Industry: Food and Beverages

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Report Type: Ongoing

Report ID: PMRREP10861

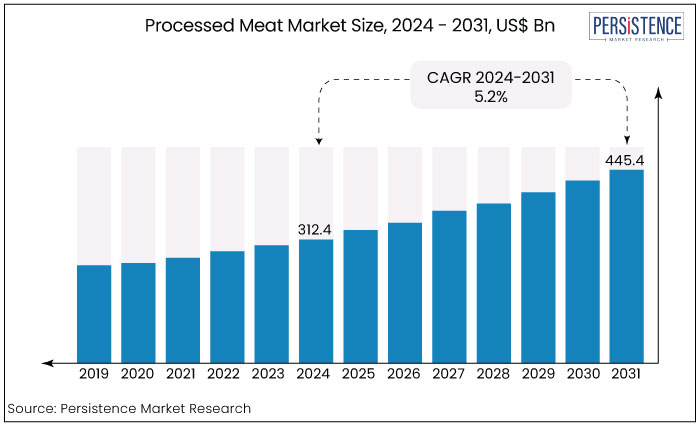

The global processed meat market is expected to increase from US$312.4 Bn in 2024 to US$445.4 Bn by the end of 2031. The market is anticipated to secure a CAGR of 5.2% during the forecast period from 2024 to 2031.

Key Highlights of the Market

|

Attributes |

Key Insights |

|

Market Size (2024E) |

US$312.4 Bn |

|

Projected Market Value (2031F) |

US$445.4 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

5.2% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

4.7% |

Processed meat refers to meat which is enriched with various additives or preservatives such as salts, acidifiers, minerals and other seasoning and flavoring agents.

Meat is chiefly processed to improve its quality, preserve it from decay and to add flavors to its original composition. It can be either red meat or white meat from poultry, swine, cattle or sea animal meat.

One of the key drivers of this market is large varieties of processed meat available in the market place at lower prices. Growth in retail market and increasing purchasing power of consumers in emerging countries are driving the market growth further.

Consumers continued to prefer processed meats market due to convenience and longer shelf life, despite growing health concerns associated with high sodium and preservatives in these products.

sustainability and health-conscious are the key market trends gained prominence within the industry. Companies responded by introducing products with reduced sodium content, organic certifications, and sustainable packaging solutions to align with evolving consumer preferences and regulatory requirements. The market recorded a CAGR of 4.7% during the historical period.

The market is expected to continue evolving with a greater emphasis on health, sustainability, and technological innovation shaping future growth trajectories.

Consumer confidence strengthened, leading to increased demand for convenience foods, including processed meats. Companies focused on expanding their product portfolios to include healthier options and cater to diverse dietary preference.

Market players responded by introducing organic, antibiotic-free, and plant-based alternatives to traditional processed meats, reflecting a broader shift towards healthier and environmentally friendly choices.

The market is expected to continue growing, driven by technological advancements, changing consumer preferences, and heightened focus on health and environmental sustainability. The market for processed meat is expected to record a CAGR of 5.2% during the forecast period from 2024 to 2031.

Increasing Shift Towards Organic Meat across the Globe

There is a growing consumer awareness and preference for organic products due to concerns about health, sustainability, and animal welfare. This shift in consumer behavior extends to processed meats market, where consumers are seeking products that are perceived as healthier and environment- friendly.

The increasing availability of organic processed meat products is expanding the market. It attracts new consumers who may have previously avoided it due to potential health concerns associated with conventional products.

Market expansion is not only driven by domestic demand but also by growing exports of organic varieties to international markets where organic certifications are highly valued.

The proliferation of organic variant in retail stores, supermarkets, and online platforms has made these products more accessible to consumers worldwide. Improved distribution channels and marketing efforts by manufacturers are also contributing to the increasing adoption of organic processed meats.

Changing Consumer Lifestyles and Preferences

Consumer lifestyles have become increasingly fast-paced, leading to a higher demand for convenient food options such as processed meats. These products offer ease of preparation and longer shelf-life, aligning with the hectic schedules of modern consumers.

The preference for ready-to-eat and ready-to-cook meals also continues to drive the demand across various demographics.

Consumers are also becoming more health-conscious while there is a growing demand for convenience. Market players are responding by reformulating products to reduce sodium content, offering leaner meat options, and introducing organic and natural variants.

The shift toward healthy eating habits is influencing product innovation and marketing strategies within the market. Advanced processing techniques improve yield, reduce waste, and ensure consistent product standards.

Additionally, innovations in packaging technology extend shelf-life, enhance food safety, and cater to consumer demands for convenience and sustainability.

Increase in Health Related Concerns

Excessive consumption of processed meat market to various health problems such as cancer, heart disease and other health problems. The World Health Organization (WHO) classifies it as a carcinogen, meaning it has the potential to cause cancer.

Studies have shown a link between processed meat intake and an increased risk of colorectal cancer, stomach cancer, and pancreatic cancer.

Processed meats are often high in sodium, saturated fat, and nitrates, which can contribute to high blood pressure, and heart disease. They might also be linked to an increased risk of type 2 diabetes, obesity, and digestive problems.

Health concerns are making consumers more conscious of their diet and prompting them to seek out healthy alternatives. This can lead to reduced consumption and demand for healthy meat.

People might choose fresh meat, fish, poultry, or plant-based protein sources over processed meats. Also, manufacturers may need to reformulate products to be lower in sodium, saturated fat, and nitrates, potentially impacting taste and shelf life.

Stringent Government Regulations and Labeling Requirements

Governments are increasingly implementing strict regulations on the processing and labeling of meat products. Restrictions on the amount of sodium, nitrates, and other additives allowed in processed meats.

Mandates for clearer labeling regarding ingredients, processing methods, and potential health risks associated with consumption.

Regulations can increase production costs for manufacturers and may make it more challenging to develop new and innovative products. Additionally, clear labeling can further highlight the health concerns associated with processed meats, potentially deterring consumers.

Increasing Popularity of Plant-based Diets

As more consumers adopt plant-based diets, there is a growing demand for meat alternatives that mimic the taste, texture, and nutritional profile of traditional meats. This has spurred the development of a wide range of plant-based meat products such as burgers, sausages, nuggets, and deli slices. These products appeal to not only vegetarians and vegans but also flexitarians and consumers looking to reduce their meat consumption.

Increasing popularity of plant-based diets presents a significant opportunity within the market. Industry players can diversify their product portfolios by introducing plant-based alternatives to traditional processed meats. These products appeal to vegan, vegetarian, and flexitarian consumers seeking protein-rich options that mimic the taste and texture of meat.

Consumers are increasingly prioritizing health and wellness, driving interest in plant-based diets perceived as healthier alternatives to traditional meats.

Plant-based products often contain lower levels of saturated fat, cholesterol, and calories compared to their animal-derived counterparts. This health-conscious consumer segment seeks products that align with their dietary preferences without sacrificing taste or convenience.

Growth of E-commerce Platforms and Direct-to-Consumer Sales Channels

The growth of e-commerce platforms and direct-to-consumer sales channels presents opportunities for industry participants to reach a broad audience and bypass traditional retail distribution channels.

Developing online marketing strategies, establishing partnerships with online retailers, and optimizing logistics for efficient delivery can enhance market presence and consumer accessibility.

E-commerce platforms, and DTC channels enable manufacturers to reach a broader audience beyond their traditional geographic limitations. They can target consumers in remote areas or international markets without the need for physical retail presence, thereby expanding their market reach and potential customer base.

E-commerce platforms facilitate flexibility in product offerings. Companies can easily introduce new products, limited-edition items, or special promotions to gauge consumer interest and response. This agility in product management enables faster adaptation to changing market trends, and consumer preferences.

Frozen Segment to Account for a Significant Market Share

The frozen segment accounted for significant market share based on product type. Freezing extends the shelf-life significantly, reducing food waste and offering consumers more flexibility in their meal planning. Frozen meats are perfect for busy lifestyles. They can be thawed quickly and used in various dishes, saving time on preparation.

Frozen varieties often come in pre-portioned packages, helping with managing portion sizes and reducing potential overconsumption. Frozen meats are generally more affordable compared to fresh cuts of meat, making them a budget-friendly option for many consumers. Freezing minimizes spoilage, leading to less food waste and potentially saving consumers money in the long run.

Commercial Sector Maintains Dominance

|

Category |

Market Share in 2022 |

|

Commercial - Application Type |

90% |

The commercial segment dominated the global market based on application in 2022, accounting for 90%. Processed meats offer convenience and efficiency in food preparation within the commercial sector. They are pre-cooked or semi-cooked, reducing cooking time and labor costs for foodservice operators. This is particularly advantageous in high-volume settings where quick service and consistency are essential.

Processed meats have versatile applications across various cuisines and menu items. They can be used as main ingredients, toppings, fillings, or garnishes in a wide array of dishes, catering to diverse consumer preferences and dietary needs within the commercial foodservice industry.

The commercial segment expanded prominently significantly in the past few decades with the increased popularity of fast-food chains, restaurants, and cafes such as KFC, McDonalds, Dominos, Burger King, and Yum Brands.

North America to be the Frontrunner in Processed Meat Industry

Emerging processed food industry is one of the key factors driving the regional market growth. North America has a strong tradition of consuming processed meats, particularly from beef and pork. This ingrained preference continues to drive demand.

The proliferation of quick-service restaurants (QSRs), and fast casual dining establishments in North America has significantly increased the demand. These establishments rely on processed meats for menu items like sandwiches, burgers, wraps, and salads, catering to consumers' preference for affordable and convenient dining options.

Manufacturers in North America are continuously innovating to meet consumer demand for healthier and more diverse options. This includes introducing products with reduced sodium, lower fat content, organic certifications, and clean label ingredients. Plant-based alternatives to traditional processed meats are also gaining traction in response to the rising popularity of vegetarian and flexitarian diets.

Innovation plays a crucial role in driving competitiveness in the market. Companies continuously innovate by introducing new flavors, formulations, and packaging solutions to meet evolving consumer preferences and differentiate their products from competitors.

Strategic partnerships, joint ventures, and acquisitions are common strategies used by companies to strengthen market position, expand product portfolios, access new technologies, and enhance distribution networks.

February 2024

Cargill is fortifying its footprint in the Northeastern US by making significant investments in two new meat processing facilities. This strategic move aims to bolster production capacity and distribution channels for supermarket case-ready beef and pork, aligning with the growing consumer preference for convenient and economical protein choices.

The acquisition of case-ready meat plants in North Kingstown, Rhode Island, and Camp Hill, Pennsylvania, from Infinity Meat Solutions underscores Cargill's commitment to enhancing its operational capabilities and market presence in key Northeastern markets. These facilities are strategically located to efficiently supply retailers with a diverse range of processed meat products tailored to meet local consumer demands.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Meat Type

By Product Type

By Application

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

The global processed meat market is expected to increase from US$312.4 Bn in 2024.

Cargill Inc., Tyson Foods Inc., and Advance Food Company Inc. are a few of the key players operating in the market.

Increasing popularity of plant-based diets is a key factor driving the market growth.

Commercial segment to lead the market with notable market share.

North America leads the processed meat market.