Industry: Chemicals and Materials

Published Date: March-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 172

Report ID: PMRREP24958

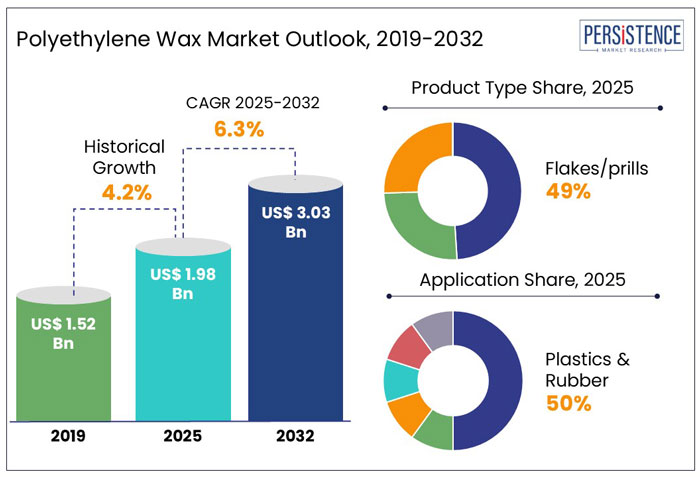

The global polyethylene wax market size is anticipated to rise from US$ 1.98 Bn in 2025 to US$ 3.03 Bn by 2032. It is projected to witness a CAGR of 6.3% from 2025 to 2032.

Growing shale gas production in North America and China, as well as increased demand from the printing ink and coatings industries, are driving significant expansion in the worldwide polyethylene wax market.

The production of ethylene, a crucial feedstock for PE wax, has been greatly influenced by the U.S. shale gas boom. In 2023, ethane output surpassed 2.5 million barrels per day, which affected the printing inks and coatings sectors, which expanded at a rate of 4.5% annually.

While strict environmental restrictions in Europe and Asia-Pacific impact industrial operations, Chevron Phillips Chemical, INEOS, and LyondellBasell are expanding their ethylene cracker facilities to sustain the supply of polyethylene wax.

Key Highlights of the Polyethylene Wax Market

|

Global Market Attributes |

Key Insights |

|

Polyethylene Wax Market Size (2025E) |

US$ 1.98 Bn |

|

Market Value Forecast (2032F) |

US$ 3.03 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.2% |

Demand for PE Wax Caters the Multiple Packaging Application

According to Persistence Market Research, the global polyethylene wax market experienced a CAGR of 4.2% from 2019 to 2024, driven by increasing eco-friendly innovations. The global demand for polyethylene wax is expanding due to its applications in the adhesive, thermoplastic, and food packaging sectors. The food packaging industry is the primary driver of the polyethylene wax market, projected to generate around US$ 350 Bn in 2023, owing to the use of superior materials.

Polyethylene wax enhances durability and heat resistance while improving the appearance, gloss, and thermal stability of masterbatches, PVC, and adhesives. Additionally, it extends the lifespan of thermoplastics used in road marking, a sector expected to be valued at US$ 6.5 Bn in 2023.

Major manufacturers such as BASF, Honeywell, and Westlake Chemical are investing in bio-based and high-performance polyethylene wax formulations, which further propel market growth in coatings, plastics, and rubber processing.

E-Commerce Trade of PE Wax Presents Growth Opportunities to SMEs

In the estimated timeframe from 2025 to 2032, the global market for polyethylene wax is likely to showcase a CAGR of 6.3%. The rise of e-commerce is transforming the PE wax industry, enabling small- and medium-scale manufacturers to expand their reach and improve supply chain efficiency.

The global B2B e-commerce market, valued at US$ 8.5 Tn in 2023, is driving online sales of PE wax, providing businesses with direct access to end-users across industries like packaging, coatings, and textiles.

Social media platforms such as LinkedIn and Facebook are increasing consumer awareness about PE wax grades, applications, and benefits. Companies like BASF, Trecora, and Honeywell are leveraging digital platforms to boost sales, making online distribution a key growth driver for the PE wax market.

Growth Driver

Rise in Textile Industry Open Up Novel Avenues for Polyethylene Wax Manufacturers

In the textile industry, the demand for polyethylene wax is expected to emerge as emulsions as long-lasting fabric softeners due to their chemical resistance, durability, and compatibility with finishing materials, ensuring consistent softness without color fading, chlorine retention, or yellowing.

The need for PE wax emulsions in clothing, household textiles, and industrial fabrics is rising due to the worldwide textile market. These emulsions improve thread resistance, lower abrasion, and avoid resin finishing flaws.

The growth of technical textiles, especially in automotive and medical applications, has further expanded PE wax usage. China, India, and Bangladesh, which collectively account for over 60% of global textile production, are key markets for PE wax manufacturers like BASF, Sasol, and Honeywell.

As sustainability gains importance, bio-based PE wax emulsions are emerging as eco-friendly alternatives, ensuring market expansion in the high-performance textile finishing sector.

Market Restraining Factor

Presence of Alternative Waxes Challenge PE Wax Production with Limited Impact

The high cost and extensive research and development required for biodegradable polyethylene wax production pose significant challenges to market expansion. While biodegradable PE wax is still in the laboratory verification stage, alternative products like polypropylene (PP) wax, polyamide wax, and Fischer-Tropsch wax are gaining traction.

Fischer-Tropsch wax, known for its low viscosity and strong PVC compatibility, is becoming a preferred lubricant in coatings and adhesives. Such alternatives are becoming increasingly popular for internal lubrication in industrial settings, despite their higher prices and fewer uses. Their overall effect on the demand for PE wax is still modest, though, since PE wax continues to dominate the market because of its affordability and adaptability.

Key Market Opportunity

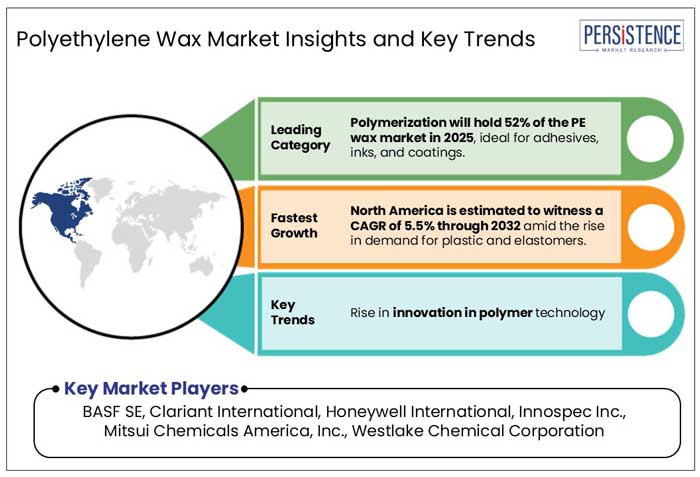

Innovations in Polymer Technology Crafts Novel Forms of PE Wax

Specialized polyethylene wax with improved qualities is being developed as a result of new developments in polymer technology, which makes it appropriate for a variety of industrial uses. In order to enhance dispersion qualities, lubricating effectiveness, and thermal stability, manufacturers are concentrating on high-performance formulas. For instance, oxidized polyethylene wax is becoming progressively well-liked in PVC processing, adhesives, and coatings because of its excellent compatibility and lubrication.

Companies such as Honeywell International, BASF SE, and Clariant AG are actively investing in research and development to provide specialized PE wax solutions for applications in plastics, textiles, and food packaging. Environmental regulations are also driving the rise of biodegradable PE wax, which is creating new prospects. PE wax is anticipated to become increasingly popular as a result of these technical developments, enhancing its use in contemporary industrial settings.

Product Type Insights

Flakes/Prills Gain Traction with Their Superior Resistance to Abrasion

The flakes/prills segment is expected to lead the PE wax market, holding a 49% share in 2025. The high demand from industries like paints, coatings, adhesives, packaging, and printing inks is driving this growth, as flakes/prills offer superior dispersibility, thermal stability, and lubrication properties. Additionally, ease of handling and transportation makes them a preferred choice over other product forms.

The powder sector, on the other hand, is anticipated to hold 38% of the market. Its tiny particle size and controlled application qualities make it extremely useful in hot-melt adhesives, rubber compounding, and plastics processing. With a 13% market share, the paste/gels are mostly used in polishing, cosmetics, and textile applications due to their improved binding qualities and smooth consistency.

Companies like BASF SE, Clariant AG, and Honeywell International are expanding PE wax production capacities, focusing on innovative formulations to cater to diverse industrial applications, ensuring steady market expansion.

Production Process Insights

Development in Polymerization Process Boost Production of PE Waxes

In 2025, the polymerization process is anticipated to control 52% of the polyethylene wax market. High-density, high-purity PE wax is produced by this technique, which makes it perfect for adhesives, printing inks, masterbatches, and coatings.

Excellent hardness, thermal stability, and chemical resistance make polymerization-derived PE wax a popular choice for a variety of industrial applications. Clariant AG and Trecora Resources are among the companies investing in the manufacturing of PE wax based on polymerization in order to satisfy the growing demand worldwide.

The thermal degradation process is projected to hold 48% of the market in 2025, driven by its ability to convert low-density polyethylene (LDPE) and polypropylene (PP) waste into valuable PE wax. This method aligns with sustainability goals by recycling plastic waste into functional products.

Honeywell International and BASF SE are advancing cracked-type PE wax technologies, particularly LDPE and PP cracked variants, to cater to eco-friendly applications in coatings, plastics, and hot-melt adhesives.

North America Polyethylene Wax Market

Growing Demand for Plastic and Elastomers Propels the Polyethylene Wax Industry in North America

The polyethylene wax market in North America is projected to hold a 38% market share in 2025, driven by rising plastic production, elastomer demand, and technical breakthroughs in polymer processing. The region's CAGR is forecasted at 5.5% from 2025 to 2032, fueled by strong demand in the coatings, adhesives, and masterbatch industries. The U.S. remains the largest contributor, with increased plastic production capacity and a thriving packaging sector.

The demand for oxidized polyethylene wax is expected to increase rapidly as plastic and elastomer applications spread throughout industries including 3D printing, construction, and automobiles. Saturated polymer uses, especially in lubricants and hot-melt adhesives, are also driving up demand for high-density polyethylene (HDP) waxes. To accommodate the rising demand, businesses like Westlake Chemical and INEOS are investing in polyethylene manufacturing capacity, while research into bio-based PE wax substitutes is being fueled by sustainability programs.

Asia Pacific Polyethylene Wax Market

Industrialization in Asia Pacific Paves the Way for PE Wax Production

The PE wax industry in Asia Pacific is projected to hold a 20% market share in 2025. The growth is driven by increasing plastic production and high polyethylene supply from India and China. China, the largest polyethylene producer globally, accounted for over 30% of the world’s PE production in 2024, fueling the expansion of PE wax applications in coatings, adhesives, and packaging.

India’s plastic industry, valued at US$ 37.8 Bn in 2024, is witnessing strong demand for PE wax in masterbatches and hot-melt adhesives. Additionally, Vietnam is emerging as a major player, with its plastics sector growing at a rate of 10 to 12% annually.

Companies like Sinopec, SCG Chemicals, and Indian Oil Corporation are increasing polymer production to provide a consistent supply of PE wax for industrial and commercial uses, bolstering Asia Pacific's international prominence.

Europe Polyethylene Wax Market

Novel Regulations in Europe for Packaging Presents Avenues for PE Wax

The PE wax market in Europe is poised for expansion in 2025, driven by novel EU packaging regulations emphasizing reduction, reuse, and recycling. The European Parliament's new rules, approved in April 2024, aim to cut packaging waste by 5% by 2030 and 15% by 2040, significantly impacting plastics used in food, cosmetics, and industrial packaging.

As a sustainable material for food packaging, adhesives, and coatings, PE wax is becoming more and more well-liked because of its improved barrier qualities, resilience, and recyclable nature. Additionally, the market is changing due to consumer desire for packaging that is biodegradable and devoid of plastic; the plant-based chewing gum industry is increasingly using PE wax derivatives.

Companies like Evonik and Clariant are innovating bio-based wax formulations, aligning with Europe's sustainability goals and fueling market growth in packaging applications.

Prominent manufacturers of polyethylene (PE) wax are actively working to enhance their presence in the global market. They are doing this by significantly expanding their production capabilities and strategically entering emerging markets that show high potential for growth.

Furthermore, these companies are placing a strong emphasis on innovation and the development of new products. This focus is driven by the increasing demand from various end-use sectors, which require advanced solutions to meet their specific needs.

Key Industry Developments

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Form

By Production Process

By Application

By Region

To know more about delivery timeline for this report Contact Sales

The market is set to reach US$ 1.98 Bn in 2025.

Polyethylene, derived from crude oil and natural gas, necessitates a catalyst for transformation, unlike nylon, which is produced through various polymerization methods.

BASF SE, Clariant International, Honeywell International, and Innospec Inc. are a few leading players.

The industry is estimated to rise at a CAGR of 6.3% through 2032.

North America is projected to hold the largest share of the industry in 2025.