Industry: Chemicals and Materials

Published Date: January-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 192

Report ID: PMRREP35091

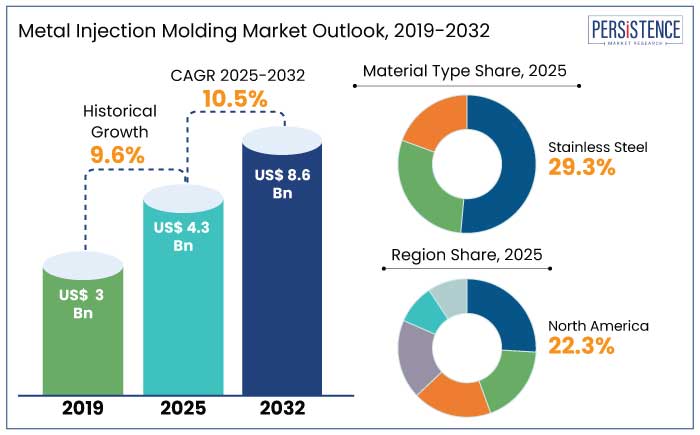

The global metal injection molding market is predicted to attain a value of US$ 4.3 Bn in 2025. The industry is estimated to record a CAGR of 10.5% during the forecast period to attain a size of US$ 8.6 Bn by 2032.

The automotive sector stands out as a key end user of Metal Injection Molding (MIM) components with a share of 35% in 2025. High complexity and strength of these parts make them ideal in critical applications like gearboxes, engines, turbochargers, and steering systems. The automotive industry has a rising demand for lightweight yet durable components. MIM efficiently meets this by enabling the production of complex parts.

Increased government spending on arms and ammunition is driving the need for precise and robust metal components, thereby boosting growth. The consumer electronics sector is also contributing to this trend, as the demand for intricate, miniature metal parts aligns perfectly with MIM's capabilities.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Metal Injection Molding Market Size (2025E) |

US$ 4.3 Bn |

|

Projected Market Value (2032F) |

US$ 8.6 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

10.5% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

9.6% |

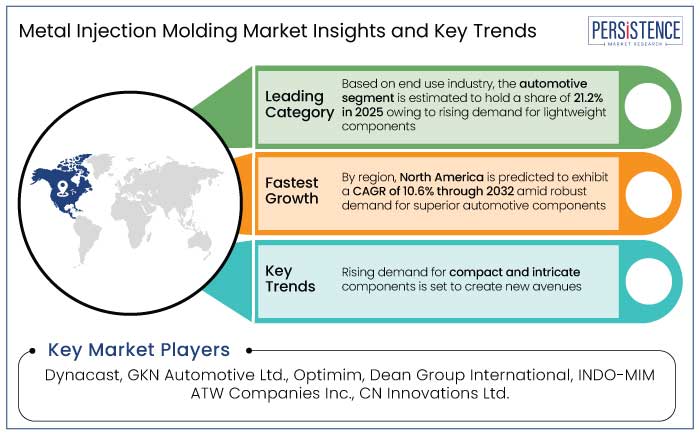

North America MIM industry is predicted to hold a share of 22.3% in 2025. Growth in the region is likely to be fueled by the resurgence of the automotive industry.

The abovementioned statistics indicate a robust demand for automotive components, where MIM plays a crucial role in producing complex and high-strength parts.

The growth highlights the U.S. manufacturing sector’s capabilities in producing high-quality automotive products. Rapid growth in the automotive sector of North America is predicted to bolster the demand for efficient technologies like MIM.

As the region capitalizes on increased production and export opportunities in the automotive sector, importance of MIM in North America's manufacturing landscape is predicted to surge. Rising demand for advanced automotive components positions MIM as a vital technology for meeting industry needs and driving future growth.

Stainless steel is predicted to hold a share of 29.3% in 2025. Stainless steel is favored in MIM due to its mechanical properties and versatility, making it ideal for complex components in various industries. Its ability to produce intricate designs with minimal waste enhances the material’s appeal to manufacturers seeking efficiency and precision.

As industries continue to seek lightweight and robust solutions, the demand for stainless steel components in MIM is likely to rise, further solidifying its position as a critical material.

Automotive is predicted to hold a share of 21.2% in 2025. MIM parts are well-suited for various automotive applications owing to their high complexity and strength. They are commonly used in critical components like gearboxes, engines, turbochargers, and steering systems.

The sector has an increasing demand for lightweight and high-strength components, fueling the efficient production of complex and durable parts through MIM. Robust growth in the European car market further supports this trend. Prominent European markets, including Italy, Spain, France, and Germany, have reported robust growth, highlighting a resurgence in automotive production despite a 19% drop from pre-pandemic levels.

MIM enables the production of complex and high-strength metal parts. The automotive sector is a primary user of MIM, owing to its applications in engines and gearboxes. The consumer electronics industry benefits from MIM’s capacity for miniaturized parts. Increased automation and regulatory support further enhance MIM's appeal, positioning it as a key technology in modern manufacturing across various industries.

The global metal injection molding market growth during the historical period was average as it showcased a CAGR of 9.6% from 2019 to 2023. Manufacturers during the period favored MIM due to its reduced material wastage, minimal finishing operations, and the ability to produce intricate components efficiently. It is also cost-effective, thereby lowering raw material usage, workforce needs, and inventory costs. For instance,

Growth during the forecast period is anticipated to be driven by ongoing technological advancements and market diversification.

Enhanced Technological Properties of MIM to Bolster Demand

Technological advancements are positively influencing the MIM landscape by making it a preferred choice for manufacturers. MIM processes are often environmentally friendly compared to traditional metalworking methods owing to their minimal material waste, aligning with the global push for sustainability.

Urbanization and industrialization are estimated to result in increased adoption of MIM in emerging economies, boosting market potential. Manufacturers are drawn to MIM as it requires fewer finishing operations, enabling the efficient production of complex components with enhanced properties.

Rising Demand for Lightweight Vehicles to Augment Sales

As the automotive industry transitions from internal combustion engines (ICE) to electric vehicles (EVs), there is an increasing need for lightweight components to enhance efficiency and mileage.

Lighter vehicles require less energy to operate, enhancing range and performance. MIM technology is particularly advantageous in this context, as it enables the production of high-strength and lightweight parts that can meet the demands of modern vehicle design. The push for lighter vehicles is significantly driving the adoption of MIM in the automotive sector. For example,

Environmental Challenges May Hamper Demand

During MIM process, binders that hold metal powders together are removed through debinding and sintering stages. This procedure can release emissions, including volatile organic compounds (VOCs) and carbon dioxide (CO2), contributing to air pollution and greenhouse gas emissions. High energy consumption required for heating during sintering further increases the carbon footprint of MIM operations.

Minimizing emissions and optimizing energy efficiency are critical to decrease the environmental impact of MIM. Improper disposal of these materials can result in environmental contamination and accumulation in landfills.

Increasing Use in Healthcare and Medical Devices to Create Opportunities

Rising demand for minimally invasive surgeries, orthopedic implants, and precision surgical instruments is fueling the adoption of MIM. This process enables the production of complex, small and intricate parts with high tolerances which are essential for medical devices.

MIM also supports biocompatible and corrosion resistant materials like titanium and stainless steel, making them ideal for implants and surgical tools. It enables the cost-effective mass production of components while maintaining quality and consistency.

Increasing Customization and Design Freedom to Forge Prospects

Rising demand for personalized products, especially in sectors like healthcare, luxury goods, and consumer electronics, is fueling the adoption of MIM. Luxury watchmakers use MIM to create intricate and custom-designed metal cases and components.

The process enables manufacturers to consolidate multiple parts in a single component, decreasing assembly requirements while enabling unique designs. MIM is becoming a preferred method for prototyping due to its ability to produce small batches of customized components without significant tooling changes.

Key drivers of competition in the metal injection molding market are likely to include technological innovation as companies focus on advancements in binder formulations and automation to enhance efficiency and quality. Market consolidation is evident, as larger firms acquire smaller companies to strengthen their capabilities and expand product offerings.

Globalization is shaping the landscape, with firms expanding their reach in emerging markets to meet rising demand for lightweight components. Sustainability initiatives are increasingly important, as companies invest in eco-friendly practices to appeal to environmentally conscious customers.

The processes’ ability to provide customized solutions and adapt to client requirements is becoming a key differentiator. Robust investments in research and development are essential for companies seeking innovation.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Material Type

By End Use Industry

By Region

To know more about delivery timeline for this report Contact Sales

The market is set to reach a size of US$ 8.6 Bn by 2032.

Automotive is the main industry targeted by companies.

India is estimated to witness moderate growth through 2032.

Dynacast, GKN Automotive Ltd., and Optimim are prominent industry players.

Metal injection molding is subject to ISO 9001 and ISO 13485.