Industry: Food and Beverages

Published Date: January-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 184

Report ID: PMRREP33881

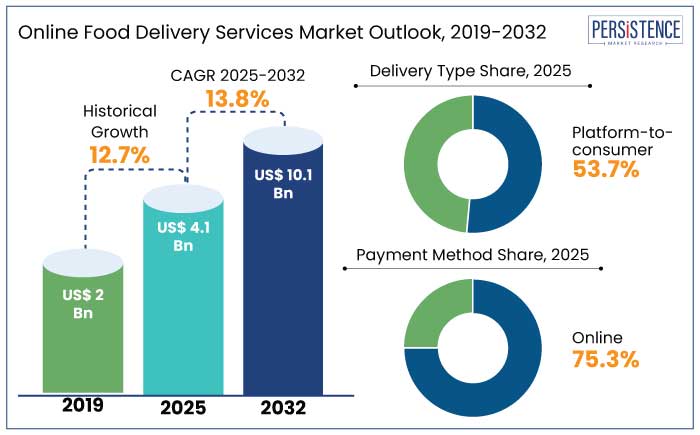

The global online food delivery services market is estimated to reach a size of US$ 4.1 Bn in 2025. It is predicted to rise at a CAGR of 13.8% through the assessment period to attain a value of US$ 10.1 Bn by 2032.

The online meal delivery operation is growing owing to improvements in technology, urbanization, and changing consumer lifestyles. Platforms such as Uber Eats and DoorDash are leading the way.

In October 2023, Zomato launched a subscription-based loyalty program in India, offering discounts and priority delivery to retain customers amid intense competition. Cloud kitchens, which lower operational costs, are now estimated to power 50% of online food orders globally.

Contactless payments and digital wallets like Apple Pay and Google Pay have streamlined transactions, accelerating adoption. Contactless delivery has become more popular due to the global pandemic, but its further expansion is hampered by issues with food quality, pricing increases, and regulatory compliance.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Online Food Delivery Services Market Size (2025E) |

US$ 4.1 Bn |

|

Projected Market Value (2032F) |

US$ 10.1 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

13.8% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

12.7% |

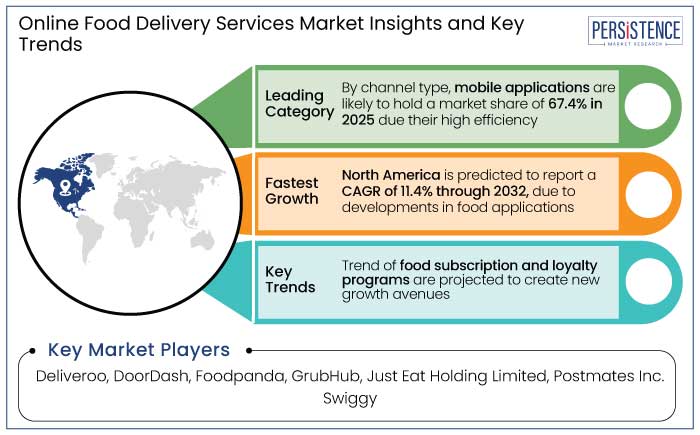

The online meal delivery industry in North America is predicted to attain a market share of 27.3% in 2025, owing to dual-income households and improvements in app-based platforms. The market is projected to generate a CAGR of 11.4% from 2025 to 2032. For instance,

North America is a leading player in the online food delivery market, renowned for its unique technology infrastructure and high adoption of digital payment methods.

Demand for online meal delivery services in Europe is anticipated to surge, with 21.5% of the global market share in 2025. The region will likely witness a CAGR of 7.7% from 2025 to 2032. The region's growth is fueled by rising adoption of app-based delivery platforms and growth of cloud kitchens, particularly in urban centers. For instance,

The rise of digital payments and sustainable delivery practices has positioned Europe's online food delivery services market to cater to evolving consumer preferences.

Platform-to-consumer food delivery, which links consumers with local eateries, is predicted to develop in capital cities that are becoming more urbanized and where convenience is essential. In 2025, the P2C model is projected to account for 53.7% of the global food delivery market, driven by rising investments in infrastructure and technology.

Companies such as Uber Eats and Deliveroo are leading this segment, leveraging AI to optimize delivery routes and enhance customer experience. For example,

The platform-to-consumer model offers scalability, diverse menu options, and seamless integration with digital payment solutions, but competition and regulatory challenges require continuous innovation for growth.

In the online food delivery services market, mobile applications are essential as these provide easy-to-use platforms for ordering, browsing menus, and monitoring deliveries in real-time. In 2025, mobile apps are predicted to hold 67.4% of the global market, fueled by rising smartphone usage and the need for user-friendly experiences. For instance,

Mobile applications are transforming food delivery by incorporating digital wallets, contactless payment methods, and unique tracking systems that improve ease and consumer satisfaction.

The advent of digital payment methods, smartphone usage, and urban population expansion are contributing to the demand for online meal delivery services. The market is driven by AI-powered optimization, surging restaurant partnerships, and consumer preference for contactless delivery. For example,

The market is surging in suburban and smaller cities due to investments in AI integration and delivery infrastructure, which lower operating costs and delivery times. The sector is reacting to evolving consumer needs by developing cloud kitchens and loyalty programs that prioritize sustainability.

The global online food market recorded a CAGR of 12.7% in the historical period from 2019 to 2023. The demand for online food orders and delivery services has decreased compared to the historical period, indicating gaps in supply chains. However, the popularity of on-demand food delivery remains high, with Chinese takeout and pizza delivery services growing.

Food delivery businesses have been encouraged by the COVID-19 pandemic, drawing customers with discounts and promo codes. However, incorporating new technology, like voice controls, may be costly and time-consuming.

Online food delivery businesses may use pricing optimization and premiumization techniques to save costs, but new business models and specialized markets like online grocery and alcohol delivery may generate revenue in the forecast period. Demand for online food delivery services is estimated to record a considerable CAGR of 13.8% during the forecast period between 2025 and 2032.

Adoption of Subscription-based Loyalty Programs to Enhance Customer Retention

Subscription-based models and loyalty programs are transforming the online food delivery market by boosting customer retention and driving recurring revenue. For instance,

Adoption of AI is improving consumer connections, stimulating market expansion, and increasing profitability through platform subscription services and customized rewards.

Introduction of Delivery Management Software to Streamline Operations

Online food delivery is growing due to delivery management software, which lowers business expenses while improving operational efficiency and real-time tracking. The program is designed to make delivery logistics easier for a variety of food enterprises, such as huge retail stores, dark kitchens, and fast-casual restaurants.

Growing need for effective delivery solutions is fueling the demand for delivery management software. For example,

In the quickly changing online food delivery sector, delivery management software is set to become an essential tool that allows for quicker and more economical delivery.

Management of Large Delivery Volumes May Limit Operations

The rise in online food ordering has led to a surge in daily orders, posing challenges for restaurants to manage efficiently. This often results in a high influx of daily orders, introducing risks like improper food handling and order misplacement, leading to erroneous deliveries and a decline in food and service quality.

Effective logistics operations for order fulfillment are a challenge, as delays can negatively impact food quality and customer satisfaction. Meeting customer expectations for hot and fresh meals is a challenge, especially for items with specific temperature and freshness criteria. Last-mile delivery logistics are complex, and optimizing delivery routes is crucial, especially in densely populated urban areas.

Collaboration of Restaurants and Food Platforms Delivers Variety in Ordering Menu

Expanding restaurant partnerships and menu options are reshaping the online food delivery market by providing consumers with diverse and tailored dining experiences. For instance,

Uber Eats and Deliveroo are collaborating to extend their cuisine offerings, addressing the increasing demand for customization. For example,

Platforms are further utilizing AI to offer personalized menus, enhancing convenience and a wider range of food options for consumers.

Online Payment Portals to Present Lucrative Prospects to Consumers

Online payment methods are emerging as a key aspect of the online food delivery market, simplifying transactions and enhancing user convenience. For example,

The growing familiarity with digital currencies and collaboration between financial institutions and food delivery platforms have accelerated adoption. For instance,

The simplicity of use and security characteristics of digital payment systems, such as digital wallets, net banking, and credit/debit cards, are propelling industry expansion.

The online food delivery services market is an intensely competitive landscape, where companies constantly seek innovative strategies to enhance their position. Several businesses are pursuing aggressive extensions, forming strategic mergers, and forging partnerships to broaden their service offerings and improve customer experiences.

In the dynamic environment, manufacturers are placing a strong emphasis on research and development, investing in cutting-edge technologies and advancements to create superior products. This commitment not only helps them gain a significant competitive advantage but also enables them to extend their market presence and reach a larger audience.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Delivery Type

By Channel Type

By Payment Method

By Region

To know more about delivery timeline for this report Contact Sales

The market size is set to reach US$ 10.1 Bn by 2032.

Food delivery service caters to busy professionals, families seeking quick, easy meals, and students and young adults who prefer online ordering.

In 2025, North America is set to attain a market share of 27.3%.

In 2025, the market is estimated to be valued at US$ 4.1 Bn.

Deliveroo, DoorDash, Foodpanda, and GrubHub are a few key players.