Industry: Food and Beverages

Published Date: July-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 170

Report ID: PMRREP34685

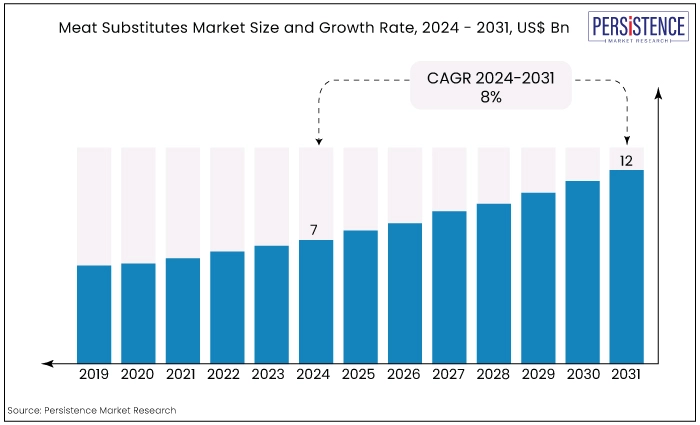

The global market for meat substitutesis anticipated to increase from US$7 Bn in 2024 to US$12 Bn by the end of 2031. The market is expected to expand at a CAGR of 8.1% during the forecast period from 2024 to 2031.

Key Highlights of the Market

|

Attributes |

Key Insights |

|

Market Size (2024E) |

US$7 Bn |

|

Projected Market Value (2031F) |

US$12 Bn |

|

Forecast Growth Rate (CAGR 2024 to 2031) |

8.1% |

|

Historical Growth Rate (CAGR 2019 to 2023) |

7% |

The modern era has seen a significant evolution in meat substitutes, driven by environmental concerns, health consciousness, and ethical considerations.

Today’s meat alternatives are formulated from various sources, including plant protein, animal cells, and insect-based sources, aiming to emulate the nutritional composition and sensorial properties of animal meat.

The market for meat substitutes has grown significantly, with a wide variety of options available that mimic the taste and texture of meat.

There is an increasing need for meat substitutes and is driven by various factors, including health concerns, environmental considerations, and ethical reasons related to animal welfare. Certain important factors are as listed below.

Meat substitutes can offer an array of health benefits. They often contain less saturated fat and cholesterol than traditional meats, which can be better for heart health. Additionally, they can provide important nutrients like fiber, vitamins, and minerals that are not found in animal products.

The production of meat substitutes typically requires fewer natural resources such as water and land, and results in lower greenhouse gas emissions compared to traditional livestock farming. This makes them a more sustainable option for those looking to reduce their environmental footprint.

Many people choose meat substitutes to avoid contributing to the industrial farming practices that are often associated with animal suffering. By opting for plant-based alternatives, they aim to support more humane treatment of animals.

Innovations in this field continue to produce alternatives that are increasingly like their animal-based counterparts, making the transition easier for those reducing or eliminating meat from their diets.

While meat substitutes can be a healthy part of the diet, it is important to consider their nutritional content and how they fit into your overall dietary needs.

Future growth of the meat substitutes market is driven by several factors. For instance, as consumers become more health-conscious, the demand for plant-based proteins, perceived as healthier options, is likely to increase.

The environmental impact of meat production is a significant driver for the adoption of meat substitutes. The lower carbon footprint of plant-based products appeals to eco-conscious consumers.

Economic factors such as fluctuations in the prices of traditional meat due to supply chain disruptions or health scares will continue to position meat substitutes as a more economically attractive alternative.

Cultural shifts are also largely responsible for inducing market growth as plant-based diets become more mainstream, cultural acceptance of meat substitutes is expected to grow, further integrating these products into regular diets.

The meat substitutes market has witnessed substantial growth over the past decade. Driven by increasing health consciousness, environmental concerns, and animal welfare considerations, consumers have shown a growing preference for plant-based alternatives. This market trend has led to a surge in product innovation and market expansion.

The COVID-19 pandemic acted as a catalyst for the market. With heightened focus on health and immunity, more people adopted plant-based diets. The shift towards home cooking and online grocery shopping also benefited the sector.

The market is poised for continued robust growth. Factors such as population increase, urbanization, and rising disposable incomes will contribute to market expansion.

The industry is expected to witness further innovation in product development, with a focus on improving taste, texture, and nutritional value.

The meat substitutes market is undergoing significant growth, driven by several key factors:

Soy Protein Maintains Dominance by Source

|

Category |

Market Share through 2023 |

|

Soy protein |

49.0% |

The interest in soy protein as a source of meal alternatives is indeed on the rise, reflecting a growing demand for plant-based proteins.

Soybean meal, with its high protein content and rich amino acid profile, is a popular choice for various animal feeds and is increasingly being considered for human consumption as well.

Here are some key points from recent findings-

Soybean Meal as a Protein Source: Soybean meal encloses about 44% crude protein and is a common ingredient in compound feeds for livestock. It’s valued for its availability, cost-effectiveness, and high-quality protein.

Functional Properties: Soy protein isolate, resulting from soybean meal, exhibits excellent functional properties like solubility, emulsion capacity, and water and oil binding capacities. These make it suitable for a variety of food products, including bakery items, meat substitutes, beverages, and dairy alternatives.

Nutritional Value: Soybean meal is not only rich in protein but also essential amino acids, omega-3 fatty acids, and other beneficial compounds. It’s seen as a sustainable contributor to alleviating protein-based malnutrition.

Alternative Protein Sources: While soybean meal is predominant, there are other alternative protein sources being explored due to various factors such as cost, availability, and nutritional profiles.

The shift towards plant-based diets and the search for sustainable protein sources are likely contributing to the increased interest in soy protein as a meal alternative. It is a trend that aligns with global efforts to find environmentally friendly and health-conscious food options.

Tofu to Contribute the Largest Share of Market by Product Type

|

Category |

Market Share through 2023 |

|

Tofu |

62.45% |

In the global meat substitutes market, tofu and tempeh are significant segments. Specifically, in 2019, the tofu and tempeh segments held over 40% and 30% shares respectively.

Tofu has been a leading product type segment in the market. Its popularity stems from its versatility, affordability, and the variety of options available in terms of types and flavors.

It is a rich source of protein for those looking to reduce their meat consumption or follow a plant-based diet. Moreover, it can be easily incorporated into a wide range of dishes, making it a convenient choice for consumers.

Europe to Take Charge in the Market

|

Region |

Market Share through 2023 |

|

Europe |

32% |

Europe holds a significant share of the global meat substitutes market.

The market is fragmented, with the top five companies occupying 11.24%.

Major players include Amy’s Kitchen Inc., Beyond Meat Inc., Conagra Brands Inc., House Foods Group Inc., and International Flavors & Fragrances Inc.

The growing trend of flexitarian diets, where people are reducing meat consumption without completely giving it up, is also contributing to the rise in demand for meat substitutes across Europe.

The competition landscape in the meat substitutes market is quite dynamic, with several key players and factors influencing its growth. Companies in the meat substitute market are employing a variety of strategies to enhance their market presence and cater to the growing demand for plant-based alternatives.

Companies are focusing on product innovation to meet consumer preferences for taste, texture, and nutrition. For instance, there’s an increasing number of soy-based food producers in India who are expanding their selection of soy protein products.

Brands are forming strategic alliances and partnerships to leverage each other’s strengths in terms of technology, distribution, and marketing. M&A are common as companies aim to expand their product portfolios and enter new markets.

Companies are expanding geographically to tap into new markets and consumer bases. There is a significant focus on optimizing distribution channels, with a particular emphasis on online retail to improve customer purchasing experiences.

With the rising market trend towards environmentally responsible diets, companies are also investing in sustainability initiatives to appeal to eco-conscious consumers.

July 2023

Beyond Meat, diversified its product range in Germany by introducing plant-based chicken-style offerings like Beyond Nuggets and Beyond Tenders in July 2023

December 2021

Companies are increasingly partnering to introduce innovative products. For example, Next Meats, a Tokyo-based company, partnered with Vegan Meat India in December 2021 to introduce meat-free products in the country. Such collaborations are part of the industry’s response to the growing consumer interest in vegan and vegetarian diets, which is influencing the meat substitutes market growth.

July 2022

CCL, a home-grown coffee brand, has launched its plant-based brand ‘Continental Greenbird’ in India. With Continental Greenbird, CCL will initially offer four plant-based meat varieties: chicken-like nuggets, Chicken-like seekh kebab, Chicken-like sausage, and Mutton-like keema

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Million for Value |

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Product Type

By Source

By Category

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

Health awareness amongst consumers regarding benefits associated with plant-based diets, including reduced cholesterol and lower risk of certain diseases.

Major players in meat substitute market are Kellog’s Company, Beyond Meat Inc., The Tofurky Company, Maple Leaf Foods Inc. Topas GmbH etc.

Europe holds the major share of the meat substitutes market.

Scientific advancements do pave the way for innovative meat alternative proteins, such as mock meat and mycoprotein, which are expected to reshape the meat industries.

Soy meat is expected to exhibit a substantial share in the market.