Industry: Healthcare

Published Date: September-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 177

Report ID: PMRREP34779

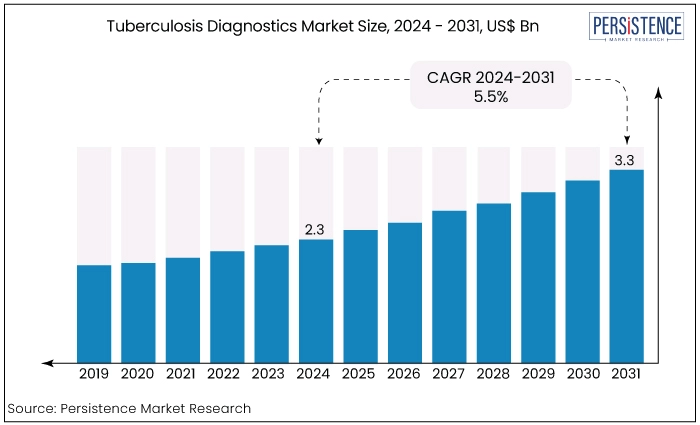

The tuberculosis diagnostics market is estimated to increase from US$2.3 Bn in 2024 to US$3.3 Bn by 2031. The market is projected to record a CAGR of 5.5% during the forecast period from 2024 to 2031. The market's expansion is primarily driven by the heightened emphasis from industry players on obtaining approval and launching tuberculosis diagnostic products, a surge in disease awareness, and a growing demand for effective TB diagnostics to manage and reduce the disease burden.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Tuberculosis Diagnostics Market Size (2024E) |

US$2.3 Bn |

|

Projected Market Value (2031F) |

US$3.3 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

5.5% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

5% |

|

Region |

Market Value Share 2024 |

|

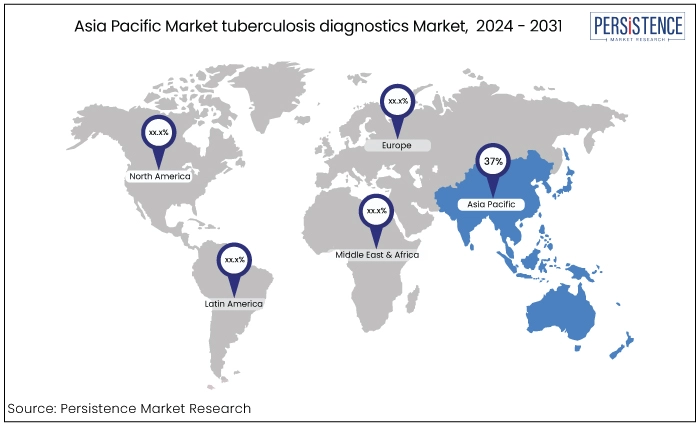

Asia Pacific |

37% |

Asia Pacific tuberculosis diagnostics market to hold the market share of 37% in 2024. Primary drivers for the regional market growth are the expanding prospects for scientific research, significant untapped opportunities in the form of unmet medical demands, and favourable economic growth.

The changing healthcare regulatory environment in fast-advancing countries is expected to entice foreign companies to take advantage of and engage in the existing opportunities.

Market expansion is expected to be driven by favourable factors such as rising awareness, government-provided healthcare benefits, and the increasing demand for improved medical diagnostics. The substantial prevalence of tuberculosis (TB) and the considerable number of affected individuals are anticipated to drive market expansion.

|

Category |

Market Share 2024 |

|

Test Type - Nucleic Acid Testing |

33% |

Based on test type, the tuberculosis diagnostics market is divided into nucleic acid testing, SMEAR microscopy, and radiography tests. Among these, the nucleic acid testing segment dominates the market.

Nucleic acid amplification has emerged as a widely used technique for detecting and diagnosing Mycobacterium TB. Bacterial DNA, or ribosomal RNA that has been transcribed into DNA is amplified using enzymes and then detected using a probe that generates a signal. This detection is done using a suitable reading device.

Various enzymatic amplification strategies are readily available for purchase in global markets. PCR, TMA, and SDA are frequently employed techniques in molecular biology. Due to its accurate tuberculosis detection capabilities, the use of this NAT approach is expected to increase over the forecast period.

|

Category |

Market Share in 2024 |

|

End Use - Hospitals & Clinics |

42% |

Based on end use, the tuberculosis diagnostics market is categorized into hospitals & clinics and diagnostics centres. Among these, the hospitals & clinics segment dominates the market. The hospitals and clinics segment is expected to experience substantial expansion during the forecast period. People with medical problems such as HIV/AIDS, chronic renal failure, and other diseases that weaken the immune system are more likely to have TB.

The increasing prevalence of immune-related illnesses is expected to raise the number of tests conducted in healthcare institutions such as hospitals and clinics. Both the government and commercial healthcare organizations have implemented numerous initiatives to address the proliferation of infectious diseases, which is expected to enhance the growth of this sector.

Tuberculosis (TB) is an infectious illness caused by Mycobacterium tuberculosis (MTB). Tuberculosis primarily impacts the pulmonary system, although it can manifest in other anatomical regions.

Most tuberculosis infections do not show symptoms, a condition called latent tuberculosis. Approximately 10% of dormant infections progress to a state of active sickness resulting in the death of roughly 50% of the afflicted individuals if not treated.

Common symptoms of active tuberculosis include chronic cough with haemoptysis, fever, nocturnal diaphoresis, and unintentional weight loss. The skin test is the most widely used method for diagnosing tuberculosis; however, blood tests are becoming increasingly popular.

The expansion of the market can be attributable to the increasing number of TB cases, growing awareness of the disease, and the rising need for tuberculosis diagnostics to alleviate the impact of the disease.

The manufacturers' heightened emphasis on obtaining approval and commercializing their solutions for tuberculosis diagnosis has significantly contributed to the market growth.

The tuberculosis diagnostics market experienced steady growth during the historical period from 2019 to 2023 due to increasing global awareness and government initiatives to improve TB detection and control.

Innovations in diagnostic technologies such as molecular tests and advanced imaging techniques contributed to market expansion. The World Health Organization (WHO) and other health agencies focused on scaling up diagnostics in high-burden regions which spurred the adoption of rapid and accurate diagnostic tools.

The market is anticipated to continue its growth trajectory by integrating advanced technologies like artificial intelligence and next-generation sequencing into diagnostic platforms. Also, efforts to address TB in low-resource settings and increased funding and research for novel diagnostics will drive market expansion.

The ongoing development of point-of-care tests and molecular diagnostics is expected to enhance early detection and patient management further driving market growth. Increased public and private sector investments will likely to support innovation and accessibility in tuberculosis diagnostics.

Technological Advancements in Diagnostic Tools

One of the primary growth drivers for the tuberculosis diagnostics market is the rapid advancement in diagnostic technologies. Innovations such as molecular diagnostics, including polymerase chain reaction (PCR) and GeneXpert MTB/RIF have significantly enhanced the accuracy and speed of TB detection. These technologies offer higher sensitivity and specificity than traditional methods like smear microscopy and culture, enabling earlier and more reliable diagnosis.

Molecular tests can detect the presence of TB bacteria and drug resistance with greater precision, which is crucial for effective treatment and control. Integrating artificial intelligence and machine learning into diagnostic platforms further improves diagnostic accuracy and efficiency, driving market growth.

Continuous research and development in diagnostic technologies contribute to introducing new and more effective tools expanding the market and improving global TB management.

Increased Funding and Government Initiatives

Increased funding and government initiatives play a crucial role in driving the growth of the tuberculosis diagnostics market. Global health organizations, including the World Health Organization (WHO) and the Global Fund are mainly investing in TB control programs and diagnostic infrastructure particularly in high-burden regions. Governments and international bodies are providing financial support for developing, procuring, and distributing advanced diagnostic tools.

Public health campaigns and national TB programs also focus on improving diagnostic access and capacity. These initiatives aim to enhance early detection rates, reduce diagnostic delays, and ensure high-quality diagnostic services are available in underserved areas. As a result, increased funding and supportive policies contribute significantly to market expansion and the overall effectiveness of TB control efforts.

Limited Access and Infrastructure Challenges

One significant restraint for the market is the limited access and infrastructure challenges in low-resource settings. Many high-burden regions, particularly low- and middle-income countries, lack the necessary healthcare infrastructure to support advanced diagnostic technologies.

The high cost of sophisticated diagnostic tools, such as molecular tests and advanced imaging equipment, further exacerbates this issue. Inadequate laboratory facilities, insufficient trained personnel, and limited supply chains can hinder these diagnostic tools' effective implementation and utilization. This gap in access and infrastructure restricts the widespread adoption of modern diagnostics and affects early detection and treatment outcomes.

As a result, addressing these infrastructural and accessibility issues is crucial for market growth and the overall effectiveness of TB control efforts in underserved areas.

High Costs of Advanced Diagnostics

The high costs associated with advanced tuberculosis diagnostic technologies present another significant restraint for market growth. Innovative diagnostic tools, such as molecular assays and next-generation sequencing, are often expensive to develop, purchase, and maintain. This cost barrier limits their affordability and accessibility, particularly in resource-constrained settings where the burden of TB is highest.

High costs can also strain healthcare budgets and delay the adoption of new technologies, impacting the speed at which advancements reach those in need. Although the long-term benefits of advanced diagnostics include improved detection rates and better patient outcomes, the initial investment and ongoing costs are challenging for widespread implementation.

Addressing the financial barrier through cost-reduction strategies, subsidies, or alternative funding models is essential for expanding access to advanced TB diagnostics and overcoming this market restraint.

Expansion of Point-of-Care Testing

One significant opportunity for the tuberculosis diagnostics market is the expansion of point-of-care (POC) testing. Point-of-care testing involves diagnostic tests that can be performed at or near the site of patient care such as clinics or community health centres rather than in a centralized laboratory. This approach offers several advantages, particularly in addressing the challenges of TB diagnosis in low-resource settings.

POC tests, including rapid molecular assays and lateral flow immunoassays, are designed to provide quick and accurate results, which can significantly improve early detection and timely treatment of TB. The development and deployment of POC diagnostics can bridge gaps in healthcare infrastructure by making testing more accessible to underserved populations.

By reducing the need for specialized laboratory facilities and trained personnel, POC tests can be integrated into various healthcare settings including remote and rural areas. The growing trend toward decentralization in healthcare and the increasing focus on improving global health equity support the expansion of POC diagnostics.

Innovations in technology are driving the development of more affordable and user-friendly POC tests, which can help overcome financial and logistical barriers. As these tests become more available and cost-effective, they can lead to higher detection rates, better management of TB cases, and, ultimately, a reduction in TB transmission.

The expansion of point-of-care testing represents a valuable opportunity for the market, aligning with global health priorities to enhance early detection, improve patient outcomes, and address disparities in healthcare access. Leveraging this opportunity can drive market growth and contribute to more effective TB control strategies worldwide.

A mix of established players and emerging innovators characterizes the competitive landscape of the market. Key market leaders include companies like Roche, Cepheid, and Becton Dickinson, which offer advanced diagnostic technologies such as molecular assays and rapid tests. These companies benefit from intense research and development capabilities, extensive distribution networks, and established relationships with healthcare providers.

Emerging players focus on developing cost-effective, point-of-care solutions and novel diagnostic platforms. Startups and smaller firms are also innovating in biosensors and digital diagnostics.

The market is highly dynamic, with frequent technological advancements and ongoing collaborations between public health organizations and private companies to enhance diagnostic capabilities and expand access globally.

Recent Industry Developments in the Tuberculosis Diagnostics Market

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Test Type

By End User

By Region

To know more about delivery timeline for this report Contact Sales

The market is estimated to be valued at US$2.3 Bn in 2024

The market is estimated to exhibit a CAGR of 5.5% over the forecast period.

A few of the leading players in the market are Abbott, QIAGEN, and Thermo Fisher Scientific Inc.

Increased funding and government initiatives are one of the key driving factors for market.

A key opportunity lies in the expansion of point-of-care Testing in the market.