Regulations by Various Regulatory Bodies”

Every country has a significant number of regulations given by regulatory authorities. Furthermore, smaller CDMOs without cutting-edge equipment are more prone to experience process errors, poor quality, and pricing issues.

Therefore, due to the presence of harsh regulations by respective regulatory bodies, there is a reduction in the approvals of small molecules in developed nations, which affects the growth of the contract development and manufacturing market.

Additionally, there are several small and major contract development and manufacturing companies in the market. To become more dominant in the market, they employ a variety of techniques such as manufacturing expansion, collaborations, partnerships, and acquisitions. These are major restraints that could hamper demand growth of outsourced clinical trials & formulations going ahead.

Which is the Largest Market for Outsourced Clinical Trials & Formulations?

“U.S. Outsourced Clinical Trials & Formulation Market Leading the Way”

The U.S. accounts for 91.7% of the market share in North America. High API manufacturing rate, better accessibility to healthcare, existence of well-established (ROs) and significant investments for novel therapies and treatments are projected to fuel revenue growth of the market in the country.

Furthermore, existence of excellent clinical research infrastructure and strong government incentive programs in the U.S. are expected to stimulate demand even further.

Why is Demand for Outsourced Clinical Trials & Formulations Rising in Germany?

“Excellent Record of Germany in Clinical Research”

Germany accounted for 22.6% market share, by value, in 2021, of the Europe formulation development outsourcing market, because the German market is known to have high population density and a well-connected network of health facilities, physicians, and research centers.

Additionally, it has an overall high-performance record in clinical research, which leads to high demand for outsourced clinical trials & formulations from across Europe.

How is China Emerging as a Prominent Market for Outsourced Clinical Trials & Formulations?

“China Benefitting from Rapidly Developing Healthcare Infra & Cheap Labor”

In 2021, the China outsourcing clinical trials & formulation market accounted for more than 30% market share in East Asia. Developing healthcare infrastructure and availability of cheap labor are some of the key factors that will positively affect the growth of this industry in China.

Additionally, China is quickly becoming the most appealing outsourcing destination. Majority of CMOs in China focus on producing APIs and bulk drug products for licensed generic and branded pharmaceuticals.

What is the Outlook for the India Outsourced Clinical Trials & Formulation Industry?

“India - World Leader in API Production”

India accounted for 27.9% market share, by value, of the total Asia Pacific outsourced clinical trials & formulation market, in 2021.

India recently overtook the U.S. as the world leader in the production of APIs and bulk medicinal supplies. In India, the pharmaceutical sector produces a variety of bulk drugs, which are important constituents having therapeutic properties that serve as the foundation for formulations.

Furthermore, key players are looking into the expansion of their businesses, which is going to provide many lucrative opportunities for new entrants in the Indian market in the next few years.

Which Product is Driving Substantial Market Growth?

“Oral Formulations Dominate Landscape”

Oral dosage form dominates in terms of revenue and accounted for more than 61% market share in 2021.

Primary factor contributing toward this high share is that the oral dosage form is self-administered and non-invasive, unlike injectables, where dependencies are unavoidable.

In addition, use of tablets or capsules for a drug product can provide many other advantages, such as increased chemical and physical stability, unique brand recognition by shape and color, and controlled-release options.

Which Application is Most Commonly Sought-after in This Space?

“API Manufacturing Driving High Market Growth”

API manufacturing is the leading segment by application and accounts for more than 46% of the market share.

Outsourcing of APIs for clinical studies is a very practical, capital-efficient, and popular option for many small- to mid-size pharma companies that do not have the required infrastructure to produce small molecule APIs and reference standards to the higher need in dosage formulation. Most companies in the industry are increasingly focused on the creation of biological APIs.

The COVID-19 pandemic resulted in the global disruption of traditional onsite clinical studies. The healthcare industry experienced an overhaul during this period. As a result, regulatory organizations throughout the world started a variety of efforts aimed at expediting clinical trials and formulations in order to discover creative solutions.

COVID-19 had a positive impact on demand growth of outsourced clinical trials & formulations. Several industries, including healthcare, underwent significant changes, with small and medium biotech companies were on the verge of permanently shutting down during COVID-19.

The market for outsourced clinical trials & formulations rose as a result of the switch to develop COVID-19 vaccines and therapeutics to expedite R&D and manufacturing processes.

The market for outsourced clinical trials & formulations is fiercely competitive, with numerous significant competitors across the landscape. Key market players are focusing on providing full services to big pharma and biotech companies. These businesses are relying on strategic collaborations to grow their market share and profit margins.

Additionally, to improve their product capabilities, industry players are also acquiring start-ups focusing on corporate network equipment technologies.

For instance:

| Attribute | Details |

|---|---|

|

Forecast Period |

2022-2027 |

|

Historical Data Available for |

2016-2021 |

|

Market Analysis |

US$ Million for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon Request |

Outsourced Clinical Trials & Formulation Market by Product:

Outsourced Clinical Trials & Formulation Market by Application:

Outsourced Clinical Trials & Formulation Market by End User:

Outsourced Clinical Trials & Formulation Market by Region:

To know more about delivery timeline for this report Contact Sales

The global outsourced clinical trials & formulation market is currently valued at over US$ 13.3 Bn, and is expected to grow 1.4X by 2027.

The market for outsourced clinical trials & formulations is set to witness a high growth rate of 6.7% and be valued at the US$ 19.6 Bn by 2027.

The global market expanded at 6.5% CAGR over the years 2017 to 2021.

Ongoing industry consolidation, formulation of APIs by outsourcing, growth of the pharma industry, and the effect of COVID-19 for expansion are key trends shaping this industry.

The U.S., China, Germany, India, and France are the top 5 countries driving highest demand for outsourced clinical trials & formulations.

North America accounts for more than 40% share in the global market for outsourced clinical trials & formulations.

The Europe market for outsourced clinical trials & formulations is expected to record a CAGR of 7.2% over the forecast period.

The U.S., China, and India are key producers of solid dosage forms in outsourced clinical trials & formulations.

The China market holds a share of 30.2% in Asia Pacific, whereas Japan accounts for 10.8% market share.