Industry: IT and Telecommunication

Published Date: October-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 179

Report ID: PMRREP34886

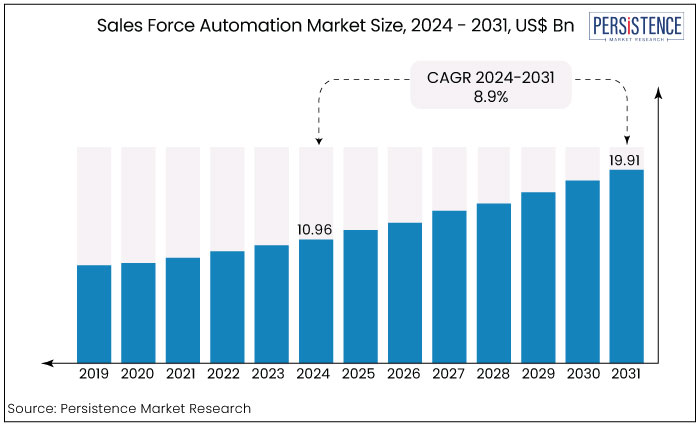

The sales force automation market is estimated to increase from US$10.96 Bn in 2024 to US$19.91 Bn by 2031. The market is projected to record a CAGR of 8.9% during the forecast period from 2024 to 2031.

The sales force automation (SFA) market has been growing significantly, driven by the increasing need for businesses to streamline their sales processes, enhance customer relationship management, and leverage data-driven insights. Over 40% of businesses prioritize solutions that integrate seamlessly with existing CRM and ERP systems, emphasizing customization to meet specific business needs, which eventually drives the market forward.

SFA solutions help BFSI organizations streamline sales processes and improve customer interactions. Also, retail businesses are increasingly adopting SFA tools for managing customer relationships and optimizing sales pipelines contributing to 20% market share.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Sales Force Automation Market Size (2024E) |

US$10.96 Bn |

|

Projected Market Value (2031F) |

US$19.91 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

8.9% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

7.8% |

|

Region |

Market Share in 2024 |

|

North America |

51% |

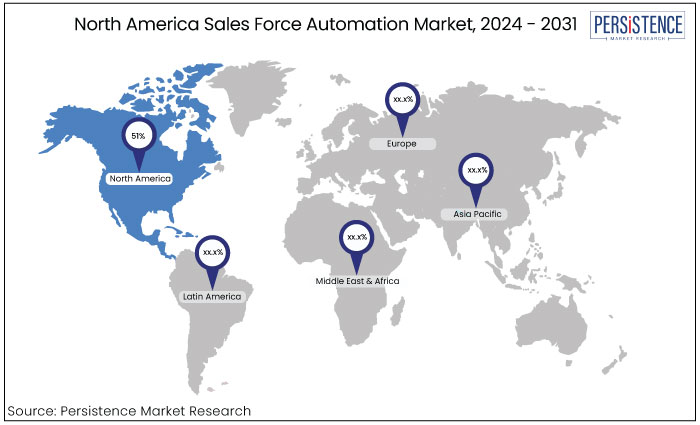

North America to account for the 51% of the market share by 2031. North America possesses advanced technological infrastructure, including high-speed internet, extensive mobile connectivity, and access to innovative software solutions.

The United States has spearheaded the implementation of sales force automation solutions across diverse sectors including technology, healthcare, banking, manufacturing, and retail. U.S. organizations prioritize innovation and client-focused strategies acknowledging the advantages of sales force automation in enhancing sales processes, strengthening customer relationships, and securing a competitive edge.

Businesses operating in the region have adopted sales force automation to enhance their sales processes, customer interaction, and overall success. It is driven by the region's technological proficiency, competitive environment, and customer-focused strategy.

|

Category |

Market Share in 2024 |

|

Deployment - Cloud |

68% |

The market is classified into cloud and on premises based on deployment. Among these, the cloud deployment type dominates the sales force automation market. Cloud-based sales force automation solutions come up with artificial intelligence and machine learning capabilities to enhance sales processes. These technologies employ consumer data analysis to automate redundant tasks, predict customer behaviour, and deliver insights.

The combination of cloud-based SFA systems with additional cloud services, including CRM, marketing automation, and communication tools, aimed to deliver a seamless interface. The link streamlined processes and enhanced data transmission.

Cloud-based SFA systems seek to implement enhanced security measures, including multi-factor authentication, data segregation, encryption, and routine software updates, to safeguard sensitive client information amid ongoing privacy concerns.

|

Category |

Market Share in 2024 |

|

Enterprise - Large Enterprises |

65% |

Based on enterprises, the sales force automation market is classified into large enterprises and SME’s, where the large enterprises segment dominates the market. Large enterprise sales teams necessitate comprehensive on boarding and training protocols. Sales force automation software aids different organizations by structuring consistent training sessions to ensure each team member learns to utilize the platform effectively.

Large organizations in Asia Pacific and North America are progressively implementing sales force automation solutions in response to economic growth and digital transformation. The varied corporate landscape in the region has resulted in a range of adoption rates.

Sales force automation (SFA) is a business approach that uses specialized software to automate operations traditionally performed by humans. SFA software resembles customer relationship management (CRM) software. SFA is more specialized than CRM, primarily developed for the direct sales process to enterprises. Sales force automation software is becoming essential for businesses looking to enhance their sales workflows and boost operational efficiency.

The advantage of SFA lies in its specialized capabilities, which encompass order processing, information sharing among sales professionals, management of customer contact information, control and recording, inventory monitoring, sales forecasting, order tracking, and employee assessment. SFA software aggregates extensive data from many consumer touchpoints across different devices in a cloud-based implementation.

The rising need for sales forecasting software in the banking, retail, IT, and telecom sectors is expected to stimulate growth. Furthermore, the utilization of artificial intelligence (AI), machine learning (ML), and the implementation of cloud technology are expected to stimulate growth.

Key applications of AI in SFA software include predictive lead scoring, which assigns a score to each sales lead, indicating its likelihood of conversion into an opportunity, forecasting, and intelligent suggestions across all product or service categories for various business sectors.

The sales force automation market experienced significant growth during the period from 2019 to 2023, driven by the increasing adoption of digital tools to streamline sales processes, improve customer relationship management (CRM), and enhance productivity.

Market growth fueled by the rising demand from small and medium enterprises (SMEs) seeking to improve sales workflows and customer interactions. Post-2024, the SFA market is expected to continue expanding due to several key factors. Integrating AI and machine learning (ML) will further drive innovation offering advanced features like sentiment analysis, predictive lead scoring, and automated follow-ups.

The growing emphasis on customer experience and personalization will push companies to adopt sophisticated SFA tools for better customer insights and engagement. Moreover, the increasing focus on sales intelligence, analytics, and the use of big data is expected to enhance decision-making capabilities. Emerging markets and industries like retail, healthcare, and BFSI will continue to fuel demand for SFA solutions, leading to sustained growth.

Shift Toward Cloud-Based Solutions and Mobile SFA Platforms

The widespread shift toward cloud-based SFA solutions is another significant driver of sales force automation market growth. Cloud technology has become increasingly popular due to its scalability, cost-efficiency, and flexibility, allowing organizations to access sales data and manage operations from anywhere.

Cloud-based SFA tools enable real-time collaboration among sales teams, improving communication and ensuring all stakeholders align on sales goals. Mobile-enabled SFA platforms are particularly important in the current remote and hybrid work era.

Sales professionals need access to their tools and customer data while on the go, and mobile SFA solutions provide a seamless experience across devices. This mobility enhances sales force productivity, accelerates response times, and supports remote workforces, which has become critical in a post-pandemic world. As businesses prioritize digital transformation, the demand for cloud-based and mobile SFA platforms will further expand the market.

Increasing Demand from Small and Medium Enterprises (SMEs)

The growing demand for SFA solutions among small and medium enterprises (SMEs) is a significant growth driver for the sales force automation market. Traditionally, SFA platforms were primarily adopted by large enterprises due to their complexity and cost. However, in recent years, SFA vendors have developed solutions tailored to the specific needs of SMEs, offering more affordable and scalable options.

SMEs are increasingly recognizing the value of automating their sales processes to improve efficiency, reduce manual tasks, and enhance customer interactions. With user-friendly interfaces and simplified functionalities, these SFA solutions enable smaller businesses to compete with larger organizations by streamlining sales activities, improving lead management, and enhancing forecasting accuracy.

The rise of cloud-based tools also reduces the need for large IT infrastructures, making SFA adoption easier for SMEs. As more small businesses adopt digital solutions to drive growth and improve their sales performance, the demand for SFA platforms within this segment is expected to rise significantly.

High Initial Setup and Integration Costs for Advanced Features

Despite the growing demand for Sales Force Automation (SFA) solutions, high initial setup and integration costs remain a significant barrier for many businesses, particularly smaller enterprises.

While basic SFA tools have become affordable, advanced features like AI-powered analytics, machine learning, and seamless integration with other enterprise systems often come with substantial costs. These include the expenses for software customization, employee training, and ongoing system maintenance.

Integrating SFA tools with existing customer relationship management (CRM), enterprise resource planning (ERP), and other third-party systems can be complex and expensive, requiring IT support and sometimes even specialized consultants. This financial burden makes it challenging for businesses with limited resources to adopt more sophisticated SFA solutions, slowing down the overall market growth in segments that would benefit most from these technologies.

Integration of SFA with Customer Experience (CX) and Sales Intelligence Platforms

The integration of SFA with customer experience (CX) and sales intelligence platforms is a key opportunity that can transform sales processes and outcomes. As businesses increasingly focus on providing seamless and personalized customer journeys, the ability to merge SFA with CX tools offers a holistic view of the customer lifecycle. Consequently, this which allows sales teams to understand customer needs and pain points better.

Integrating sales intelligence tools that leverage big data, social listening, and competitive analysis can equip sales teams with critical insights for strategic decision-making. This interconnected ecosystem enhances the overall effectiveness of sales efforts and improves customer satisfaction making it a game-changer in the sales force automation market.

The sales force automation market features a competitive landscape characterized by a mix of established players and emerging start-ups. Key competitors include Salesforce, Microsoft, HubSpot, and Oracle, which offer comprehensive, cloud-based solutions with robust features such as AI-driven analytics and seamless integration capabilities. These companies dominate the market through extensive product offerings, strong brand recognition, and established customer bases.

Emerging players, like Pipedrive and Zoho, focus on providing cost-effective, user-friendly solutions tailored for small and medium enterprises (SMEs), thus capturing market share in underserved segments.

Strategic partnerships and acquisitions are common as companies seek to enhance their offerings and expand market reach. The growing emphasis on customer experience and data-driven decision-making intensifies competition driving continuous innovation in SFA solutions.

Recent Industry Developments in the Market

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

To know more about delivery timeline for this report Contact Sales

The market is estimated to be valued at US$19.91 Bn by 2031.

The market is projected to exhibit a CAGR of 8.9% over the forecast period.

Nimble, Oracle Corporation, Pipedrive, Salesforce.com, Inc., are some of the leading key players in the market.

North America region dominates the market.

Large enterprise leads the market with significant market share.