Industry: Chemicals and Materials

Published Date: October-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 183

Report ID: PMRREP34870

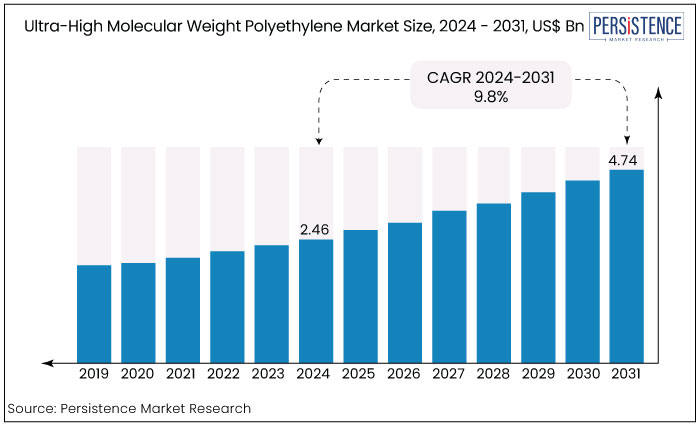

The ultra-high molecular weight polyethylene market is estimated to increase from US$2.46 Bn in 2024 to US$4.74 Bn by 2031. The market is projected to record a CAGR of 9.8% during the forecast period from 2024 to 2031.

The market for ultra-high molecular weight polyethylene (UHMWPE) is driven by strong demand in medical, automotive, aerospace, and defence applications, alongside technological innovations and sustainability initiatives. Rapid growth in Asia Pacific and increased investment in research and development further enhance industry potential.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Ultra-High Molecular Weight Polyethylene Market Size (2024E) |

US$2.46 Bn |

|

Projected Market Value (2031F) |

US$4.74 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

9.8% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

8.7% |

|

Region |

Market Share in 2024 |

|

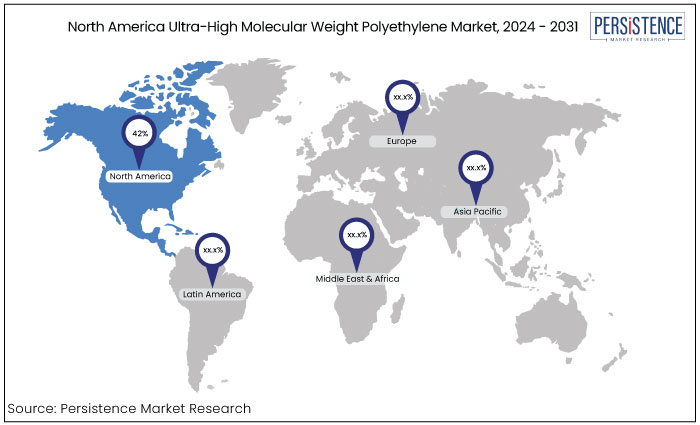

North America |

42% |

North America dominates the market accumulating market share above 42%. The United States led the North American UHMWPE market and is anticipated to sustain its leadership during the forecast period. The utilization of UHMWPE in protective armour is experiencing substantial expansion in the region.

The escalation of the military and defence budget in the U.S. along with the rise in reported instances of joint operations particularly hip and knee procedures is anticipated to propel the market expansion in North America.

The U.S. ultra-high molecular weight polyethylene (UHMWPE) market was propelled by substantial demand in aerospace and medical sectors encompassing body panels and sophisticated medical devices.

The widespread adoption of ultra-high molecular weight polyethylene across several sectors including aerospace, military, automotive, and healthcare in the region is driving market growth.

|

Category |

Market Share in 2024 |

|

Form - Sheets |

25% |

Based on form, the market is categorized into sheets, rods & tubes, films and tapes. Among these, the sheets form dominates the market segment. UHMWPE sheets are widely utilized to address wear, friction, and material flow issues across diverse industrial applications. It is mainly due to their exceptional sliding qualities, elevated impact strength, remarkable wear resistance, and significant chemical resistance.

UHMWPE sheets are extensively utilized throughout multiple sectors including packaging, food and beverage, general conveyor technology, and chemicals. UHMWPE has emerged as a highly favoured material in the manufacturing of medical implant applications. It has been trusted due to its exceptional resistance to wear and abrasion and its superior durability.

UHMWPE is a polymer characterized by long chains that exhibit exceptional flexibility and impact resistance. Furthermore, these materials possess a lower weight in comparison to metallic substances. These attributes have augmented product demand in medical applications in recent years. This tendency is anticipated to persist during the predicted period.

|

Category |

Market Share in 2024 |

|

End Use - Healthcare |

24% |

In terms of end use, the market is classified into healthcare, aerospace & defence, automotive, and oil & gas. Among these, healthcare sector dominates the market. The healthcare and medical sector to lead the market exhibiting significant revenue share exceeding 24%.

Healthcare segment growth is attributed to increased healthcare investments, developments in medical technologies, and an aging population. All these factors propel demand for ultra-high molecular weight polyethylene products in the medical sector.

UHMWPE is frequently employed in producing various medical devices, including orthopaedic implants like hip and knee joint replacements and prosthetic components for limbs.

Aerospace and defence represent significant end use sectors for ultra-high molecular weight polyethylene. UHMWPE demonstrates exceptional durability and resistance to wear and abrasion rendering it appropriate for aerospace and defence applications including helmets, body armour plates, and vehicle armour panels.

Ultra-high molecular weight polyethylene (UHMWPE) is a semi-crystalline polymer characterized by exceptional resistance to wear, abrasion, corrosion, strong acids, and alkalis. It possesses exceptional impact strength compared to all thermoplastics and exhibits non-stick and self-lubricating properties.

The growing focus on electric vehicles (EVs) and renewable energy sectors will boost demand for UHMWPE in lightweight and high-performance components. Expanding applications in sports equipment and the aerospace industry will also drive market expansion. However, environmental concerns regarding non-biodegradable plastics and fluctuating raw material prices could pose challenges.

Ultra-high molecular weight polyethylene is experiencing a surge in demand from the aerospace, defense, and automotive sectors due to its superior qualities to other polymers. The rising preference for polymer-based implants in various medical treatments will enhance market growth.

The rising demand from diverse applications including batteries, medical-grade products, prostheses, additives, fibres, filters, and membranes is substantially propelling the expansion of the market. Also, the rising demand for products in defence applications and the exceptional physical features of UHMWPE nrelative to other polymers are expected to propel the ultra-high molecular weight polyethylene market.

The ultra-high molecular weight polyethylene market has experienced steady growth during the period from 2019 to 2023. Market growth during this period was driven by its diverse applications in industries such as medical, automotive, aerospace, and defense.

UHMWPE’s unique properties such as high impact resistance, low friction, and exceptional chemical resistance make it essential for high-performance products like orthopedic implants, bulletproof vests, and industrial machinery components.

The market is projected to expand during the forecast period with projections indicating a CAGR of 9.8%. Key drivers include rising healthcare expenditure and technological advancements in medical devices as UHMWPE is increasingly used in hip and knee replacements.

Rising Elderly Demographic

The increasing demand for UHMWPE is attributable to the growing senior demographic, which is a significant driver and attributed to the increasing demand for healthcare and medical implants among the elderly.

Countries such as China and Japan are experiencing an increase in the percentage of their populations aged 65 and older. Moreover, there exists a significant demand for UHMWPE from manufacturers of orthopedic implants and medical device components. This demand is due to the attributes of material such as a high strength-to-weight ratio, self-lubrication, exceptional, excellent dielectric and electrical insulation, chemical resistance, and impact resistance. These attributes enhance the material's overall superior performance.

UHMWPE serves as a battery separator in electric car batteries and is used to fabricate spare components for these batteries. Consequently, a rise in the quantity of electric vehicles is expected to elevate the need for UHMWPE.

Increasing Use in Defence and Ballistics Applications

UHMWPE has gained significant traction in the defence and ballistics sectors due to its exceptional strength-to-weight ratio making it a key material in producing lightweight body armour, helmets, and vehicle protection systems.

UHMWPE fibres such as those used in ballistic protection offer superior impact resistance and durability while being lighter than traditional materials like Kevlar. This characteristic allows for enhanced mobility and comfort for military and law enforcement personnel without compromising protection.

As global defence spending increases particularly in regions facing security challenges, the demand for advanced protective equipment is rising. Also, UHMWPE's application in lightweight military vehicles, which require materials that enhance fuel efficiency and manoeuvrability has further strengthened its market position.

The increasing need for personal protection and vehicle armour in both military and civilian sectors ensures that the defence industry will remain a robust driver for the ultra-high molecular weight polyethylene market.

Increasing Use in Defence and Ballistics Applications

UHMWPE has gained significant traction in defence and ballistics due to its exceptional strength-to-weight ratio. It is a key material in producing lightweight body armour, helmets, and vehicle protection systems.

UHMWPE fibers such as those used in ballistic protection offer superior impact resistance and durability while being lighter than traditional materials like Kevlar. This characteristic allows for enhanced mobility and comfort for military and law enforcement personnel without compromising protection.

As global defence spending increases particularly in regions facing security challenges, the demand for advanced protective equipment is rising. UHMWPE's application in lightweight military vehicles, which require materials that enhance fuel efficiency and manoeuvrability, has further strengthened its market position.

The increasing need for personal protection and vehicle armour in both military and civilian sectors ensures that the defence industry will remain a robust driver for the ultra-high molecular weight polyethylene market.

Increased Demand for Medical Implants

Due to its superior biocompatibility, wear resistance, and ductility, ultra-high molecular weight polyethylene is increasingly utilized in the medical industry. Numerous research efforts have led to the development of ultrahigh molecular weight polyethylene (UHMWPE) with enhanced tribological and mechanical properties. It has facilitated the creation of durable implants for patients.

Various companies have created medical-grade items designed for biomedical implants. DSM provides a medical-grade ultra-high molecular weight polyethylene fibre known as Dyneema Purity, which adheres to ASTM and ISO standards and possesses a tensile strength that is 15 times great than steel.

Technological advancements have created enhanced prostheses that possess increased durability, improved comfort for patients, and an extended anticipated lifespan. The prevalence of hip and knee joint replacement surgeries has surged in recent years within the medical domain.

Advancements in Recycling Technologies

Developing advanced recycling technologies presents a transformative opportunity for the ultra-high molecular weight polyethylene market. As environmental concerns about plastic waste intensify, the ability to recycle UHMWPE effectively can enhance its market appeal.

Innovations in chemical recycling methods could break UHMWPE into its monomers, producing new, high-quality UHMWPE without relying on virgin materials. This could significantly reduce the environmental impact associated with disposal and increase sustainability in industries that utilize UHMWPE such as healthcare and automotive.

Manufacturers can comply with growing regulatory pressures and meet consumer demand for sustainable products by investing in recycling initiatives. Establishing a circular economy for UHMWPE would allow companies to differentiate themselves in the market attracting environmentally conscious customers and contributing to long-term growth.

The competitive landscape of the ultra-high molecular weight polyethylene market features several key players including Celanese Corporation, Mitsui Chemicals, Inc., DSM, and Toray Industries, Inc. Companies leverage their technological expertise and strong distribution networks to dominate the market.

Competition primarily focuses on innovation with firms investing in advanced manufacturing processes and new applications to enhance product performance. The market is characterized by strategic partnerships, mergers, and acquisitions to expand product portfolios and geographic reach.

Emerging players are entering the market to capitalize on the growing demand for sustainable and high-performance materials. Regulatory compliance and sustainability initiatives are becoming increasingly important as companies strive to meet environmental standards and consumer expectations.

Recent Industry Developments in the Market

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Form

By Application

By End Use

By Region

To know more about delivery timeline for this report Contact Sales

The market is estimated to be valued at US$4.74 Bn by 2031.

The market is projected to exhibit a CAGR of 9.8% over the forecast period.

Some of the leading key players in the market are Honeywell International, Inc., Mitsui Chemicals, Inc., and TSE Industries, Inc.

North America region dominates the market.

Sheets form of UHMWP leads the market with significant market share.