Industry: Industrial Automation

Published Date: January-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 197

Report ID: PMRREP35039

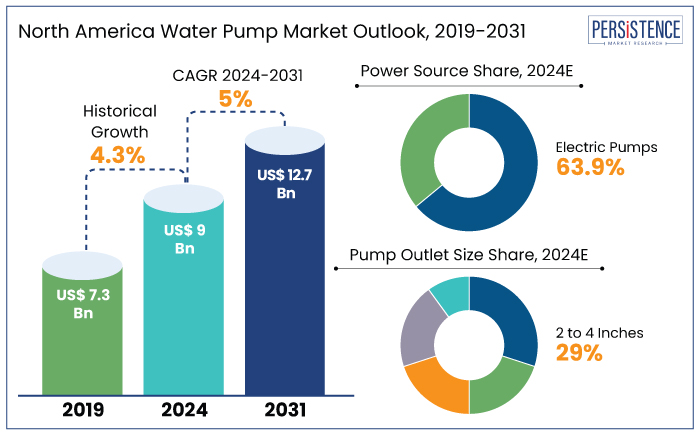

The Noth America water pump market is projected to witness a CAGR of 5% during the forecast period from 2024 to 2031. It is anticipated to increase from US$ 9 Bn recorded in 2024 to a considerable US$ 12.7 Bn by 2031.

The regional market has shown steady growth in both volume and value from 2019 to 2023, with strong projections through 2031. In terms of volume, the market grew from 7.5 million units in 2019 to an estimated 8.7 million units in 2023. It reflects an increasing demand for water pumps across sectors such as construction, industrial, and agricultural.

The market is anticipated to reach 11.8 million units by 2031. This consistent growth highlights the rising need for water management solutions in light of rapid urbanization, industrialization, and infrastructure development.

In terms of value, the North America water pump market followed a similar upward trend. Starting at US$ 7.3 Bn in 2019, the market grew to US$ 8.7 Bn in 2023. The higher growth rate in market value, compared to volume, suggests an increase in the price per unit.

It is mainly driven by factors such as technological innovations, rising demand for more efficient and durable pumps market, and growing use of smart pumps in industrial applications. Shift toward more energy-efficient and environmentally sustainable water pump solutions is anticipated to contribute to this rise in unit value.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

North America Water Pump Market Size (2024E) |

US$ 9 Bn |

|

Projected Market Value (2031F) |

US$ 12.7 Bn |

|

Noth America Market Growth Rate (CAGR 2024 to 2031) |

5% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

4.3% |

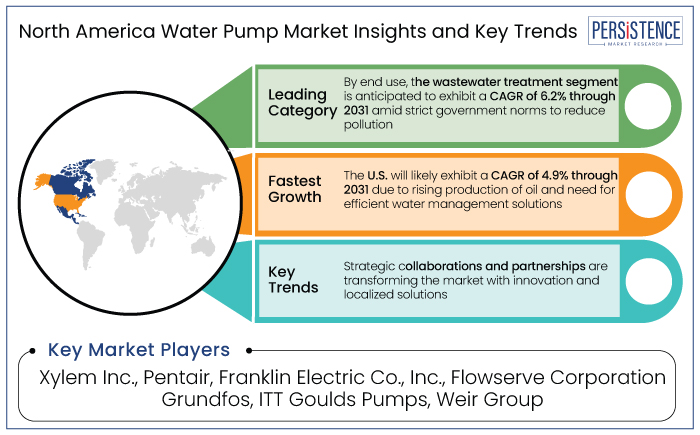

In the U.S., the market is being shaped by a surging demand from industries like oil and gas, agriculture, and municipal water systems. The country is anticipated to witness a CAGR of 4.9% through 2031 and hold a share of 80.3% in 2024. Rapid growth of oil production, especially in the Permian Basin, has driven the need for more efficient water management solutions, including pumps for enhanced oil recovery.

Companies like Ingersoll Rand are extending their portfolios through acquisitions, such as the recent purchase of APSCO and UT Pumps. These are strengthening their capabilities in energy-efficient and high-pressure pumps. With the U.S. government tightening energy efficiency standards, manufacturers are focusing on developing smart and sustainable pump technologies. These trends highlight the rising focus on innovation and sustainability in the market.

Canada holds a significant share in the North America water pump market. It is projected to rise with an average CAGR of 5.7% through 2031. The country’s growth is driven by demand across key sectors like agriculture, water treatment, and industrial applications, particularly in the oil and gas industry.

Expansion of infrastructure projects, along with the government’s focus on sustainability and efficient water management systems, further boosts the market. Canada’s commitment to adopting novel pump technologies, including energy-efficient solutions, plays a vital role in this growth.

Increasing focus on environmental regulations and water conservation contributes to the rising demand for innovative pump solutions. These factors collectively position Canada as a key player in the water pump industry.

Electric pumps dominate the North America water pump market, with a CAGR of 5.2% through 2031, driven by their high energy efficiency and reduced environmental impact. As industries and municipalities prioritize sustainability, electric pumps offer a cleaner, more efficient alternative to traditional engine-driven models. The segment will likely hold a share of 63.9% in 2024.

They are ideal for various applications, including wastewater treatment, irrigation, and municipal water systems. They can also integrate seamlessly with renewable energy sources like solar and wind.

Developments in smart technologies, such as IoT-enabled monitoring and automation, further enhance their appeal, optimizing performance and reducing operational costs. This surging trend positions electric pumps as a significant contributor to the market's growth.

The oil and gas segment will likely exhibit a CAGR of 4.5% through 2031. This growth is largely driven by the sector's surge in production, particularly in the U.S., where innovations in hydraulic fracturing and horizontal drilling have spurred the need for water management systems.

Water pumps are essential in various oil and gas operations, such as drilling, hydraulic fracturing, and produced water handling. Regions like the Permian Basin have seen increased demand for durable pumps capable of withstanding high pressures and abrasive materials.

In Canada, the oil sands industry drives demand for specialized high-capacity pumps, especially for Steam-Assisted Gravity Drainage (SAGD) operations. As the industry focuses on improving efficiency and sustainability, water pump technologies that minimize water consumption and meet environmental regulations are becoming increasingly crucial. The wastewater treatment segment, on the other hand, is set to witness a CAGR of 6.2% through 2031.

The North America market has evolved significantly, driven by rising water conservation demands and development of smart technologies. Key developments such as the integration of smart water systems and IoT-enabled pumps are reshaping the landscape. Companies like Xylem and Pentair are at the forefront of adopting energy-efficient solutions, focusing on variable speed pumps and unique monitoring systems.

Adoption of eco-friendly pumps that comply with stringent environmental regulations is a prevailing trend. These technological developments are helping industries, especially agriculture and municipal infrastructure, manage water resources more efficiently.

Rising investments in water treatment facilities and infrastructure upgrades are fueling demand for robust and energy-efficient water pumps. As companies continue to innovate in energy-efficient and automated solutions, the trend of sustainability will remain a leading growth driver.

From 2019 to 2023, the Noth America water pump market recorded a CAGR of 4.3%. Over the past decade, the market has experienced consistent growth, driven by increased demand from agriculture, construction, and water management sectors.

Key players like Franklin Electric and Grundfos have led the charge with product diversification, including high-efficiency pumps and automated systems. The market was supported by substantial investments in water treatment technologies. These spurred demand for unique pumps that cater to both residential and industrial applications. Key players also capitalized on emerging trends in energy efficiency and smart water solutions, extending their reach and maintaining competitiveness in a fragmented market.

Sales of water pumps are estimated to rise at a CAGR of 5% from 2024 to 2031. The market is poised for continued growth, with key players like Xylem and Pentair focusing on sustainability, smart technologies, and automation to capture future demand.

Increasing adoption of Internet of Things (IoT)-integrated pumps and novel water monitoring solutions will likely revolutionize the market. It is anticipated to enable real-time data collection and improved system performance. Energy-efficient pumps and solutions for water reuse and conservation are set to be central to the market's growth, propelled by both regulatory demands and consumer preferences.

Development of Novel Testing Facilities to Meet Rising Demand Spurs Growth

The regional market is witnessing robust growth, fueled by significant investments in infrastructure and manufacturing capabilities by industry leaders. For instance,

Ongoing Development of Irrigation Technologies to Fuel Sales

The regional market is evolving with a focus on unique irrigation technologies, driven by the agriculture sector's need for efficiency and sustainability. For instance,

Farmers and ranchers invested over US$ 3 Bn in irrigation equipment and systems in 2023, emphasizing the shift toward modernizing infrastructure. Technologies with automation and real-time monitoring capabilities are gaining traction, enabling optimized water use and reducing operational costs.

Canada is also seeing developments, with C$ 31.8 Mn allocated under its Indo-Pacific Strategy to enhance agricultural innovation, including sustainable irrigation solutions. These developments, coupled with concerns about climate variability and water scarcity, position the market to capitalize on trends toward efficient resource management.

Constant Pressure from Alternative Water Management Technologies

The market is experiencing growing competition from alternative water management technologies such as membrane filtration systems, unique recycling solutions, and chemical treatments. These innovations significantly reduce the reliance on large-scale pumping infrastructure by enabling water reuse in closed-loop systems and enhancing conservation efforts.

Industries adopting these alternatives are shifting toward solutions that prioritize sustainability and operational efficiency, challenging traditional systems' long-term demand. Water recycling systems, for instance, allow businesses to cut down on continuous water input and output. It is reshaping market dynamics and posing a potential threat to conventional equipment's growth trajectory.

The cost-efficiency of novel water management solutions further intensifies competition, as membrane filtration and recycling technologies often result in lower energy consumption. Companies facing regulatory pressures and striving to meet sustainability goals are increasingly inclined to invest in these systems.

The trend demands significant innovation from manufacturers, including features like energy-saving mechanisms, IoT integration, and compatibility with alternative technologies. As industries adapt to these evolving expectations, traditional systems must evolve to compete in a market increasingly dominated by intelligent and efficient water management solutions.

Companies to Develop 2 to 4-inch Pump Outlet Size to Gain Competitive Edge

The 2 to 4-inch outlet size range presents significant potential across municipal, agricultural, and industrial sectors due to its high versatility and efficiency. The segment will likely hold a share of 29% in 2024.

In agriculture, this size range is ideal for drip and sprinkler irrigation systems. These are aiding farmers in implementing water conservation practices to enhance crop yields amid concerns over climate variability and water scarcity.

Municipal systems benefit from these solutions for moderate flow applications, such as water distribution, stormwater management, and small-scale sewage treatment. Industrial processes leverage these systems for efficient fluid handling, cooling operations, and chemical applications, aligning with goals of cost reduction and energy efficiency. Demand for adaptable and sustainable solutions in these diverse applications underscores growth opportunities in North America water pump market.

Strategic Collaborations and Partnerships to Transform the Market

The North America water pump market is witnessing transformative growth driven by strategic collaborations and partnerships aimed at bolstering local production. The partnership between Xylem Inc. and Tiba Manzalawi Group, culminating in the launch of the Xylem Egypt Plant in May 2023, underscores this trend.

By producing Split-Case Centrifugal and End-Suction systems locally, this facility enhances delivery efficiency and caters to regional irrigation and HVAC needs. Such initiatives reflect a broader focus on local manufacturing to address supply chain challenges, reduce reliance on imports, and support economic growth through job creation.

Collaborations like the non-exclusive partnership between Flowserve Corporation and Gradiant, announced in March 2022, further highlight the market’s evolution toward integrated solutions. This alliance combines novel flow control products with innovative water treatment technologies, targeting the high demand in desalination and municipal sectors.

Development of systems such as the H2O+ submersible pump and integration with Gradiant's IoT platform enhances operational efficiency and sustainability. Similarly, Franklin Electric’s strategic realignment of its Abernathy, Texas facility into its Global Water Systems segment reflects a commitment to operational optimization.

By consolidating engineering and manufacturing resources, the company is addressing increasing demands for efficient and sustainable solutions. These partnerships exemplify how collaborations and innovations are shaping the future of water management technologies in the region.

The Noth America water pump market is characterized by a fragmented competitive landscape with a mix of large multinational corporations and regional players. Key manufacturers, such as BASF, Dow, Huntsman, and Covestro, are increasingly focusing on sustainable solutions, driven by rising demand for eco-friendly and energy-efficient products.

Companies are also investing heavily in circular economic initiatives, such as recycling technologies for polyurethane foams and developing products made from recycled materials. They are emphasizing product innovations, such as low-emission and lightweight solutions, particularly in industries like automotive and construction.

The trend is reshaping the competitive dynamics as firms seek to capitalize on regulatory support and evolving consumer preferences for sustainability. Despite the dominance of a few Noth America-based firm, the market remains highly competitive. Several regional and small-scale players are extending their footprint through strategic partnerships, acquisitions, and product diversification.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Power Source

By Pump Outlet Size

By Volume Flow Rate

By Pump Type

By End Use

By Sales Channel

By Country

To know more about delivery timeline for this report Contact Sales

The market is projected to rise from US$ 9 Bn in 2024 to US$ 12.7 Bn by 2031.

Electric Pumps are set to showcase a CAGR of 5.2% through 2031, attributed to their superior performance characteristics.

The U.S. is poised to dominate with a CAGR of 4.9% through 2031.

Canada is predicted to witness a significant CAGR of 5.7% through 2031.

A few leading manufacturers include Xylem Inc., Pentair, Franklin Electric Co., Inc., Flowserve Corporation, Grundfos, and Sulzer Ltd.