Mycobacterium Tuberculosis Treatment Market Segmentation by Disease Type - Latent TB, Active TB | Treatment Type - First-Line of Drugs, Second-Line of Drugs

Industry: Healthcare

Published Date: November-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 287

Report ID: PMRREP33190

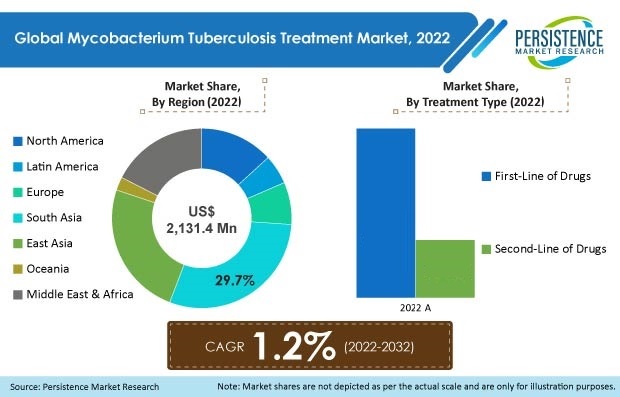

Worldwide revenue from the mycobacterium tuberculosis treatment market was US$ 1.97 Bn in 2021, with the global market estimated to expand at a CAGR of 1.2% to reach US$ 2.40 Bn by the end of 2032.

As assessed by Persistence Market Research, mycobacterium tuberculosis treatment for active tuberculosis (TB) accounted for a market value of US$ 1.35 Bn in 2021. Overall, mycobacterium tuberculosis drug sales accounted for approximately 2.7% revenue share of the global infectious disease treatment market in 2021.

The global market for mycobacterium tuberculosis treatment recorded a historic CAGR of 9.5% in the last 9 years from 2012 to 2021.

Despite the negative impact of COVID-19 on the overall market, it is set to exhibit growth over the coming years. Also, due to factors such as governments’ challenges and the National Strategic Plan to eradicate tuberculosis by 2025, the market is likely to show steady growth over the coming years.

|

Mycobacterium Tuberculosis Treatment Market Size (2022) |

US$ 2.13 Bn |

|

Projected Market Value (2032) |

US$ 2.40 Bn |

|

Global Market Growth Rate (2022-2032) |

1.2% CAGR |

|

Market Share of Top 5 Countries |

50.9% |

“Rising Incidence of Multi-Drug Resistant Tuberculosis (MDR-TB)”

Over the projected period, the prevalence of multi-drug resistant tuberculosis (MDR-TB) and extensively drug-resistant tuberculosis (XDR) is anticipated to increase in developing nations. Since there are few marketable effective pharmacological alternatives, low patient adherence to medicine continues to be an issue in the development of MDR TB.

Through programs run by the WHO, such as Directly Observed Therapy (DOT), this wave of antimicrobial drug resistance in mycobacterium TB strains has inspired a global initiative. Additionally, the development of shorter treatment regimens to combat drug resistance through cooperation between international organizations such as Unitaid, WHO, UNICEF, and TB Alliance is addressing unmet medical requirements, which is anticipated to drive market expansion.

“Advancements for Improvement of Novel Therapeutics and International Funding”

Advanced technology and the improvement of novel therapeutics are anticipated to shorten the time of remedy for tuberculosis and the occurrence of tuberculosis. Moreover, despite existing medicines for tuberculosis, there is a constant demand for novel therapeutics, especially in lower economies, for multidrug-resistant tuberculosis and pediatric tuberculosis. In low- and middle-income countries, international donor funding remains critical. The chief source is the Global Fund to fight tuberculosis and increase awareness among the population.

“Generic Drugs - Competition for Market Players”

MDR-TB is a type of tuberculosis caused by bacteria that are resistant to rifampicin and isoniazid, the two most potent first-line TB medications. Second-line medications can be used to treat and even eradicate MDR-TB. However, second-line treatment choices are few and require lengthy chemotherapy using expensive and hazardous drugs.

There is a wide range of low-cost prescription options as a result of the availability of generic alternatives to the medications used to treat tuberculosis. Additionally, many drugs are currently in pipeline, which is expected to increase the competition among manufacturers in the near future.

Certain pharmaceutical manufacturers will face generic competition as patented branded pharmaceuticals lose their patent protection. This means that companies designing and manufacturing original products (drug molecules) will face more competition. Patients and doctors may choose to use generic medications because they are less expensive than brand-name drugs. As a result, issues with patent expiration will impede the market for mycobacterium tuberculosis treatment to some extent.

Why is the U.S. Mycobacterium Tuberculosis Treatment Market Booming?

“Government Funding Programs for Tuberculosis”

The U.S. accounted for 12.3% share of the global market in 2021, and a similar trend is expected over the forecast period.

The incidence of tuberculosis among U.S.-born persons increased from 0.71 in 2020 to 0.79 in 2021 (cases per 100, 000 population), whereas, in non-U.S.-born persons, it increased from 11.71 to 12.61 (cases per 100, 000 population) in 2021, thereby increasing the incidence of tuberculosis, which is a major driver for market growth in the country.

Why is China Emerging as a Prominent Market for Mycobacterium Tuberculosis Drug Suppliers?

“Rising Burden of Latent Tuberculosis Infection”

China held the largest market share of 58.8% of the East Asia mycobacterium tuberculosis treatment market in 2021, with a market value of US$ 280.9 Mn.

As such, the increasing burden of latent TB and government initiatives are expected to drive market growth in China over the forecast period

Will India be a Lucrative Market for Mycobacterium Tuberculosis Treatment?

“High Prevalence of Tuberculosis and Increasing Digital Initiatives”

India held 45.2% share of the South Asian market in 2021.

Which Disease Type is driving Global Market Growth?

“Rising Incidence of Active TB”

Active TB held 68.5% share of the overall disease type segment within the global market. The active TB (ATB) segment dominated the market due to the growing incidence of MDR TB cases, which can be considered incomplete treatment patterns in high-risk and low- and middle-income countries.

Which Treatment Type is in High Demand?

“Standard Treatment Regimen- 1st Line of Drugs”

The first line of drugs held the largest market share of 74.5% in 2021. The first line of drugs is a standard treatment pattern for tuberculosis patients. Increasing adoption of novel therapeutics as combination therapies is expected to boost the first line of drug treatment types in the market.

Key players in the mycobacterium tuberculosis treatment industry are engaged in activities such as new product launches, acquisitions, collaborations, and expansion for the advancement and development of new products and therapies.

For instance,

|

Attribute |

Details |

|

Forecast Period |

2022-2032 |

|

Historical Data Available for |

2012-2021 |

|

Market Analysis |

USD Million for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon Request |

By Disease Type:

By Treatment Type:

By Route of Administration:

By Distribution Channel:

By Region:

To know more about delivery timeline for this report Contact Sales

The global mycobacterium tuberculosis treatment market was valued at around US$ 1.97 Bn in 2021.

Sales of the mycobacterium tuberculosis treatment medications are set to exhibit a growth rate of 1.2% and reach US$ 2.40 Bn by 2032.

Demand for mycobacterium tuberculosis treatment increased at 9.5% CAGR from 2012 to 2021.

The U.S., China, Germany, Japan, and India accounted for the most demand for mycobacterium tuberculosis treatment and held a cumulative market share of 50.9% in 2021.

The U.S. accounted for 12.3% share of the global market in 2021.

Lupin, Novartis AG, and Glaxo SmithKline Ltd. are the top three manufacturers of mycobacterium tuberculosis medications.

China held a share of 58.8% in the East Asian market in 2021, while Japan accounted for 7.7% share of the global market.

The German mycobacterium tuberculosis treatment market is valued at US$ 62.6 Mn in 2021.

The market share of India was 45.2% in the South Asian mycobacterium tuberculosis treatment market in 2021.

The European market is expected to grow at a CAGR of 1.2% during the forecast period.