ID: PMRREP4858| 177 Pages | 19 Sep 2025 | Format: PDF, Excel, PPT* | Industrial Automation

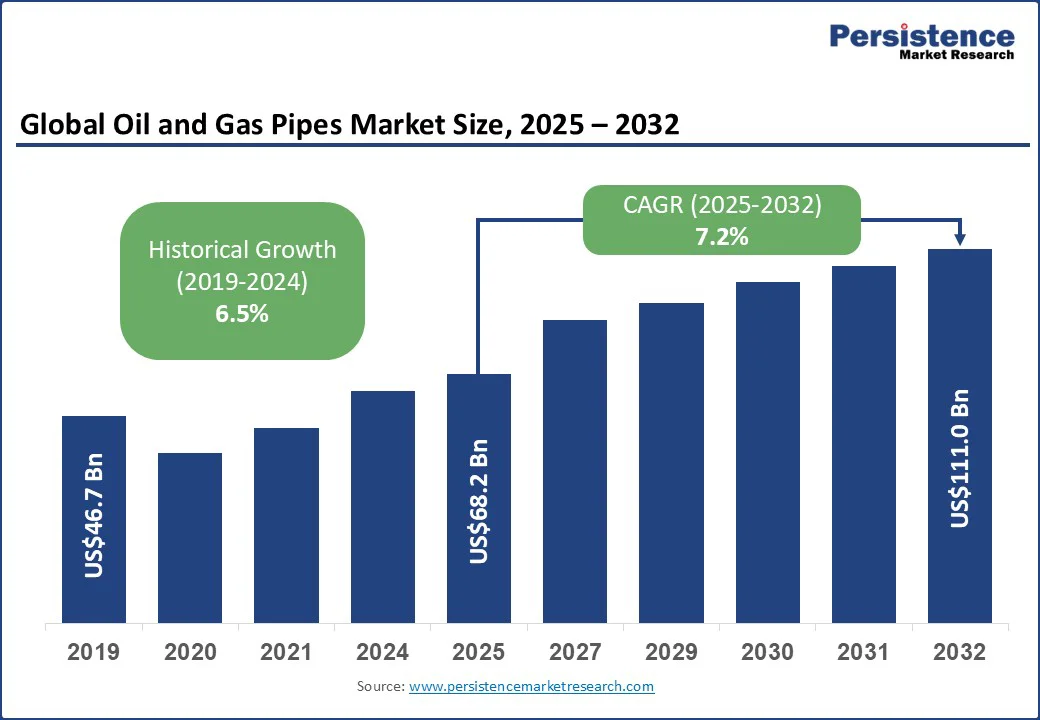

The global oil and gas pipes market size is likely to be valued at US$68.2 Bn in 2025 and is estimated to reach US$111.0 Bn in 2032, growing at a CAGR of 7.2% during the forecast period 2025 - 2032, due to the infrastructure expansion and evolving energy demand patterns. Rising global consumption of hydrocarbons, as well as the growth of natural gas and LNG projects, is boosting investments in upstream and midstream pipelines.

Key Industry Highlights:

| Key Insights | Details |

|---|---|

| Oil and Gas Pipes Market Size (2025E) | US$68.2 Bn |

| Market Value Forecast (2032F) | US$111.0 Bn |

| Projected Growth (CAGR 2025 to 2032) | 7.2% |

| Historical Market Growth (CAGR 2019 to 2024) | 6.5% |

The rising global energy consumption is spurring demand for oil and gas pipes as growth in energy needs requires both expanded production and transport infrastructure. Demand for oil and natural gas is increasing as developing economies in the Asia Pacific, Africa, and Latin America undergo industrialization and urbanization.

This necessitates new pipelines and the upgrading of existing networks. For instance, India’s launch of city gas distribution networks to meet increasing residential, industrial, and transportation energy requirements has led to a surge in orders for medium- and large-diameter steel pipes.

In North America, the resurgence of shale production, bolstered by continued energy consumption growth, has prompted expansion in OCTG and line pipe requirements. Offshore and LNG projects further accelerate demand. As countries seek clean alternatives to coal, liquefied natural gas pipelines and subsea transport infrastructure have become important.

Australia’s Woodside Scarborough LNG project and Mozambique’s Rovuma LNG expansion are direct responses to increasing global gas demand. Both require premium offshore-grade pipes capable of withstanding pressure, corrosion, and subsea conditions.

The potential for severe environmental and safety incidents, such as pipeline fires, explosions, and leaks, is increasingly hindering demand for oil and gas pipes. Such incidents are making operators and regulators cautious about approving new projects.

High-profile accidents raise scrutiny on pipeline design, material selection, and operational procedures, which tend to delay construction timelines and increase costs. Environmental concerns also influence the types of pipes being demanded.

In sensitive areas, including wetlands, permafrost regions, or densely populated urban zones, regulators often mandate novel coatings, corrosion-resistant alloys, and real-time monitoring systems.

While these measures improve safety, they also increase capital expenditure and extend procurement timelines, suppressing short-term demand growth. Oil and gas companies are weighing insurance costs, litigation risks, and public opposition before making investment decisions.

The development and expansion of green and blue hydrogen generation plants are creating new avenues for oil and gas pipes. They are pushing demand for specialized pipeline infrastructure that can safely transport hydrogen over long distances.

Hydrogen, whether produced via electrolysis from renewable energy or from natural gas with carbon capture, has unique chemical properties. It is highly diffusive and can cause embrittlement in conventional steel.

It has prompted manufacturers to experiment with pipelines made from hydrogen-resistant alloys, composite materials, and internally coated steel. Large-scale projects in the Middle East are also stimulating this trend.

Saudi Arabia’s NEOM initiative includes green hydrogen plants designed for both domestic use and export in ammonia form. The pipelines connecting the electrolyzers to storage and export terminals are creating opportunities for high-spec hydrogen-compatible steel and seamless pipes.

By product type, the market is bifurcated into crude oil and natural gas. Among these, natural gas is expected to account for nearly 63.2% of the market share in 2025, as it is central to the ongoing energy transition.

Unlike oil, it requires extensive midstream infrastructure to be transported in its gaseous state. Pipelines are the most economical and secure way to move gas over land. This makes the demand for line pipes directly tied to every expansion of gas distribution networks and LNG projects.

Crude oil is considered a key product type as it continues to support global energy security and industrial supply chains. It requires vast midstream networks for its movement from wellheads to refineries and export hubs. Crude oil transport depends on long-haul and large-diameter pipeline systems that are capital-intensive and technically demanding. Its significance also lies in its ability to secure long-term pipe investments in geopolitically sensitive areas.

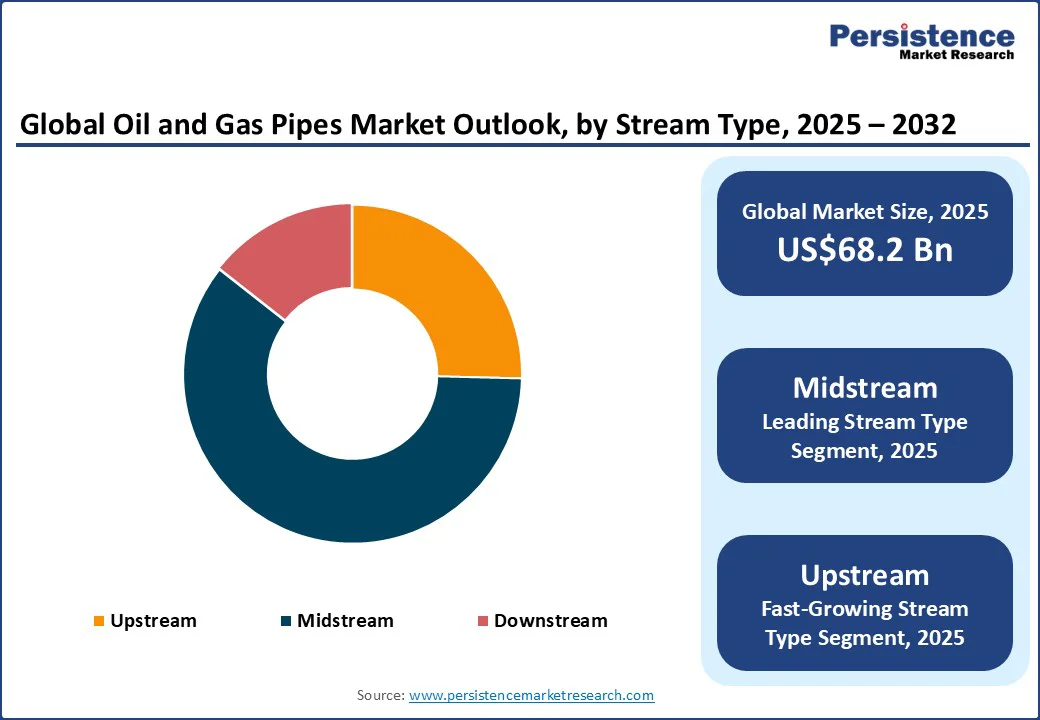

Based on the stream, the market is trifurcated into upstream, midstream, and downstream. Out of these, midstream operations are poised to hold around 60.2% of the market share in 2025, as they form the main link between production and consumption.

They help in ensuring safe, reliable, and efficient transport of hydrocarbons over long distances. Pipelines, storage facilities, and terminals in the midstream segment provide stability to the entire supply chain. This reduces dependency on spot transport methods, including trucks or rail, which are more vulnerable to disruptions.

Upstream is expected to witness steady growth as it represents the origin of the hydrocarbon supply. This pushes the requirement for pipes that can withstand the most demanding operational conditions. Exploration and production activities, mainly in deepwater, shale, and ultra-deep reservoirs, require OCTG capable of withstanding high pressure, temperature, and corrosive fluids. Technological developments in upstream operations have further spurred pipe demand.

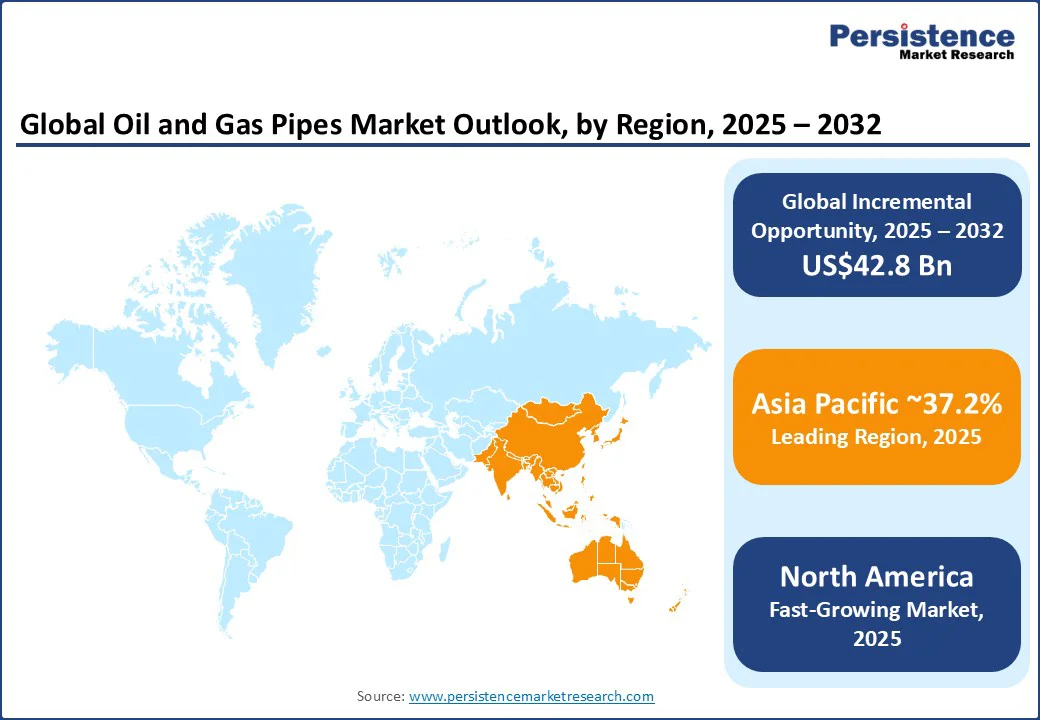

In 2025, Asia Pacific is estimated to account for approximately 37.2% of the market share owing to rising domestic energy demand and a strategic push toward localized manufacturing. India and China are expanding pipeline networks for crude oil and natural gas distribution. At the same time, they are prioritizing indigenous production of pipes to reduce dependence on imports.

For instance, India’s GAIL recently accelerated plans for new cross-country natural gas pipelines as part of its gas-based economy push. It has led domestic suppliers such as Jindal SAW and Maharashtra Seamless to secure long-term orders.

In China, the government-backed West-East Gas Pipeline expansion continues to create opportunities for both OCTG and large-diameter line pipes. However, the emphasis has shifted to using domestic manufacturers, including Baosteel, to strengthen self-reliance amid trade friction with the U.S. and Europe.

The offshore sector in Asia Pacific is another growth driver with Malaysia, Indonesia, and Australia continuing upstream exploration and LNG projects. Here, the demand is rising for high-specification seamless pipes and anti-corrosion coated pipes.

In North America, the market is heavily influenced by shale activity and regulatory shifts, which directly impact demand for OCTG and line pipes. The U.S. oil and gas pipes market is predicted to see steady growth as shale basins such as the Permian, Eagle Ford, and Bakken continue to push large volumes of OCTG requirements.

Demand is skyrocketing for seamless pipes with premium connections that can withstand high-pressure and high-temperature drilling conditions. The pipeline segment is also spurred by high-profile infrastructure projects and regulatory hurdles.

While large projects such as Keystone XL were cancelled, there is still steady demand for replacement and expansion of natural gas pipelines due to rising LNG exports. Projects, including the Mountain Valley Pipeline, which finally overcame legal delays in 2023, have highlighted the requirement for high-spec large-diameter pipes in challenging terrains.

This shows that while oil-focused pipeline construction is politically constrained, natural gas and LNG infrastructure remain a key source of pipe demand in North America.

In the Middle East and Africa, the market is augmented by mega-projects and national strategies that tie directly into self-sufficiency goals. In the Gulf, Saudi Arabia and the UAE are moving away from reliance on imports and encouraging domestic or joint-venture pipe production.

Aramco, for example, has been prioritizing In-Kingdom Total Value Add (IKTVA) commitments. It has pushed suppliers such as Tenaris and Vallourec to localize threading, finishing, and premium connection services in Saudi Arabia. This has transformed competition as manufacturers are setting up regional hubs to secure long-term supply contracts.

East Africa’s LNG developments, such as Mozambique’s offshore Rovuma Basin projects, have required premium OCTG and corrosion-resistant line pipes. However, delays due to security issues have meant suppliers must stay agile, balancing between project commitments and risks.

In West Africa, Nigeria’s ongoing focus on gas pipeline infrastructure under the Decade of Gas plan has generated steady demand for line pipes. Local companies such as SCC Nigeria have collaborated with global firms to meet specifications for major gas transmission projects.

The global oil and gas pipes market consists of various companies dominating different categories. In OCTG, global firms such as Tenaris and Vallourec lead with their high-spec pipes and premium connections. Regional players, including Jindal SAW, focus more on welded and large-diameter line pipes for key pipeline and infrastructure projects.

This split reflects the technology and investment required in each segment. Competition today is increasingly about value-added services rather than just supplying steel. Oil and gas companies also want local or near-local sourcing to avoid tariffs, reduce lead times, and ensure supply security.

The oil and gas pipes market is projected to reach US$68.2 Bn in 2025.

Rising global energy demand and the expansion of natural gas infrastructure are the key market drivers.

The oil and gas pipes market is poised to witness a CAGR of 7.2% from 2025 to 2032.

Growth in offshore exploration and increasing hydrogen transport projects are the key market opportunities.

Al Jaber Group, APA Group, and Amana Contracting and Steel Buildings LLC are a few key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Stream Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author