Industry: Chemicals and Materials

Published Date: September-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 193

Report ID: PMRREP34766

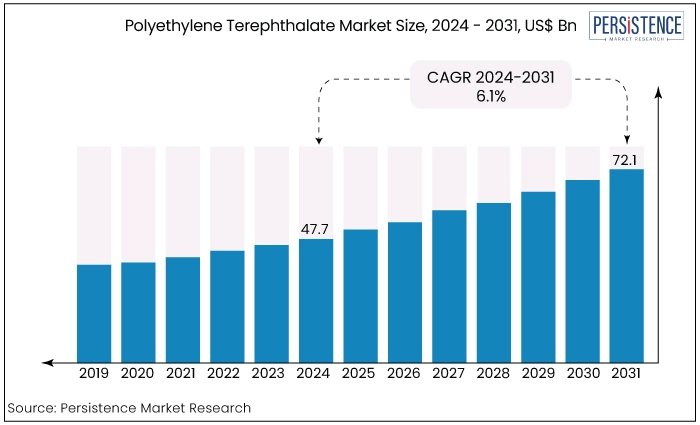

The global polyethylene terephthalate (PET) market is estimated to be valued at US$47.7 Bn in 2024 and is expected to reach a value of US$72.1 Bn by 2031. The market is expected to register a CAGR of 6.1% during the forecast period from 2024 to 2031. The rising need for recycled PET across diverse sectors like packaging, food and beverages, and automotive is projected to create substantial growth opportunities in the market.

Key Highlights of the Market

|

Attributes |

Key Insights |

|

Market Size (2024E) |

US$47.7 Bn |

|

Projected Market Value (2031F) |

US$72.1 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

6.1% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

5.7% |

|

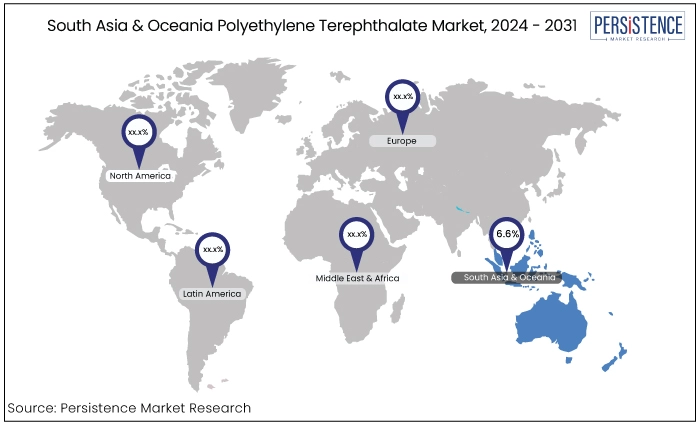

Region |

CAGR through 2031 |

|

South Asia & Oceania |

6.6% |

South Asia & Oceania region dominates the polyethylene terephthalate (PET) market accounting for the largest share of the market. This dominance is primarily due to the rapid industrialization, urbanization, and growing middle-class population in countries like India and other Southeast Asian countries. These factors are driving the demand for packaged goods, particularly in the food and beverage sector, which is the largest consumer of PET.

China, being the largest producer and consumer of PET, plays a pivotal role in the market’s growth in the East Asian region. Additionally, the presence of major PET manufacturers and investments in recycling infrastructure further strengthen the market in East Asia.

|

Region |

CAGR through 2031 |

|

North America |

4.1% |

The demand for PET in North America is driven by the extensive use of PET in the beverage industry particularly for bottled water and carbonated soft drinks. The region also has a well-established recycling infrastructure, which supports the market for recycled PET.

North America governments and regulatory bodies are implementing policies to promote recycling and reduce plastic waste. For example, various states and municipalities are setting targets for increasing recycled content in PET products and reducing single-use plastics.

There is rising consumer awareness and demand for environment-friendly products. Consumers in North America are increasingly seeking products made with recycled materials, which boosts the demand for rPET and drives growth in the polyethylene terephthalate (PET) market.

|

Category |

CAGR through 2031 |

|

Product - Recycled PET |

7.1% |

The recycled PET is projected to witness a 7.1% CAGR in the market. This growth is primarily driven by the increasing global emphasis on sustainability and the circular economy. Governments and regulatory bodies across the world are implementing stringent regulations to reduce plastic waste and promote recycling, compelling manufacturers and consumers to shift towards eco-friendly packaging solutions.

|

Category |

CAGR through 2031 |

|

Application - Rigid Packaging |

5.2% |

Rigid packaging is expected to lead the market in terms of share and demand. This dominance is largely driven by the widespread use of PET in the food and beverage industry, particularly for packaging bottles and containers for water, carbonated drinks, juices, and dairy products.

PET’s excellent properties such as its strength, durability, and lightweight nature make it an ideal material for rigid packaging solutions that require a high level of product protection and shelf life extension.

The growing consumer preference for convenient, on-the-go food and beverage options is further fuelling the demand for PET rigid packaging. Additionally, PET’s transparency and ability to retain the freshness of products make it a preferred choice for packaging in sectors such as personal care, pharmaceuticals, and household products.

The global polyethylene terephthalate (PET) market has seen various developments from manufacturers as well as consumers mostly driven by the need for sustainability, efficiency, and performance enhancement. These technologies are reshaping the market and creating new growth opportunities.

Companies like JEPLAN and others are at the forefront of this innovation, and their technologies are expected to revolutionize PET recycling, contributing to a more sustainable and circular PET economy. For instance,

JEPLAN operates two chemical recycling plants in Japan. This has contributed to the reduction of carbon dioxide emissions as well as the reduction of petroleum resource use. This development underscores the potential of chemical recycling as a key driver in the shift towards a circular economy within the polyethylene terephthalate (PET) market.

Bio-based PET is produced from renewable resources, such as sugarcane, and offers similar properties to conventional PET, making it a suitable alternative for various applications. Several leading players have launched bio-based PET products, and the market is expected to witness increased adoption of these products in the coming years.

The growing emphasis on sustainability and the rising consumer preference for eco-friendly products are likely to drive the demand for bio-based PET. Consequently, creating new growth opportunities for manufacturers in the global Polyethylene Terephthalate (PET) market.

The polyethylene terephthalate (PET) market has seen consistent growth driven by its widespread use in packaging, textiles, and industrial applications. There has been a growing emphasis on sustainability and recycling, which has shaped the PET market.

Advances in PET production technologies including efficient polymerization processes and the development of PET with improved performance characteristics have contributed to market growth. The market for polyethylene terephthalate recorded a CAGR of 5.7% during the period from 2019 to 2023.

The PET market is expected to continue growing. The market is projected to expand at a CAGR of 6.1% during the forecast period from 2024 to 2031. This growth is driven by increasing demand across several end-use sectors including packaging, textiles, and automotive.

Rising Demand for Sustainable Packaging

The growing consumer awareness regarding environmental sustainability is significantly driving the demand for PET in packaging applications. PET is known for its recyclability and with increasing regulations aimed at reducing plastic waste, many companies are shifting towards sustainable packaging solutions.

The demand for PET is particularly strong in the beverage industry, where it is extensively used for water and soft drink bottles. Major brands are committing to use more recycled PET (rPET) in their packaging, which is further boosting market growth. The shift toward a circular economy, where PET can be repeatedly recycled into new products is a key driver for the market.

Technological Advancements in Recycling

Technological advancements in PET recycling are another key driver of the market. Traditional mechanical recycling has limitations particularly with colored and contaminated PET.

Recent developments in chemical recycling technologies are overcoming these challenges. Chemical recycling breaks down PET into its monomers, which can be purified and re-polymerized into new PET ensuring a high-quality recycled product. This technology not only helps in managing plastic waste more effectively but also supports the production of high-quality PET suitable for food-grade applications.

As companies invest in these advanced recycling technologies, the availability of recycled PET (rPET) is expected to increase, driving the growth of the polyethylene terephthalate (PET) market.

Fluctuating Raw Material Prices

The fluctuation in raw material prices is one of the leading factors impeding the polyethylene terephthalate (PET) market growth. PET is primarily produced from petrochemical derivatives such as ethylene glycol and terephthalic acid whose prices are closely tied to crude oil prices.

The volatility in crude oil prices, driven by geopolitical tensions, supply-demand imbalances, and economic fluctuations, directly impacts the cost of PET production. These price fluctuations create uncertainty for PET manufacturers and can lead to increased production costs, which are often passed on to consumers.

The price volatility affects the profitability of PET manufacturers especially those operating on thin margins and may hinder investments in capacity expansions and technological innovations. This restraint poses a challenge for the market particularly in maintaining stable supply chains and competitive pricing.

Growing Adoption of Bio-based PET

The increasing emphasis on sustainability and the reduction of carbon footprints is driving the demand for bio-based PET. Produced from renewable resources such as sugarcane, bio-based PET offers similar properties to conventional PET but with a lower environmental impact.

As consumers and brands alike seek green alternatives, the adoption of bio-based PET is expected to rise. Manufacturers are investing in the development and commercialization of bio-based PET, and this trend is likely to gain momentum in the coming years.

The shift toward bio-based materials presents an opportunity for the polyethylene terephthalate (PET) market to expand its application scope and appeal to environmentally conscious consumers particularly in the packaging and automotive sectors.

The global polyethylene terephthalate (PET) market is highly competitive with several key players dominating the market. These companies are engaged in strategies such as mergers and acquisitions, partnerships, and capacity expansions to strengthen their market positions.

Companies are increasingly investing in the advanced recycling technologies like chemical recycling, which converts post-consumer PET trash into high-quality PET resins to reduce the impact on the environment, and promote circular economy concepts. For instance,

Recent Developments in the Polyethylene Terephthalate (PET) Market

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Region Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Product Type

By Application

By Region

To know more about delivery timeline for this report Contact Sales

Rising demand for sustainable packaging is a key driver for the market.

Some of the key players operating in the market are Indorama Venture, and BASF SE.

The recycled PET is projected to witness a 7.1% CAGR in the market

Growing adoption of bio-based PET coupled with circular economy in PET production presents significant opportunity for the market players.

South Asia & Oceania accounts for the significant share of the market.