PMR Foresees a Stable Growth Outlook for the Specialty Fats and Oils Market Based on Demand for Healthier Alternatives, Application in F&B and Cosmetics, and Consumer Preference for Natural and Organic Products

Industry: Food and Beverages

Published Date: June-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 157

Report ID: PMRREP21685

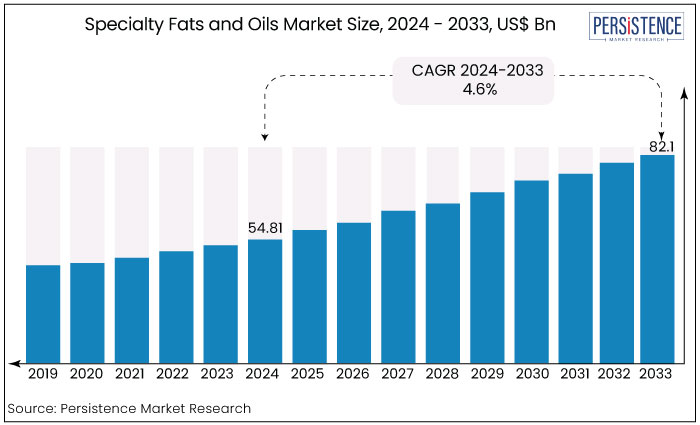

The global specialty fats and oils market is expected to rise from US$54.81 Bn in 2024 to US$82.1 Bn by the end of 2033. The market is anticipated to secure a CAGR of 4.6% during the forecast period from 2024 to 2033.

Key Highlights of the Market

|

Attributes |

Key Insights |

|

Specialty Fats and Oils Market Size (2024E) |

US$54.81 Bn |

|

Projected Market Value (2033F) |

US$82.1 Bn |

|

Forecast Growth Rate (CAGR 2024 to 2033) |

4.6% |

|

Historical Growth Rate (CAGR 2018 to 2023) |

4.1% |

Fats and oils are recognized as essential nutrients for both human and animal nutrition. The key component of fats and oils is triglycerides.

Specialty fats and oils are the unique categories of fats that are substitutes for commonly available fats such as cocoa butter, butter, milk fats.

These types of fats and oils are tailored to meet the desired application in several industrial segments. These industries include food and beverages industry, personal care and cosmetic industry, and other industries.

Specialty fats and oils cover oils such as coconut oil, olive oil, palm kernel oil, cocoa butter substitutes, milk fat replacers, and other fats.

Specialty oils and fats have increasingly found new applications over time in the food industry. It is mainly due to the increasing consumer preference for clean-label functional foods.

The global specialty fats and oils market has witnessed significant growth in the historical period registering a CAGR of 4.1% in the historical period.

Increasing demand for nutritional food products along with increasing living standards are the key factors contributed toward market growth over the past few years.

Specialty fats and oils find application across different industries such as cosmetics, pharmaceuticals and industrial sectors. This diversification of applications broadened the market scope.

The trend toward healthy eating habits is projected to persist, fueling demand for specialty fats and oils that offer functional benefits and meet specific dietary preferences.

Increasing interest in functional foods fortified with ingredients such as plant sterols, antioxidants and fatty acids is expected to drive innovation in speciality fats and oils.

These ingredients offer health benefits including immunity enhancement, and skin health improvement. Sales of specialty fats and oils are estimated to exhibit a CAGR of 4.6% during the forecast period from 2024 to 2033.

Ample Availability of Soybean Oil to Fulfil the Demand-Supply Gap

Soybean oil is one of the leading types of edible oils, which dominates in terms of consumption in markets around the globe. North America is one of the leading producers of soybean oil in the world and accounts for a significant share of the global soybean oil production volumes.

Soybean oil production is expected to remain high due to the high output in the US, and Argentina, resulting in lower soybean oil prices. This is also expected to compensate for the increasing demand and supply gap due to the reduced supplies of other edible oils including canola and corn oil.

The narrowing price gap between palm oil and soybean oil prices are also projected to support the demand for soybean oil in the global market.

Enzymatically inter-esterified (EIE) high oleic soybean oil is widely used as an alternative to the traditional shortenings made with partially hydrogenated oils (PHOs) with its excellent stability and functionality.

Growing Adoption of Specialty Palm-based Fats

An increase in the global production of oils and fats and demand for alternatives and value-added ingredients across the food and beverages industry is expected to contribute to the specialty fats and oils market growth.

Over the last few years, there has been significant growth in the global market owing to the rising consumption of specialty oils in several industrial applications.

Research in developing specialty fats and oils has increased significantly since the last few years due to the growing demand for value-added ingredients across the food and beverages industry.

Shea butter and palm oil derivatives are the most common sources of cocoa butter alternatives. Researchers are working on creating novel and healthy alternatives ranging from mango seed to hump fat.

Demand for Low-fat Dairy Products

The demand for dairy products with low saturated fats has increased to a significant extent in recent years. High fat intake is associated with an increased risk of obesity, which is creating the demand for food products with low-fat content.

Fat replacers are low-calorie and low-fat alternatives to the conventional fat solutions available in the market, serving industries such as dairy, bakery, chocolate, and others.

Protein- and carbohydrate-based fat replacers are gaining much attention among consumers, thus pushing revenue generation in the overall market. The increasing application of milk fat replacers in infant formula is expected to drive its consumption across the region.

Declining Demand for Coconut Oil

The demand for coconut oil has been decreasing across the globe. The popularity of coconut oil is declining rapidly particularly in the United States leading to a reduction in revenue in North America market.

This remarkable reduction in the consumption of coconut oil is associated with the increasing health-conscious population particularly in North America. Consequently, this factor contributes to hamper the market during the forecast period.

The prices of oil crops are unstable due to uncertain weather conditions and political instability, thereby impacting the oil output from oil crop growers. Consequently, this factor is restraining the oil supply to manufacturers.

There are a few other key factors attributed to reduced production volumes of specialty oils across the globe. These factors include limited access to finance and a lack of knowledge about modern farming techniques and farm management skills.

It is estimated that around 30%-40% of crops in leading producing regions are lost due to improper pest and crop disease control procedures.

Growing Demand for Natural Cosmetic Products

Consumers are becoming more conscious of the ingredients they apply to their skin and hair, preferring products that are perceived as safe and environment friendly.

Specialty fats and oils derived from natural sources, such as shea butter, cocoa butter, coconut oil, and jojoba oil, align well with this preference.

There has been an increasing preference for natural products over artificial chemicals in the personal and beauty care industry.

Factors such as a surge in online presence and internet usage, and increasing awareness toward sustainable and environment-friendly products contribute toward market growth significantly.

Increasing Consumption of Processed Foods, Especially Developing Markets

Increasing consumption of processed foods in emerging markets provide further opportunities for growth in the specialty fats and oils sector. These factors create a favorable environment for companies to innovate, differentiate their products, and capture market share in this dynamic industry.

There is a growing demand for specialty fats and oils as processed food consumption rises, which can serve specific functional purposes.

These may include improving texture, enhancing shelf life, providing better mouthfeel, or imparting specific flavors. Specialty fats and oils can be tailored to meet these needs, driving demand in the market.

Processed food manufacturers in emerging markets are increasingly looking to differentiate their products. Specialty fats and oils offer opportunities for customization, allowing manufacturers to create unique products that stand out in the market.

Customization can include developing products with specific melting points, stability under various processing conditions, or unique sensory properties that appeal to local tastes.

Specialty Oils Dominant Product Type Category

The specialty oils product type holds the maximum value of US$39.8 Bn in 2023 and 76.1% of the value share. Palm, soya, peanut, sunflower, olive, rapeseed, and other oils have distinct qualities that make them useful for industrial and non-food uses.

The essential fatty acid of each cooking oil, as well as their minor components, are primarily responsible for the oils' functionality.

Sunflower oil is used in the household, fast-food restaurants, and industry to cook meals such as French fries and frozen pre-fried foods.

The increasing tendency toward the use of vegetable oils for cooking and household use is driving rapid expansion in developing regions such as Asia and the Middle East.

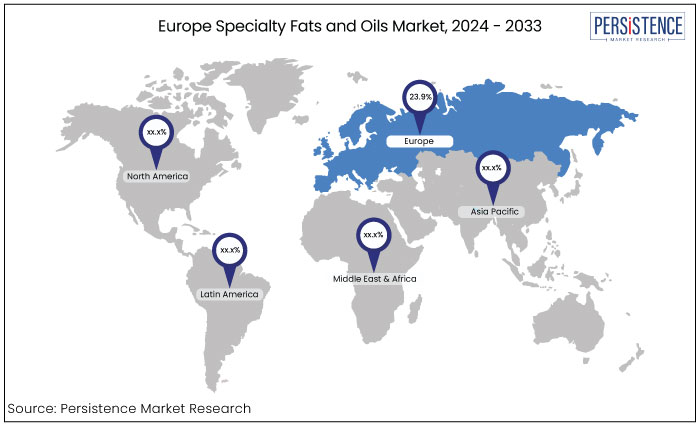

Europe Holds 23.9% of the Current Market Share

Europe region holds 23.9% of the current market share and valued at US$12.5 Bn in 2023. The popularity of specialty oils in Europe market has gained immense traction in the recent past, both, as a consumer product and as a high-value ingredient.

Nut-based specialty oils such as coconut, walnut, and peanut are significantly increasing in certain countries of Europe such as Germany, Italy, France, Poland, the UK, and Spain.

The demand for cold-pressed extra virgin olive oil, rapeseed oil, coconut oil, and other oils has significantly gained traction in Europe market since many consumers today are seeking natural products.

November 2021

Cargill Incorporated has invested roughly US$ 35 Mn in expanding its production plant in Port Klang, Malaysia, to meet the increasing consumer demand for specialty fats.

This is the first phase of a multi-year international investment that is estimated to exceed US$100 Mn and will greatly extend the company's global portfolio in specialty fats.

Companies that are part of the specialty oils and fats supply chain are entering into meaningful partnerships with various stakeholders of the market.

The partnerships are supporting them to ensure a traceable and transparent supply chain and gain access to continuous specialty oils and fats supply.

Players are also prioritizing innovation and they are investing in research and development activities. Increasing geographic presence and mergers & acquisitions are the key strategies inculcated by prominent players.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2033 |

|

Historical Data Available for |

2018 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Product

By End-Use Industry

By Region

To know more about delivery timeline for this report Contact Sales

Growing adoption of specialty palm-based fats is a key factor for market growth.

Cargill Inc., Wilmar International Limited, and Kiril Mischeff are a few of the key manufacturers in the market.

Growing demand for natural cosmetic products presents a key opportunity for the market players.

The popularity of specialty oils in Europe market has gained immense traction in the market.

Europe holds the largest share of the market revenue.